KBank Multi Asset Strategies oct 2011 (English)

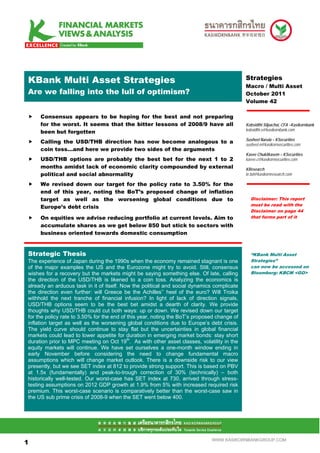

- 1. .Mean S Multi Asset Strategies KBank Strategies Macro / Multi Asset Are we falling into the lull of optimism? October 2011 Volume 42 Consensus appears to be hoping for the best and not preparing for the worst. It seems that the bitter lessons of 2008/9 have all Kobsidthi Silpachai, CFA –Kasikornbank kobsidthi.s@kasikornbank.com been but forgotten Susheel Narula – KSecurities Calling the USD/THB direction has now become analogous to a susheel.n@kasikornsecurities.com coin toss…and here we provide two sides of the arguments Kavee Chukitkasem – KSecurities USD/THB options are probably the best bet for the next 1 to 2 kavee.c@kasikornsecurities.com months amidst lack of economic clarity compounded by external KResearch political and social abnormality kr.bd@kasikornresearch.com We revised down our target for the policy rate to 3.50% for the end of this year, noting the BoT’s proposed change of inflation target as well as the worsening global conditions due to Disclaimer: This report must be read with the Europe’s debt crisis Disclaimer on page 44 On equities we advise reducing portfolio at current levels. Aim to that forms part of it accumulate shares as we get below 850 but stick to sectors with business oriented towards domestic consumption Strategic Thesis “KBank Multi Asset The experience of Japan during the 1990s when the economy remained stagnant is one Strategies” of the major examples the US and the Eurozone might try to avoid. Still, consensus can now be accessed on wishes for a recovery but the markets might be saying something else. Of late, calling Bloomberg: KBCM <GO> the direction of the USD/THB is likened to a coin toss. Analyzing the economics is already an arduous task in it of itself. Now the political and social dynamics complicate the direction even further: will Greece be the Achilles’’ heel of the euro? Will Troika withhold the next tranche of financial infusion? In light of lack of direction signals, USD/THB options seem to be the best bet amidst a dearth of clarity. We provide thoughts why USD/THB could cut both ways: up or down. We revised down our target for the policy rate to 3.50% for the end of this year, noting the BoT’s proposed change of inflation target as well as the worsening global conditions due to Europe’s debt crisis. The yield curve should continue to stay flat but the uncertainties in global financial markets could lead to lower appetite for duration in emerging market bonds: stay short th duration prior to MPC meeting on Oct 19 . As with other asset classes, volatility in the equity markets will continue. We have set ourselves a one-month window ending in early November before considering the need to change fundamental macro assumptions which will change market outlook. There is a downside risk to our view presently, but we see SET index at 812 to provide strong support. This is based on PBV at 1.5x (fundamentally) and peak-to-trough correction of 30% (technically) – both historically well-tested. Our worst-case has SET index at 730, arrived through stress- testing assumptions on 2012 GDP growth at 1.9% from 5% with increased required risk premium. This worst-case scenario is comparatively better than the worst-case saw in the US sub prime crisis of 2008-9 when the SET went below 400. 11 1 WWW.KASIKORNBANKGROUP.COM

- 2. Key Parameters & Forecasts at Year-end 2004 2005 2006 2007 2008 2009 2010 2011E 2012E GDP, % YoY 6.3 4.6 5.2 4.9 2.5 -2.3 7.8 3.8 4.5 Consumption, % YoY 6.2 4.6 3.0 1.6 2.7 -1.1 4.8 3.6 3.8 Investment Spending, % YoY 13.2 10.5 3.9 1.3 1.2 -9.2 9.4 6.3 5.8 Govt Budget / GDP % -0.2 0.3 -0.7 -1.5 -1.0 -5.6 -3.2 -4.0 -4.5 Export, % YoY 21.6 15.2 17.0 17.3 15.9 -14.0 28.5 20.0 10.0 Import, % YoY 25.7 25.8 7.9 9.1 26.5 -25.2 36.8 24.0 12.0 Current Account (USD bn) 2.77 -7.6 2.3 14.1 1.6 21.9 14.8 12.9 8.1 CPI % YoY, average 2.8 4.5 4.6 2.3 5.5 -0.9 3.3 3.8 3.7 USD/THB 38.9 41.0 36.1 33.7 34.8 33.3 31.4 29.0 28.0 Fed Funds, % year-end 2.25 4.25 5.25 4.25 0.25 0.25 0.25 0.25 0.25 BOT repo, % year-end 2.00 4.00 5.00 3.25 2.75 1.25 2.00 3.50 3.50 Bond Yields 2yr, % year-end 2.78 4.94 5.02 3.91 1.98 2.17 2.35 3.60 3.60 5yr, % year-end 4.0 5.3 5.1 4.5 2.2 3.6 2.75 3.65 3.65 10yr, % year-end 4.9 5.5 5.4 4.9 2.7 4.3 3.25 3.80 3.80 USD/JPY 102.5 118.0 119.1 111.8 90.7 93.0 82.0 77 81 EUR/USD 1.36 1.18 1.32 1.46 1.40 1.43 1.40 1.35 1.40 SET Index 668.1 713.7 679.8 858.1 450.0 734.5 1040 812 1320 Source: Bloomberg, CEIC, KBank, KResearch, KSecurities KBank Thai Government Bond Rich / Cheap model Bps (actual YTM vs. model) 20.00 15.00 10.00 5.00 0.00 -5.00 -10.00 -15.00 3 mth avg Now -20.00 LB296A LB123A LB133A LB137A LB145B LB14DA LB155A LB15DA LB167A LB16NA LB175A LB183B LB191A LB196A LB198A LB19DA LB213A LB24DA LB267A LB283A LB396A Source: Bloomberg, KBank 22 2

- 3. KBank THB NEER Index KBank USD/THB – FX Reserves / USD Majors model Jan 1995 = 100 KBank THB Trade Weighted Index KBank USD/THB model 48 105 46 44 100 + 1 std 42 d 40 95 38 36 90 average 34 32 85 30 80 -1 std dev 28 01 02 03 04 05 06 07 08 09 10 11 12 75 00 01 02 03 04 05 06 07 08 09 10 11 actual model Source: Bloomberg, KBank Source: Bloomberg, KBank FX reserves – USD/THB model DXY – USD/THB model USD/THB USD/THB since 2001 48 50 46 y = -7.4157Ln(x) + 69.035 44 2 45 42 R = 0.8878 40 40 38 36 35 y = 29.695Ln(x) - 95.504 2 34 R = 0.7685 32 30 30 28 25 26 70 75 80 85 90 95 100 105 110 115 120 125 25 50 75 100 125 150 175 200 225 250 DXY FX reserves to USD/THB mapping current 2011 forecast FX reserves, USD bn DXY to USD/THB mapping current Source: Bloomberg, KBank Source: Bloomberg, KBank KBank BOT repo model SET forward dividend yield vs. 10yr bond yield % % 5.5 9 5.0 8 4.5 7 4.0 6 3.5 5 3.0 4 2.5 2.0 3 1.5 2 1.0 1 0.5 0 0.0 00 01 02 03 04 05 06 07 08 09 10 11 01 02 03 04 05 06 07 08 09 10 11 12 13 actual model 10yr yields SET forward dividend yields Source: Bloomberg, KBank Source: Bloomberg, KBank 33 3

- 4. Thai inflation parameters Thai contribution to GDP growth CPI yoy PPI yoy Core CPI yoy % yoy 25% 15 20% 10 15% 5 10% 0 5% -5 0% -10 -5% -15 -10% 1Q09 3Q09 1Q10 3Q10 1Q11 -15% Private consumption Government Consumption Gross fixed capital formation 05 06 07 08 09 10 11 Inventory change Net exports GDP yoy Source: CEIC, KBank Source: NESDB, KBank Implied forward curve: swaps Implied forward curve: TGBs % Implied forward rate shifts (IRS) % Bond yields implied curve shifts 3.90 4.25 3.70 4.00 3.50 3.30 3.75 3.10 2.90 3.50 2.70 tenor (yrs) tenor (yrs) 2.50 3.25 0 1 2 3 4 5 6 7 8 9 10 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 Oct-11 Jan-12 Apr-12 Oct-12 Oct-11 Jan-12 Apr-12 Oct-12 Source: Bloomberg, KBank Source: Bloomberg, KBank US 2yr yields and implied forward US 5yr yields and implied forward 7.0 8 6.0 7 5.0 6 5 4.0 4 3.0 3 2.0 2 1.0 1 0.0 0 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 2yr yields, % implied forwards 5yr yields, % implied forwards Source: Bloomberg, KBank Source: Bloomberg, KBank 44 4

- 5. KBank EUR/THB model KBank JPY/THB model EUR/THB JPY/THB 43.0 56.0 54.0 41.0 52.0 39.0 50.0 37.0 48.0 46.0 35.0 44.0 33.0 42.0 31.0 40.0 29.0 38.0 36.0 27.0 34.0 25.0 01 02 03 04 05 06 07 08 09 10 11 12 01 02 03 04 05 06 07 08 09 10 11 12 actual model actual model Source: Bloomberg, KBank Source: Bloomberg, KBank KBank GBP/THB model KBank CNY/THB model GBP/THB CNY/THB 5.8 78.0 5.6 73.0 5.4 68.0 5.2 63.0 5.0 58.0 4.8 4.6 53.0 4.4 48.0 4.2 43.0 4.0 01 02 03 04 05 06 07 08 09 10 11 12 01 02 03 04 05 06 07 08 09 10 11 12 actual model actual model Source: Bloomberg, KBank Source: Bloomberg, KBank KBank THB/VND model KBank AUD/THB model THB/VND AUD/THB 800 35.0 750 700 33.0 650 31.0 600 29.0 550 500 27.0 450 25.0 400 350 23.0 300 21.0 01 02 03 04 05 06 07 08 09 10 11 12 01 02 03 04 05 06 07 08 09 10 11 12 actual model actual model Source: Bloomberg, KBank Source: Bloomberg, KBank 55 5

- 6. This page has been left blank intentionally 66 6

- 7. Are we falling into the lull of optimism? Kobsidthi Silpachai, CFA - Kasikornbank If we look at consensus forecasts for 2011 and especially 2012, economists are not kobsidthi.s@kasikornbank.com paying heed to Michel de Notradamus’s prediction that the world as we know it will no longer exist post December 21st, 2012. According to the IMF’s latest forecasts, the global Nalin Chutchotitham – Kasikornbank nalin.c@kasikornbank.com economy is to expand close to 4% for 2012 while Thailand is see a 4.8% pick up in economic activities. Amonthep Chawla, Ph.D. – Kasikornbank amonthep.c@kasikornbank.com An argument against such optimism is gaining momentum as financial market conditions looks and feels more and more of a de javu of 2008. Prior to 2008, the US yield curve was flat and or inverted most of 2006 and 2007. In early 2008, Bear Stearns a global investment bank which had a peak market capitalization of USD 24.88bn collapsed and was bought by JP Morgan. On the macro front, non-farm payrolls had peaked in January 2008 (138 million) and were on a substantial decline leading to a surge on mortgage delinquencies. Fig 1. IMF forecast for global economic growth... Fig 2. IMF forecast for Thai economic growth 6 9 8 5 7 4 6 5 3 4 3 2 2 1 1 0 0 -1 -2 -1 -3 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 World economic growth, % IMF projections, % Thai economic growth, % IMF projections, % Source: IMF Source: IMF Beside these ominous sign posts, one barometer of a prelude towards a full blown financial crisis is proxies of credit spreads. Here we are referring to LIBOR OIS spreads. These LIBOR OIS spreads (short for Overnight Index Swaps) are the difference between inter-bank funding benchmarks such as 3mth LIBOR minus a geometric estimate of central bank funding rates. The rule of thumb is, the higher the spread, the tighter the credit conditions in the inter-bank market Fig 3. US Libor OIS Fig 4. EU Libor OIS 400 200 350 180 160 300 140 250 120 200 100 150 80 60 100 40 50 20 0 0 02 03 04 05 06 07 08 09 10 11 02 03 04 05 06 07 08 09 10 11 US LIBOR OIS (Overnight Index Swap), bps Euro LIBOR OIS (Overnight Index Swap), bps Source: Bloomberg, CEIC, KBank Source: Bloomberg, CEIC, KBank 77 7

- 8. USD/THB, it cuts both ways In the following, we ponder both cases for further USD/THB downside and upside and summarized in fig 5. Fig 5. USD/THB, it cuts both ways The case for lower USD/THB The case for higher USD/THB The US economy is still floundering. With unemployment very Bureaucracy of the EU system limits the speed of how elevated at 9%+, economic stimulus no doubt is needed European authorities can effectively respond and resolve the Fiscal constraints means that stimulus in the form of crisis and allows the Eurozone to implode into a full fledge expansionary fiscal policy is not an option sovereign domino defaults and bank runs / closures …hence QE3, 4, …. is still needed…..meaning the Fed will Risk aversion kicks in and investors further reduced printing more US dollars to monetize and reduce their investment positions in all sorts of risk asset classes indebtedness including emerging markets equities and bonds The European authorities, despite having demonstrated Higher risk perception of the EUR will prompt a shift of shortcoming of leadership, solidarity and efficiency in dealing reserves away from the 17 nation currency (market share of with the sovereign debt / banking crisis, is able to prevent or 27%) and towards the US dollar (market share of 60%) postpone a full blown crisis The Fed is contented with just the 2011 version of “Operation Thailand is seen to post current account surpluses, meaning Twist”. This means that the Fed will not expand its balance sellers of USD/THB outnumber buyers of USD/THB at the sheet and slows down the pace of US dollar printing i.e. M1 current level money supply China proceeds with CNY appreciation. This allows regional The Bank of Thailand adopts a wait and see stance on currencies including the Thai baht to appreciate as well monetary policy amidst lack clarity on the global economic without significant implications on competitiveness front. This reduces support for the baht as policy rates stay Thai baht remains undervalued e.g. the Economist Big Mac at 3.50% index estimates Thai baht is 42.3% undervalued relative to the US dollar. Source: KBank Source: KBank USD/THB elevating higher… because? In May 2010 and onwards, Greece, Ireland and Portugal sought financial bailout packages from other Eurozone countries and the International Monetary Fund (IMF). More than a year afterwards, much of the pledges of austerity, especially for the case of Greece were empty promises. With cross holdings of various Eurozone government bonds by various Eurozone commercial banks, the deterioration in fiscal health of government inadvertently meant the demise of commercial banks. If one was to make an analogy what CDOs (collateralized debt obligations) did to American and other banks worldwide post 2008 to now, it would be the toxic bonds of the weaker links (such as the PIIGS group) in the EU. Fig 6 shows that as Greek bond prices fall, it will take the Euro Stoxx bank index with it. The Euro Stoxx bank index comprises of 32 European banks with a cumulative total asset of EUR 5 trillion versus the Eurozone GDP of EUR 2.9 trillion. As the market value of these banks equity falls below their book value, it provides a estimate of how much recapitalization is needed. On figure 7, the implied recapitalization needs of these 32 banks are about EUR 367bn, currently. This is a moving target, as market expectations changes. Another point that can be taken from this is that, investors of banks have more or less have withdrawn their money in the form of equity. The question now is whether other sources of funds will withdraw their deposits i.e. bank runs. 88 8

- 9. Fig 6. Greece 10yr bond price, Euro Stoxx bank index Fig 7. Implied recapitalization of Euro Stoxx banks 110 260 600,000 100 240 90 400,000 220 80 200 200,000 70 180 60 0 160 50 00 01 02 03 04 05 06 07 08 09 10 11 40 140 -200,000 30 120 -400,000 20 100 Mar-10 Jun-10 Sep-10 Dec-10 Mar-11 Jun-11 Sep-11 -600,000 Greece 10yr bond, % of par (left) Euro Stoxx Bank index (right) Euro Stoxx bank index, market cap less book value implied recapitalization, EUR mn Source: Bloomberg, CEIC, KBank Source: Bloomberg, CEIC, KBank What is the European immediate response, attempting to contain the crisis? Four little letters: EFSF with a big task. EFSF is short for “European Financial Stability Facility”. EFSF is similar in concept to our FIDF (Financial Institution Development Fund). During the 1997 crisis, the FIDF attempt to assuage bank runs on deposits. But when the dust settled, some 56 finance companies had to close and a handful of banks had to be nationalized to avert calamity. Recently, the EU authorities are pushing to expand the war chest of the EFSF, from EUR440bn to around EUR780bn, which represents the guaranteed commitments by countries within the Eurozone. The idea being, the EFSF would raise funding in the market, which it has so far sold 3 tranches for a total of EUR13bn, and on-lend to entities it deems needed financial assistance. However in the event that the EFSF could not honor its own financial obligations, the countries as shown in fig 8, would have to honor the EFSF on its behalf. Imagine a case where if the EFSF lent money to France. France was unable to pay back the EFSF and causing the EFSF to be unable to pay back its creditors. The creditors can then demand payments from say, Germany. The unfortunate thing is that most of these countries pledging to back the EFSF are not in a healthy fiscal position to back up their commitments in the first place. Even the market perceived mighty economy of Germany already has a debt / GDP ratio of 83%, well above the Maastricht Treaty limit of 60%. This questions the viability of the EFSF as it is really the weak nations trying to save themselves. It would stand a higher probability of success if Asian investors / central banks / sovereign wealth funds are lured into buying the EFSF bonds despite the fact that it is backed by near bankrupt nations. 99 9

- 10. Fig 8. EFSF guarantors and their budget / GDP & debt / GDP ratios Country Guarantee commitments, EUR mn budget / GDP, % public debt/ GDP, % Kingdom of Belgium 27,032 -4.1 96.8 Federal Republic of Germany 211,046 -3.3 83.2 Ireland 12,378 -32.4 96.2 Kingdom of Spain 92,544 -9.2 60.1 French Republic 158,488 -7.0 81.7 Italian Republic 139,268 -4.6 119.0 Republic of Cyprus 1,526 -5.3 60.8 Grand Duchy of Luxembourg 1,947 -1.7 18.4 Republic of Malta 704 -3.6 68.0 Kingdom of the Netherlands 44,446 -5.4 62.7 Republic of Austria 21,639 -4.6 72.3 Portuguese Republic 19,507 -9.1 93.0 Republic of Slovenia 3,664 -5.6 38.0 Slovak Republic 7,728 -7.9 41.0 Republic of Finland 13,974 -2.5 48.4 Hellenic Republic 21,898 -10.5 142.8 Republic of Estonia 1,995 0.1 6.6 Total Guarantee Commitments 779,783 Source: http://www.efsf.europa.eu/about/index.htm This hence leads to the lingering-in- the-back-of- market’s mind, will the euro survive. In his last ECB meeting, Jean Claude Trichet said that the euro will still be around in 10 years time. But what if it isn’t and the market has to go back to the US dollar, despite all of its imperfections? As the EUR arrived on the FX scene Asian central banks which had the Deutschemark as one of its reserve currency had to trade it in for the Euro. At the time of fixing, it was 1.95583 DEM to 1 EUR. Fig 10 shows that EUR’s market share rose from 18% to 26%+ at the expense of a lower USD market share slipping from 72% to 60%. Fig 9. Market share of fiat FX currency reserves Fig 10. USD, EUR market share in FX reserves GBP Other World's breakdown of reserve currency CHF 4.2% 4.9% 74 30 0.1% 72 28 JPY 3.9% 70 26 68 24 66 22 EUR 26.7% 64 20 USD 60.2% 62 18 60 16 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 % holding in USD (left axis) % holding in EUR (right axis) Source: Bloomberg, CEIC, KBank Source: Bloomberg, CEIC, KBank 1010 10

- 11. Operation Twist is another factor which had reversed the bearishness of the USD towards a bullish swing. The September 21st FOMC statement was US dollar bullish as: To support a stronger economic recovery and to help ensure that inflation, over time, is at levels consistent with the dual mandate, the Committee decided today to extend the average maturity of its holdings of securities. The Committee intends to purchase, by the end of June 2012, $400 billion of Treasury securities with remaining maturities of 6 years to 30 years and to sell an equal amount of Treasury securities with remaining maturities of 3 years or less. This program should put downward pressure on longer-term interest rates and help make broader financial conditions more accommodative. The Committee will regularly review the size and composition of its securities holdings and is prepared to adjust those holdings as appropriate. The buying and selling of equal amounts equates to no significant expansion in the Fed’s balance sheet. Hence the exercise is merely a sector rotation, from the short end of the curve to the long end of the curve. This is a means of reducing the gapping as to force commercial banks to switch from making money from taking duration risk and toward taking credit risk. Operation Twist is to crowd out the non-private sector simulative activities i.e. borrowing from the Fed and lending to the US Treasury instead of lending to the private sector. Fig 11 shows that Fed Funds rate and the shape of the yield curve move in opposite directions, that is, as Fed Funds rises, the yield curve steepens. Whereas when the Fed Funds falls, the curve flattens. The Fed has flagged its intention to keep short rates where they are i.e. low. Hence to flatten the yield curve to encourage banks to take credit risk, the Fed has to buy longer dated maturity treasuries. Fig 11. Fed Funds rate, shape of the US yield curve Fig 12. US bank’s loans and leases, stagnating bps % 8,000 350 7 7,000 300 correlation is -93% 6 6,000 250 5 5,000 200 150 4 4,000 100 3 3,000 50 2,000 2 0 1 1,000 -50 00 01 02 03 04 05 06 07 08 09 10 11 - -100 0 73 75 77 79 81 83 85 87 89 91 93 95 97 99 01 03 05 07 09 11 US 10yr yield less 2yr yield, left Fed Funds, right Loans and leases, USD bn Source: Bloomberg, CEIC, KBank Source: Bloomberg, CEIC, KBank 1111 11

- 12. This, in it of itself, highlight that the Fed is in no urgency to print more money. Hence it reduces the bearish cue for USD/THB. Fig 13. y = f(x), USD M1 money supply as a function of Fig 14. y = f(x), USD/THB as a function of USD M1 Fed’s balance sheet money supply USD M1 money supply, USD bn 2200 USD/THB 48 2100 46 2000 44 y = -0.0188x + 65.37 2 y = 0.0002x - 0.4615x + 1711.7 42 1900 2 R = 0.9398 2 40 R = 0.8832 1800 38 1700 36 34 1600 32 without Sept 2006 to Dec 2008 period 1500 30 2108.8 1400 28 26 800 1000 1200 1400 1600 1800 2000 2200 2400 2600 2800 3000 Fed's balance sheet, USD bn 1000 1100 1200 1300 1400 1500 1600 1700 1800 1900 2000 2100 2200 USD M1, bn Source: Bloomberg, CEIC, KBank Source: Bloomberg, CEIC, KBank Thailand’s Katrina / 3-11 or our 10-11 The current unfolding events regarding the floods that have devastated about 59 provinces out of 77 province is similar to how Katrina impacted the US Gulf coast areas or what Japan faced following the 3-11 earthquake / tsunami. Economic and social losses are at the moment are difficult to estimate. Finance Minister Thirachai Phuvanatnaranubala has put losses at about THB 60bn while the National Economic and Social Development Board (NESDB) have estimates the losses at THB80- 90 bn. As the Bank of Thailand is located at the banks of the Chao Prahya river, the Central Bank is to have a great sense of urgency to adopt a wait and see stance as both internal and external environment are in an extreme state of flux. This means that carry trades by shorting the US dollar and a long position in Thai baht is less attractive in comparison to expectations of a hawkish Bank of Thailand and a dovish Fed. The Venice of the East (Bangkok is to face the most critical periods of flooding during October 16th to th 18 ) given the convergence of a high tide, more run off from the dams up North and possibly more rainfall from new depression systems. 1212 12

- 13. Fig 15. The BOT is located on the banks of the Chao Fig 16. Chao Phraya River System, highlighting Phraya river impacted areas Source: Google Maps Source: wikipedia Fig 17. Policy rates, TH vs. US Fig 18. Implied forward rates, 1yr rate, 1yr from now % change : 1yr rate, 1yr from now 7 0.50 6 0.40 5 0.30 4 0.20 3 0.10 0.00 2 -0.10 US CH ID MY UK KR EU SG TH 1 -0.20 0 -0.30 00 01 02 03 04 05 06 07 08 09 10 11 % change : 1yr rate, 1yr from now BOT repo Fed Funds Source: Bloomberg, CEIC, KBank Source: Bloomberg, CEIC, KBank 1313 13

- 14. USD/THB is declining… because? The first Friday is one that is most followed by the markets since it is Jobs Friday. The US labor department reported that September created about 103k jobs which were higher than what economists had penciled in at 60k. The market seems to be contented with the report with 10yr bond yields climbing about 2% post the Fed’s announcement of Operation Twist. Still this is hardly something to celebrate about since while the US economy might have recovered, but the jobs market (one of the two Fed mandates) is hardly in equilibrium. At the peak of the US economic boom, the total number of Americans working excluding the agricultural sector was 137,996k whilst September’s reading is 131,334k. Fig 19. US non-farm payrolls change vs. consensus Fig 20. Total non-farm payrolls 140,000 '000 800 138,000 600 400 136,000 200 134,000 0 -200 132,000 -400 -600 130,000 -800 128,000 -1000 00 01 02 03 04 05 06 07 08 09 10 11 Jan-07 Jul-07 Jan-08 Jul-08 Jan-09 Jul-09 Jan-10 Jul-10 Jan-11 Jul-11 non-farm payrolls, k non farm payroll - actual survey Source: Bloomberg, CEIC, KBank Source: Bloomberg, CEIC, KBank Hence, there is no double dip for the US jobs market, since it had never recovered. Many considered that this recent recovery was a “jobless” recovery, which is rather unsustainable since the US economy is largely driven by consumption. No jobs = no wages = no income = no spending = no growth. Therefore, it can not be stressed enough that the economy has to grow in order to accommodate the jobs market. Fig 21 maps the change in non-farm payrolls as a function of change in nominal GDP, which suggests that the US economy needs to grow at least 1% just to keep non-farm payrolls at a zero change. Unfortunately, stimulus via expansionary fiscal policy is no longer an option as the Eurozone crisis will attest to or else we will hear about the US sovereign debt crisis…again. Fig 21. y= f(x), change in non-farm payrolls as a Fig 22. US debt to GDP ratio, IMF estimates function of change in US nominal GDP change in non-farm payrolls 120 1.0% 110 100 90 0.5% 80 70 0.0% 60 -2.5% -2.0% -1.5% -1.0% -0.5% 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 50 -0.5% 40 change in nominal GDP 30 20 -1.0% 10 y = 0.5025x - 0.0048 2 0 -1.5% R = 0.6318 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 since 2000 -2.0% US GDP % IMF projections Source: Bloomberg, CEIC, KBank Source: IMF 1414 14

- 15. Beside cheap money with respect to time i.e. interest rates, one way the US can hope to recover is with cheap money with respect to other currencies i.e. foreign exchange rate. Fig 23 states our case, mapping the US dollar on a trade weighted basis versus the US GDP (chain weighted, real). The map suggests that as dollar weakens it will be supportive of US economic growth. For every point reduction in the US dollar, it should generate real economic growth of USD 54 bn, vice versa. This is why the legislative branch of the US government is looking towards a very precarious maneuver by drafting the “anti China currency bill” which is likely to spark a trade war. One bitter lesson from the Great Depression was that protectionism and trade barriers made matters worse and sank the global economy ever further. Fig 24 states the case for the currency bill, which shows that as the US sinks further into a trade deficit with China, the number of non-farm payrolls in the manufacturing also falls. Fig 23. y= f(x), US GDP as a function of trade weight Fig 24. US trade balance with China & US non-farm dollar payrolls – manufacturing sector US chain weighted real GDP, US bn 0 19.0 13500 -50 18.0 -100 17.0 13000 y = -49.137x + 16851 16.0 74, 13,272 2 -150 12500 R = 0.8366 15.0 -200 14.0 12000 -250 13.0 ρ = 92% -300 12.0 11500 -350 11.0 11000 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 10500 US trade balance with China, 12mth moving sum, USD bn (left axis) 60 70 80 90 100 110 120 130 US non-farm payrolls, manufacturing, mn (right axis) DXY, US dollar index Source: Bloomberg, CEIC, KBank Source: Bloomberg, CEIC, KBank The market expectation is for further downside for the USD/CNY is still tepid since the spot and the 12mth NDF (non-deliverable forward) is about the same levels. Therefore if this bill truly picks up momentum, such expectations are likely to change for further downside for USD/CNY as well as USD/THB as shown by the mappings on fig.26 Fig 25. USD/CNY 12mth NDF, USD/THB Fig 26. USD/CNY 12mth NDF, USD/THB mapping USD/THB spot 48 7.4 37 46 7.2 36 y = 6.3239x - 9.664 correlation coefficient = 0.93 44 2 35 R = 0.9411 7.0 42 34 40 6.8 33 38 6.6 36 32 6.4 31 34 6.2 32 30 6.348, 30.88 30 6.0 29 28 Jan-08 Jul-08 Jan-09 Jul-09 Jan-10 Jul-10 Jan-11 Jul-11 6.0 6.5 7.0 7.5 8.0 8.5 9.0 USD/CNY NDF USD/CNY 12mth NDF (left axis) USD/THB spot (right axis) Source: Bloomberg, CEIC, KBank Source: Bloomberg, CEIC, KBank 1515 15

- 16. A Japanization: are we going to see a lost decade in US/EU? The experience of Japan during the 1990s when the economy remained stagnant is one of the major examples the US and the eurozone might try to avoid The US and the eurozone had better take a serious measure to solve their economies unless they will end up like Japan which its government was reluctant to do anything except printing more money The US could employ fiscal policy and reform its economy to lean toward more exports; meanwhile, debasing the dollar is also an important tool to lower its debt obligation The tangible solution for the eurozone is to take a painful but meaningful step; default is already out of the question as Greece is seen unable to pay off debt without restructuring the payments with its creditors The conflict between the US and China over the yuan appreciation will remain on-going and will be a part of the global economic volatility for the following year Don’t learn from the Japanese model The experience of Japan during the 1990s when the economy remained stagnant, called lost decade, is one of the major examples the US and the eurozone might try to avoid. The cause of the economic crisis in the US and Japan was similar: the burst of asset prices. The stock market clashed in 1990 in Japan while the housing prices burst in 2008 in the US. Both the events led to banking crises. The governments took part in stabilizing the financial market by injecting a great deal of money to keep banks alive. However, loosening monetary policy led to an increase in money supply and a lower interest rate. Liquidity trap was a major challenge in economic recovery as borrowers were reluctant to invest depite low interest rate. Bond issuance caused an increase in public debt, which led to a question on fiscal sustainability. Consequently, both the US and Japan’s governments were downgraded. How about the eurozone? The cause of the upcoming crisis was from an increase in public participation in solving financial crisis in 2008 when banks were unwilling to lend to another bank for fear of bankrupcy as seen in Lehman Brothers. Governments in the eurozone stimulated the economies by injecting money to the system, which subsequently was developed into another form of crisis: sovereign debt crisis. When the public becomes the problem the economies have no one left to rescue them. Japan, US and the eurozone have something in common which is the problem of huge public debt. How can the US and the eurozone avoid following the Japan’s foot step that caused the economy to stay stagnant for a decade? Actually, the way the US and the eurozone have been solving their economies is resemble to what Japan did two decades ago, which is by procrastinating the problem. No one has been taking a problem seriously. We have not yet seen a critical reform in any of these economies. Economic structure has remained the same prior to the crises. American consumers still enjoy incuring consumer’s debt while exports are discouraged 1616 16

- 17. by recent rise of the dollar. Greece and other PIIGS were reluctant to take a painful way of the austerity measures. They could not meet the target that they promised earlier. German and France have kept bailing out these countries for fear if these governments declare default. German and French banks would be in trouble as they hold a great deal of sovereign bonds. Therefore, the solution in the past is very simple: let’s hope there will be a mirable! Of course, there is no economic miracle to solve the sovereign debt problem in PIIGS. The longer they wait, the more painful creditors will encounter when facing with hair cut as the size of the loan has grown bigger due to series of bail-out. The US and the eurozone had better take a serious measure to solve their economies unless they will end up like Japan which its government was reluctant to do anything except printing more money. Don’t forget that Japan was in a better position than the US and perhaps the eurozone on the ground that Japanese are net savers and exports from Japan are more competitive. Fig 27. Growth of money supply in Japan Fig 28. Growth of money supply in the US % yoy Japan money supply % yoy US money supply 35 25 30 20 25 20 15 15 10 10 5 5 0 0 -5 -5 May-01 May-02 May-03 May-04 May-05 May-06 May-07 May-08 Aug-06 Aug-07 Aug-08 Aug-09 Aug-10 Aug-11 Growth of M1 (% yoy) Growth of M1 (% yoy) Source: Bloomberg, KBank Source: Bloomberg, KBank Is there a way out? Yes, of course. There are solutions to solve economic problems in the US and the eurozone. For the US, monetary policy is doomed. Liquidity trap of low interest rate is apparent. Therefore, the remaining tool is the fiscal policy. It is still hard to imagine that this is a solution, especially after the political tension between the Democrats and the Republicans over raising the debt ceiling and cutting budget deficit. However, the US still has room to increase government spending to create jobs and private consumption. Without political competition, the US government still has one powerful tool left. By doing so, it is important that the US continue reforming its economy to lean toward more exports. Meanwhile, debasing the dollar is also an important tool to lower its debt obligation. How about the eurozone? Politicians in the eurozone have been denying the truth that they cannot rescue PIIGS. If they continue injecting more money to rescue Greece and others, they will end up transfering money to PIIGS or bailing out their own banks. Even they continue pumping more money, it will end up hurting PIIGS more. It is noted that a country with larger debt obligation is likely to grow at a slower pace than before. There is a negative relationship between debt burden and growth. When public debt rises sharply, investors are likely to be worried about fiscal sustainability, which eventually leads to banking crisis. Banks can be punished from buying government bonds. Higher public debt leads to higher bond payments, which take a bigger portion of government budget. The government is seen to have fewer resources to invest. Consequently, a slow growth of capital stock is unable to induce higher labor productivity, which leads to slower pace of economic production. The tangible solution for the eurozone is to take a painful but meaningful step. Default is already out of the question as Greece is seen unable to 1717 17

- 18. pay off debt without restructuring the payments with its creditors. Creditors, including taxpayers, will need to accept losses. The remaining questions are whether other members of PIIGS will default and how much banks will need to recapitalize. Answers for these questions remain unknown as it depends on how much investors would continue selling stocks and depositors could be panic and start to withdraw money from banks that have high exposure to PIIGS’s debt. It is unavoidable that banks in the eurozone will end up being downgraded if they fail to recapitalize or prevent the bank run. Fig 30. Claims on PIIGS’s public debt by French and Fig 29. Japanization in the US and the eurozone German banks USD bn Foreign claims on public debt by nationality of reporting banks 250,000 200,000 150,000 100,000 50,000 0 Dec-11 Mar-11 Dec-11 Mar-11 Dec-11 Mar-11 French banks German banks Other banks Portugal Ireland Italy Greece Spain Source: The Economist, July 30, 2011 Source: Bloomberg, KBank Dexia and more to come Dexia could be viewed as a sign of an early stage of banking crisis in the eurozone. Dexia is a Franco-Belgian bank that is being in trouble for its high exposure to Greece’s debt. Dexia used short-term funding to finance long-term lending; hence, credit dried up during the eurozone debt crisis. Investors are concerned about the bank’s financial health that has led to a sharp decline in bank’s capital. French-Belgian governments tried to rescue Dexia either by injecting capital through the EFSF and ECB similarly to the US’ TARP in 2008, yet the plan was dropped as it would deplete resources from EFSF which should be used as the last resort. France and Belgium helped bail out Dexia, yet failed to separate bad bank. Subsequently, Dexia was agreed to the nationalization of its Belgian banking division, which was followed by a warning by Moody’s that the Belgium’s Aa1 government bond ratings could fall with this bail out plan. Based on this example, we will see larger public intervention on bailing out troubled banks, either by nationalizing banks or injecting more capital to prevent bank run. If banks collapse, financial turmoil in the eurozone will prevail. It is likely to see slower growth in the eurozone for the next few years until banks have successfully recapitalized to gain financial health. In addition, fiscal reform is necessary to allow the governments to reduce public debt for fear of disrupting economic growth in the future. BRICS and world economic recovery BRICS, namely Brazil, Russia, India, China and South Africa, are emerging economies that have been enjoying high economic growth. During the economic crisis in 2008, BRICS’s economies grew remarkably despite a fall of the global demand. Major factors are that they relied on their domestic consumption and investment to generate growth. Can they revive the ailing global economy again if we all fall into trouble? This time the answer is full of uncertainty. After the sub-prime crisis, the Fed introduced QE1 and QE2, which caused rapid capital flows to BRICS and other regions. Capital flows has led to an increase in the demand for local currencies, causing stronger exchange rate versus the US dollar. In order to maintain competitiveness in exports, several central banks 1818 18

- 19. intervened the market by accumulating more foreign reserve so as to slow down the pace of local currency appreciation. This attempt has drawn attention to currency war where one country has tried to make its exchange rate under-valued so as to gain greater competitiveness against others. The US is seen hostile to China for making the yuan artificially under-valued, threatening to pass a currency bill to punish China. The US claimed that it could generate more jobs if the yuan has been more appreciated. However, China warned the US that the currency war could lead to a trade war. This conflict will remain on-going and will be a part of the global economic volatility for the following year. 1919 19

- 20. Pricing in economic slowdown and policy rate pause We revised down our target for the policy rate to 3.50% for the end of this year, noting the BoT’s proposed change of inflation target as well as the worsening global conditions due to Europe’s debt crisis Given the new policy target and the BoT’s forecast of decelerating headline inflation rate, there should be less pressure to call for further hikes Bond yields had a volatile third quarter but basically the yield curve remained flat Foreign investors turned net-sellers of Thai bonds for the first time in months and risks of further sell-offs continue although we do not expect such an outcome unless European debt crisis turned into a global financial crisis of similar impact as the crisis in 2008 Q1 bond supply capped by delays in fiscal budget, high treasury cash balance, and P/N substitution FY2012 bond supply plan changed slightly : more long-term bonds, lower 3-year bonds We continue to see a flat yield curve going forward but the uncertainties in global financial markets could lead to lower appetite for duration in emerging market bonds: stay short duration Market update – September and October interest rate movements During the past 3 weeks or so, the situation in Europe with regards to Greece’s debt crisis had worsened drastically, driving local bond yields and the IRS rates into different directions. The government yield curve shifted upwards as a result of foreign investors’ sell-off in emerging market assets while the IRS rates fell, following the short-dated THBFIX rates on the back of USD liquidity concern in the global markets. During the first week of October, such trends started to revert: bond yields started to fall slightly while IRS rates saw less downward pressure from the declines in swap points. Fig 1. Government bond yield curve rebounded Fig 2. Movements of IRS rates % Government bond yield curve % 4.00 3.83 5.0 3.81 3.82 3.77 3.80 3.69 4.5 3.63 3.61 3.62 3.56 3.58 3.67 3.69 3.64 3.64 4.0 3.60 3.55 3.55 3.53 3.53 3.53 3.48 3.5 3.40 3.45 3.0 3.38 3.41 3.41 3.4 3.36 3.33 3.35 3.20 3.32 3.31 2.5 3.00 2.0 1y 2y 3y 4y 5y 6y 7y 8y 9y 10y Mar-11 Apr-11 May-11 Jun-11 Jul-11 Aug-11 Sep-11 Oct-11 07-Oct-11 22-Aug-11 26-Sep-11 TTM IRS 2Y IRS 5Y IRS 10Y repo Source: Bloomberg, KBank Source: Bloomberg, KBank 2020 20

- 21. In any case, we expect that the short-term swap rates would remain capped at low levels (way below policy rate) for up to the end of December, given the market’s expectation that the Bank of Thailand (BoT) would not increase the policy rate further and the ongoing concerns about USD liquidity amid the tightness of USD funding conditions in Europe. Hence, we iterated our view last month that it is still a good time for the corporate sector to hedge borrowing costs but there is no hurry in doing so. Fig 3. 6m swap points and 6m THBFIX rate Fig 4. Bond-swap spreads picked up slightly satangs % bps 50 3.75 80 60 45 3.50 40 40 3.25 20 35 3.00 0 -20 30 2.75 -40 25 2.50 -60 20 2.25 -80 Jun-11 Jul-11 Aug-11 Sep-11 Oct-11 Jan-11 Feb-11 Mar-11 Apr-11 May-11 Jun-11 Jul-11 Aug-11 Sep-11 Oct-11 USD/THB 6m forward point 6M THBFIX 2Y bond-swap spread 5Y bond-swap spread 10Y bond-swap spread Source: Bloomberg, KBank Source: Bloomberg, KBank Foreign investors had turned net-sellers of local THB fixed income securities for the first time in more than a year during September. During the same month, foreigners also pulled out of the local stock market (net-sell USD 541.5mn) and the USD/THB turned 4.01% weaker in the month of September before rebounding by nearly 1.0% in October. Expectations that the Thai baht would not perform in the near-term also reduce foreigners’ reinvestment into short-dated debt. As a result, foreign investors’ net holding of THB fixed income securities fell from THB 438.6bn at end August to THB 434.2bn at end September and further to THB 425.6bn as of October 7th. Furthermore, we note as well that foreigners’ holding of THB bonds had climbed by THB 300bn in a short 12 month period from THB 150bn back in September 2010. This reflects substantial risk of sudden capital outflow should foreign funds liquidate THB bonds in the face of another outbreak of global financial crisis. If that worst case scenario does not happen, we expect that emerging market bonds would continued to see positive demand, given their rising significance in the global markets and the stronger fiscal positions of emerging market economies. Fig 5. Foreign holding position declined Fig 6. Foreign outright trade (net-purchase, monthly) Bt bn THB bn 500 180 163 450 160 400 140 127 128 350 120 300 100 84 73 71 79 up till 250 80 200 45 Oct 7th 60 40 150 28 40 16 19 100 50 20 3.7 - 0 -20 -1.5 Jan-10 Mar-10 May-10 Jul-10 Sep-10 Nov-10 Jan-11 Mar-11 May-11 Jul-11 Sep-11 Sep Nov Jan Mar May Jul Sep foreign holding in Thai fixed income, THB bn foreign net-buy in THB bonds (billion baht) Source: PDMO, KBank Source: PDMO, KBank 2121 21

- 22. During the sell-off, we did notice two factors. First of all, the yield curve had not steepened very much, which could be implying that demand for the long-term bonds remained and could be similar to the mid-curve bonds. In fact the flattening of the yield curve at the end of August, with 2-10 spread at 1bp, had been too abrupt and somewhat an overreaction of the market to the flattening of the U.S. yield curve. The sell-off in September thus helped to correct this spread back to around 20bp before declining towards 9bp on October 7th. This is in line with our expectation that insurance companies and pension funds continued to have high demand of bonds going forward. At the same time, the government’s bond supply plan does not overweight long-term bonds, as the PDMO is careful to push up long-term borrowing costs. Secondly, Fig 8. shows that local asset management companies continued to buy into the bond market, with the outright net-purchase position increasing for second straight month in September. Fig 7. Foreigners continued to trade in securities with Fig 8. Asset management (net-purchase, monthly) maturities <1Yr Composition of bond traded by Non-resident THB bn % 100 600 80 500 400 60 300 up till 40 200 Oct 7th 20 100 0 0 Jul- Aug Sep Oct Nov Dec Jan- Feb Mar Apr May Jun Jul Aug Sep Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct 10 11 0-1 Y 1-3 Y 3-5 Y 5-10 Y > 10 Y Mutual fund net-buy in THB bonds (billion baht) Source: PDMO, KBank Source: PDMO, KBank BoT’s to pause in the face of worsening global conditions We have revised down our target for the policy rate this year to 3.50%, from earlier expectation of two more rate hikes that could bring the policy rate to 4.00% at year-end. For the year 2012, we think that that BoT will continue to stay pat, given that inflationary pressure would be reduced by the decelerating growth momentum. As for the MLR (minimum lending rate), we do expect it to stay at current level of 7.25% (average of 4 large banks) following the pausing of the policy rate. At the same time, we do expect that the fixed deposit rates would likely pause as well, or edge up very slightly due to banks’ competition to amass deposits. As a result, we expect that the real policy rate and real 1-year deposit rate would remain in the negative zone for the next two quarters, with the assumption that headline consumer price index climbs by an average of 0.23% each month the next three quarters (average monthly change since 2011). Such a condition means that monetary conditions remained somewhat accommodative to growth should the Thai economy decelerate in accordance to the slowdown in the advanced economies. 2222 22