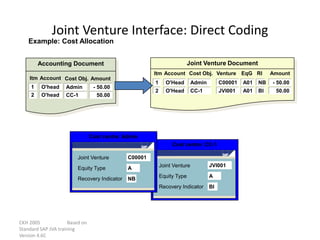

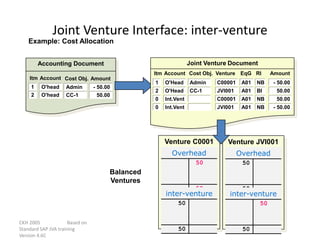

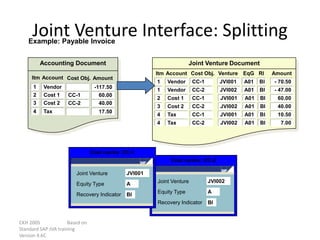

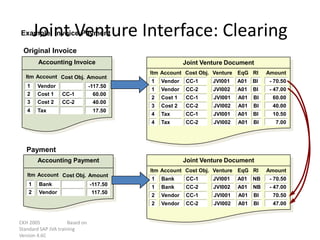

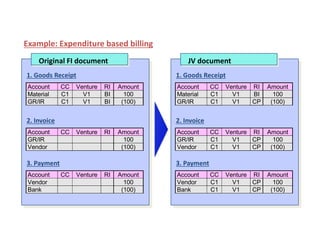

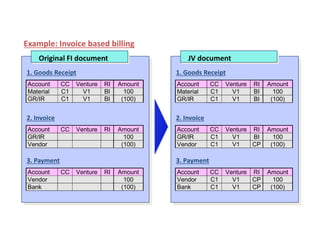

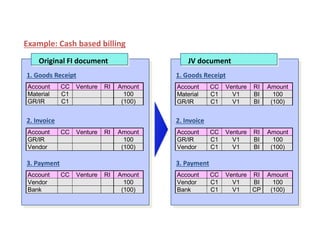

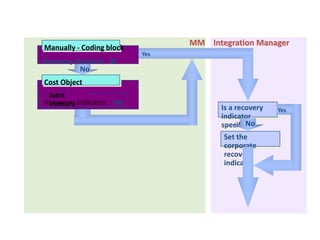

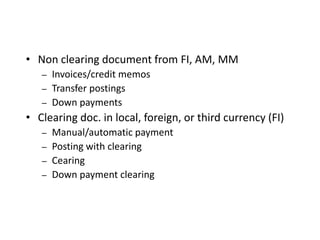

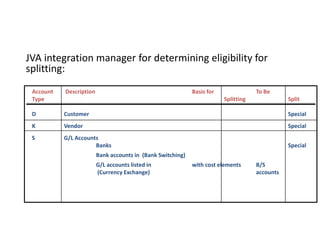

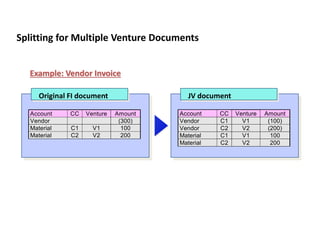

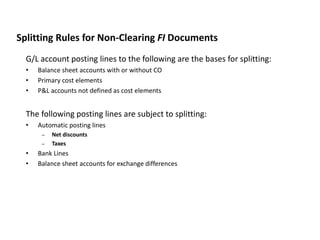

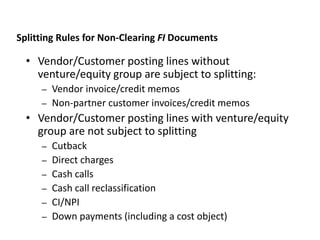

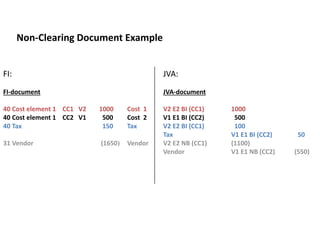

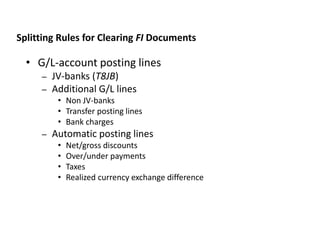

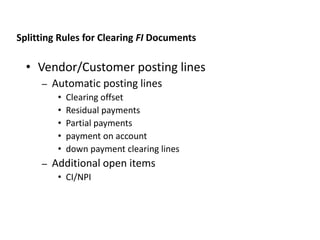

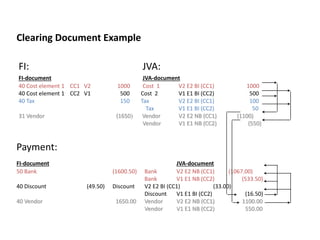

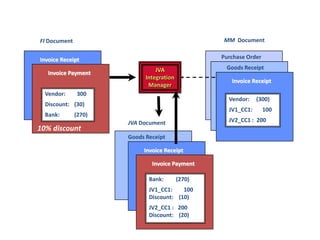

The document discusses rules for splitting joint venture accounting transactions across multiple ventures in SAP. It provides examples of how purchase invoices, payments, and other documents would be split between two joint ventures defined as Venture V1 and Venture V2. Key points covered include splitting rules for non-clearing documents, clearing documents, and special cases like ensuring balanced books for each venture.