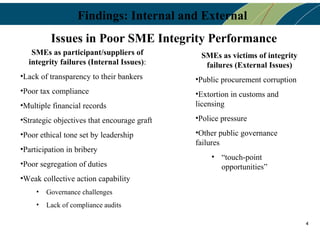

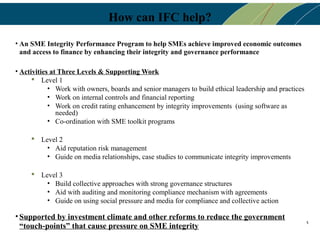

This document outlines a proposed SME Integrity and Governance Performance Program. It discusses findings from workshops with SMEs that identified internal and external integrity issues. The program would help SMEs strengthen integrity through activities at three levels: foundations, demonstration, and collective action. Key elements for success include framing integrity as a financial issue and ensuring benefits to SMEs and partner banks. The proposal outlines the program structure, budget, deliverables, and some remaining questions.