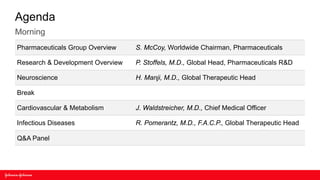

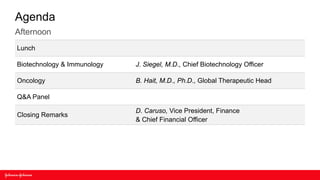

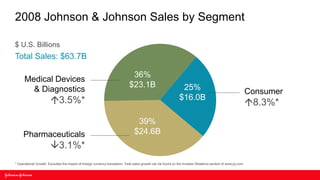

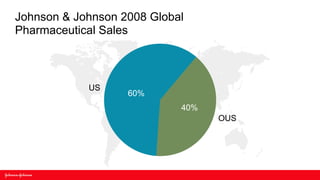

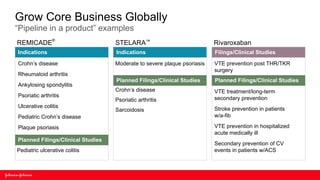

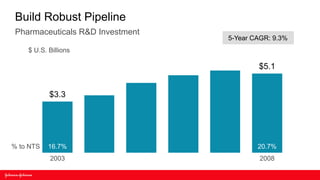

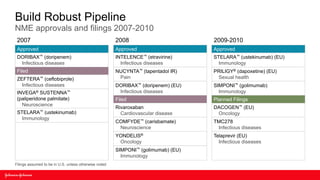

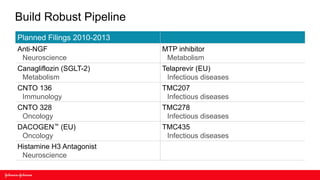

The document discusses Johnson & Johnson's pharmaceutical business and strategies for growth. It notes that J&J is the 7th largest pharmaceutical company globally with $24.6 billion in pharmaceutical sales in 2008. It outlines J&J's strategies to grow its core business globally, successfully execute new product launches, build a robust pipeline, fuel growth in emerging markets, shape the external environment, and focus on its people. The document also provides an overview of the global pharmaceutical market and key dynamics.