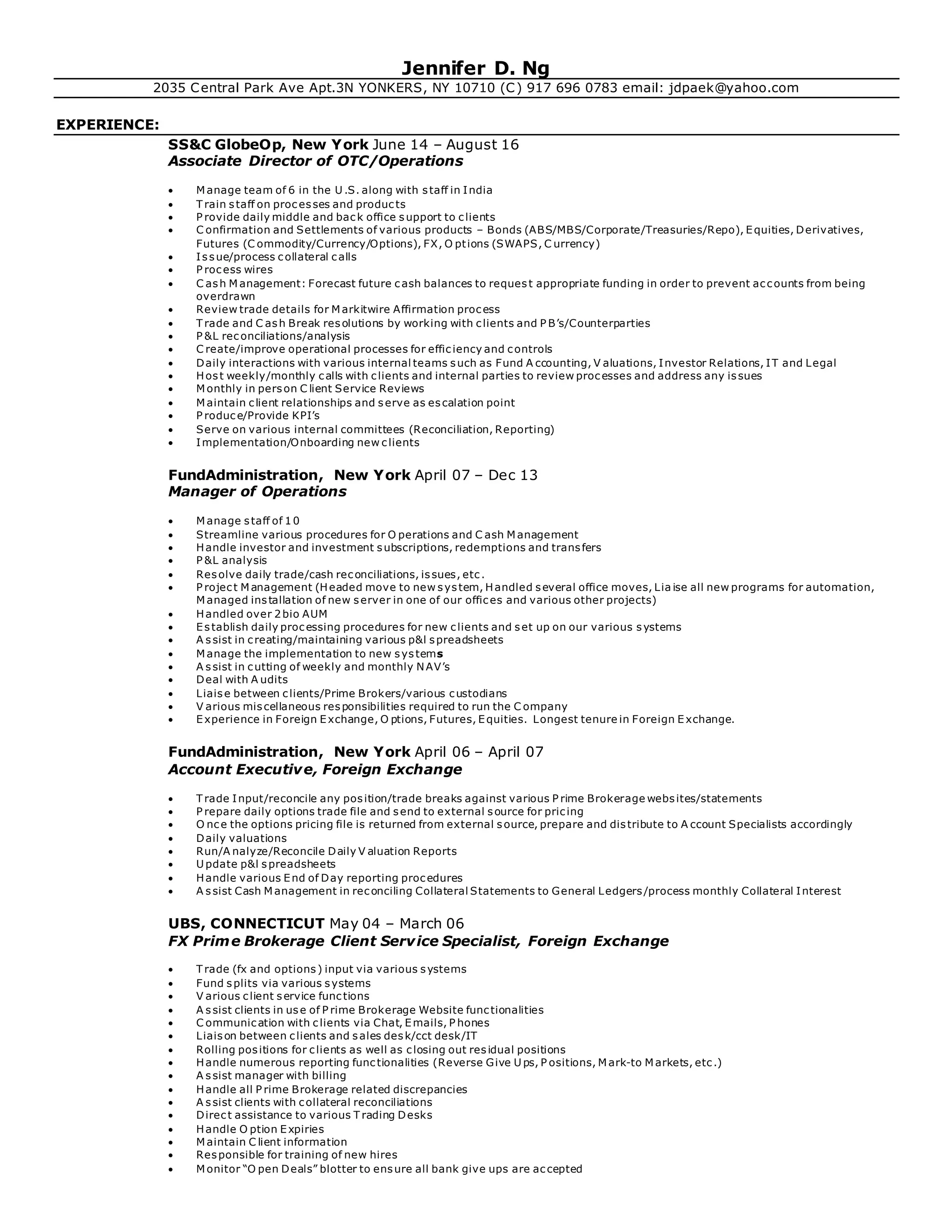

Jennifer Ng has over 20 years of experience in operations and client services roles in the foreign exchange and derivatives industries. She is currently an Associate Director at SS&C GlobeOp, where she manages a team that provides middle and back office support to clients, including trade processing and reconciliations. Previously, she held manager and account executive roles at several financial institutions, where her responsibilities included trade input, client services, implementing new systems, and managing teams of operations staff. She has a Bachelor's degree in Economics from SUNY Buffalo.