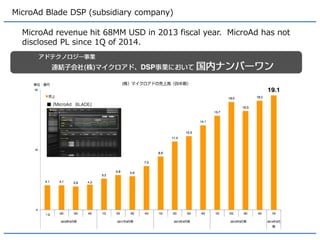

This document summarizes the Japanese adtech market in 2014. It reports that the real-time bidding (RTB) market grew significantly and is projected to continue growing. Several of Japan's major demand-side platforms (DSPs) and supply-side platforms (SSPs) saw large increases in revenue and traffic. For example, MicroAd's revenue hit $68 million in 2013, while Voyage Group's adtech revenue doubled to $20 million in the third quarter of 2014. The document also discusses trends in data management platforms (DMPs), attribution tracking, and the growing importance of omni-channel retailing.

![Agenda

This is a summary for marketers who want to know Japanese

Internet/mobile advertising industry.

-Market size and growth

-Chaos map

-Major players [ Local and global players ]

•The report is made from news , PR and IR documents.

•1 USD is calculated to be 100 JPY.](https://image.slidesharecdn.com/japanadtechindustryport-141028071548-conversion-gate01/85/Japan-adtech-industry-report-2014-2-320.jpg)

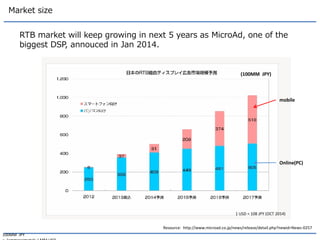

![Market size

RTB market will keep growing in next 5 years as MicroAd, one of the biggest DSP, annouced in Jan 2014.

Resource: http://promotionalads.yahoo.co.jp/netad/first.html

100MM JPY

= (ammroximately ) MM USD

1 USD = 108 JPY (OCT 2014)

(100MM JPY)

Mass media (TV, New paper etc): 2785 Billion JPY

Online(PC)/mobile 938 Billlion JPY

[Promotion others]Direct Mail/Event etc

2145 Billlion JPY](https://image.slidesharecdn.com/japanadtechindustryport-141028071548-conversion-gate01/85/Japan-adtech-industry-report-2014-4-320.jpg)

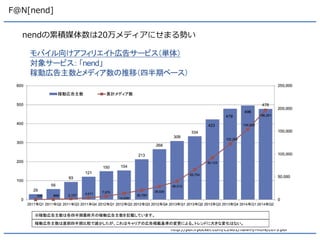

![Fan communications [nend]

F@n owns the biggest mobile ad network which severs more than 60 Billion impressions per a month.](https://image.slidesharecdn.com/japanadtechindustryport-141028071548-conversion-gate01/85/Japan-adtech-industry-report-2014-10-320.jpg)

![F@N[nend]

http://pdf.irpocket.com/C2461/h8MH/HlUN/co7S.pdf

nend revenue keeps growing fast and reached 30MM USD 2nd quarter in 2014.](https://image.slidesharecdn.com/japanadtechindustryport-141028071548-conversion-gate01/85/Japan-adtech-industry-report-2014-11-320.jpg)

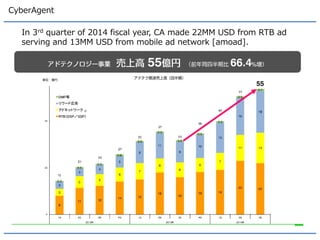

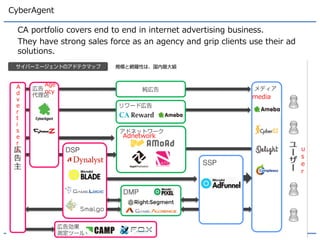

![CyberAgent

In 3rd quarter of 2014 fiscal year, CA made 22MM USD from RTB ad serving and 13MM USD from mobile ad network [amoad].](https://image.slidesharecdn.com/japanadtechindustryport-141028071548-conversion-gate01/85/Japan-adtech-industry-report-2014-13-320.jpg)

![UNITED [Bypass DSP & adstir SSP]](https://image.slidesharecdn.com/japanadtechindustryport-141028071548-conversion-gate01/85/Japan-adtech-industry-report-2014-17-320.jpg)

![UNITED [Bypass DSP & adstir SSP]

Bypass/adstir gererated 7.6MM USD from RTB business.](https://image.slidesharecdn.com/japanadtechindustryport-141028071548-conversion-gate01/85/Japan-adtech-industry-report-2014-18-320.jpg)

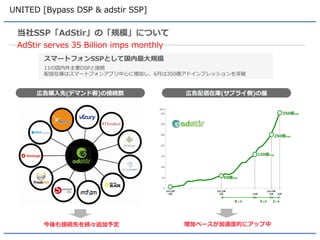

![UNITED [Bypass DSP & adstir SSP]

AdStir serves 35 Billion imps monthly](https://image.slidesharecdn.com/japanadtechindustryport-141028071548-conversion-gate01/85/Japan-adtech-industry-report-2014-19-320.jpg)

![VOYAGE GROUP [Fluct SSP & Zucks adnetwork]](https://image.slidesharecdn.com/japanadtechindustryport-141028071548-conversion-gate01/85/Japan-adtech-industry-report-2014-23-320.jpg)

![VOYAGE GROUP [Fluct SSP & Zucks adnetwork]](https://image.slidesharecdn.com/japanadtechindustryport-141028071548-conversion-gate01/85/Japan-adtech-industry-report-2014-24-320.jpg)

![VOYAGE GROUP [Fluct SSP & Zucks adnetwork]

Business portfolio of VOYAGE GROUP is consisted by adtech and media.

http://v4.eir- parts.net/DocumentTemp/20141028_084415921_vcddq345defap255lqu0ep45_0.pdf](https://image.slidesharecdn.com/japanadtechindustryport-141028071548-conversion-gate01/85/Japan-adtech-industry-report-2014-25-320.jpg)

![VOYAGE GROUP [Fluct SSP & Zucks adnetwork]

In 3rd fiscal quarter in 2014, adtech dev revenue reached 20MM USD which became double( + 200%) than last year. Operation margin reached 2.6MM USD.](https://image.slidesharecdn.com/japanadtechindustryport-141028071548-conversion-gate01/85/Japan-adtech-industry-report-2014-26-320.jpg)

![VOYAGE GROUP [Fluct SSP & Zucks adnetwork]

See blue bar, VOYAGE ad tech business grew much faster than last year.](https://image.slidesharecdn.com/japanadtechindustryport-141028071548-conversion-gate01/85/Japan-adtech-industry-report-2014-27-320.jpg)

![VOYAGE GROUP [Fluct SSP & Zucks adnetwork]

Growth of SSP revenue](https://image.slidesharecdn.com/japanadtechindustryport-141028071548-conversion-gate01/85/Japan-adtech-industry-report-2014-28-320.jpg)

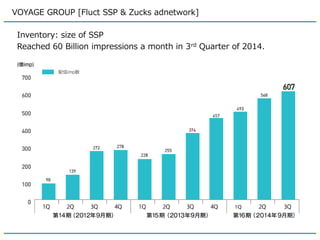

![VOYAGE GROUP [Fluct SSP & Zucks adnetwork]

Inventory: size of SSP

Reached 60 Billion impressions a month in 3rd Quarter of 2014.](https://image.slidesharecdn.com/japanadtechindustryport-141028071548-conversion-gate01/85/Japan-adtech-industry-report-2014-29-320.jpg)