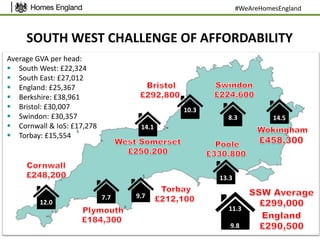

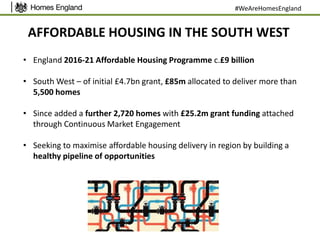

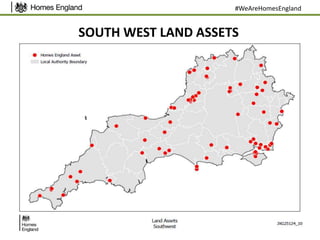

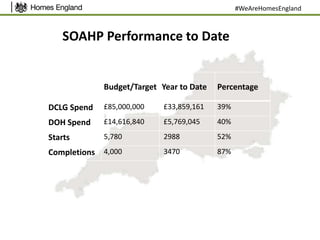

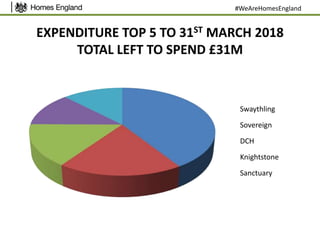

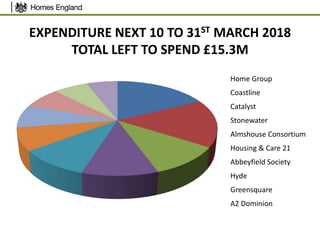

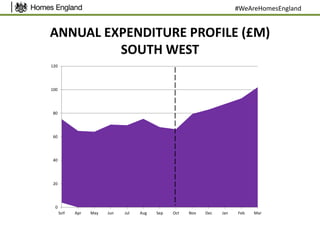

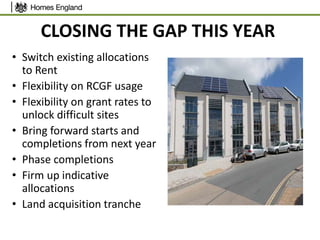

The document outlines the strategic meeting on affordable housing delivery in the South West, discussing the challenges and opportunities for increasing housing supply. It highlights ongoing partnerships, funding availability, and the government's commitment to affordable housing amidst regional economic disparities. Key priorities include accelerating housing delivery and maximizing affordable housing opportunities through various initiatives and flexibility in funding and allocations.