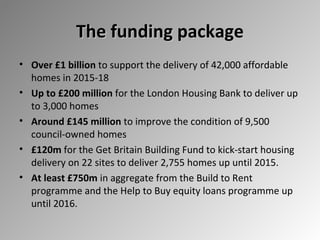

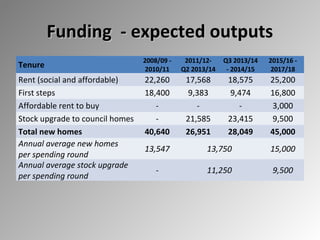

This document summarizes London's draft housing strategy and funding prospectus for 2015-2018. It aims to increase housing supply to over 42,000 new homes per year, including 15,000 affordable homes and 5,000 long-term private rental homes. The funding package totals over £1 billion to support affordable housing delivery. The strategy addresses London's growing population, affordability crisis, and increased housing needs through increasing supply, improving quality, supporting workers, and meeting needs like reducing homelessness.