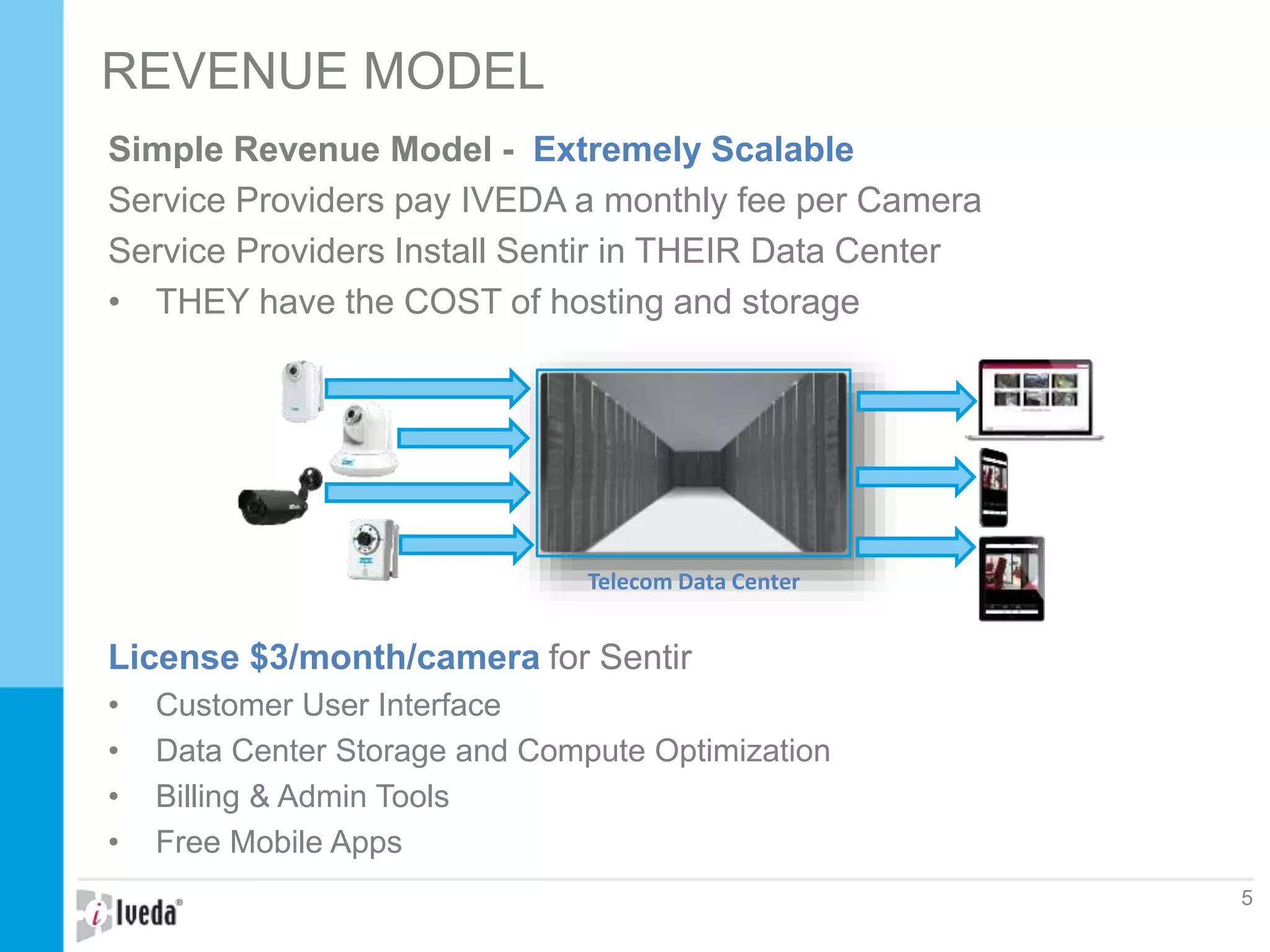

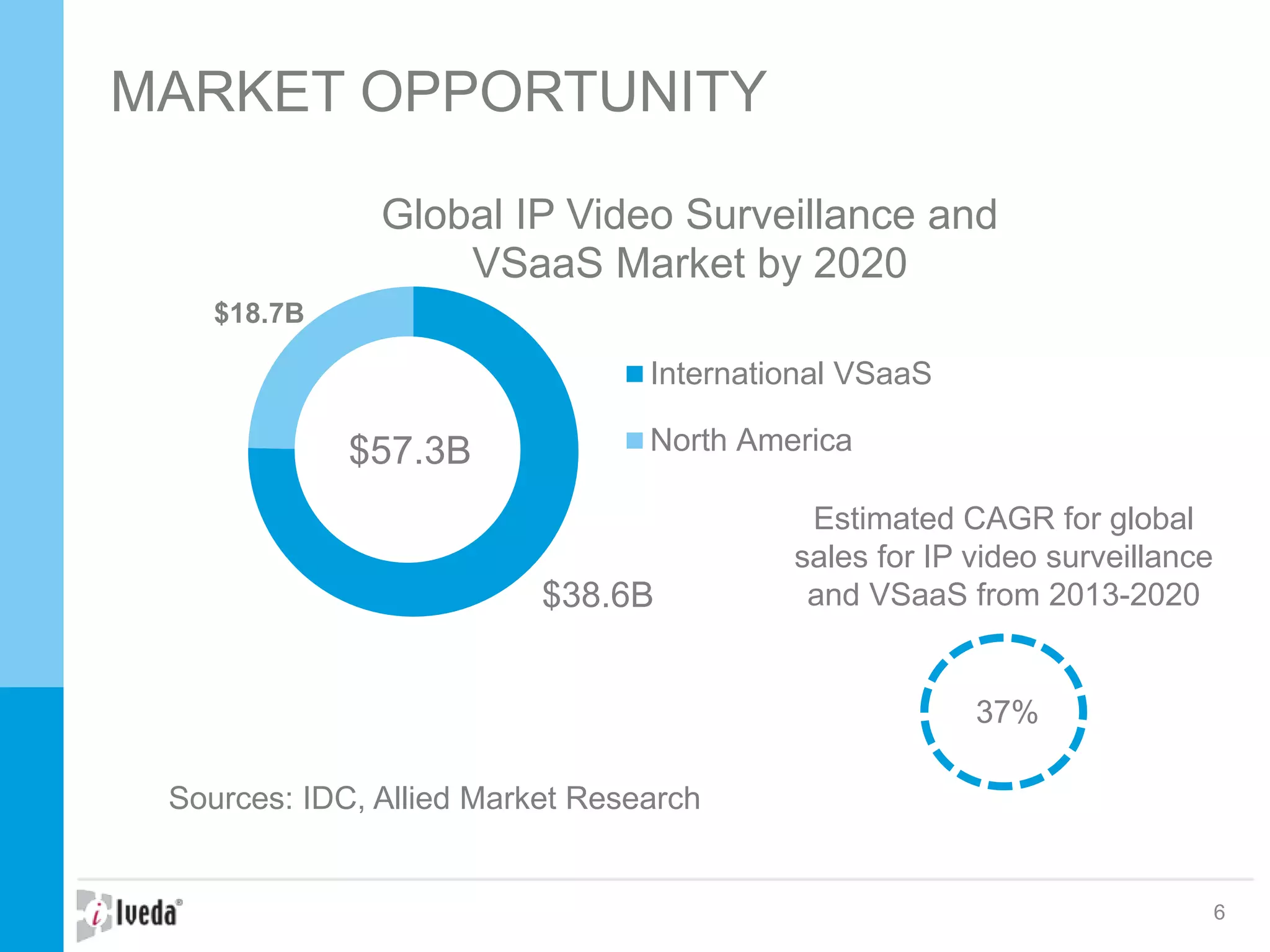

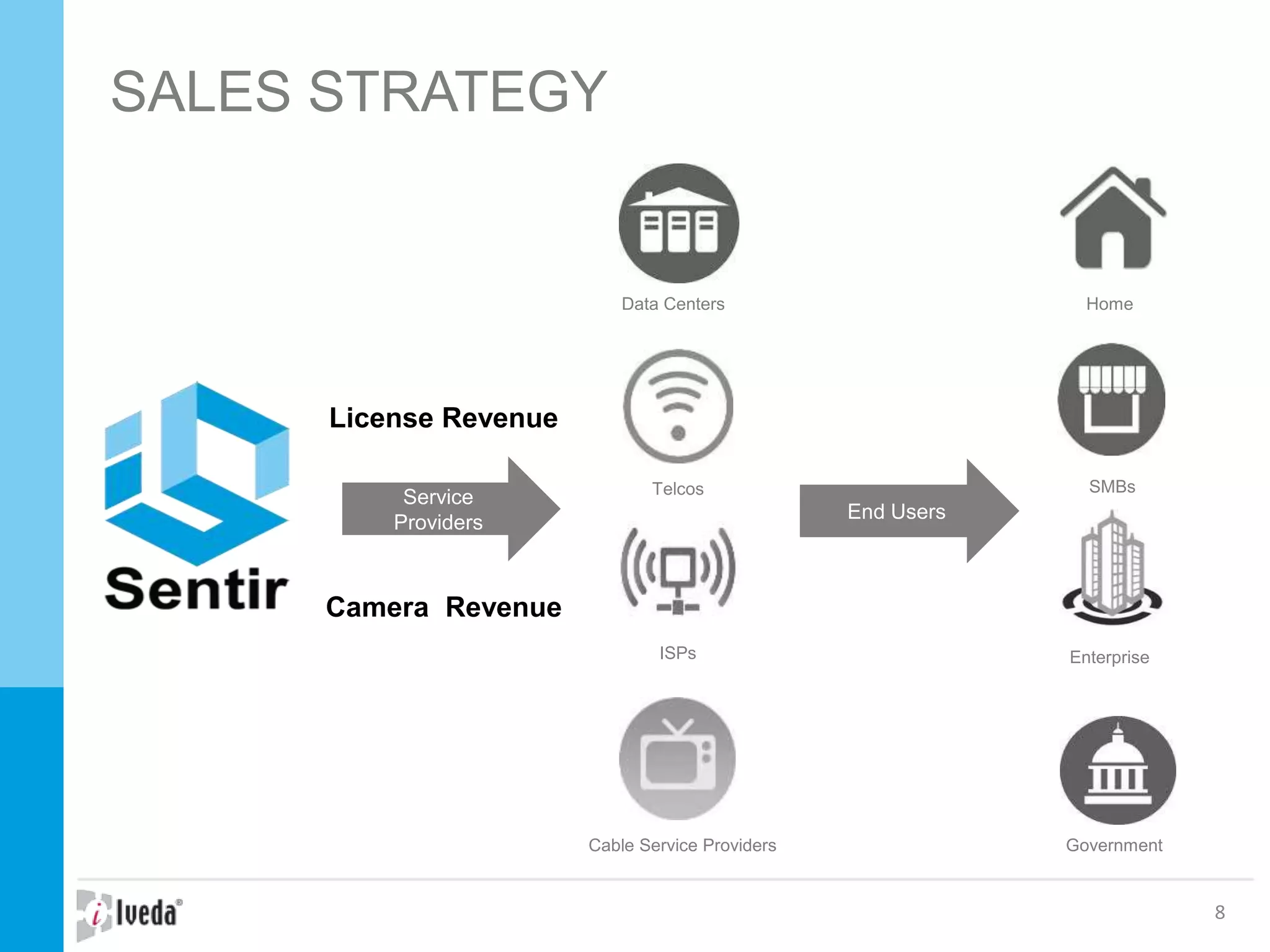

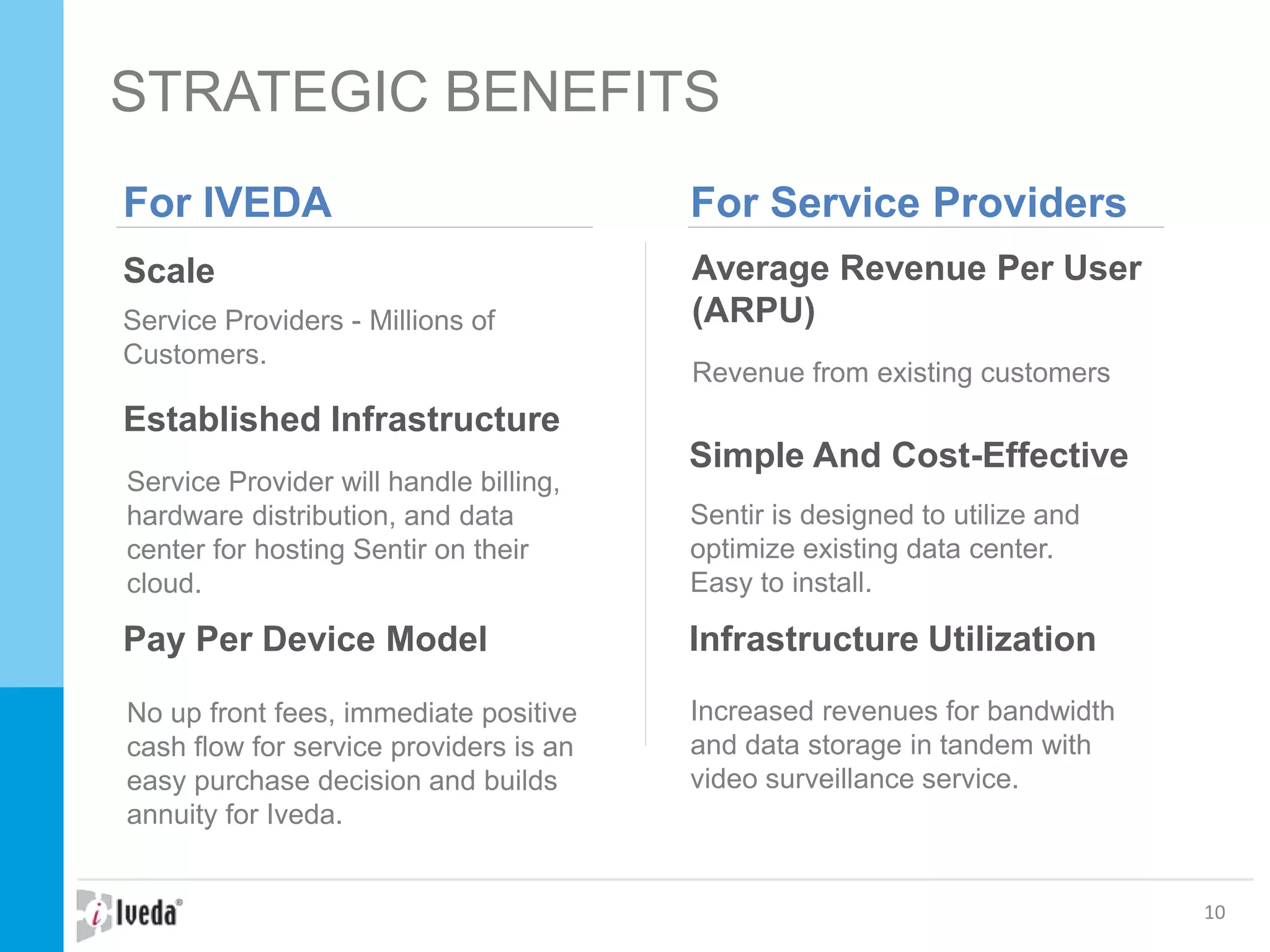

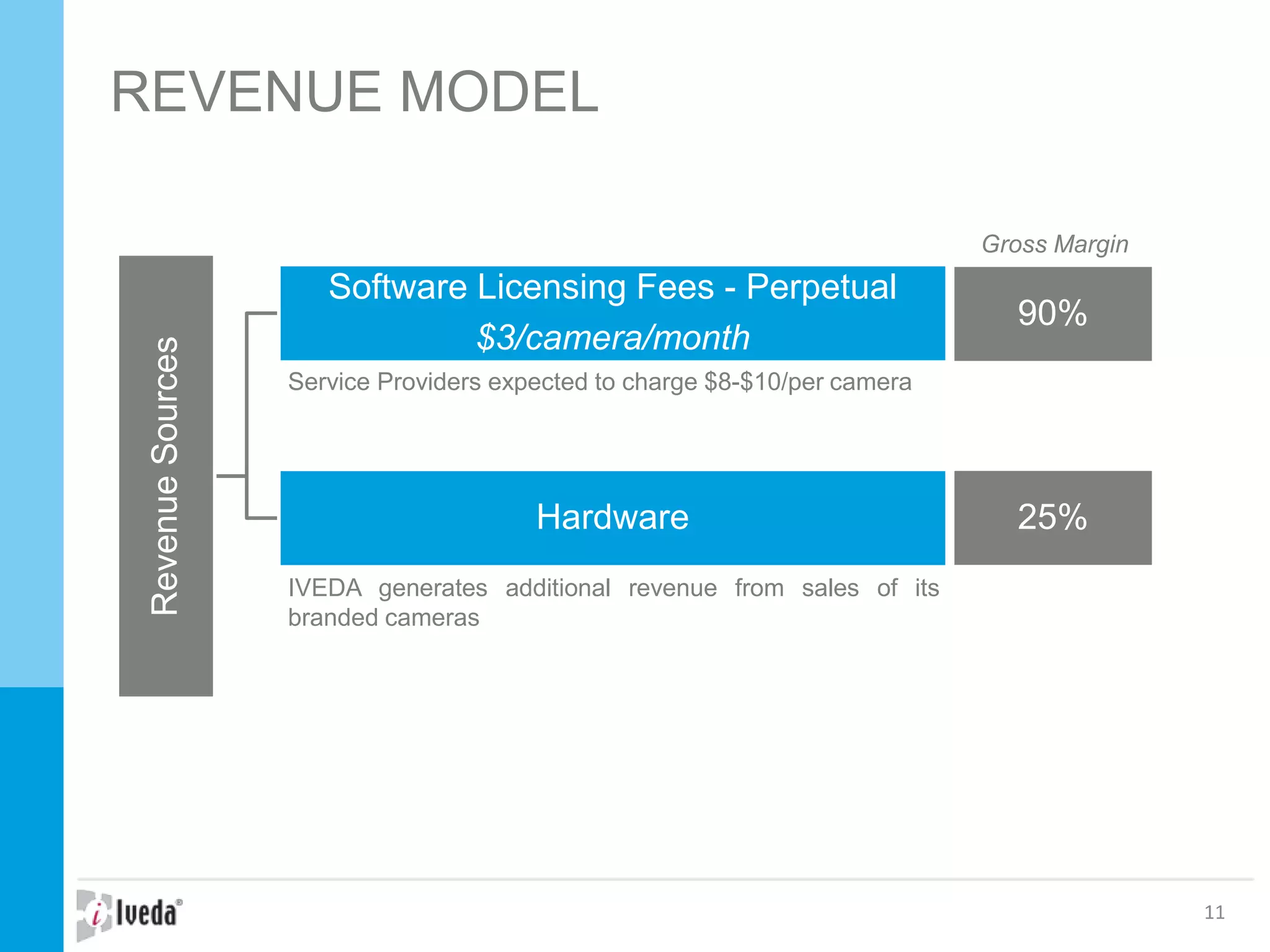

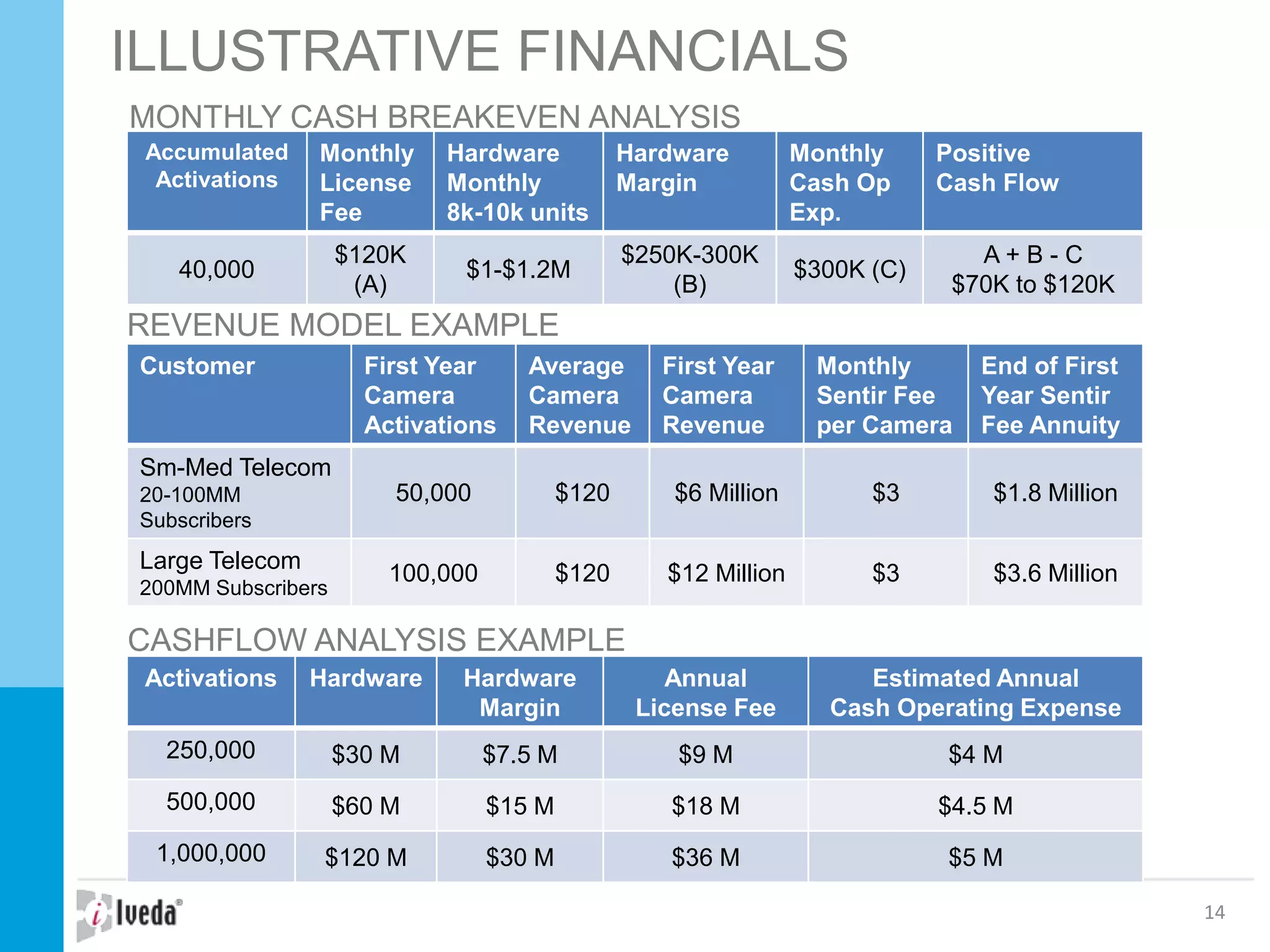

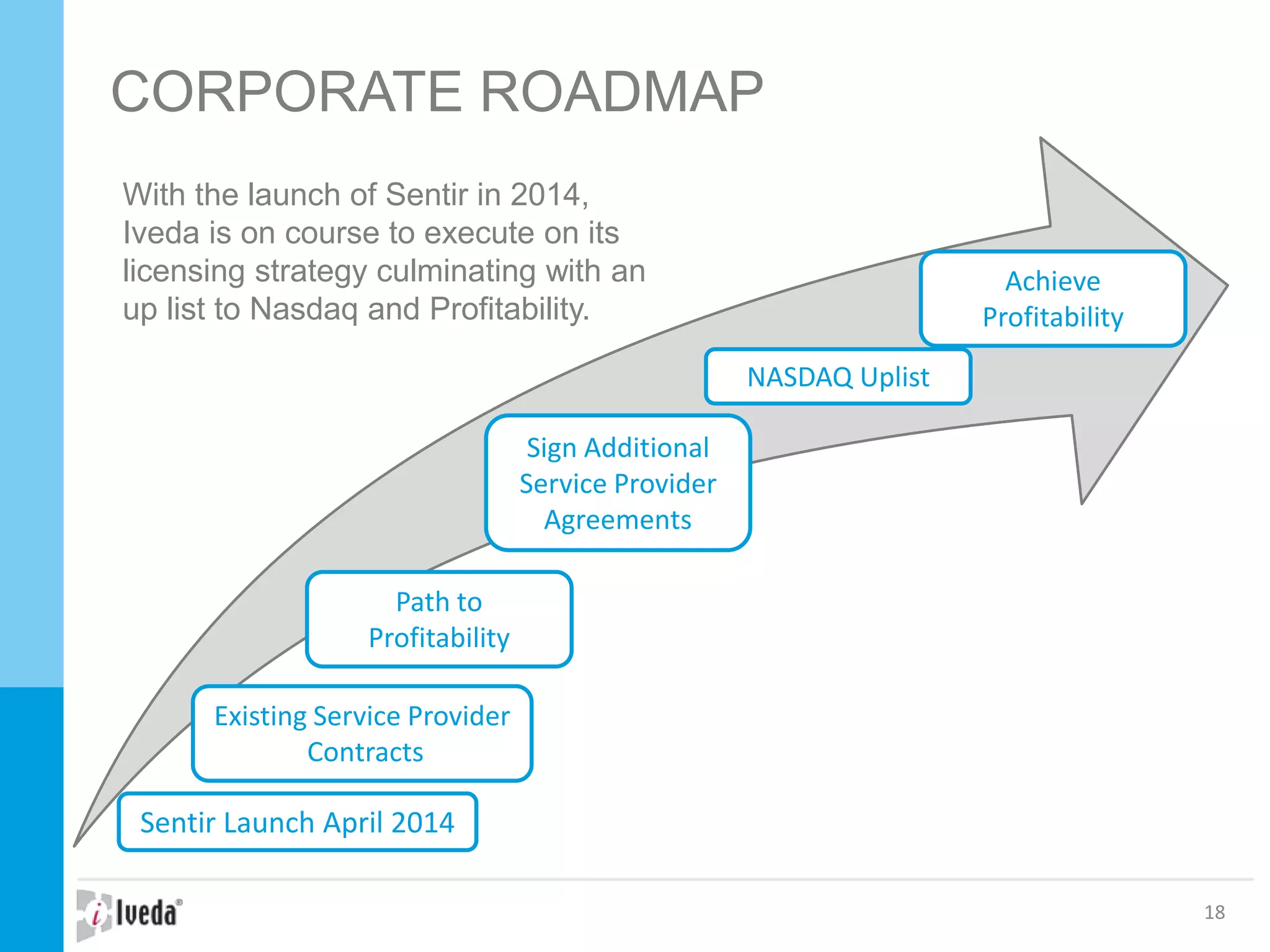

Iveda is a cloud video surveillance company that licenses its Sentir software platform to large service providers. Sentir allows service providers to offer video surveillance as a service (VSaaS) without on-site systems or DVRs. Iveda's recurring revenue model involves charging service providers a monthly fee per camera for use of the Sentir platform. Iveda has existing contracts with large telecom providers and expects these partnerships will lead to profitable growth as the global VSaaS market expands significantly in coming years.