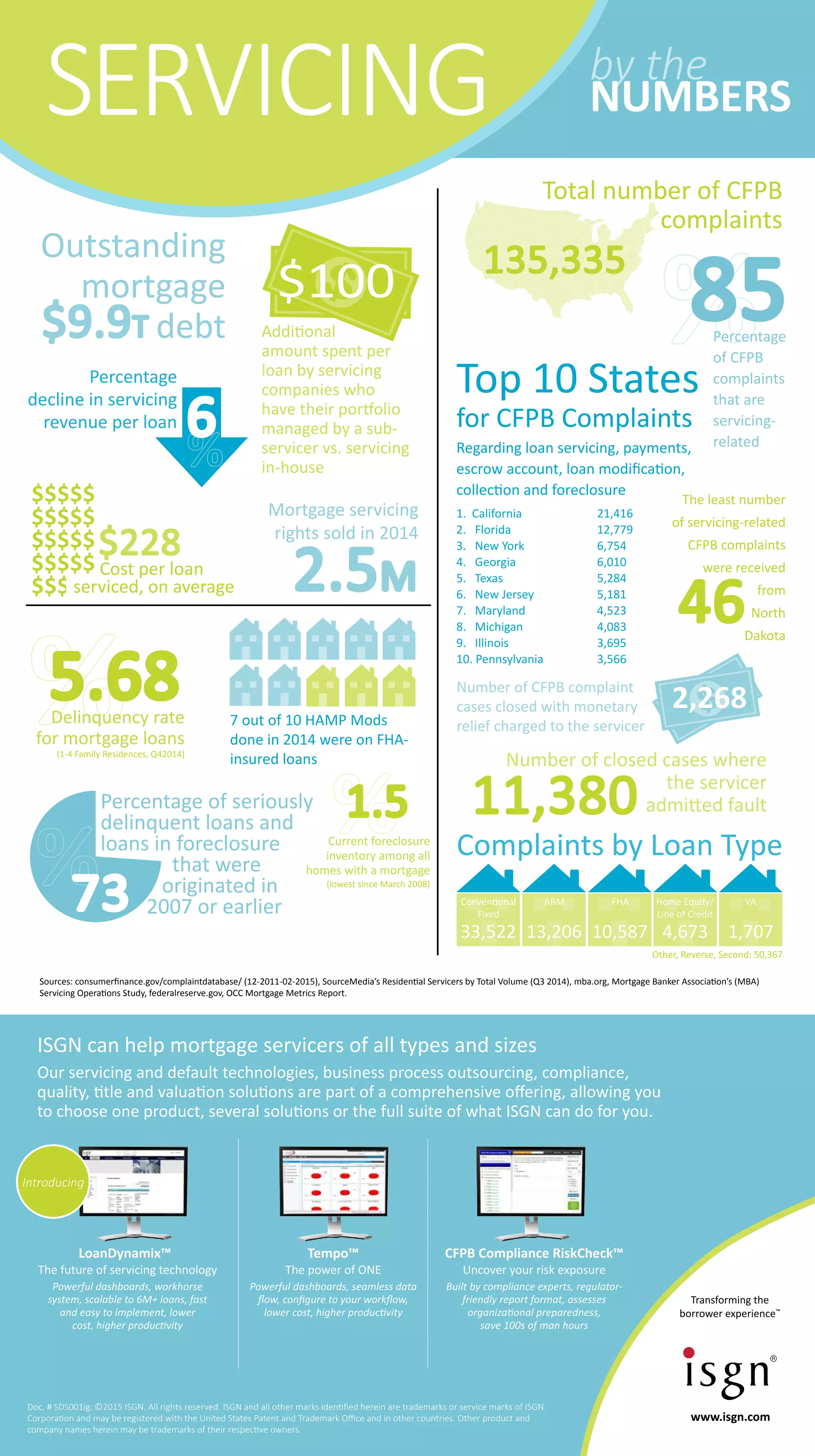

The document provides statistics on mortgage loan servicing complaints and performance. It shows that California had the most consumer financial protection bureau (CFPB) complaints regarding loan servicing at 21,416. Conventional fixed rate loans accounted for the majority (46%) of CFPB complaints. Servicers that outsource loan portfolio management to sub-servicers spend $100 more per loan on average than servicers managing loans in-house. The document also introduces ISGN as a provider of mortgage servicing technology and business process outsourcing solutions.