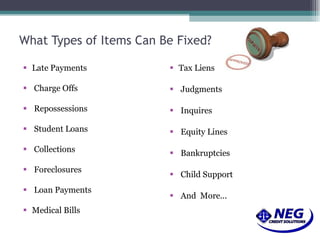

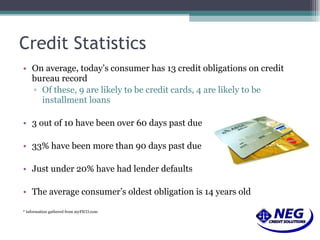

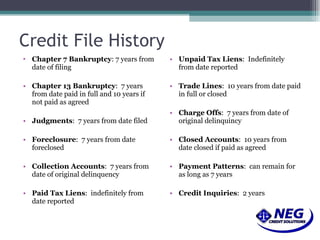

NEG Credit Solutions has been providing credit repair services for over 8 years. They help clients improve their credit reports and scores within 90 days by disputing negative items like late payments, collections, and bankruptcies. Credit repair can help remove these items and increase a client's credit score, leading to lower interest rates and improved creditworthiness. While some claim credit repair is a scam, NEG has a proven track record of success and their services are competitively priced compared to other companies.

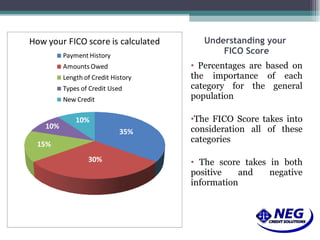

![Industry Outlook Credit Repair is one of the fastest growing industries in the United States More and more consumers recognize the importance of their score, thanks to advertising from credit report companies Consumers recognize how a credit score just a few points below average can greatly increase their interest rate. Example: 30-year fixed interest loan with a FICO score of 620, you may pay 7.693 percent interest. With a score of 619, the interest on the same loan could jump to 12.018 percent [source: Fair Isaac ]. FHA just raised guidelines to a minimum score of 620](https://image.slidesharecdn.com/client-presentation-1243622472-phpapp01/85/All-about-Credit-Repair-9-320.jpg)