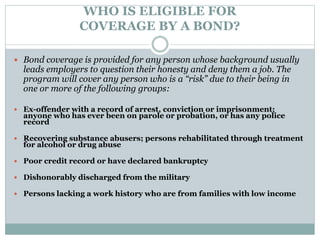

The Federal Bonding Program and Work Opportunity Tax Credit can help place hard to serve job applicants by providing employers with fidelity bonds and tax incentives. The Federal Bonding Program issues bonds free of charge to employers who hire at-risk applicants, such as those with a criminal record or substance abuse history, to insure against loss. The Work Opportunity Tax Credit provides employers a tax credit for hiring individuals from target groups. Both programs aim to facilitate employer engagement and help hard to place participants obtain employment.