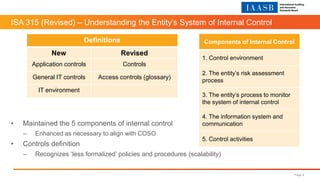

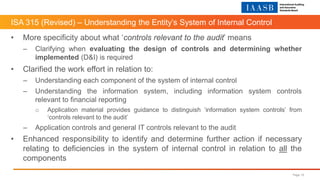

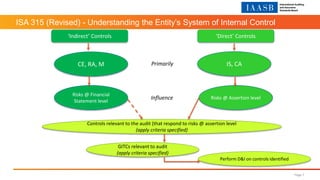

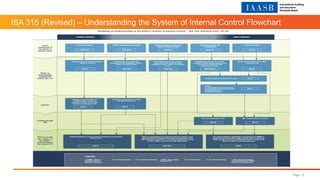

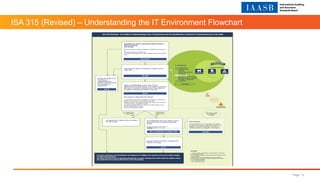

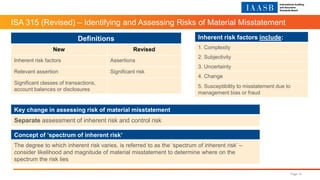

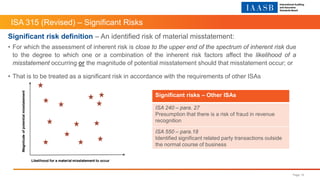

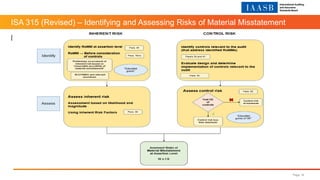

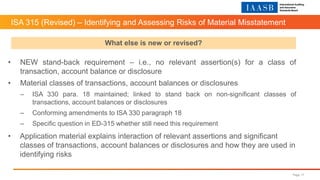

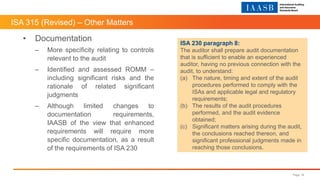

The document outlines updates to ISA 315 (Revised), focusing on identifying and assessing risks of material misstatement with an emphasis on professional skepticism and scalable application across various entity sizes. Key enhancements include clearer definitions of internal controls, the iterative nature of risk assessment procedures, and the introduction of a separate assessment for inherent and control risks. The revisions aim to address evolving business environments and support auditors through improved guidance and tools before the anticipated final standard approval in June 2019.

![ISA 315 (Revised) – The Way Forward

Page 19

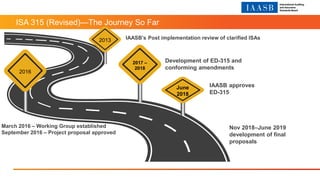

June

2018

IAASB approved

ED–315

Nov 2

2018

Comments close November 2, 2018

June

2019

Anticipated approval

of final standard

Dec 15

2020

[Planned effective date of standard] – Audits of financial

statements for periods beginning on or after December

15, 2020

Further consideration by

IAASB about

implementation guidance](https://image.slidesharecdn.com/isa315revisedexposuredraftwebinar-180814141527/85/ISA-315-Revised-Exposure-Draft-Webinar-19-320.jpg)