Irfp 1819 07 dtx project delivery review services

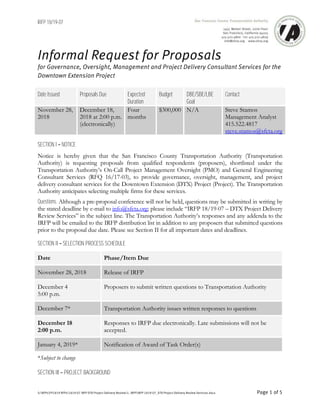

- 1. IRFP 18/19-07 S:RFPsFY1819 RFPs1819-07 IRFP DTX Project Delivery Review1. IRFPIRFP 1819-07_DTX Project Delivery Review Services.docx Page 1 of 5 Informal Request for Proposals for Governance, Oversight, Management and Project Delivery Consultant Services for the Downtown Extension Project Date Issued Proposals Due Expected Duration Budget DBE/SBE/LBE Goal Contact November 28, 2018 December 18, 2018 at 2:00 p.m. (electronically) Four months $300,000 N/A Steve Stamos Management Analyst 415.522.4817 steve.stamos@sfcta.org SECTION I NOTICE Notice is hereby given that the San Francisco County Transportation Authority (Transportation Authority) is requesting proposals from qualified respondents (proposers), shortlisted under the Transportation Authority’s On-Call Project Management Oversight (PMO) and General Engineering Consultant Services (RFQ 16/17-03), to provide governance, oversight, management, and project delivery consultant services for the Downtown Extension (DTX) Project (Project). The Transportation Authority anticipates selecting multiple firms for these services. Questions. Although a pre-proposal conference will not be held, questions may be submitted in writing by the stated deadline by e-mail to info@sfcta.org; please include “IRFP 18/19-07 – DTX Project Delivery Review Services” in the subject line. The Transportation Authority’s responses and any addenda to the IRFP will be emailed to the IRFP distribution list in addition to any proposers that submitted questions prior to the proposal due date. Please see Section II for all important dates and deadlines. SECTION II SELECTION PROCESS SCHEDULE Date Phase/Item Due November 28, 2018 Release of IRFP December 4 5:00 p.m. Proposers to submit written questions to Transportation Authority December 7* Transportation Authority issues written responses to questions December 18 2:00 p.m. Responses to IRFP due electronically. Late submissions will not be accepted. January 4, 2019* Notification of Award of Task Order(s) *Subject to change SECTION III PROJECT BACKGROUND

- 2. S:RFPsFY1819 RFPs1819-07 IRFP DTX Project Delivery Review1. IRFPIRFP 1819-07_DTX Project Delivery Review Services.docx Page 2 of 5 As a major funding partner (including sales tax and other Transportation Authority-programmed funds), the Transportation Authority provides project delivery support and oversight for major capital projects in the Prop K Expenditure Plan, including the Transbay Transit Center (TTC) and DTX. The Transportation Authority has oversight responsibility for constructing the new TTC, and the 1.3-mile DTX from its current terminus into the new TTC; all in support of creating a new transit-friendly neighborhood with 3,000 new homes and mixed commercial development. As the TTC nears completion and the DTX project begins to ramp up, the Transportation Authority will continue to provide project delivery and project finance support for the Project. The Transbay Joint Powers Authority (TJPA) is currently the lead implementing agency. On October 23, 2018, the Transportation Authority Board unanimously voted to suspend the funding agreement with TJPA for DTX 30% Design Part 1 efforts through approval of Resolution 19-18 until the following conditions are met: 1) The San Francisco Controller’s Office conducts an evaluation of TJPA’s management and delivery of the TTC; 2) Transportation Authority staff perform a review of alternative oversight and governance models for management and delivery of the DTX, in addition to its previously scoped task to advise on project delivery methods for the DTX as approved through Resolution 19-02; and 3) The results of both efforts are presented to the Transportation Authority Board and the Board subsequently acts to release in whole or in part said funding. Additionally, at a prior Transportation Authority Board meeting, the Chair suggested that the Transportation Authority take this opportunity to assess how to ensure that the DTX is delivered on time and on budget, noting that insufficient oversight of the TTC contributed to a series of lapses, including among other things, a final cost that far exceeded the original budget and caused funds intended for DTX (Phase 2) to be used to cover TTC (Phase 1) overruns, and required a $260 million loan from the City and County of San Francisco (CCSF). The estimated cost of the DTX rail extension from 4th and King Streets is approximately $4 billion. SECTION IV SCOPE OF SERVICES The Transportation Authority is assembling a team of experts to conduct a review of international mega rail project delivery best practices and assist in the review and evaluation of alternative governance and oversight arrangements for management and delivery of the DTX. The team will also review and advise on overall funding and project delivery strategy for the project and implications for the organizational structure for the project. The effort will consist of research, expert interviews, and a series of charrettes and workshops with key stakeholders (e.g. CCSF, TJPA, Caltrain, Metropolitan Transportation Commission, California High-Speed Rail Authority (CHSRA), and the Transportation Authority) that will result in the development of alternatives and recommendations for consideration. The findings of the review will be presented to the Transportation Authority Citizens Advisory Committee (CAC) and Board, as well as the TJPA Board. The Transportation Authority anticipates selecting multiple firms to provide subject matter experts on the tasks described below and to serve on an expert peer review panel. The peer review panel is envisioned as a 5-6-member panel, to serve at the discretion of the Transportation Authority. The Transportation also may, at its discretion, select additional individuals as alternates, and select one of

- 3. S:RFPsFY1819 RFPs1819-07 IRFP DTX Project Delivery Review1. IRFPIRFP 1819-07_DTX Project Delivery Review Services.docx Page 3 of 5 the firms to assist in the overall coordination of this effort and provide administrative support, coordination, and production of a Final Report. Participation in this effort will not disqualify participating firms or personnel from pursuing other future work on the DTX. Consultant Tasks We anticipate that this effort will take place over approximately four months and include multiple interviews and workshops with stakeholders and industry experts. The main scope elements will include, but are not limited to: 1. Review of International/Domestic Rail Project Best Practices: Case studies of 3-5 mega rail projects of similar scale and complexity. Identification of best practices in the areas of oversight, governance/decision-making, program management, project delivery, risk management, and innovative/project finance. Deliverable: Draft and Final International/Domestic Rail Project Case Studies Memorandum 2. Project Finance and Delivery Strategy: The team will review existing project engineering, schedule and funding documents and assist the Transportation Authority in performing a review of project delivery and funding strategy work to date by the TJPA. The team should advise on the opportunity to strengthen or further develop this work, and identify the implications of the preferred project delivery and funding strategies for the organizational structure and management capabilities of the DTX delivery entity. We are not seeking definitive recommendations on either project delivery or funding, but rather an indication of which appear most promising and what work needs to be done to more completely assess the options. This task includes participation of partner agencies, key stakeholders and other experts, as necessary. Resources that will be available for review include: o “TTC Phase 2 Project Delivery Options Report” prepared by URS for TJPA, July 2016 (available at: http://tjpa.org/uploads/2016/07/Item10_Phase-2-Alternative- Delivery-Options.pdf) o “Third Party Review of the Funding Plan for the Downtown Rail Extension Project” prepared by Ross Financial Capital Partnerships, Inc. for TJPA, October 2016 (included as Attachment 1) o “Peer Review Panel Report on Findings, Review of Three Operations Studies for the Design of the Caltrain DTX” prepared for the Transportation Authority, April 2018 (available at: https://www.sfcta.org/board-april-10-2018) To be provided at a later date: o Current DTX Preliminary Engineering Documents, Cost Estimate, Schedule o Caltrain Business Plan (currently under development) o CHSRA Business Plan (2016, 2018) o CHSRA Santa Clara to San Francisco Segment Draft Environmental Impact Report (DEIR) work Deliverable: Draft and Final Project Management and Delivery Method Strategy Memorandum

- 4. S:RFPsFY1819 RFPs1819-07 IRFP DTX Project Delivery Review1. IRFPIRFP 1819-07_DTX Project Delivery Review Services.docx Page 4 of 5 3. Governance and Oversight Models: The team will review current TJPA governance and oversight policies and processes, and identify alternative structures and protocols to enhance or strengthen these as appropriate, given the business needs identified in Task 2. This task includes design, facilitation and participation in charrettes and workshops with stakeholders and peer experts, as necessary, anticipated to be 4-5 in total. Deliverable: Governance and Oversight Options Memorandum 4. Final Report: The team will participate in drafting and reviewing the Final Report. One of the selected consultants will be assigned by staff as the “lead consultant” with the additional task of leading development and production of the Final Report. This task will also include developing a presentation of the findings and recommendations and presenting it to the Transportation Authority’s CAC and Board, as well as to the TJPA Board. Deliverable: Draft and Final DTX Governance and Oversight Findings and Recommendations, Draft and Final PowerPoint presentation of findings and recommendations Budget The Transportation Authority has budgeted $300,000 for this work, which represents the combined effort for all selected consultants. It is anticipated that Task Orders will be awarded for a four- month term and that each consultant’s effort will be approximately 100 hours, not including the lead consultant’s additional effort, which will be determined by the Transportation Authority. The Transportation Authority does not have office space available for this Task Order and, with the exception of progress and coordination meetings, all work shall take place at the consultant offices. Proposers should be prepared to mobilize within 48 hours following Task Order negotiations. SECTION V PROPOSAL The Transportation Authority is seeking multiple firms to provide subject matter experts to be part of a review team and conduct the tasks described in Section IV. Proposers may submit multiple principal and alternate candidates, candidates may be proposed for one or multiple tasks. All proposals should be clear, concise, and provide sufficient information to minimize questions and assumptions. Proposals should be limited to fifteen (15) pages (no smaller than 12-point font shall be used), for all content. The Transportation Authority accepts no financial responsibility for any costs incurred in the preparation of proposals. Upon receipt by the Transportation Authority, all accepted proposals submitted in response to this IRFP will become the property of the Transportation Authority. Time and Place for Submission of Proposals. By the proposal submission deadline, the following must be transmitted: ▪ Proposal (written proposal): one (1) electronic file (PDF), including all information herein requested. Please clearly specify in the subject line of the e-mail transmittal: “Response to IRFP 18/19-07 for DTX Project Delivery Review Services”. The proposals must be transmitted electronically to the Transportation Authority at the following address: info@sfcta.org. All responses must be in writing and identified as to content and be received by the Transportation Authority by the due date. Proposals received later than the above date and time will be rejected.

- 5. S:RFPsFY1819 RFPs1819-07 IRFP DTX Project Delivery Review1. IRFPIRFP 1819-07_DTX Project Delivery Review Services.docx Page 5 of 5 Proposals must include the following: 1. Cover letter introducing the proposed staff, indicating the task for which they are being proposed, together with a statement describing why the candidates are particularly well- suited to perform the requested tasks. This should include a summary of the qualifications and experience of the proposed staff, emphasizing the specific qualifications and experience acquired while providing services similar to those being requested. Candidates may be proposed for one or multiple tasks. Although there is no Disadvantaged Business Enterprise (DBE), Local Business Enterprise (LBE), or Small Business Enterprise (SBE) goal, the cover letter should indicate if the firm is certified as a DBE, LBE, or SBE, along with the certifying entity. The cover letter must also specify any potential or perceived conflicts of interest which would disqualify the firm from doing business with the Transportation Authority. If proposers are unaware of existing or foreseeable conflicts of interest, a simple statement will suffice. However, proposers should provide a brief description of each apparent, existing or foreseeable conflict of interest, if any. 2. Resumes of proposed staff, including references. References must include the names, telephone numbers, and e-mail addresses of at least three (3) references, in addition to staff of the Transportation Authority, if any. The references should cover work performed by the proposed staff and be for work recently performed and similar in nature to the requested services. The references must include a brief description of the projects involved and the roles of the proposed staff in successfully completing the project. 3. Rate sheet showing base rate, overhead, and profit fee that form the basis for the billing rate, as well as estimated travel costs and all other direct costs. Hourly rates should correspond to the rates approved in the on-call PMO and General Engineering contract between the Transportation Authority and consultant. In order to assist the Transportation Authority in determining travel costs the rate sheet must also state where the proposed staff is based. SECTION VI EVALUATION CRITERIA AND METHOD OF AWARD Selection will be based solely on the relevant experience and credentials of the proposed staff. The proposed staff must demonstrate experience in project management and management structures, oversight, and alternative project delivery methods for comparable mega projects, particularly mega rail projects. The selection committee retains the right to independently verify and evaluate relevant experience and client references, including any sources not mentioned in the proposal. Once the top candidates have been identified and the proposers’ cost and pricing data has been reviewed, Transportation Authority staff will start task order negotiations with those proposers. The Transportation Authority reserves the right to modify and/or suspend any and all aspects of this procurement, to obtain further information from any firm or person responding to this procurement, to waive any informality or irregularity as to form or content of this procurement or any response thereto, to be the sole judge of the merits of the proposals received, and to reject any or all proposals. ATTACHMENT: 1. Third Party Review of the Funding Plan for the Downtown Rail Extension Project, prepared by Ross Financial Capital Partnerships, Inc. for TJPA, October 2016

- 6. TRANSBAY JOINT POWERS AUTHORITY Third Party Review of the Funding Plan For the Downtown Rail Extension Project ROSS FINANCIAL CAPITAL PARTNERSHIPS INC. (SUBCONTRACTOR) October 2016 Attachment 1

- 7. TRANSBAY JOINT POWERS AUTHORITY THIRD PARTY REVIEW OF THE FUNDING PLAN FOR THE DOWNTOWN RAIL EXTENSION PROJECT Table of Contents Page I. Introduction and Summary of Analysis 1 II. DTX Project and Funding Overview 5 III. Mello-Roos Special Taxes 7 IV. Tax Increment Revenue 12 V. Passenger Facilities Charges 17 VI. Other DTX Funding 23 VII. Conclusion 25 Exhibits A. B. Reports, Studies and Schedules Reviewed Summary of Properties in the Community Facilities District and Future Annexation Area

- 8. Peer Review of DTX Funding Plan October 2016 Page 1 of 29 I. Introduction and Summary of Analysis This report represents a third-party review of the overall reasonableness of the methodology and key assumptions used in the funding plan for the Transbay Joint Powers Authority’s (“TJPA”) Downtown Rail Extension Project (“DTX” or the “Project”). In general, the review assesses the: • Proposed revenue streams identified in the DTX funding plan, including the calculation of revenues and the assumptions that underlie such revenue generation; • Availability of the financing vehicles to be secured by the proposed revenue streams, including the reasonableness of related financing assumptions; and • Overall timing of proposed expenditures versus the expected funding for the Project. Our analytic methodology involved a review of the reports, studies and schedules identified in Exhibit A and the development of multiple Excel spreadsheets to confirm individual revenue streams (e.g., Mello-Roos and tax increment revenues) and the overall cash flow for the Project. In addition, we have held multiple conversations with Sperry Capital, TJPA’s financial consultant, with respect to various aspects of the funding plan. Our focus has been on three funding sources: Mello-Roos special taxes, tax increment, and passenger facilities charges (“PFCs”). We did not assess the validity of cost estimates, which have been the subject of multiple cost reviews by other agencies. Our overall assessment is as follows: • Mello-Roos. The assumptions relating to the planned issuances of Mello-Roos bonds and the expected proceeds seem reasonable based on the schedule of proposed development. o The schedule of proposed development reflects current information provided by the San Francisco Planning Department o The projection of special tax revenues tie into the special tax formula in the rate and method of apportionment o Special tax revenues are projected to cover aggregate debt service by 1.10 times o The interest rate and maturity assumptions for the bonding program are conservative based on the current market. While the interest rates on individual transactions may exceed 5.5%, the rate represents a blended average that should be achievable given the likelihood that earlier issuances in the program should be at lower rates. o The approach of bonding after the certificates of occupancy are issued is conservative as it removes construction risk. o The primary caveat relates to whether the schedule of construction in the Community Facilities District (“CFD”) will, in fact, be realized. Factors that

- 9. Peer Review of DTX Funding Plan October 2016 Page 2 of 29 could affect the schedule of development include: changes in the local economy, the real estate market in the CFD, and increased development costs that impact project feasibility. • Tax Increment. The assumptions relating to a Phase 2 US DOT loan secured by tax increment revenues seem achievable. o The pace of land sales and development in the Transbay Redevelopment Project Area appears to be tracking in accordance with the most recent projections. The construction activity associated with the Salesforce Tower in Parcel T lends credibility to these projections. o The projection of net tax increment revenue is based on traditional assumptions and reflects the current timing of proposed development. o The assumptions relating to the proposed TIFIA loan generally are reasonable and should produce net proceeds at least equal to the $200 million assumed in the “low” scenario. § The existing Phase 1 TIFIA loan lays a strong foundation for the Phase 2 US DOT loan. The strong pace of development strengthens that foundation § The analysis provides for 1.3 times coverage, after payment of the Phase 1 loan; however, the approach to calculating that coverage is aggressive. A more traditional coverage calculation would produce less proceeds, but still in excess of $200 million. § The loan rate will have a significant impact on leveraging. The low proceeds assumed a 4.17% interest rate (2.67% plus 1.5%) whereas the high proceeds scenario assumed a 3.17% interest rate (2.67% plus 0.5%). The impact is approximately $75 million in proceeds. It would be prudent to assume the more conservative interest rate scenario. • PFCs. The general methodology and the key assumptions relating to PFCs represent a reasonable approach to projecting PFC revenues. o Caltrain ridership is based on actual on-board passenger counts o HSR ridership projections are based on industry- accepted methodology o PFC charges do not seem excessive even in the high funding scenario § The high Caltrain PFC is lower than the BART surcharge for SFO boardings and the average daily cost of a MUNI Fast Pass § The high HSR PFC is in line with airline PFCs in the HSR travel corridor o Assuming (a) the availability of TIFIA and/or RRIF financing and (b) acceptability of the revenue projections, the aggregate amount of the loan will depend on two factors:

- 10. Peer Review of DTX Funding Plan October 2016 Page 3 of 29 § Approach to coverage – the DTX funding plan contemplates a 1.30 times coverage requirement implemented as follows: (a) PFC revenues cover the initial debt service on the TIFIA loan by 1.30 times and (b) the excess revenues cover debt service on the RRIF loan by 1.30 times. That approach, which was used in the one instance of dual TIFIA/RRIF financing on the same project (Denver Union Station) will generate a larger loan size at a given interest rate than the alternative approach of measuring PFC revenues with combined debt service for a TIFIA/RRIF loan. The latter approach would reduce the TIFIA/RRIF loan proceeds by approximately $250 million in the high scenario. § Interest rate - The TIFIA/RRIF loan size is highly sensitive to interest rates. A 0.5% change in rates could affect loan sizing by approximately $125 million. It would be prudent to assume the more conservative interest rate scenario. o PFCs represent, by far, the largest potential funding source for the DTX project. PFC funding accounts for 23.3% to 48.9% of overall funding sources, with the large majority of PFC funding deriving from HSR1 . Yet PFC funding carries with it the greatest uncertainties of all funding sources. § While the majority of TIFIA/RRIF loans have been for greenfield projects, the primary concerns, nonetheless, relate to the willingness of the TIFIA/RRIF programs to underwrite a revenue stream for service that has not commenced on a rail alignment that has not been constructed and, assuming that willingness, the underwriting standards that would apply under such circumstances. § A secondary concern relates to the RRIF program – and whether FAST Act amendments, in fact, will improve its functionality of the program and speed of execution. • Timing – The DTX project involves expenditures of $3.774 to $3.934 billion2 to be incurred during the period 2019 to 2026. Delay in the construction schedule could have a snowballing effect: (a) total project costs are estimated to increase at approximately $200 million for each year of delay; (b) the collection of PFC revenues would lag as they are premised on service to the Transbay Transit Center; and (c) the pace of development in the surrounding area could slow. Delay in the funding schedule could have a similar effect as funding needs to be available prior to incurring costs. The biggest timing challenge would seem to relate to the PFC revenue loan from TIFIA/RRIF – anticipated for 2019. Many critical steps remain, including approval and execution of intergovernmental agreements as to the PFC 1 The low funding PFC scenario is projected to result in over $1 billion in less funding. As a result, the low funding PFC scenario, premised on the lowest PFC charge of all scenarios considered, may result in a project funding shortfall. 2 Depends on whether the $161 BART/Muni Pedestrian Connector is included

- 11. Peer Review of DTX Funding Plan October 2016 Page 4 of 29 charge, procurement for the construction of HSR, and preparation of an investment grade ridership study. A delay in addressing these items could affect the timing of financial close and overall project implementation – leading to increased costs and further delays.

- 12. Peer Review of DTX Funding Plan October 2016 Page 5 of 29 II. DTX Project and Funding Overview The DTX Project represents Phase 2 of the Transbay Transit Center (the “Transit Center”), a state-of-the-art multimodal transit center located in downtown San Francisco. Phase 1, with completion expected in late 2017, will accommodate bus operations for eight local and regional agencies. Phase 2 will add commuter and high speed rail operations. Specifically, Phase 2 will complete: the design and construction of the DTX tunnel, the build-out of below-grade train state facilities, a new underground station along the DTX alignment, an intercity bus facility and a pedestrian tunnel between the Transit Center and the Embarcadero BART/Muni Metro station. Phase 2 entails expenditures of approximately $3.774 to $3.934 billion3 to be incurred during the period 2019-2026 based on the most recent cost refresh as of February 11, 2016. The DTX funding plan anticipates 12 different funding sources, some of which are considered committed and some of which are conditioned on various approvals. The table below ($ in millions) summarizes the low and high estimates, funding time frame and funding status of these funding sources: The table below provides an annual cash flow of expenditures (per AECOM) and funding from sources other than Mello Roos special tax, tax increment and PFCs. The table assumes that these sources will be spread equally over seven years beginning in Fiscal Year 2018-19. However, if those funding sources are made available when needed to pay for project costs, no funding shortfalls would exist in 2018/19 and 2019/20 – allowing TJPA to delay the need for financing to a later year. 3 The difference in estimated cost relates to the inclusion of the pedestrian tunnel to the Embarcadero BART/Muni Metro station. Project Funding Low Estimate (6/9/2016) High Estimate (6/9/2016) Funding Timeframe Funding Status SFCTA - Prop. K Sales Tax $83 $83 2016-2019 Committed SMCTA - Meas. A Sales Tax 19 19 n/a Committed/spent MTC/BATA - Bridge Tolls 7 7 n/a Committed/spent Tax Increment 200 340 2019-2050 Committed Mello-Roos Special Tax 275 375 2020-2015 Committed MTC – RTIP 18 18 n/a Committed SFCTA - Future Sales Tax 350 350 2019-2026 Subject to voter approval FTA - New Starts 650 650 2019-2026 Subject to FTA approval MTC/BATA - Bridge Tolls 300 300 2019-2026 Subject to MTC/BATA approval CHSRA - High Speed Rail 557 557 2019-2026 Subject to FTA./State approval Land Sales 45 45 2018 Contingency upon sale PCJPA/CHSRA – PFCs 865 1,920 2026-2060 Subject to PCJPB/CHSRA approval Total $3,369 $4,664

- 13. Peer Review of DTX Funding Plan October 2016 Page 6 of 29 * 2018/19 Cumulative Net Revenue (Shortfall) includes a prior year shortfall The annual/cumulative shortfalls are expected be funded from Mello-Roos special tax revenues, tax increment revenues, and passenger facilities charges (PFCs), which will be pledged to different financial transactions. Collectively, these funding sources account for between 40% to 56% of the overall low and high funding sources for the Project, as indicated below: These three funding sources form the primary focus of this report. Category Expenditures Right of way Programwide Construction Construction Contingency Program Reserve BART/Muni Ped. Conn. Total 18/19 19/20 20/21 21/22 22/23 23/24 24/25 25/26 150.0 50.0 50.0 50.0 75.0 75.0 75.0 65.0 20.0 78.0 220.0 300.0 425.0 475.0 425.0 275.0 100.0 7.8 22.0 30.0 42.5 47.5 42.5 27.5 10.0 50.0 100.0 100.0 100.0 62.0 50.0 13.0 68.0 70.0 10.0 285.8 292.0 430.0 642.5 710.5 710.5 499.5 190.0 Pay-Go Funding SFCTA sales tax - existing SMCTA sales tax MTC / BATA bridge tolls MTC - RTIP 23.0 Land sales SFCTA sales tax - future MTC / BATA bridge tolls FTA new starts CHSRA funds Total Annual Pay-Go Funding 50.0 50.0 50.0 50.0 50.0 50.0 50.0 42.0 43.0 43.0 43.0 43.0 43.0 43.0 92.0 93.0 93.0 93.0 93.0 93.0 93.0 78.0 78.0 79.0 80.0 80.0 81.0 81.0 285.0 264.0 265.0 266.0 266.0 267.0 267.0 0.0 Annual Net Revenue (Shortfall) Cumulative Net Revenue (Shortfall)* (0.8) (28.0) (165.0) (376.5) (444.5) (443.5) (232.5) (190.0) (24.8) (52.8) (217.8) (594.3) (1,038.8) (1,482.3) (1,714.8) (1,904.8) Amount ($MM) Percent Amount ($MM) Percent Mello-Roos funding $275 8.2% $375 8.0% Tax Increment funding 200 5.9 340 7.3 PFC Funding 865 25.7 1,920 41.2 Subtotal $1,340 39.8% $2,635 56.5% All other funding 2,029 60.2 2,029 43.5 Total Funding $3,369 100.0% $4,664 100.0% Source of Funding Low Estimate High Estimate

- 14. Peer Review of DTX Funding Plan October 2016 Page 7 of 29 III. Mello-Roos Special Taxes The Phase 2 funding plan contemplates the issuance of $275 to $375 million in funding from Mello-Roos special tax bonds – approximately 8% of overall funding sources. The Phase 2 Mello-Roos bonds would be issued after the Mello-Roos bonding program for Phase 1 costs is completed. The Mello-Roos bonds for both Phase 1 and Phase 2 will be secured by special tax revenues generated from properties in the existing Community Facilities District (the “CFD”) and from properties to be developed in an area to be annexed to the CFD in the future (the “Future Annexation Area” or “FAA”). The table below shows the projected timing of issuance, the anticipated bond par, deposit to the project fund (after payment of transaction costs and funding of debt service reserves and capitalized interest) and applicable Phase to which the bond issue pertains. Under the applicable Project Initiation Documentation (“PID”), the TJPA may use 82.6% of the aggregate spendable Mello-Roos proceeds for Phase 1 and Phase 2 purposes. While the PID does not seem to proscribe when the TJPA may utilize its allocable share, the table below, for planning purposes, assumes that the share will be taken pro rata on a per series basis. Methodology The estimation of Mello-Roos special tax revenue essentially involved the following methodology and assumptions. Goodwin Consulting developed a methodology entailing the following elements: 1. Identifying and quantifying the planned and proposed land uses within the CFD and FAA, as provided by the Planning Department and the Controller’s Office of Public Finance, In particular, the following were noted: a. Block, parcel, and/or lot numbers and street addresses (where known) b. Location – in the CFD or the FAA c. Current zoning, height limitations, and planned number of stories d. Square footage by property type: office, retail, hotel, and market rate housing e. Number of market rate and affordable housing units f. Applicability of the Mello-Roos special tax g. Year of absorption (certificate of occupancy by June 30th ) h. First fiscal year of the Mello-Roos special tax levy. (See Exhibits B and C ) Bond #1 Bond #2 Bond #3 Bond #4 Bond #5 Bond #6 Bond #7 Timing FY 2017 FY 2017 FY 2018 FY 2019 FY 2020 FY 2022 FY 2025 Bond Par $33.6M $181.4M $24.3M $118.9M $276.0M $20.2M $276.1M Project Fund $27.4M $150.6M $20.2M $98.7M $229.2M $16.7M $229.2M TJPA Share $22.6M $124.4M $16.7M $81.5M $189.3M $13.8M $189.3M Phase 1 1 1 1 1 and 2 2 2 CFD Initial Initial FAA Initial Mixed Mixed FAA

- 15. Peer Review of DTX Funding Plan October 2016 Page 8 of 29 2. Estimating the annual and cumulative absorption of gross square footage (“GSF”) and net square footage (“NSF”) by property type by year for FY 2013-14 through FY 2028-29 3. Projecting the annual and cumulative special tax revenue generated by property type – based on the number of stories and square footage and applicable special tax rate contained in the Amended and Restated Rate and Method of Apportionment of Special Tax (the “RMA”) adopted in the Resolution of Formation of City and County of San Francisco Community Facilities District 2014-1 (Transbay Transit Center) and determining other matters in connection therewith (“Resolution of Formation”). 4. Sizing each Mello-Roos bond based on a 30-year bond term, 5.5% interest rate, a deposit to the Project Fund that is net of transaction costs, reserves and capitalized interest, and the use of 82.6% of that deposit for TJPA purposes. 5. Timing the bond issuances to coincide with planned initial occupancies of the proposed developments. Key Assumptions The Goodwin analysis embeds several key underlying assumptions. These are identified in the table below. Assumption Value Reason- able? Basis for Reasonableness Check Timing of property development in Initial CFD See Exhibit B √ San Francisco Planning Dept.; current real estate activity Timing of property development in FAA See Exhibit B √ Subject to annexation agreements GSF to NSF adjustment 20% √ Industry standard provided by San Francisco Planning Department Average annual increase in special tax due to initial annual adjustment factor (IAAF) 3.0% √ 4.0% is the maximum specified in Resolution 2014-1; 4.0% IAAF was used for FY 2015-17; 3.0% IAAF applies thereafter Average annual increase in special tax after issuance of certificate of occupancy 2.0% √ Specified in Resolution 2014-1 Special tax rate period 30 years √ Specified in Resolution 2014-1 CFD termination date 75 years √ Specified in Resolution 2014-1 Mello-Roos bond term 30 years √ Typical Mello-Roos bond term; consistent with special tax rate period MR average bond interest rate 5.50% √ Historical interest rates. Rates on individual transactions may exceed 5.5%, but conservative average across multiple issuances Sources: San Francisco Planning Department and Goodwin Consulting

- 16. Peer Review of DTX Funding Plan October 2016 Page 9 of 29 Reasonableness Check of Methodology and Key Assumptions Approach To confirm the methodology used by Goodwin Consulting and the reasonableness of key underlying assumptions, our analytic methodology involved the following: • Review of the reports, studies and schedules identified in Exhibit A • Conversations with Bryant Jenkins of Sperry Capital • Conversations with investment banking firms regarding interest rates and the Mello Roos market • Creation of an Excel financial model to independently project special tax revenues to be generated from the proposed developments in the CFD and FAA • Assessment of bonding assumptions for Mello-Roos bond issuances. Findings 1. The overall methodology for projecting the special tax revenue to be generated in the CFD and the FAA is reasonable. 2. The projections of special tax revenues reflect the San Francisco Planning Department’s most recent projections as to timing and proposed type of property development in the CFD and FAA and the elements of the RMA. 3. Our financial model generates a special tax revenue cash flow from the proposed development in the CFD and FAA that is consistent with projections used in the DTX funding plan. 4. The Mello-Roos bonding assumptions are generally reasonable. a. The issuance of bonds after the certificate of occupancy is conservative as it eliminates construction risk. b. A 30-year maturity is standard for a Mello-Roos bond. c. Projected special tax revenues cover annual debt service by at least 1.10 times. d. Debt service escalating at 2.0% is standard for Mello-Roos bonds e. The amount of funding for capitalized interest, debt service reserve funds and transaction costs comports with market standards. f. Mello Roos financing is well-accepted in California. While issuance over the years has been cyclical, depending on real estate cycles and interest rates, more than $3.3 billion of Mello Roos bonds have been issued since 2015. g. For planning purposes, the interest rate assumption of 5.5% as an average borrowing rate seems reasonable particularly in the context of current market interest rates and San Francisco’s ready access to the market. The actual rate will depend on several factors, notably whether interest on the bonds is tax-

- 17. Peer Review of DTX Funding Plan October 2016 Page 10 of 29 exempt or taxable and whether the bonds are issued on rated or unrated basis4 . The input from investment banks is an average borrowing cost in the current market of approximately 2.50% (AA rating) to 3.50% (unrated) for tax-exempt Mello Roos bonds and 4.25% (AA rating) to 4.85% (unrated) for taxable Mello Roos bonds. Interest rates are at or near historical lows. Over the eight-year course of the planned issuances, the interest rate on a particular transaction could exceed 5.5%, particularly if bond interest is considered taxable. However, on a programmatic basis, positive interest rate variances with the initial issuances will reduce, if not fully offset, the effect of potentially higher rates in the later years. See Caveats below. Caveats Our conclusion as to the reasonableness of the methodology and key assumptions that underlie the projection of Mello Roos special tax funding for DTX is subject to the following caveats: 1. Development. The generation of projected special tax revenues ultimately depends on the timing and the extent to which the projected development of office/hotel, retail, and market rate housing properties in the CFD and FAA occur. The issuance of Mello Roos bonds for Phase 2 is projected to occur in FY 2020, 2022 and 2025. Changes in the local economy, demand for the product type, increased development costs, and similar factors could impact the timing or overall feasibility of such development. A potential wild card is whether the issues surrounding Millennium Tower will affect the timing, costs, and approval processes associated with later development in the CFD/FAA. Any delays and/or reduction of special tax revenues could affect the timing and sizing of the resulting Mello Roos bond issues. 2. Annexation of FAA. Approximately 51% of Mello Roos funding stems from properties in the FAA that are not yet annexed to the CFD. While there is no reason to expect that the FAA will not be annexed, a delay in annexation would adversely affect the timing in receipt of funding from Mello Roos special taxes. 3. Interest Rates. It is conceivable that during the course of planned issuance, the interest rate on a series of bonds could exceed the assumed 5.5%. The interest rate on the bonds will be based on applicable index plus a spread. The index is AAA Municipal Market Data (MMD) in the case of tax-exempt bonds and US Treasury bonds in the case of taxable bonds. The spread will depend on several factors, including: tax status of bonds, supply-demand factors, credit matters5 , and maturity and amortization structure. In addition, headline “risks,” such as the 4 Per a recent rating assessment from Fitch Ratings, the expected rating on the Mello Roos bonds would be in the “AA” category – although it remains to be seen whether other rating agencies and/or investors adopt Fitch’s methodology. 5 These include: rating on the bonds (if applicable), value to lien ratio, debt service coverage from special tax revenues, size of community facilities district, diversity of uses, concentration of ownership and security provisions in the bond documents.

- 18. Peer Review of DTX Funding Plan October 2016 Page 11 of 29 publicity surrounding Millennium Tower, could affect the market for these Mello Roos bonds. With weighted average maturities of approximately 20 to 22 years, the current spread for a Mello Roos bond, depending on rating, can range 0.40% to 1.20% for tax-exempt bonds and 1.80% to 2.50% for taxable bonds. The following table shows data for the applicable index over the past 5, 10 and 20 years: Tax-Exempt Rates (20-year MMD) Taxable Rates (30-year UST) 5 years 10 years 20 years 5 years 10 years 20 years Average 2.87% 3.51% 4.21% 3.03% 3.68% 4.56% High 4.25% 5.16% 5.92% 3.92% 5.10% 7.09% Low 1.86% 1.86% 1.86% 2.23% 2.23% 2.23% When the pricing spread is added, this rate history suggests that a reversion to a 10- year average could lead to an interest rate in excess of 5.5% for specific issues, particularly if interest is taxable. That said, the overall impact on the Mello Roos bonding program should be somewhat minimal – and the effect of higher rates in later years should be offset by the lower rates with earlier issuances.

- 19. Peer Review of DTX Funding Plan October 2016 Page 12 of 29 IV. Tax Increment Revenue The DTX funding plan contemplates a loan from the U.S. Department of Transportation, under the Transportation Infrastructure Finance and Innovation Act (“TIFIA”), in the amount of between $200 to $340 million, secured by tax increment revenues from seven parcels known as the “Former State-Owned Parcels” in the Transbay Redevelopment Project Area (the “Project Area”). The tax increment revenues will be supplemental to the tax increment revenues that currently secure and repay a $171 million TIFIA loan that was entered into in 2010 at a rate of 4.57% to fund a portion of Phase 1 improvements. The estimated timing of the Phase 2 TIFIA loan is in FY 2017. The potential also exists to refinance the Phase 1 TIFIA loan with the goal of increasing resulting financing capacity from a Phase 2 TIFIA loan. Methodology Seifel Consulting has developed a methodology that involves the following elements: 1. A base year (FY 2004-05) assessed value of $0 for the Former State-Owned Parcels. 2. A FY 2015-16 assessed value of $311.9 million. 3. Increasing the assessed value on such parcels by: a. Adding a 2% annual inflationary adjustment to existing development; b. Adding a 0.5% annual adjustment for reassessed properties, beginning in FY 2018-19 c. Adding the value of new developments (as projected by the Office of Community Investment and Infrastructure (OCII) to the assessed value roll: Block/Parcel Total Taxable Value Improvement Value (net of land) Year of Land Sale Block 4 $364,300,000 $333,800,000 1Q2018 Block 5 645,500,000 473,000,000 3Q2015 Block 6 387,600,000 357,000,000 4Q2013 Block 8 777,300,000 706,300,000 4Q2015 Block 9 381,200,000 337,600,000 1Q2015 Parcel F 870,500,000 710,600,000 2Q2016 Parcel T 1,470,100,000 1,278,300,000 1Q2015 Total $4,896,500,000 $4,196,600,000 4. Estimating annual tax increment revenues, statutory pass-through payments and 20% housing set-asides, and the net amounts available for non-housing projects. 5. Creating a spreadsheet with low and high tax increment estimates and other pledged revenues (e.g., interest earnings), annual TIFIA fees and Phase 1 debt service, the remaining revenues available for Phase 2 debt as reduced by a coverage factor required by TIFIA (at least 1.30 times)

- 20. Peer Review of DTX Funding Plan October 2016 Page 13 of 29 Key Assumptions The Seifel Consulting analysis embeds several key underlying assumptions. These are identified in the table below. Assumption Value Reason- able? Basis for Reasonableness Check FY2015/16 assessed value of parcels $311,940,109 √ Per the Tax Roll Annual growth in assessed values 2.0% √ Historical CPI cap TI property tax rate 1.0% √ SB 628 – September 29, 2014 Time limit for receipt of TI revenues 45 years √ Transbay Redevelopment Plan (p. 32) TI pass-through to City & County of SF 86.6% √ Tax increment Allocation & Sales Proceeds Pledge Agreement TI pass-through retained by CCSF Tier 1 √ Tax increment Allocation & Sales Proceeds Pledge Agreement TI pass-through to Agency Tiers 2 & 3 √ Tax increment Allocation & Sales Proceeds Pledge Agreement Agency TI administration fee 0.0% √ Tax increment Allocation & Sales Proceeds Pledge Agreement TI available for housing programs 20% √ AB 3674 (1976) and Prop. C (2012) TI available for non-housing projects 80% √ Tax increment Allocation & Sales Proceeds Pledge Agreement TI bonding capacity limit $800 million √ Transbay Redevelopment Plan (p. 31) TIFIA loan maturity 2050 √ Per Plan Limits Financial Close 2017 TBD Additional loan under existing program Coverage requirement 1.3x √ Consistent with Phase 1 loan Phase 1 TIFIA loan rate – low scenario 4.57% √ Phase 1 TIFIA loan rate Phase 2 TIFIA loan rate – low scenario 4.17% TBD 30 Year UST (2.67%) + 1.5% Phase 1 TIFIA refi rate – high scenario 3.17% TBD 30 Year UST (2.67%) + 0.5% Phase 2 TIFIA loan rate – high scenario 3.17% TBD 30 Year UST (2.67%) + 0.5% Source: Seifel Consulting Inc. – Summary of Tax Increment Projections – State Owned Parcels

- 21. Peer Review of DTX Funding Plan October 2016 Page 14 of 29 Reasonableness Check of Methodology and Key Assumptions Approach To confirm the methodology used by Seifel Consulting and the reasonableness of key underlying assumptions, our analytic methodology involved the following: • Review of the reports, studies and schedules identified in Exhibit A • Conversations with Bryant Jenkins of Sperry Capital • Creation of Excel financial model to independently project supplemental tax increment revenues to be generated from the former State-owned parcels in the Project Area. • Assessment of the assumptions underlying a Phase 2 TIFIA loan. Findings 1. The methodology and the key assumptions represent a reasonable approach to projecting the tax increment revenue to be generated by the former State-owned parcels in the Project Area. 2. OCII’s most recent projections as to timing and proposed type of property development in the Project Area are reflected in the Seifel Consulting projections. 3. Our financial model generates tax increment revenues that are consistent with those incorporated in the Seifel Consulting projections. 4. The main assumptions relating to assessed valuation growth generally are reasonable: a. Existing Assessed Value – Historically, assessors have increased existing assessed values at the rate of 2% per year, the maximum inflation factor established by Proposition 13. In the 40-year period from 1976-77, the 2% inflation factor was applied in all but 9 years. However, since 2010-11, the inflation factor has been under 2% four times, including one year (2010-11) in which the inflation factor was negative. b. New Assessed Value – The projections seem reasonable in that land sales/transfers have occurred in each of the parcels (except for Block 4) and construction on several of the State-Owned Parcels has commenced (e.g., Salesforce Tower on Parcel T, the mixed use development on Block 5, and the financing activity that has occurred or is pending with respect to the housing developments on Blocks 7, 8 and 9). 5. The assumptions relating to a Phase 2 TIFIA loan generally are reasonable: a. We presume that a TIFIA loan will be available for Phase 2, particularly if the financing process is initiated in 2017. On March 11, 2016, the US DOT announced the availability of $1.435 billion in budgetary allotments for TIFIA over five years beginning in FY 2015-16 plus any funds that may be available from prior fiscal years (approximately $800 million) to provide TIFIA credit

- 22. Peer Review of DTX Funding Plan October 2016 Page 15 of 29 assistance for eligible projects pursuant to the recently enacted Fixing America’s Surface Transportation (“FAST”) Act. These budget allotments are used for credit subsidy – with the average subsidy being approximately 7.5% per loan6 . While there could be nationwide competition for TIFIA funds, that demand is should not affect availability of funding in the foreseeable future, given the budgetary allocation. It is reasonable to believe that, from a credit standpoint, additional funding will be available for the DTX given the high profile of the Project, the existence of the Phase 1 loan and the development activity in the Project Area. The Phase 2 loan, in effect, will finance off with the same revenue stream approved in Phase 1 – while still providing at least 1.30 times coverage. b. TIFIA loan proceeds can be used to refinance existing obligations of federal credit instruments if the refinancing provides additional funding capacity for the completion, enhancement, or expansion of any project that would otherwise be eligible. Based on current rates plus a cushion assumed in the high funding scenario, the refinancing of the Phase I TIFIA loan would generate additional funding capacity as the Phase 1 loan rate of 4.57% was incurred at time of higher prevailing rates. c. The interest rate assumption (between 3.17% and 4.17%) is reasonable and falls within the 5 year and 10 year averages for 30 year US Treasury rates (3.03% and 3.68%, respectively). The impact of interest rates on loan size, however, is notable. In the “low” scenario, the assumed rate of 4.17% generates loan proceeds of approximately $230 million compared with over $300 million at a rate of 3.17%. d. The approach to coverage seems aggressive and may require revisiting. As currently shown, Total Pledged Revenue is reduced by Phase 1 debt service and Reserve Fund transfers. The resulting net Pledged Revenue, then, becomes the basis for measuring 1.30 coverage of Phase 2 debt service. Using this methodology, the low coverage point of 1.30 times is in 2025. The more conservative approach is to measure Total Pledged Revenue against combined Phase 1 and Phase 2 debt service7 . Using this approach, combined coverage in 2025 would be 1.16 times. If TIFIA requires the 1.30 coverage to be measured on a combined debt service basis, the resulting Phase 2 loan amount would be lower. – but still in excess of the amount shown in the low scenario (depending on interest rates). We recommend that, for planning purposes, the Phase 2 TIFIA loan be re-sized using the more conservative methodology. e. The TIFIA approach is preferable to the primary funding alternative: publicly offered tax allocation bonds. This approach will lead to a lower funding amount and delayed funding for several reasons: (a) sizing is typically based on current 6 Assuming a 7.5% credit subsidy, a $100 million TIFIA would require a $7.5 million credit subsidy from the budget allocation. 7 The current formula is: (Total Pledged Revenue – Phase 1 debt service)/Phase 2 debt service >1.30x. The more traditional approach is: Total Pledged Revenue/(Phase 1 and Phase 2 debt service) > 1.30x.

- 23. Peer Review of DTX Funding Plan October 2016 Page 16 of 29 year tax revenues, with coverage based on maximum annual debt service; (b) the interest rate will be higher as it will be based on a rating that likely will be low investment grade due to the small size and concentrated nature of the tax base; and (c) the transaction costs will be higher than with TIFIA due to the need for an underwriter, bond ratings, disclosure counsel and a debt service reserve (funded upfront); and bond administration will be more burdensome. Caveats Our conclusion as to the reasonableness of the methodology and key assumptions that underlie the projection of tax increment funding for DTX is subject to the following caveats: 1. TIFIA Availability. While logic suggests that TIFIA funding for Phase 2 should be available because of the development activity that is occurring, application to TIFIA has not yet been made, and there is no guaranty that TIFIA will approve an additional loan in at least the amount of $200 million. The reasons could relate to competition for funding (not anticipated), the amount of funding already provided to the region, the status of other funding sources with which to complete DTX and/or existing exposure to additional value capture financing. Regardless, TIFIA will need assurance from a rating agency that the bonds would qualify for an investment grade rating. 2. Interest Rates. The amount of TIFIA funding is highly sensitive to interest rates. Each 0.5% change in interest rates affects loan size by approximately $30 to $35 million. Based on the most recent projected tax increment revenue stream and the existing approach to calculating coverage, the TIFIA loan rate could exceed 5% and still generate sufficient revenue to meet the “low” loan scenario of $200 million 3. Tax Increment Revenue. Tax increment revenues are based on increases in the assessed values of properties over their base year values. Assessed valuation increases arise from the annual inflation factor applicable to existing assessed values, property sales, improvements to existing properties, and new construction. The amount and timing of the projected revenues could be adversely impacted by: • Application of a lower inflation factor – which has occurred in 4 of the past 6 fiscal years • Changes in economic and real estate market that could affect the timing or feasibility of remaining development or the market value of existing development (similar to the effect of the Great Recession on the original projections for the area). • Property owner challenges to assessed values (to the extent the right to appeal was not contracted away in development agreements) • Delays in reflecting assessed value increases on the Assessor’s rolls. Nonetheless, given the status of property sales and the construction activity that already has commenced on several of the parcels, it is reasonable to assume that these adverse impacts would not result in a material change in the tax increment currently projected.

- 24. Peer Review of DTX Funding Plan October 2016 Page 17 of 29 V. Passenger Facility Charges The largest funding source projected for the DTX project, by far, is from passenger facility charge (“PFC”) revenues. PFC revenues derive from ticket surcharges for Caltrain and High Speed Rail (HSR) trips that begin or end at the Transit Center. PFC revenue depends on three factors: the amount of the surcharge, the passenger count and the escalation assumption. PFC revenues, in turn, are projected to secure loans in 2019 under TIFIA and/or the RRIF program, administered by the Federal Railroad Administration (“FRA”). The amount of upfront funding available depends on interest rates. The DTX funding plan considers four scenarios based on different PFC surcharges for Caltrain and HSR service, projected passenger counts, different inflation factors and the commencement of revenue service in 2026: Scenario (Caltrain PFC/HSR PFC) Revenue Range ($ in Billions) Upfront Funding Range ($ in Billions) 1 - $2.00 PFC / $8.00 PFC $2.510 - $5.430 $0.865 - $1.365 2 - $2.25 PFC/ $9.00 PFC $2.830 - $6.110 $1.030 - $1.530 3 - $2.50 PFC/$10.00 PFC) $3.140 - $6.790 $1.195 - $1.695 4 - $2.74 PFC/$10.96 PFC $3.440 - $8.025 $1.253 - $1.924 The elements of the low and high funding scenarios are as follows: *The Cambridge study projected ridership of 5,554,000 beginning in 2029. As the PFC financing anticipates a start date of 2026, it became necessary to discount that ridership projection back by three years. Mathematically, this results in a higher starting 2026 ridership in the low funding scenario (which escalates ridership at 1%) than in the high funding scenario (which escalates ridership at 3%). In the low funding scenario, approximately 11.8% of the estimated PFC funding is projected to derive from Caltrain riders and approximately 88.2% is projected to derive Caltrain HSR Caltrain HSR 2026 PFC $2.00 $8.00 $2.74 $10.96 2026 Ridership* 2,912,698 5,379,338 3,613,847 5,059,859 2026 PFC Revenue ($000) $5,825 $43,035 $9,902 $55,456 CPI 1% 1% 3% 3% 2060 PFC $2.81 $11.22 $7.49 $29.94 2060 Ridership 4,085,283 7,547,199 9,872,688 13,860,445 2060 PFC Revenue ($000) $11,460 $84,680 $73,901 $415,505 Upfront Funds in 2019 ($000) $102,496 $762,504 $287,525 $1,636,331 Discount Factor 4.17% 4.17% 3.17% 3.17% % of Total PFC Funding 11.8% 88.2% 14.9% 85.1% % of Total DTX Cost ($3.934 B) 2.6% 19.4% 7.3% 41.6% Analytic Components Low Funding Scenario High Funding Scenario

- 25. Peer Review of DTX Funding Plan October 2016 Page 18 of 29 from HSR passengers. In the high funding scenario, approximately 14.9% of the estimated PFC funding is projected to derive from Caltrain riders and approximately 85.1% is projected to derive from HSR passengers. With total project costs of $3.934 Billion, PFC funding from HSR accounts for 20.5% of the low funding scenario and 41.6% of the high funding scenario. Methodology The projections of PFC revenues involve a composite of methodologies: 1. Caltrain ridership projections initially were generated by Cambridge Systematics (2008 analysis) based on: a. Use of the San Francisco County Transportation Authority’s advanced travel model (with its new zone system for the downtown area); b. Updates of walk and transfer access parameters derived from an on-board survey conducted on Caltrain; c. Estimated times spent looking for a parking space (doubled from 5 to 10 minutes); d. Projected auto operating costs (i.e., gasoline and parking); and e. Estimated Caltrain initial wait times, transfer wait times, bus access/egress, and walk times. 2. Caltrain ridership projections were subsequently updated to reflect the results of a geographic information system (“GIS”) analysis of 2014 MTC survey data on Caltrain ridership that “zoomed in” on: a. Passenger trips to the vicinity of the Transbay Transit Center b. Passenger access / egress data for all trips to and from Fourth and King Streets 3. Caltrain ridership projections were also updated to reflect 2016 ridership counts. 4. High Speed Rail ridership projections were generated by Cambridge Systematics (2014 analysis) based on a travel demand model with the following components: a. Trip frequency model, which estimates the number of trips made by each household on an average day; b. Destination choice model, which estimates the destinations of home-based trips; and c. Mode choice model, which estimates the choice of main mode (auto, air, conventional rail, or high speed rail) as well as access/egress mode. 5. Caltrain PFC amounts are based on variations of the average fare for a bus trip from Caltrain’s existing terminus at Fourth and King Streets to the Transbay Transit Center. 6. HSR PFC amounts are four times the Caltrain amounts, which track the ratios used in the 2004 environmental clearance document for the Project.

- 26. Peer Review of DTX Funding Plan October 2016 Page 19 of 29 7. PFC revenue projections for Caltrain were calculated by Sperry Capital based on the inputs from the above sources. 8. A combined TIFIA and RRIF loan financing based on the projected PFC revenue stream over 35 years from a 2026 start date for revenue service, coverage of 1.30x and interest rates of 30 year Treasury rate plus 1.50% (low scenario)/0.50% (high scenario). Key Assumptions The PFC analysis embeds several key underlying assumptions. These are identified in the table below. Assumption Value Reason- able? Basis for Reasonableness Check Period of operation 35 years √ Consistent with maximum financing terms allowed by TIFIA and RRIF Caltrain annual ridership (2016) 2,610,720 √ Consistent with 2016 YTD ridership Caltrain PFC start state 2026 √ Consistent with MTC Phase 2 cost review (November 2015) Caltrain PFC amount (2026) $2.74 √ Equivalent to $2.25 (2016) adult fare on Muni from Caltrain’s current terminus at Fourth & Townsend to the TTC; lower than $4 BART surcharge for SFO trips Caltrain annual boarding growth √ Consistent with ABAG population growth projections and MTC trans- portation growth projections HSR PFC start date 2026 TBD Consistent with MTC Phase 2 cost review (November 2015) HSR annual ridership (2026) 5.05 to 5.38 million TBD Cambridge projects 5,554,000 in 2029. Need to confirm in investment grade HSR ridership study HSR annual boarding growth 1.00% TBD Confirm in HSR ridership update HSR PFC charge $10.96 √ Consistency with PFCs charged by airlines Annual PFC escalation rate to 2026 2.00% √ Consistent with long-term CPI rate. Escalation after 2026 are at low rate of 1% and high rate of 3% Combined TIFIA/RRIF funding availability TBD Outstanding authorization/capacity; USDOT desire to improve RRIF

- 27. Peer Review of DTX Funding Plan October 2016 Page 20 of 29 Assumption Value Reason- able? Basis for Reasonableness Check Funding close 2019 TBD Aggressive time frame given RRIF history TIFIA/RRIF Loan Term 35 years √ Consistent with program terms TIFIA/RRIF Coverage Requirement 1.3x √ Consistent with program standards – assumes indicative investment grade rating Interest Rate 30 UST (then at 2.67%) + 50bp & 150bp TBD Cushion of 1.50% conservative based on current rates but possible to see higher rates by 2019 Sources: (a) Caltrain Downtown Extension and Transbay Ridership Analysis; (b) Transbay Terminal / Caltrain Downtown Extension / Redevelopment Project, Final EIS/EIR; and (c) June 9, 2016 TJPA staff report Reasonableness Check of Methodology and Key Assumptions Approach To confirm the methodology employed by Caltrain and Cambridge Systematics and the reasonableness of key underlying assumptions, our analytic methodology involved the following: • Review of the reports, studies and schedules identified in Exhibit A • Conversations with Bryant Jenkins of Sperry Capital • Creation of Excel spreadsheet to independently project PFC revenues based on the four PFC funding scenarios and the low vs. high range of ridership projections • Assessment of the assumptions underlying a TIFIA/RRIF loan. Findings 1. Subject to the caveats below, the general methodology and the key assumptions relating to PFCs, in principle, represent a reasonable approach to projecting PFC revenues a. Caltrain ridership is based on 2016 on-board counts and a 2014 GIS analysis of passenger access/egress at Fourth and King Streets b. HSR ridership projections are based on an industry accepted methodology and Version 2 of the Cambridge Systematics ridership and revenue forecasting model, which reflects the most current thinking about California’s future c. Initial PFC charges do not appear excessive: o The potential Caltrain PFC of $2.76 compares favorably with the $4 surcharge for BART trips originating from or terminating at the San Francisco International Airport (SFO) and is the equivalent to the 2015 MUNI fare of $2.25.

- 28. Peer Review of DTX Funding Plan October 2016 Page 21 of 29 o The potential HSR PFC of $10.96 is effectively in line with airline PFCs. The Federal Aviation Administration (FAA) PFC program allows airlines to collect PFC fees up to $4.50 for every enplaned passenger at commercial airports controlled by public agencies. PFCs are capped at $4.50 per flight segment (maximum of $9.00) with a maximum of two PFCs charged on a one-way trip or four PFCs on a round trip (maximum of $18.00). 2. Our financial spreadsheet generates a similar amount of revenues to those projected for the DTX project. 3. The 1.3 coverage ratio is consistent with the coverage ratio for other revenue-backed loans, as evidenced by the existing TIFIA loan secured by tax increment. While both the TIFIA and RRIF loans are initially sized with 1.30 times coverage based on projected first year revenues, the coverage on the RRIF loan is measured on PFC revenues after payment of the TIFIA loan. While this senior/subordinate approach is consistent with one instance where TIFIA and RRIF loans were issued for the same project (Denver Union Station), it is conceivable that the Build America Bureau that is to administer both programs would measure total PFC Revenue against combined TIFIA/RRIF PFC debt service. This approach reduces the TJPA’s ability to leverage PFC revenues by approximately $250 million in the high funding scenario. We recommend that the PFC-backed loan(s) be re-sized using the more conservative methodology. 4. There is reason for cautious optimism about TIFIA/ RRIF: a. TIFIA may fund up to 33% of a project’s cost (or approximately $1.3 billion for DTX. RRIF may fund 100% of costs. Both programs appear to have ample funding capacity. The funding terms are comparable (35 years at the 30-year US Treasury rate. While TIFIA may not be able to fund the full PFC-backed loan that is needed, the combination of TIFIA and RRIF could. The same Build America Bureau now administers both programs. b. RRIF apparently has approved a loan to Amtrak secured by incremental fare revenues projected from future high speed rail service. PFCs are analogous to incremental fare revenue – particularly with respect to the Caltrain service. 5. The TIFIA/RRIF loan size is highly sensitive to interest rates. Assuming the acceptance of PFC revenues to secure a loan, the accuracy of HSR ridership projections, 1.3 times coverage and the high PFC revenue scenario, a 0.5% change in rates could affect loan sizing by approximately $130 to $140 million. 6. As discussed in “Caveats” below, the TIFIA/RRIF loan size is premised on PFC revenue streams that increase in each year by a CPI assumption. Ultimately, the projected revenue stream will need to be based on an investment grade ridership study that considers other variables. Caveats The caveats pertain to (a) whether TIFIA/RRIF funding will, in fact, be available, (b) credit considerations and (c) timing.

- 29. Peer Review of DTX Funding Plan October 2016 Page 22 of 29 1. TIFIA/RRIF Loan Availability. While the funding capacity would appear to exist for a TIFIA/RRIF loan in some combination, it is difficult to assert with certainty whether these programs will underwrite the proposed PFC credit, particularly given the large percentage of the projected revenue stream to derive from the HSR service that is not in existence on an alignment that has not been constructed. The recent $2.45 billion Amtrak RRIF loan secured by incremental revenues projected to arise from proposed high speed rail service on the Acela line is an encouraging development. However, that loan is most analogous to the PFC revenues projected to derive from the Caltrain service which, like Acela, is an existing service. 2. Investment Grade Ridership Study. The TIFIA/RRIF loan will be premised on the preparation of an investment grade ridership study and the receipt of an indicative investment grade rating by a major rating agency. At present, the analysis takes the Cambridge ridership assumption in 2029, projects ridership back to a 2026 start date, then increases ridership, PFC charges and PFC revenues linearly at assumed CPI growth rates of 1% and 3% without interruption. This approach is rather simplistic by necessity and leads to large numbers. An investment grade ridership study will consider a multitude of variables that could lead to different outcomes. 3. Timing Considerations. The DTX funding plan projects a financial close of the RRIF loan by June 30, 2019. Realization of projected PFC revenues depends on (a) HSR revenue service by 2026; (b) Caltrain electrification; and (c) an operational Transbay Transit Center. While the favorable political environment suggests HSR will be completed in accordance with the schedule in the 2014 HSR business plan, considerable work remains, including: a. Intergovernmental agreements b. Procurements (design/build contractor, rail cars, and operator) c. Construction d. Testing and commission of service, and e. Preparation of the investment grade ridership study The intergovernmental agreements are particularly important, as they will establish the PFC charge. They need to be in place well before the 2019 date assumed for financial close. Given the importance of PFCs to the overall funding of Phase 2, it behooves the TJPA to establish as much certainty around the elements of these funding sources as possible and to develop clarity as to any structuring constraints to be imposed by TIFIA/RRIF.

- 30. Peer Review of DTX Funding Plan October 2016 Page 23 of 29 VI. Other DTX Funding The DTX funding plan contains three funding sources that together comprise between 27.8% and 38.5% of Project funding. These funding sources (in millions of year-of- expenditure dollars) are: Funding Source Amount Low Estimate High Estimate Funding Timeframe SFCTA - Future Sales Tax $350 Million 10.4% 7.5% 2019-2026 FTA - New Starts $650 Million 19.3% 13.9% 2019-2026 MTC/BATA - Bridge Tolls $300 Million 8.9% 6.4% 2019-2026 The funding plan assumes that these funding sources will be available in full when needed before or during construction. While each of these funding sources is subject to major contingencies (e.g., voter approval), assuming such contingencies are met, the resulting revenues/funding are predictable. Future sales tax revenues. The DTX funding plan calls for an additional $350 million in future sales tax revenues - $50 million per year over seven years. That represents 7.5% to 10.3% of total DTX project funding. Such funding would augment Proposition K sales tax funding (2004-2034) approved by 74.8% of San Francisco voters in November 2003. The half-cent sales tax currently collected by San Francisco County Transportation Authority is budgeted at $108 million for the current fiscal year. The funding expected from the pending 0.75% measure, therefore, would generate approximately $160 million per year – and therefore can accommodate the planned funding for the DTX project over the 2019-2026 timeframe. The availability of future sales tax funding is subject to San Francisco voter approval of a San Francisco ballot measure to increase the local sales tax by 0.75% for a period of 25 years to provide funding for transportation and homelessness programs. The 0.25% State component of San Francisco’s existing 8.75% sales tax will expire on December 31, 2016, so the net effect of voter approval would be to increase the local sales tax to 9.25%. San Francisco voters have had a history of approving tax increases. In 2014, Proposition A, a $500 million general obligation bond measure for transportation, received 71.9% of the vote – in excess of the 2/3rd voter approval requirement. The sales tax increase assumed in the DTX funding plan carries a lower threshold for approval – majority – furthering the likelihood of approval. Working against approval is the large number of local and State propositions on the ballot – many of which will have the effect of tax increases. Future bridge tolls. The DTX funding plan calls for the Bay Area Toll Authority (“BATA”) to provide $300 million in future bridge toll revenues between fiscal years 2019-2025. This aggregate funding represents 6.4% to 8.9% of total DTX project funding. The availability of future bridge toll funding is subject to approval by both BATA and the Metropolitan Transportation Commission (“MTC”).

- 31. Peer Review of DTX Funding Plan October 2016 Page 24 of 29 According to its most recent Annual Report filed on the Electronic Municipal Market Access (EMMA) website, in Fiscal Year 2015, BATA received about $725 million annually in bridge toll revenues, interest earnings and other revenues, had maintenance and operation expenses of approximately $107 million and annual debt service obligations of approximately $409 million. Excess revenues are over $200 million. BATA has the cash flow and bonding capacity to meet the funding objective assumed in the DTX funding plan. FTA Section 5309 new starts funding. The DTX funding plan calls for $650 million in FTA New Starts funding. That represents 13.9% to 19.3% of total DTX project funding. New Starts funding is part of FTA’s primary grant program for funding major transit capital investments. New starts funding requires (a) completion of both project development and preliminary engineering (PE) bases of a major capital project, (b) satisfaction of federal transportation planning and environmental review requirements, and (c) an FTA rating at various points in the process using statutory criteria for evaluating project justification and local financial commitment. The DTX project is one of two Bay Area “big” starts projects included in Plan Bay Area 2013, which designates the project as a regional priority and calls for $650 million in federal funding to go with $639 million in committed local funding. However, the DTX project has not yet been approved for New Starts funding. The Bay Area’s track record of attracting Federal funding commitments for major transportation improvements reinforces the likelihood that New Starts funding will occur. The one caveat is FTA New Starts funding is dependent on Administration and Congressional support for major transit capital investments.

- 32. Peer Review of DTX Funding Plan October 2016 Page 25 of 29 VII. Conclusion The DTX funding plan is a comprehensive and creative plan that entails a myriad of local, regional and Federal financing sources. Many elements of the plan involve traditional and predictable funding sources that derive from outside agencies, such as from Federal New Starts, City and County sales tax revenues and MTC/Bay Area Toll Authority bridge tolls. Realization of these revenues depends on certain approvals from governmental bodies and/or voter approval. There is a solid basis to expect those approvals will be forthcoming. These funding sources may or may not involve financing. Three revenue sources, however, will require financing: Mello Roos special taxes, tax increment revenues and PFCs. The proceeds from such financial transactions will account for 39.8% to 56.5% of overall funding. The implementation of these financial transactions is critical to the timely construction of DTX. Of these financial transactions, the Mello Roos and tax increment financing are the most traditional. The Mello Roos bonds will be issued as development in the CFD is completed and becomes ready for occupancy. This is a conservative approach that relies on an accepted method of financing. The bonding approach – 30 year maturity and 1.10 debt service coverage – is standard and the interest rate of 5.5% should be achievable as a program- wide average. The primary concern to achieving the funding assumptions relating to Mello Roos relates to whether development and occupancy will occur as projected. Delays could occur due to changes in the local economy and to the feasibility of the proposed projects. The tax increment financing relies on securing a loan from TIFIA in the amount of at least $200 million. With Phase 1, TIFIA has shown a willingness to lend its favorable program terms to allow the TJPA to monetize tax revenues to be generated by future development. The Phase 1 loan represented a pioneering approach at the time but it lays the foundation for the Phase 2 loan. TIFIA should derive comfort from the development that is now underway in the Transbay Redevelopment Project Area. Assuming TIFIA is willing to increase its exposure to value capture financing in a concentrated district, the primary variables that could impact loan sizing would be interest rates and the approach for demonstrating debt service coverage. The PFC financing represents, by far, the largest component to the overall funding plan – and the one with the most issues associated with it. The theoretical basis to the funding approach is sound – a revenue stream based on a ticket surcharge in the manner that airlines have been charging for years. One of the ticket surcharges is on existing service – Caltrain.

- 33. Peer Review of DTX Funding Plan October 2016 Page 26 of 29 The vast majority of PFC revenue, however, derives from HSR service – which will not commence until 2026 (at the earliest) and will be over an alignment for which much of the construction work has not been procured. More importantly, there have been no agreements with Caltrain or HSR with respect to the PFC to be charged – a critical component of PFC revenues. TIFIA and/or RRIF are identified as the financing vehicles to securitize PFC revenues. On a combined basis, the financing capacity with those programs should exist. There is no certainty as to whether they will lend against the proposed PFC revenue stream, particularly as deriving from HSR. If they do, the size of the loan(s) will depend on four main factors: ridership, the PFC charge, coverage and interest rates. The point of greatest uncertainty is ridership – number and timing. That uncertainty largely may be resolved by the existence an investment grade ridership study. However, before revenue projections can be generated, the PFC charge must be known. The timing element is that PFC revenues materialize only after service commences to the Transbay Transit Center. It is conceivable that TIFIA/RRIF require HSR to reach certain milestones before a TIFIA/RRIF loan can be implemented – i.e., the PFC charge established, contracts let and a firm construction schedule developed. Assuming the ridership and PFC matters are resolved, then the remaining factors that impact loan size are financial: debt service coverage and interest rates. Debt service coverage is currently presented in a way that maximizes loan proceeds – by calculating 1.30 coverage first on a large TIFIA loan and then assuming another loan that is based on 1.30 coverage from revenues after TIFIA loan debt service. On a combined basis, the effect is reduced overall coverage. TIFIA/RRIF ultimately may be willingness to accept this approach – but this would appear to be an open issue. The interest rate is established by reference to the 30 year US Treasury rate. Rates are near historic lows but the Federal Reserve Board has been signaling the need for higher rates. The 0.50% cushion assumed in the high funding scenario may not be sufficient cushion for a financial close in 2019. A delay in funding – absent the availability of interim financing – could delay overall Project completion, creating a snowballing effect: (a) costs are estimated to increase at approximately $200 million year; (b) the collection of PFC revenues would lag as they are premised on service to the Transbay Transit Center; and (c) the pace of development in the surrounding area could slow. With a funding date of 2019 for PFC financing, time is of the essence.