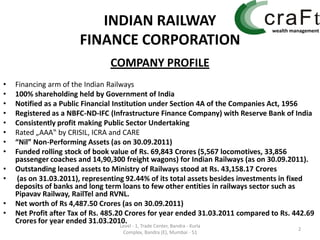

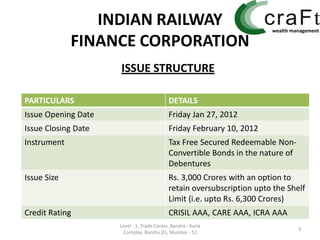

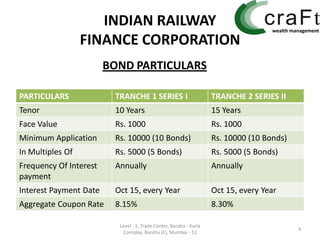

The Indian Railway Finance Corporation (IRFC) is a government-owned financial institution that issues secured tax-free bonds from January 27 to February 10, 2012, aiming to raise ₹3,000 crores with a potential oversubscription up to ₹6,300 crores. The bonds have credit ratings of AAA and offer attractive tax benefits, including tax-free interest and exemption from wealth tax. The corporation maintains a strong financial profile, including zero non-performing assets and a consistently profitable track record.