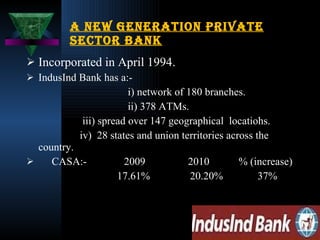

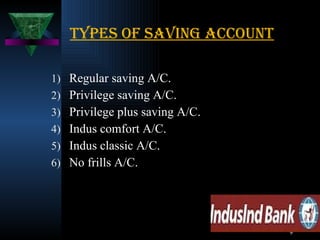

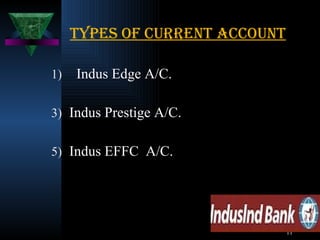

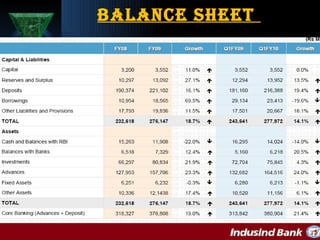

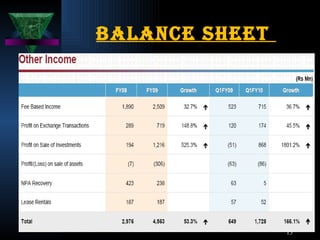

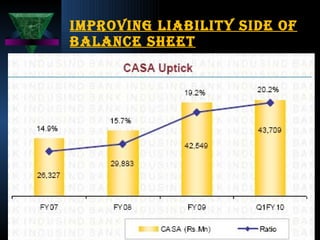

This document summarizes a summer training report on a study of the customer accounts at Indusind Bank. The report aimed to study the bank's current and savings accounts, understand customer perceptions of its products and services, and assess the bank's brand image. The report used survey methods to collect data and analyze account types, services, customer awareness, and opportunities to increase business. It concluded that while customers were satisfied, the bank needs more advertising and promotional activities to increase awareness and compete with larger national and foreign banks.