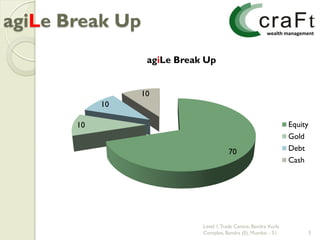

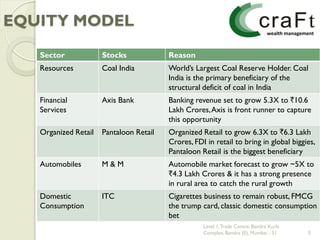

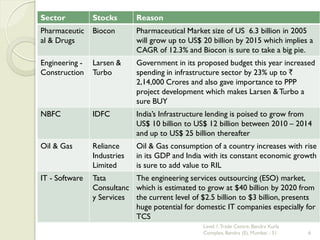

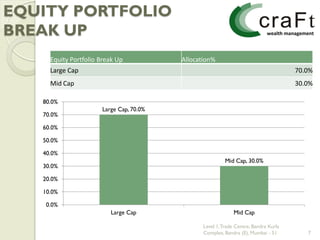

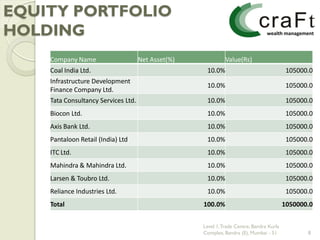

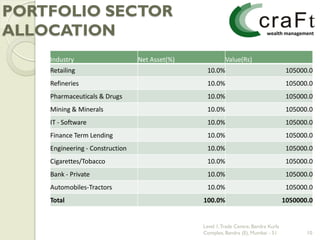

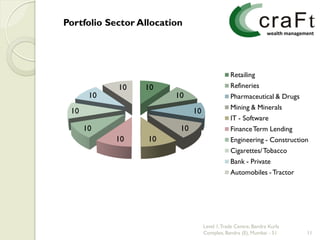

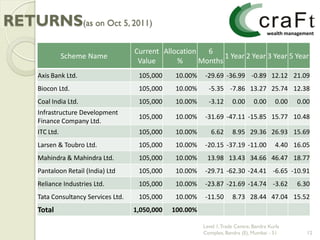

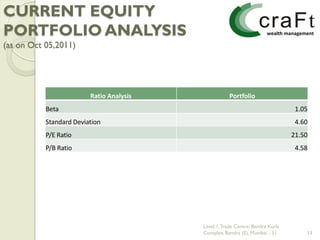

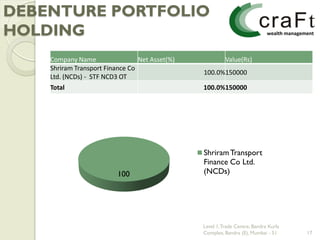

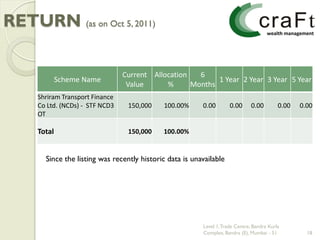

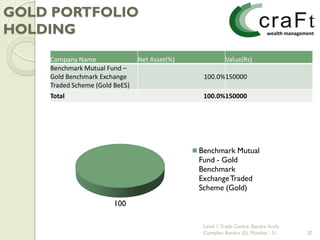

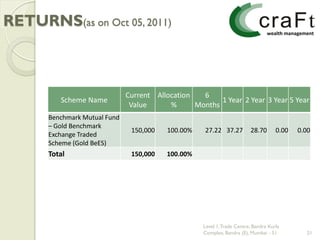

The document describes an ideal portfolio for a 15 lakh investment. It allocates 70% to equity, 10% to gold, 10% to debt, and 10% to cash. The equity allocation is further divided with 70% in large caps and 30% in mid caps. Specific stocks are recommended across sectors like resources, financial services, retail, automobiles, and pharmaceuticals to construct a diversified equity portfolio.