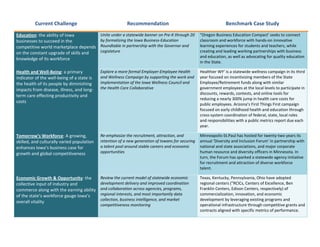

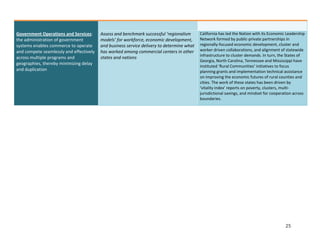

This document provides a summary of a report titled "A Blueprint for Iowa 2025" which assesses Iowa's historical, current, and future economic competitiveness. The report was commissioned by the Iowa Business Council to identify challenges and opportunities to maintain positive economic growth over the next 5-20 years. Key findings include: (1) Iowa faces fiscal challenges that limit investments needed for growth; (2) federal expenditures in Iowa focus more on social services than growth; (3) retaining students and innovators lags national trends; and (4) Iowa's population gap and lack of diversity challenges its future workforce. The report recommends convening a forum to discuss goals, recommendations, and performance measures to address these issues and ensure Iowa