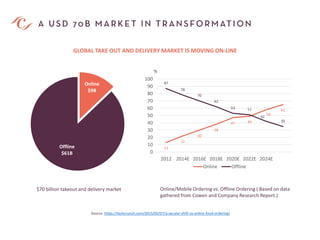

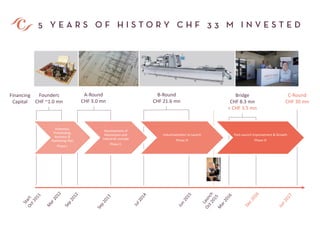

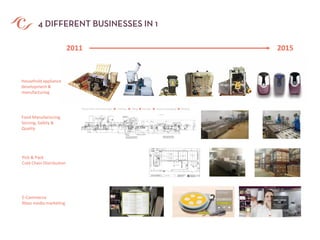

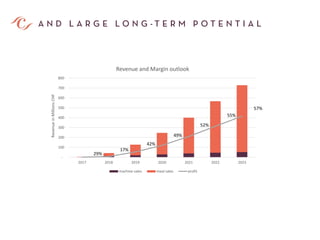

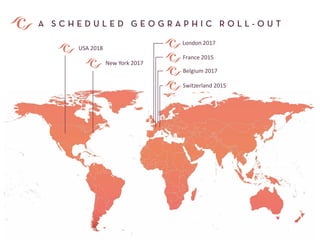

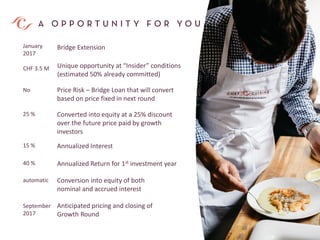

The document highlights the growing trend towards online food ordering, estimating a $70 billion global market with significant shifts from offline to online ordering. It outlines Nutresia's operational plans, including phases for development, launch, and growth, as well as detailed financial projections and funding rounds. Additionally, it emphasizes the unique investment opportunities and expected returns for potential investors within the company's growth strategy.