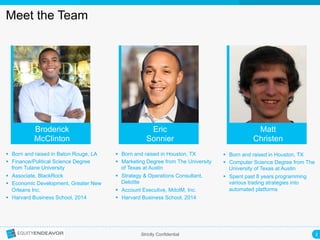

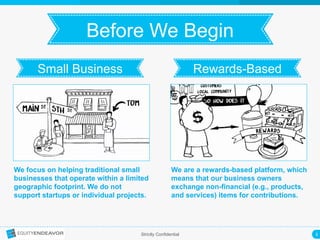

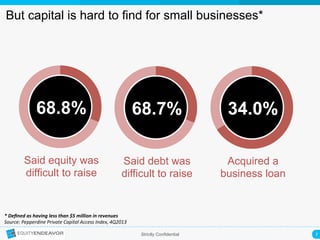

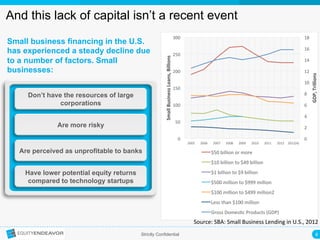

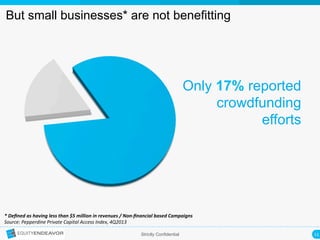

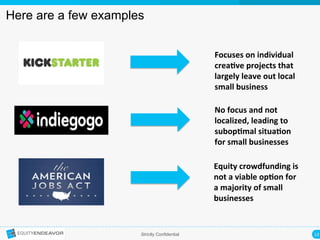

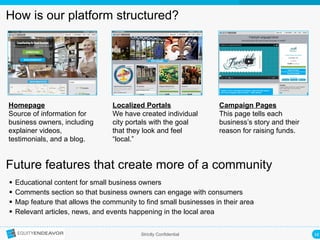

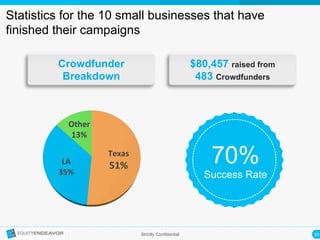

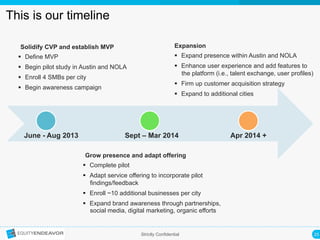

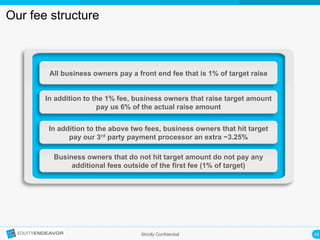

This document provides an overview of Equity Endeavor, Inc., a crowdfunding platform designed for small businesses. It introduces the founding team and describes two major trends driving the company's creation: 1) Small businesses struggle to access capital for growth, and 2) Crowdfunding has grown significantly but existing platforms are not well-suited for small businesses. Equity Endeavor aims to address this problem with a rewards-based crowdfunding platform focused on local small businesses. An initial pilot in Austin and New Orleans saw success in helping businesses raise funds.