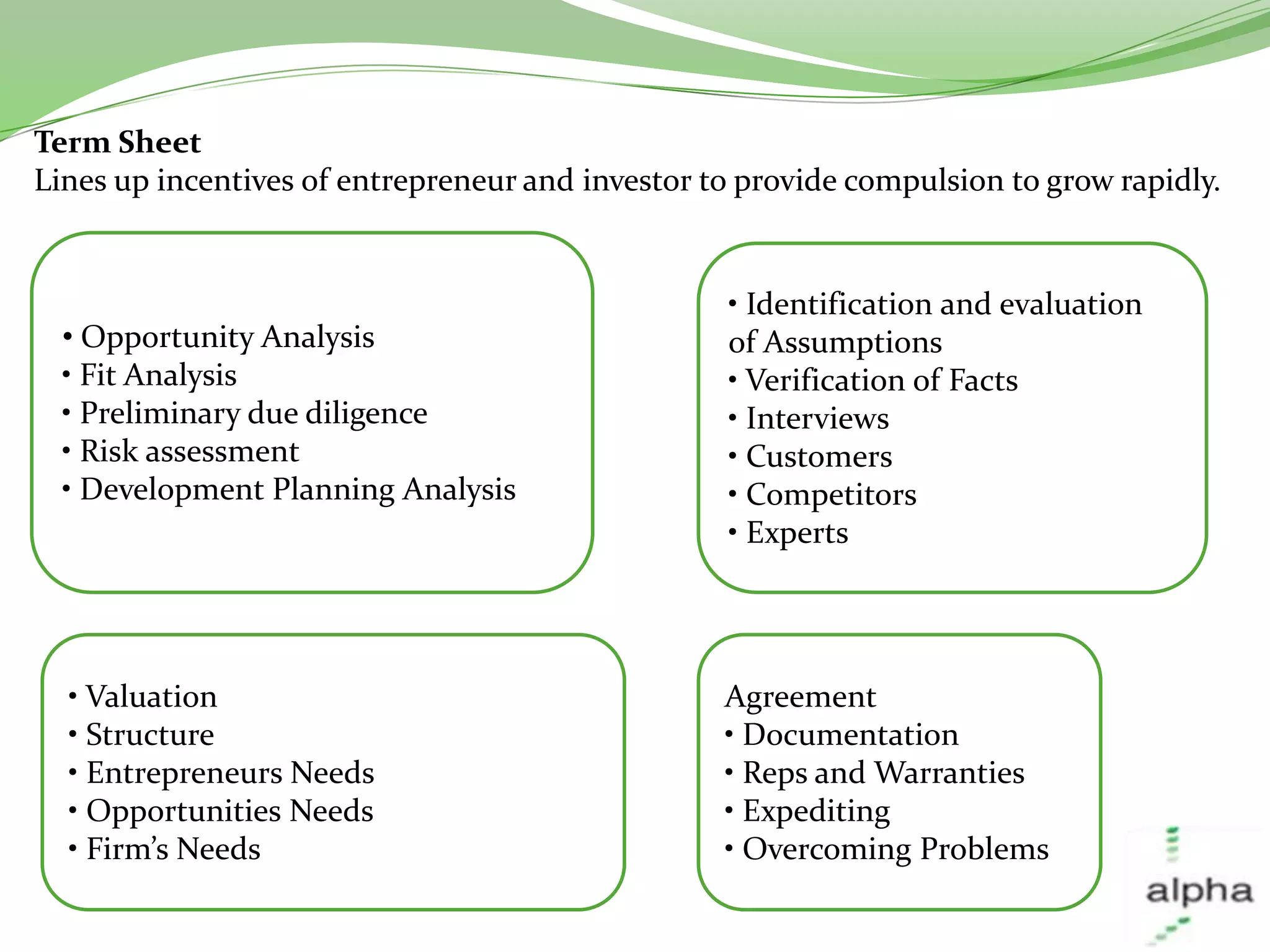

This document provides an overview of investment term sheets, including:

- A term sheet is a non-binding agreement that outlines the basic terms and conditions for an investment, and serves as a template for more detailed legal documents.

- It balances the interests of entrepreneurs/inventors and investors by answering key questions around investment growth, roles, rights, and exit provisions.

- Once agreed, a binding contract is drawn up conforming to the term sheet details around items like valuation, investment amount, stake percentage, and provisions.