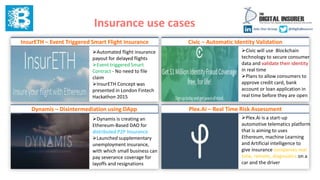

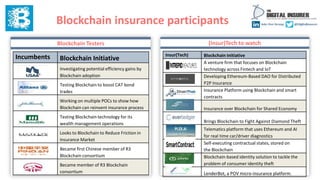

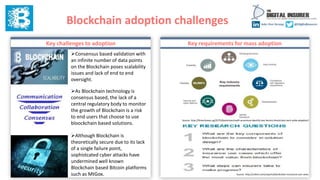

The document reviews the potential of blockchain technology in the insurance industry, highlighting its ability to modernize processes like identity verification and claims settlement. Despite significant investment and emerging use cases, challenges remain in terms of security, regulation, and mass adoption. Key developments include automated smart contracts and decentralized applications, although scalability and oversight issues pose barriers to widespread implementation.