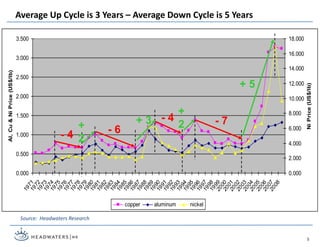

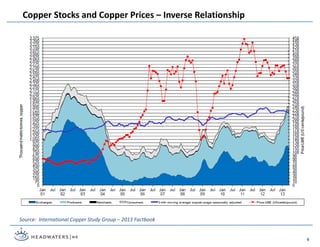

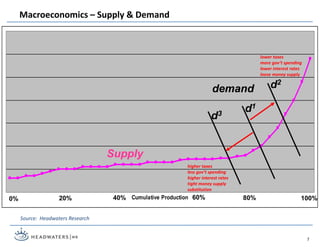

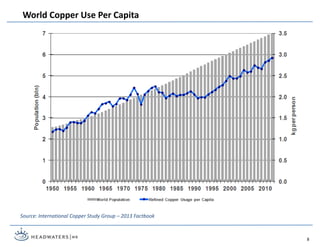

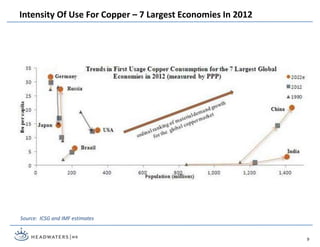

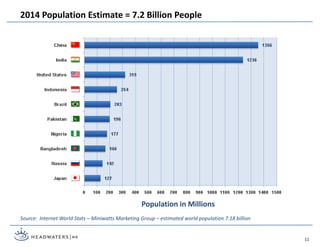

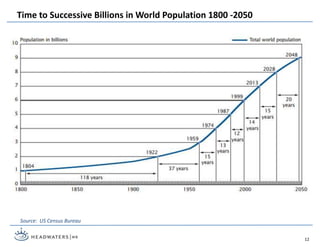

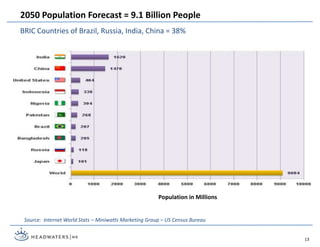

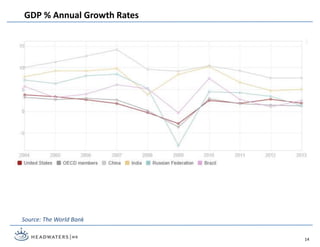

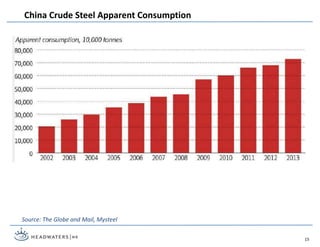

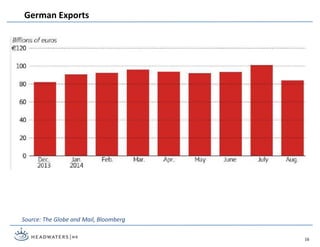

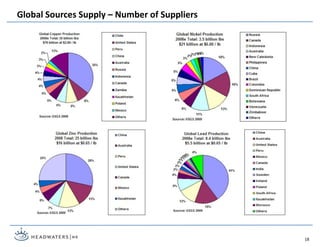

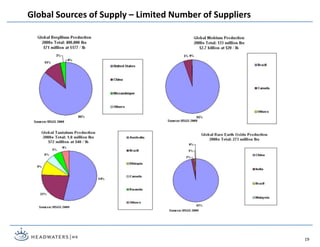

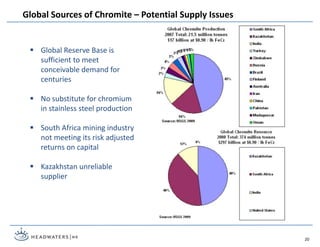

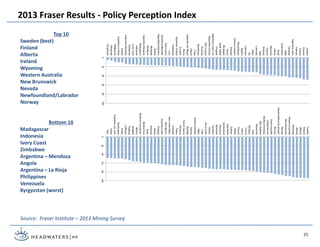

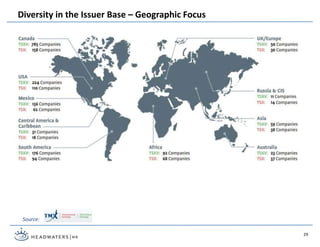

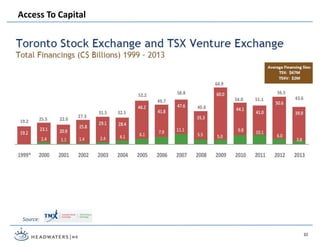

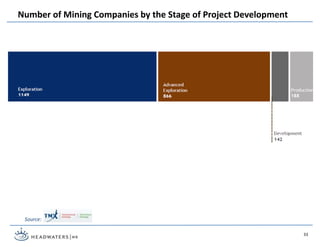

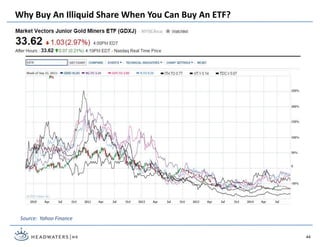

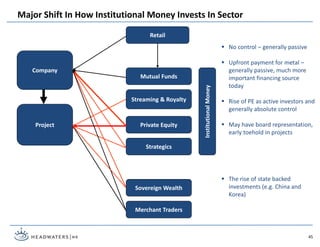

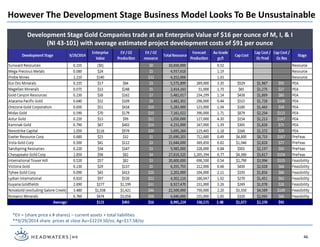

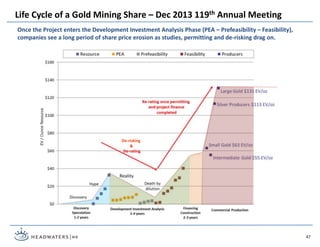

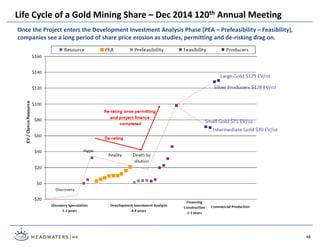

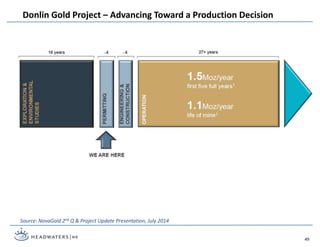

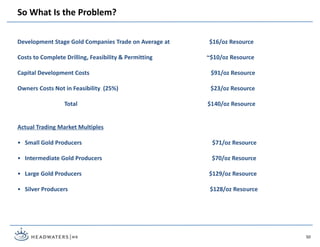

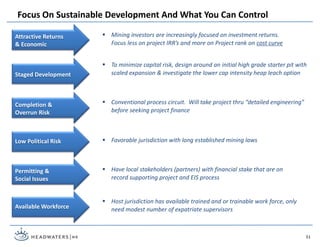

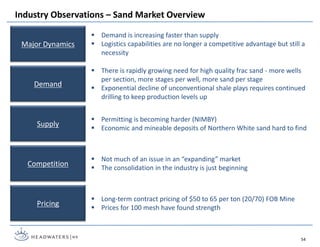

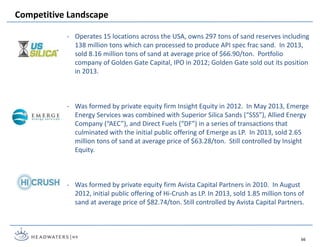

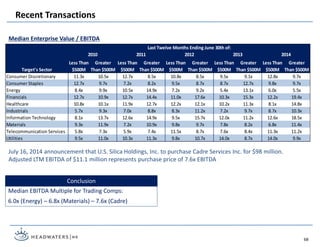

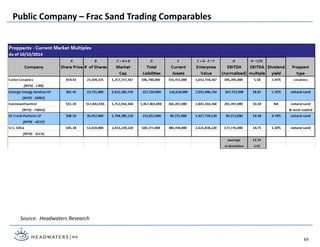

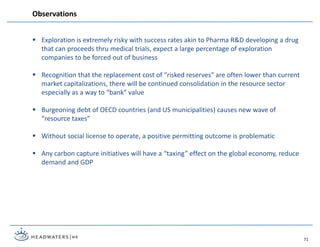

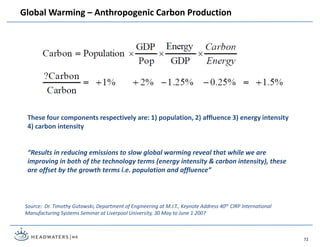

The document presents an overview of the global mining industry, highlighting the cyclical nature of prices, demand driven by BRIC countries, and the political risks faced by mining firms. It also examines the challenges related to raising capital and provides insights into various segments of the mining sector, including development-stage gold companies and the frac sand industry. Additionally, it discusses the importance of political and regulatory environments on mining operations worldwide.