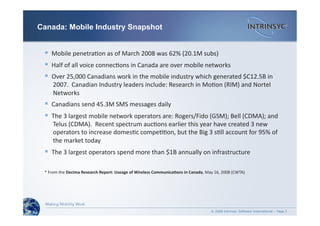

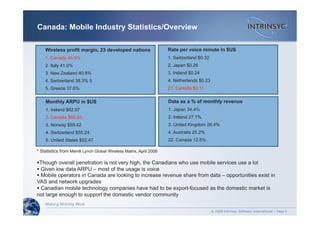

1) Mobile trends in Canada include high mobile penetration rates, significant revenue and profits for operators, and a large mobile industry workforce, though data usage as a percentage of revenue remains relatively low.

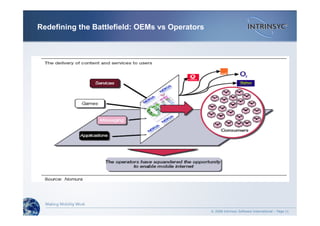

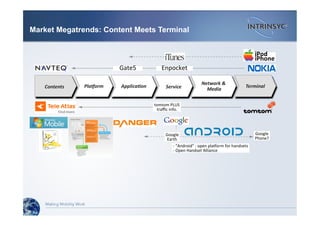

2) Key assumptions about future mobile trends include declining voice revenue, rise of all-you-can-eat data plans, mobile internet surpassing walled gardens, and convergence of services across devices and networks.

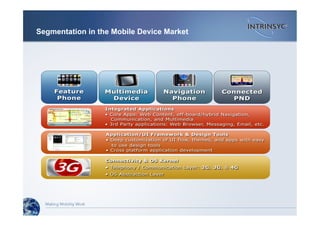

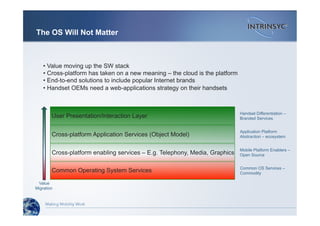

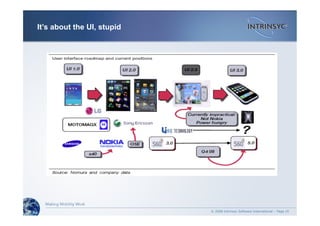

3) Mobile devices are becoming multi-functional converged platforms for many services beyond just voice and messaging, with the user interface rather than operating system becoming the key differentiator between devices.