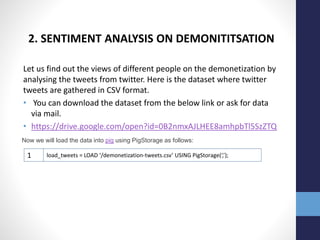

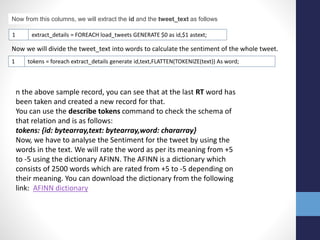

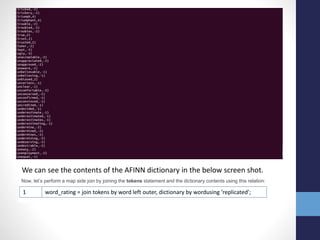

The document outlines projects completed by an intern in machine learning, including handwritten digit recognition using TensorFlow, sentiment analysis on demonetization tweets, and statistical arbitrage detection in Indian stock markets. It discusses the implementation details of each project, such as using TensorFlow for neural networks, data processing with Apache Pig for sentiment analysis, and predictive modeling with neural networks for stock prices. The conclusion emphasizes the challenges in predicting chaotic stock prices and the benefits of simpler models for better generalization.

![1

2

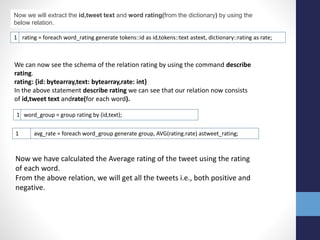

x = tf.placeholder(tf.float32, shape=[None, 784])

y_ = tf.placeholder(tf.float32, shape=[None, 10])

Creating Placeholders

The method tf.placeholder allows us to create variables that act as nodes holding the data. Here,

x is a 2-dimensionall array holding the MNIST images, with none implying the batch size (which

can be of any size) and 784 being a single 28×28 image. y_ is the target output class that

consists of a 2-dimensional array

Creating Variables

1

2

W = tf.Variable(tf.zeros([784, 10]))

b = tf.Variable(tf.zeros([10]))

Initializing the model

Python1 y = tf.nn.softmax(tf.matmul(x,W) + b)

1 cross_entropy = tf.reduce_mean(-tf.reduce_sum(y_ * tf.log(y),

reduction_indices=[1]))

Defining Cost Function

This is the cost function of the model – a cost function is a difference between the predicted

value and the actual value that we are trying to minimize to improve the accuracy of the model.](https://image.slidesharecdn.com/internshipprojectpresentationfinalupload-180803164802/85/Internship-project-presentation_final_upload-8-320.jpg)

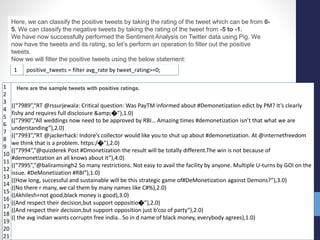

![Executing the model

1 sess.run([train_op], feed_dict={x: batch_x, y_: batch_y})

Print accuracy of the model

1

2

3

4

if epoch % 2 == 0:

print "Epoch: ", epoch

prit "Accuracy: ", accuracy.eval(feed_dict={x: mnist.test.images, y_:

mnist.test.labels})

print "Model Execution Complete"

Final Note

Creating a deep learning model can be easy and intuitive on Tensorflow. But to

really implement some cool things, you need to have a good grasp on machine

learning principles used in data science.](https://image.slidesharecdn.com/internshipprojectpresentationfinalupload-180803164802/85/Internship-project-presentation_final_upload-10-320.jpg)

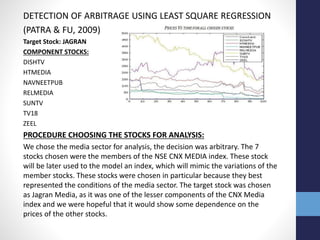

![3. WORK DONE PREVIOUSLY:

• Over more than half a century, much empirical research was done on testing the

market efficiency, which can be traced to 1930’s by Alfred Cowles, Many studies have

found that stock prices are at least partially predictable. The method to test the

existence of statistical arbitrage was finally described in the paper “Statistical

arbitrage and tests of market efficiency” [4] by, S.Horgan,

• R.Jarrow, and M. Warachka published in 2002.And an improvement on the paper “An

Improved test for Statistical arbitrage”[5] was published in 2011 by the same team

which forms the basis for this project.

4. MOTIVATION:

• Arbitrage has the effect of causing prices in different markets to converge. [3] “The

speed at which the convergence process occurs usually gives us a measure of the

market efficiency”.

• Hence a thorough analysis of statistical arbitrage opportunities using the advanced

learning techniques is essential in mapping the efficiency of current day Indian

market.](https://image.slidesharecdn.com/internshipprojectpresentationfinalupload-180803164802/85/Internship-project-presentation_final_upload-19-320.jpg)