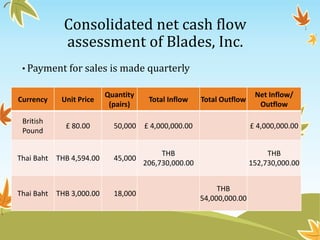

Blades Inc. exports swimsuits to the UK and Thailand and imports materials from Thailand. It is assessing hedging strategies to manage foreign exchange risk. For the UK exports, a money market hedge provides the highest dollar value of pounds received. For Thai baht exports, money market hedging is also best to maximize baht inflows in dollars. It is easier for Blades to hedge foreign currency inflows than outflows due to uncertainty in payment amounts. Blades could modify import timing or payment terms to reduce transaction exposure, but this increases inventory costs or requires more frequent hedging.