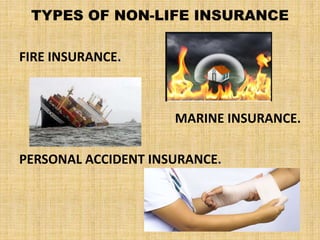

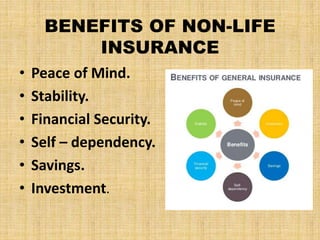

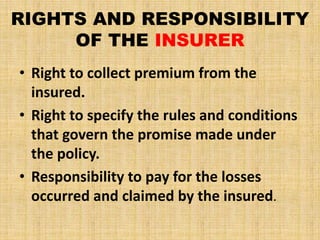

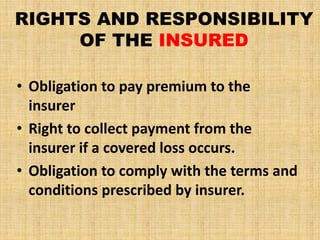

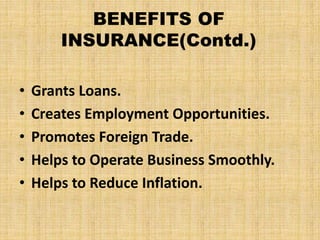

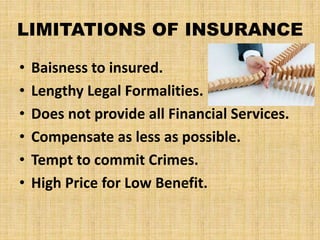

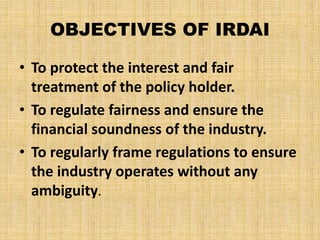

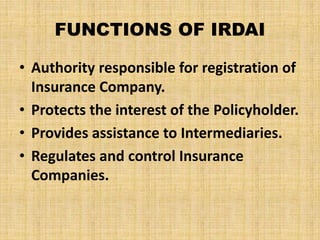

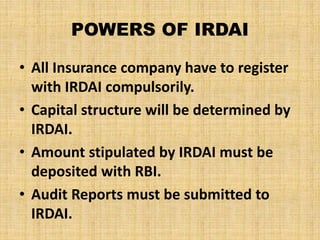

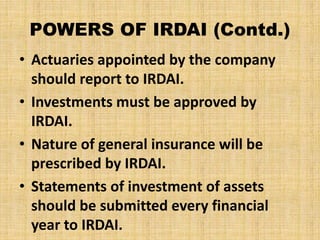

The document discusses the fundamentals of insurance, including principles, types (life and non-life), benefits and disadvantages. It outlines the workings of insurance, the rights and responsibilities of both insurers and insured parties, and the functions and powers of the Insurance Regulatory Development Authority of India (IRDAI). Additionally, it highlights the benefits and limitations of insurance in providing economic protection and risk sharing.