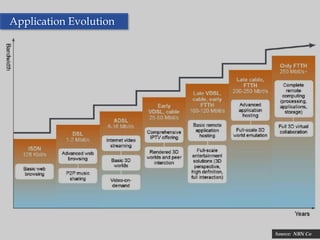

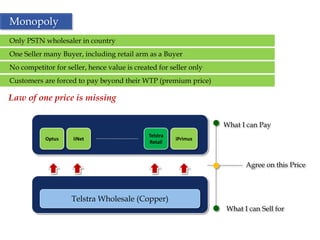

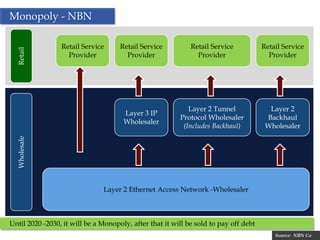

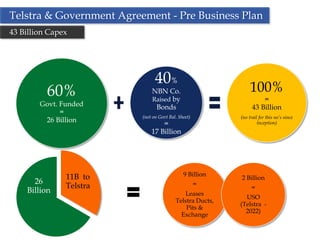

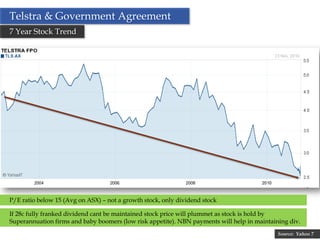

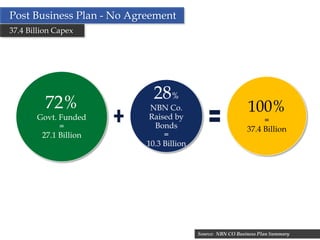

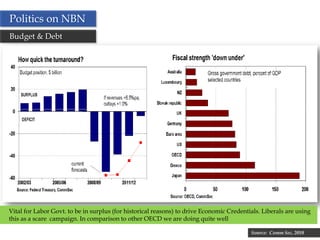

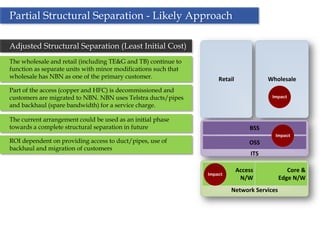

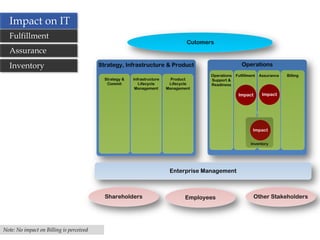

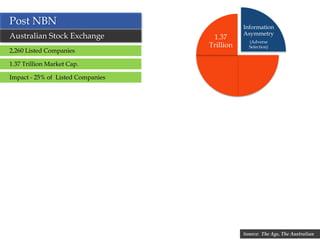

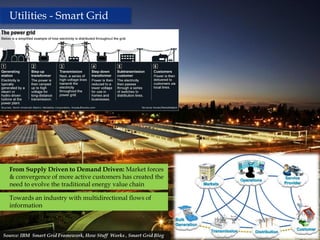

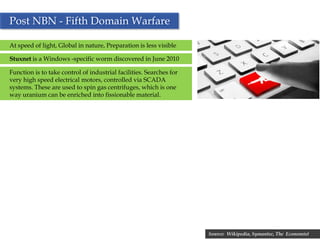

The document provides an agenda and slides for a presentation on the National Broadband Network (NBN) update in December 2010. It discusses the impact of the NBN on various Australian industries and companies. It also covers the agreement between the government and Telstra regarding Telstra's infrastructure and customer migration to the NBN network, and the hurdles in finalizing that agreement. The business plan for the NBN outlines the capital expenditures required and sources of funding from both government and bonds issued by NBN Co.