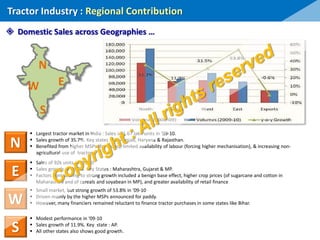

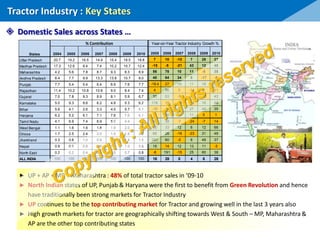

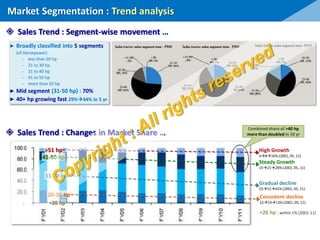

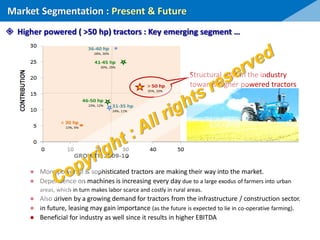

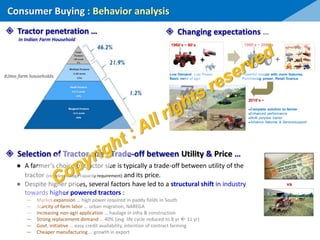

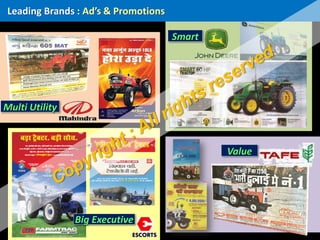

The document provides an analysis of the Indian tractor market, highlighting its significance in the agricultural sector and its contribution to India's GDP. It discusses market evolution, growth trends, segmentation, and consumer behavior while noting the dominance of key players like Mahindra & Mahindra. Future projections suggest continued growth driven by government initiatives and a shift towards higher-powered tractors due to labor scarcity and non-agricultural applications.