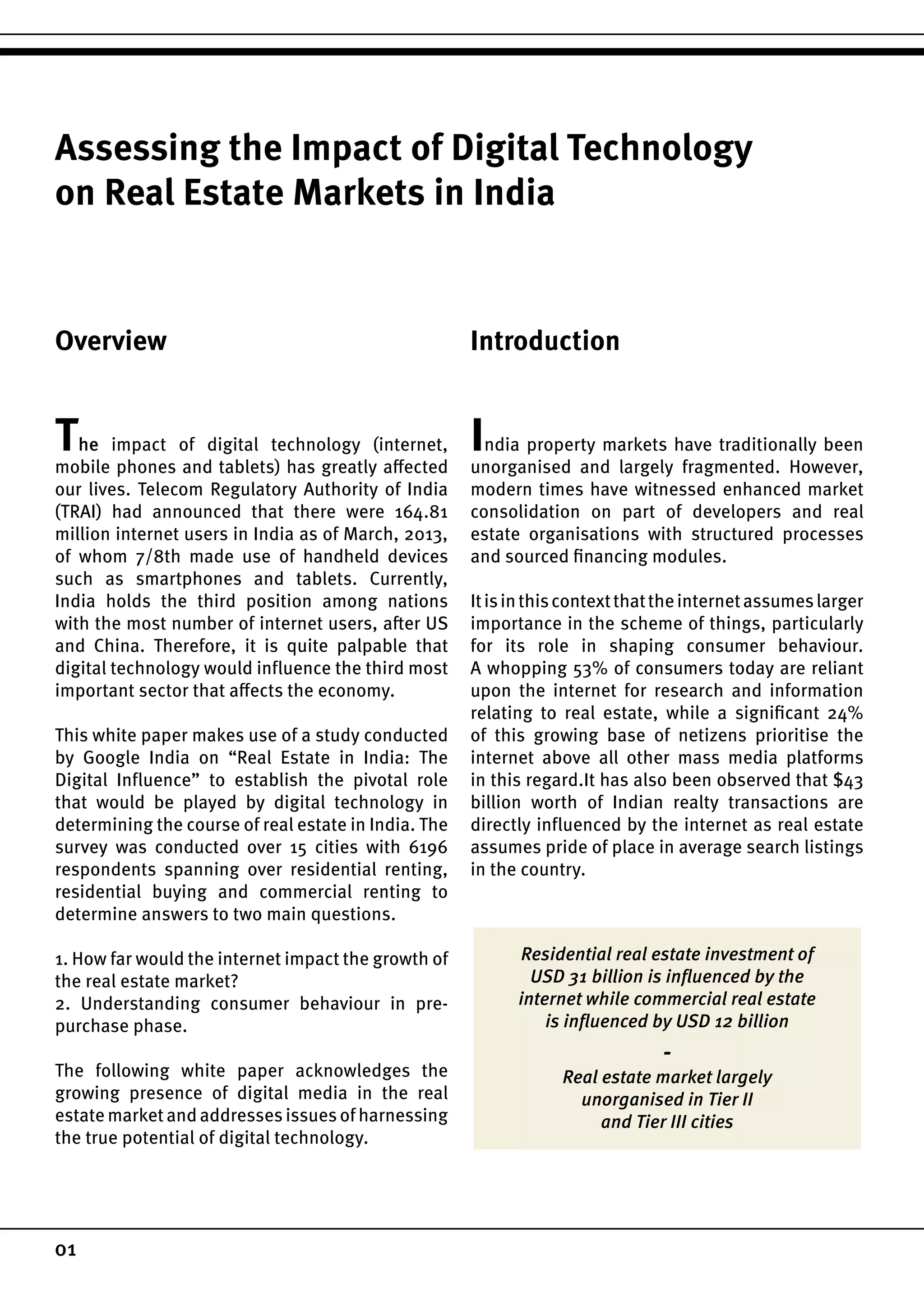

This document summarizes a study on the impact of digital technology on the Indian real estate market. Some key findings include:

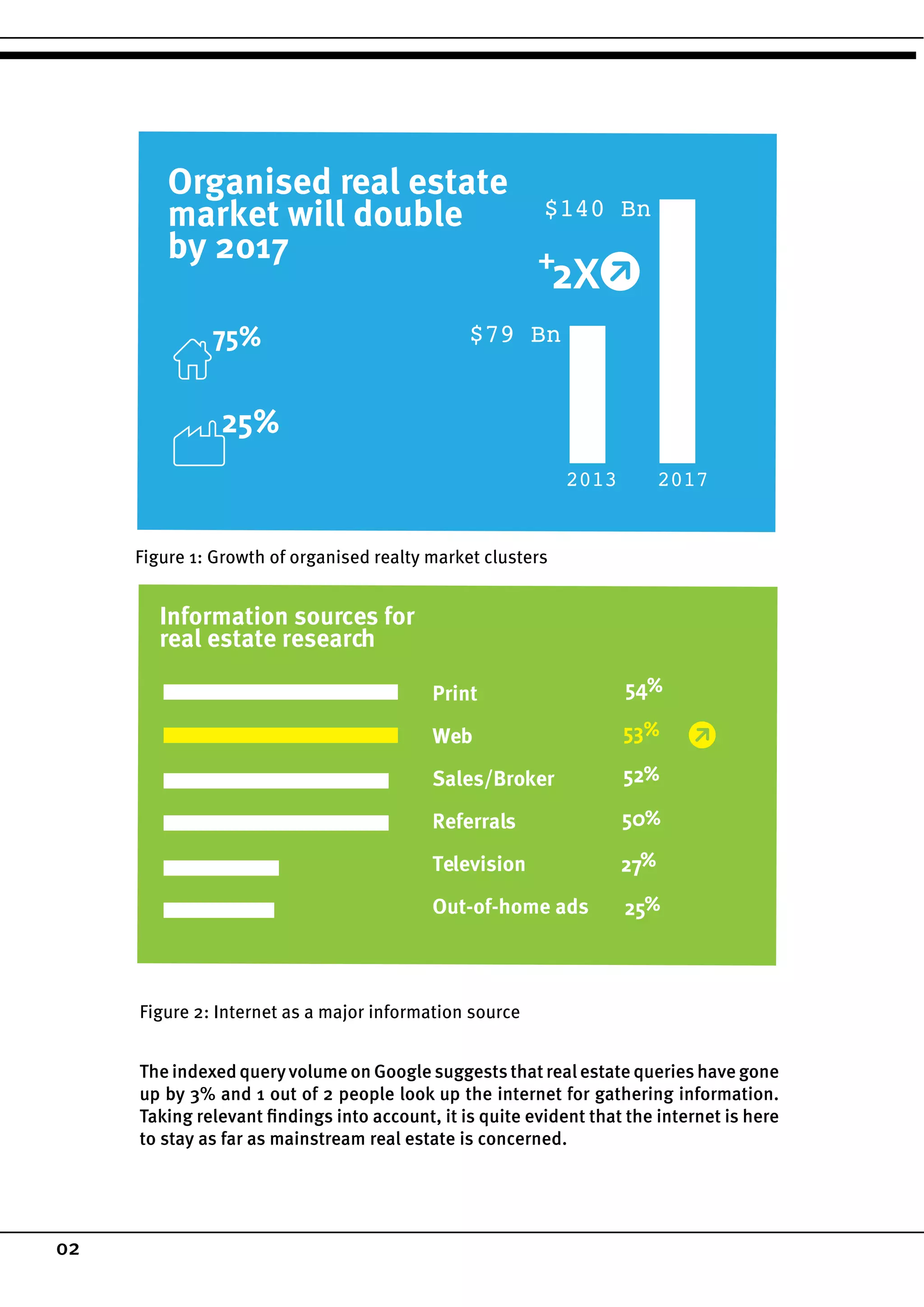

1. Digital technology, especially smartphones and tablets, has greatly influenced consumer behavior in the real estate sector. Over 50% of consumers now use the internet for real estate research.

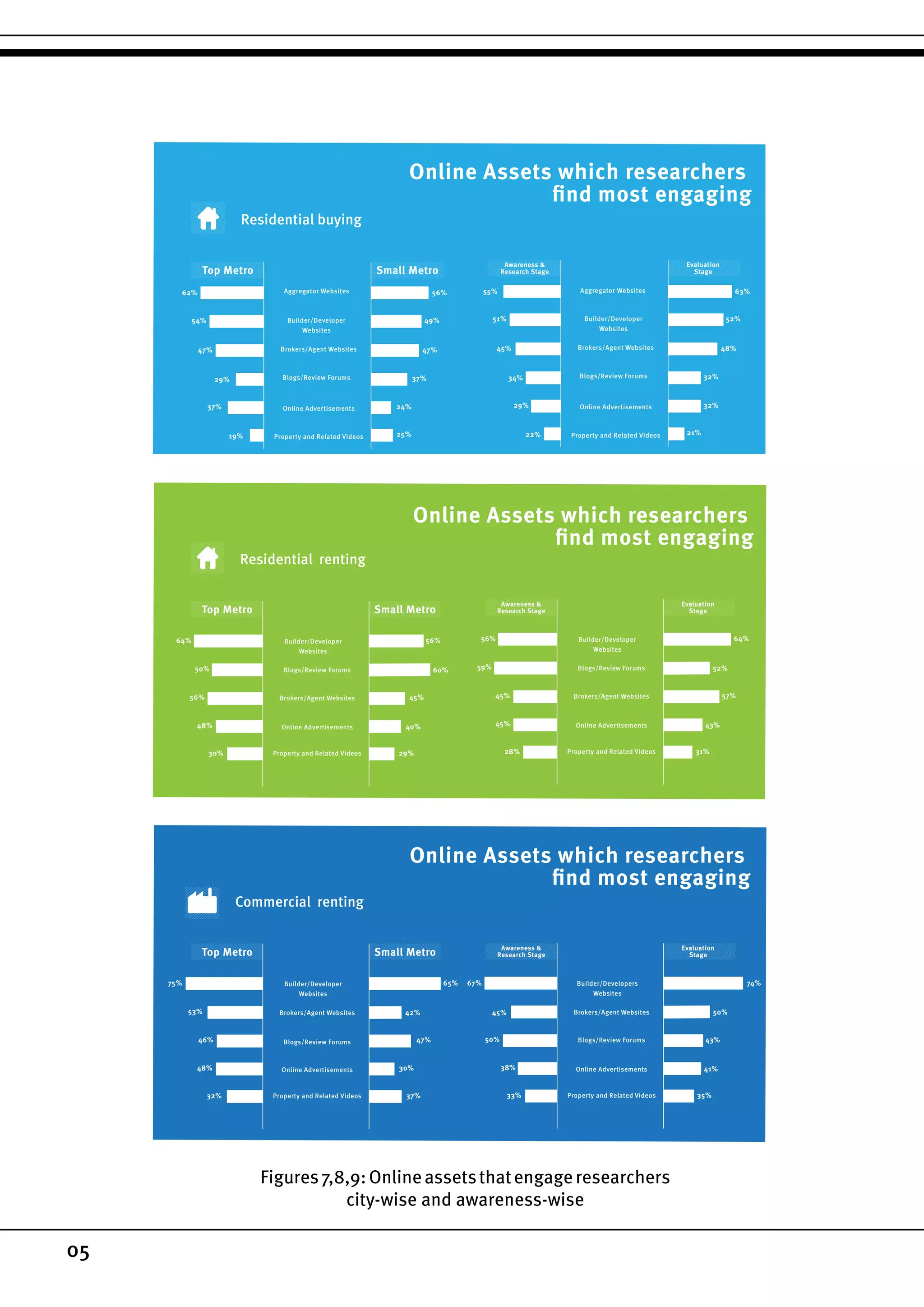

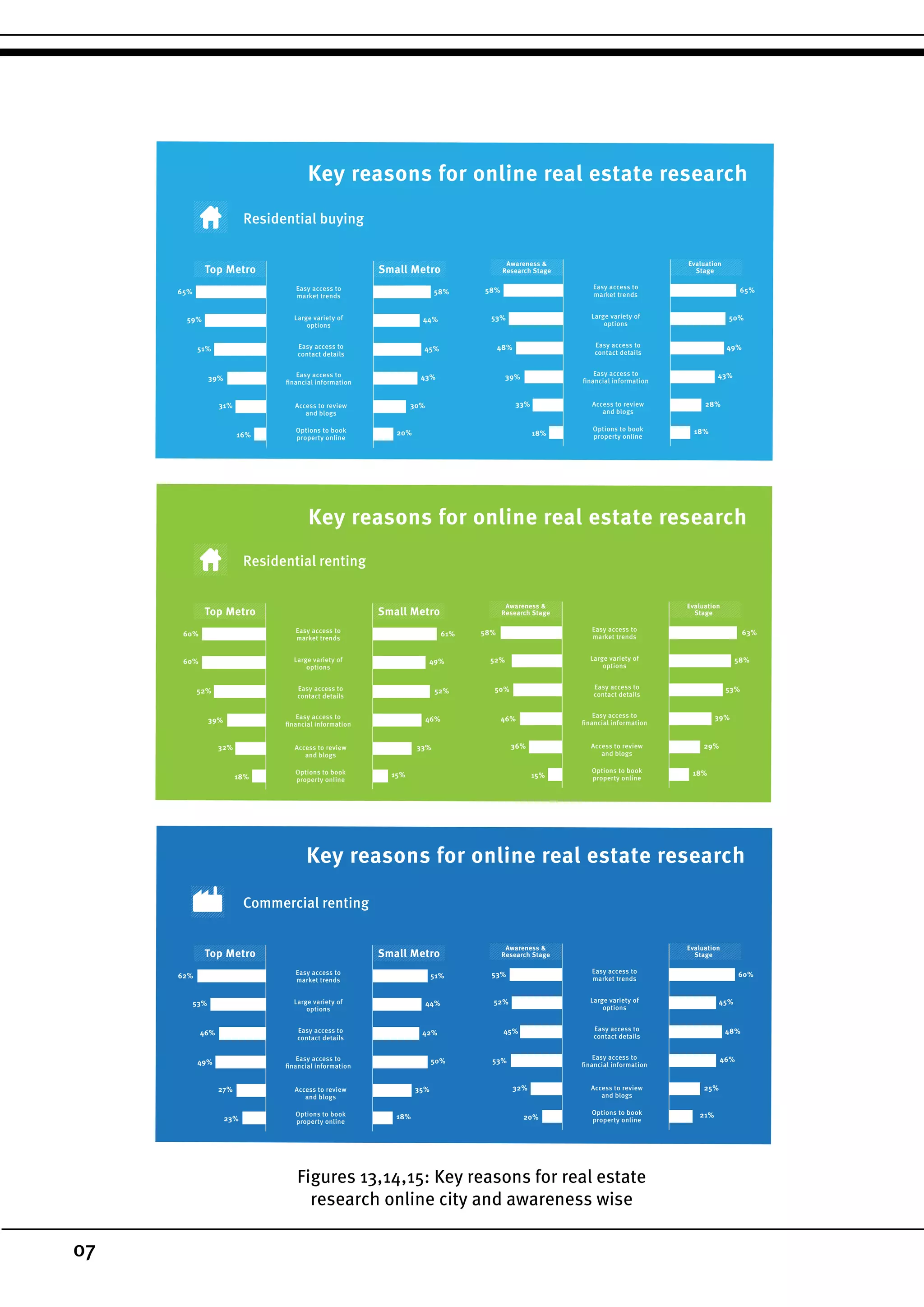

2. Aggregator websites that provide consolidated real estate information are very popular, engaging over 50% of users across various stages of property buying and renting.

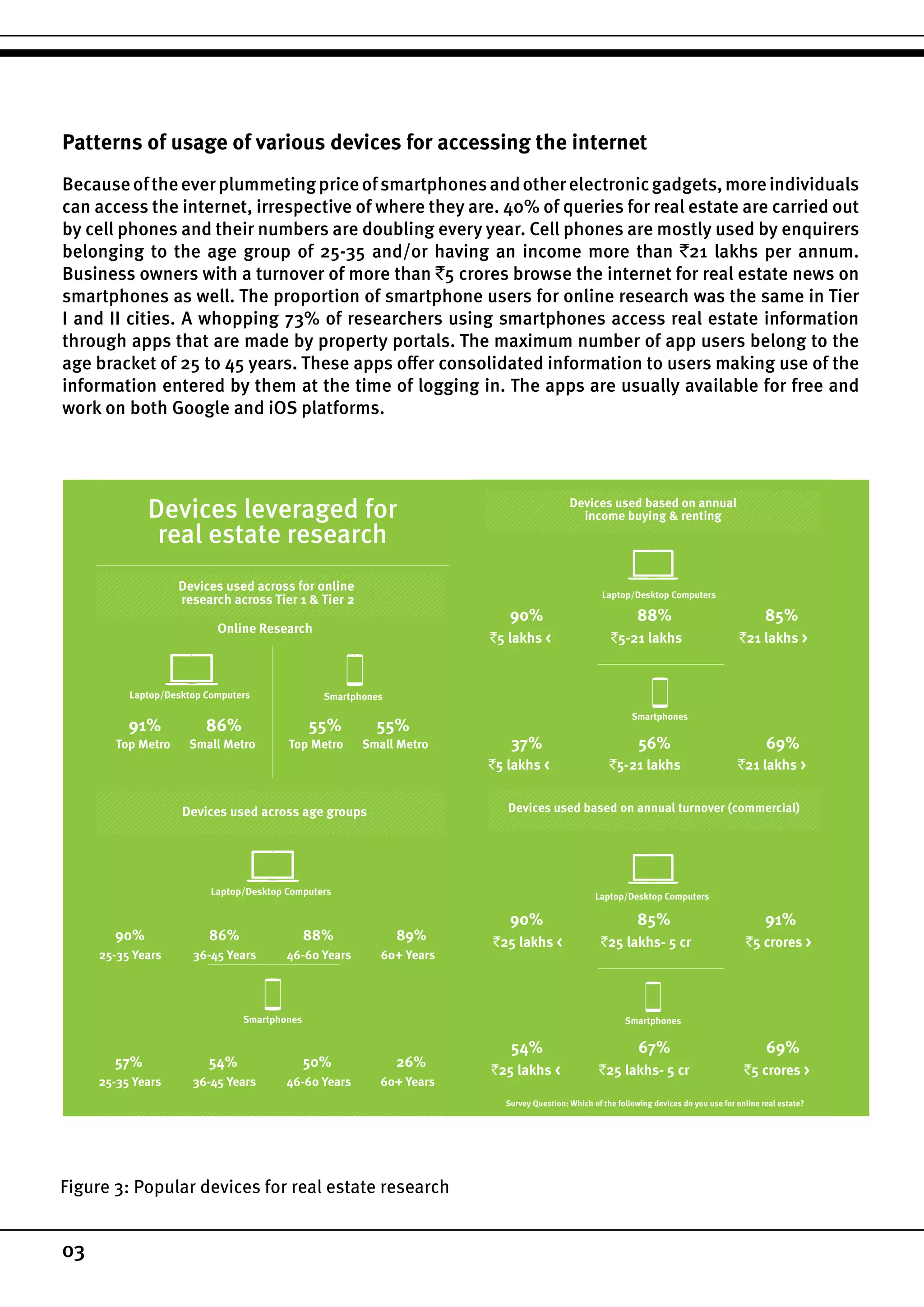

3. Smartphones are the most popular device for online real estate research, used by over 50% of researchers. Property portal apps that provide customized listings are also popular.

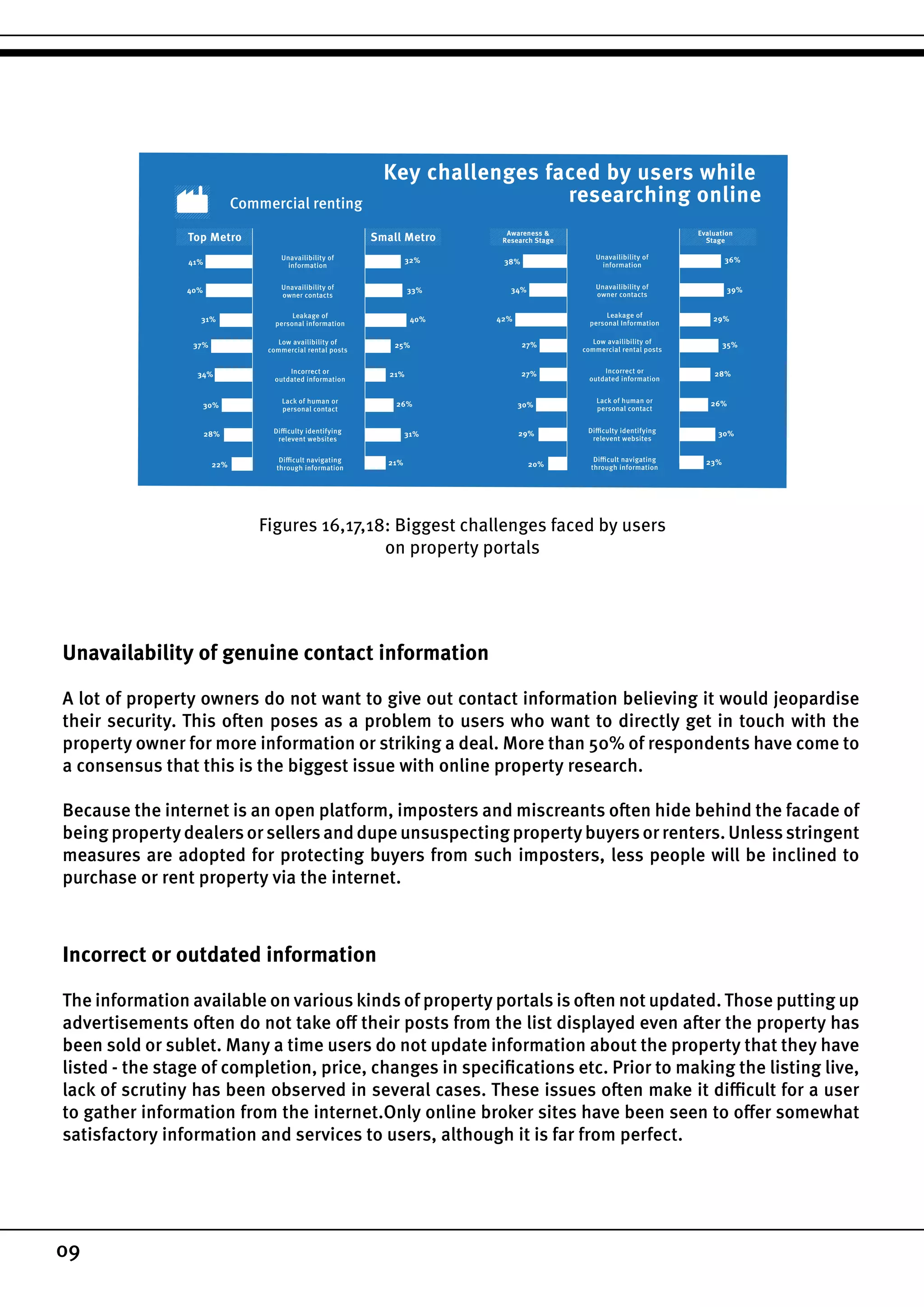

4. The largest challenges users face are outdated or incorrect property information