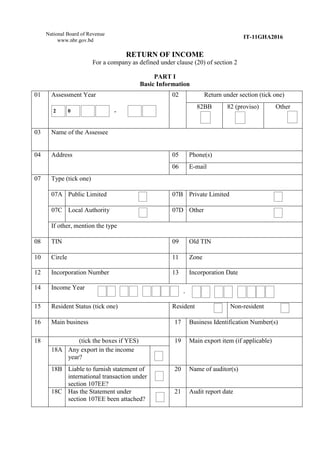

Income tax form for company it-11 gha2016

•

0 likes•132 views

This document is a return of income form for a company to report financial information and tax details to tax authorities. It requests information about the company, directors, affiliated entities, income sources, expenses, assets, liabilities, tax computations, exemptions, and enclosures. The form has six parts covering basic information, income and tax details, tax benefits, financial statements, other particulars, and instructions/verification. It requires information about the company's sales, costs, profits, assets, equity, bank accounts and more for the current and previous income year. The completed form is signed and submitted to the tax office for processing.

Report

Share

Report

Share

Download to read offline

Recommended

Colorado Company has provided you the following information

The document provides financial information for Colorado Company for years 2014-2017 including taxable income and tax rates. It states Colorado Company will use loss carryback and carryforward for the $1.2M loss in 2017. The journal entry to record this on 12/31/2017 is to be prepared. It also provides additional financial information for Matrix Company and Cannon Company, and asks questions about temporary/permanent differences, preparation of statements of cash flows, and reconciliation of net income to cash flows from operating activities.

Income tax article 24

The document discusses Indonesia's tax laws regarding Article 24 on income tax. It provides details on how taxpayers can credit foreign income taxes paid abroad against their tax liability in Indonesia. Foreign tax credits are allowed up to the lower of the foreign taxes paid, a proportionate amount of the Indonesian tax based on foreign income percentage, or the full Indonesian tax liability. The document provides examples of how foreign tax credits are calculated for corporate and individual taxpayers, including scenarios involving losses abroad or in Indonesia.

Accounting for Income Tax

This document discusses accounting for income taxes. It explains the differences between accrual and cash basis accounting and how pretax financial income can differ from taxable income. It also discusses temporary versus permanent differences, deferred tax liabilities, deferred tax assets, and examples of how to calculate them. Carryforward and carryback of tax losses are explained as well as how to account for changes in future tax rates.

Vivad se Vishwas Scheme 2020

Guided by “Sabka Saath, Sabka Vikas, Sabka Vishwas”, the Finance Minister Smt. Nirmala Sitharaman had introduced a new No Dispute but Trust Scheme – ‘Vivad Se Vishwas’ in the Budget 2020 in the Lok Sabha on 5th February, 2020. Expectations are that the new scheme will work better than erstwhile similar scheme “The Direct Tax Dispute Resolution Scheme, 2016”, given the kind of cases that are in appeal.

To know more:https://itatorders.in/blog/eligible-person-under-vivad-se-vishwas-scheme-2020/

Get consultation under the VSV scheme and calculate your taxes : https://www.itatorders.in/vsvcalculator

Resume with 4 Excel Attachments 2-1-16

This document contains a resume and cover letter for Victoria McGeehan. It details her education, including a Bachelor of Science in accounting from the University of Texas at Arlington with honors. It lists her relevant work experience in accounting, teaching, and tutoring. It also includes attachments with sample accounting work regarding deferred assets/liabilities, defined benefit pensions, and statements of cash flows.

Accounting for Income Tax

This chapter from the textbook Intermediate Accounting discusses accounting for income taxes. It covers differences between pre-tax financial income and taxable income, temporary and permanent differences that result in future taxable or deductible amounts, deferred tax assets and liabilities, applying tax rates, net operating losses, and the asset-liability method for income tax accounting. The chapter is prepared by Jep Robertson and Renae Clark of New Mexico State University.

Accountig for tax

The document discusses various taxes in accounting including income tax, sales tax, and value-added tax (VAT). It provides details on income tax slabs for salaried individuals, how to maintain income tax withholding on goods and services, the liability and rates of sales tax, and defines VAT. The key information covered includes different categories of taxpayers for income tax, the responsibilities of withholding agents to deduct and deposit taxes, and the requirements for registered entities to file tax returns and maintain records.

Recommended

Colorado Company has provided you the following information

The document provides financial information for Colorado Company for years 2014-2017 including taxable income and tax rates. It states Colorado Company will use loss carryback and carryforward for the $1.2M loss in 2017. The journal entry to record this on 12/31/2017 is to be prepared. It also provides additional financial information for Matrix Company and Cannon Company, and asks questions about temporary/permanent differences, preparation of statements of cash flows, and reconciliation of net income to cash flows from operating activities.

Income tax article 24

The document discusses Indonesia's tax laws regarding Article 24 on income tax. It provides details on how taxpayers can credit foreign income taxes paid abroad against their tax liability in Indonesia. Foreign tax credits are allowed up to the lower of the foreign taxes paid, a proportionate amount of the Indonesian tax based on foreign income percentage, or the full Indonesian tax liability. The document provides examples of how foreign tax credits are calculated for corporate and individual taxpayers, including scenarios involving losses abroad or in Indonesia.

Accounting for Income Tax

This document discusses accounting for income taxes. It explains the differences between accrual and cash basis accounting and how pretax financial income can differ from taxable income. It also discusses temporary versus permanent differences, deferred tax liabilities, deferred tax assets, and examples of how to calculate them. Carryforward and carryback of tax losses are explained as well as how to account for changes in future tax rates.

Vivad se Vishwas Scheme 2020

Guided by “Sabka Saath, Sabka Vikas, Sabka Vishwas”, the Finance Minister Smt. Nirmala Sitharaman had introduced a new No Dispute but Trust Scheme – ‘Vivad Se Vishwas’ in the Budget 2020 in the Lok Sabha on 5th February, 2020. Expectations are that the new scheme will work better than erstwhile similar scheme “The Direct Tax Dispute Resolution Scheme, 2016”, given the kind of cases that are in appeal.

To know more:https://itatorders.in/blog/eligible-person-under-vivad-se-vishwas-scheme-2020/

Get consultation under the VSV scheme and calculate your taxes : https://www.itatorders.in/vsvcalculator

Resume with 4 Excel Attachments 2-1-16

This document contains a resume and cover letter for Victoria McGeehan. It details her education, including a Bachelor of Science in accounting from the University of Texas at Arlington with honors. It lists her relevant work experience in accounting, teaching, and tutoring. It also includes attachments with sample accounting work regarding deferred assets/liabilities, defined benefit pensions, and statements of cash flows.

Accounting for Income Tax

This chapter from the textbook Intermediate Accounting discusses accounting for income taxes. It covers differences between pre-tax financial income and taxable income, temporary and permanent differences that result in future taxable or deductible amounts, deferred tax assets and liabilities, applying tax rates, net operating losses, and the asset-liability method for income tax accounting. The chapter is prepared by Jep Robertson and Renae Clark of New Mexico State University.

Accountig for tax

The document discusses various taxes in accounting including income tax, sales tax, and value-added tax (VAT). It provides details on income tax slabs for salaried individuals, how to maintain income tax withholding on goods and services, the liability and rates of sales tax, and defines VAT. The key information covered includes different categories of taxpayers for income tax, the responsibilities of withholding agents to deduct and deposit taxes, and the requirements for registered entities to file tax returns and maintain records.

Accounting for Income Tax

This document summarizes key points from a lecture on accounting for income tax in accordance with PSAK 46. It discusses temporary and permanent differences between pre-tax income and taxable income, and how these lead to deferred tax assets or liabilities. Examples are provided to illustrate deferred tax calculations for temporary differences that arise over multiple years. The document also covers topics like current and deferred tax expense/revenue, loss carryforwards, and implications of changes in tax rates.

IAS 12

IAS 12 provides guidance on accounting for income taxes. It aims to ensure that entities account for deferred tax liabilities and assets for temporary differences between the carrying amount of assets and liabilities and their tax bases. Key aspects covered include defining temporary differences, recognizing deferred tax assets and liabilities, offsetting current tax assets and liabilities, and presenting current and deferred taxes. Entities must also disclose information related to income taxes in their financial statements.

Personal income tax in canada

The document discusses key aspects of personal income tax in Canada, including:

1) Canadians must file self-assessed tax returns each year reporting all income and expenses to calculate taxes owing. Returns can be filed by mail or electronically.

2) The Canada Revenue Agency administers income taxes and the purposes include raising government revenue and promoting policies around home ownership, retirement savings, education and the environment.

3) Taxable income is calculated by subtracting deductions and credits from total income, which includes employment, business, property, capital gains and investment income.

4) Taxpayers can claim various deductions and non-refundable tax credits to reduce taxes owing and receive benefits like the Canada Child Tax Benef

Ayar law -IRS offer in Compromise

An offer is an agreement between a taxpayer and the government that settles a tax liability for payment of less than the amount owed.

Deferred taxes

The document discusses key concepts related to accounting for income taxes, including temporary vs permanent differences, deferred tax assets and liabilities, valuation allowances, loss carrybacks and carryforwards, and intraperiod tax allocation. Temporary differences between book and tax income can result in future taxable or deductible amounts, creating deferred tax liabilities or assets. The enacted tax rate is used to calculate deferred tax amounts, which are presented on the balance sheet. A valuation allowance may reduce the deferred tax asset if future taxable income is uncertain. Loss carrybacks and carryforwards allow losses to offset past or future taxable income. Total tax expense must be allocated to income statement line items.

06 chapter 7 business taxes

This document discusses various types of business taxes in the Philippines. It covers transactions that are subject to business tax, including commercial activities involving the sale of goods and services, as well as services rendered by nonresident foreign persons. It also discusses non-business transactions like the sale of stocks and overseas communications that are subject to other percentage taxes. The document then provides examples of casual or occasional sales by those not engaged in business. It concludes with summaries of value-added tax (VAT), other percentage tax (OPT), and excise tax responsibilities and requirements for business registration and invoicing.

Bir form 1700

This document appears to be an annual income tax return form for individuals in the Philippines earning compensation income. It requests information such as the tax filer's name, address, income sources, deductions, exemptions, tax credits, payments made and amounts owed. It contains sections to provide background information on the tax filer and spouse, compute total tax payable, provide details of income and withholdings, calculate tax credits and payments, and supply supplemental information. The multi-page form must be filled out in capital letters and includes tables, boxes to check and places to sign declaring the truth and accuracy of the filing.

TDS NEW SYSTEM

The notification provides amendments to certain rules under the Income Tax Act of 1961 relating to time and mode of payment of tax deducted at source (TDS) or collected at source (TCS), certificates for TDS and TCS, and quarterly statement filings. Key changes include:

1) TDS/TCS to be paid within a prescribed time period from the month of deduction/collection electronically through specified modes.

2) Revised forms for TDS certificates and due dates for issuance aligned with different cases.

3) Introduction of quarterly statement of TDS/TCS details to be filed electronically.

BIR FORM 1701

This document provides information about BIR Form 1701-A, the income tax return form that must be filed in the Philippines. It discusses who must file the form based on income thresholds for different filing statuses. It also outlines when and where the form must be filed each year, noting it is due by April 15 to the local Revenue District Officer. The document explains what factors like exemptions, deductions, and the nature of income affect the tax computation. It defines gross compensation income and gross income for tax purposes.

IAS 12 Deferred Tax

This document provides an overview of accounting for income taxes under IAS 12. It discusses the key concepts of current tax and deferred tax. Current tax is the amount of income taxes payable for the current period based on taxable profit. Deferred tax arises from temporary differences between the carrying amount of assets and liabilities in the statement of financial position and their tax bases. The document explains recognition and measurement of current and deferred tax, and provides examples of common temporary differences that give rise to deferred tax assets and liabilities, such as provisions, property, plant and equipment, and fair valuation adjustments.

2316

This document is a Certificate of Compensation from the Philippine Department of Finance for an employee. It contains information about the employee such as name, address, tax ID number, employer details, compensation income from the employer which is categorized as taxable and non-taxable, exemptions, taxes withheld, and signatures of the employer and employee to certify the accuracy of the compensation details.

18 tax deducted at source

Tax deducted at source (TDS) involves deducting income tax from certain types of payments and depositing this amount with the government. The document discusses TDS concepts like scope, applicable incomes, TDS rates, TAN registration, deductors, deductees, and configuring TDS in Tally ERP 9 software. It provides steps to enable TDS in a company, set up TDS statutory masters for nature of payments and deductee types, and create necessary expense and party ledgers for accounting TDS transactions.

income tax act and law

The document outlines various penalties under the Income Tax Act of India for failure to comply with tax laws and procedures. These include penalties for failure to file tax returns, pay taxes owed, maintain proper accounting records, deduct or collect taxes that are required to be deducted or collected at the source, and penalties for intentionally evading taxes through concealment or providing false information. The penalties include fines, imprisonment, or both and range from minimum to maximum amounts depending on the type and severity of the offense.

Tax

TDS and TCS are methods for collecting tax in India. TDS refers to tax deducted at source, where a person making payments deducts tax from the payment. TCS refers to tax collected at source, where a seller collecting payment collects tax on top of the sale price. Key differences are that TDS deducts tax from payments while TCS collects additional tax on sales. Both aim to simplify tax collection by collecting taxes as and when transactions occur. The document provides detailed sections under the Income Tax Act that specify rules for TDS and TCS rates and compliance procedures.

Tax issues for swedish companies

The document discusses various tax issues that Swedish companies may face when doing business in the United States, including establishing a permanent establishment, setting up a subsidiary or branch office, corporate income tax rates, and determining resident alien vs. nonresident alien status for tax purposes. Key considerations include whether business income is attributable to a permanent establishment located in the US, how branches and subsidiaries are taxed differently, federal and state corporate income tax rates, and tests for determining resident alien status.

M&J/ZIMRA Taxation Workshop Presentation

Slides from the Presentations that were hosted by M&J Consultants and the Zimbabwe Revenue Authority focused on Tax Updates for the 4th Quarter of 2020.

Taxation System in Canada

This document discusses taxation in Canada. It outlines that Canadian residents are taxed on worldwide income and must file a T1 tax return. Non-residents are taxed only on Canadian-source income. Topics covered include types of income tax collected, deductions, filing deadlines, federal and provincial tax structures, and provincial/territorial tax rates. Both federal and provincial governments collect income tax in Canada through the Canada Revenue Agency, with Quebec being the exception.

Tax Reform Update: What It Means to Business Owners

Senior leaders from Perkins & Co's tax team explain the consequences of tax reform for corporations, pass-through entities and their owners.

Tds rates for fy 2014 15 (ay 2015-16)

This document provides information on tax deducted at source (TDS) rates for the financial year 2014-2015 in India, including:

- TDS rates for various sections like 194A, 194C, 194D etc for individuals/HUF and others.

- Notes on not adding surcharge/education cess, deducting 20% TDS if PAN not provided, and software acquisition.

- Due dates for TDS payment, return filing, and certificate issuance monthly from April 2014 to March 2015.

- Events that attract penalties like failing to deduct/deposit TDS, providing incorrect details in TDS return, and failing to furnish TDS return.

law case study

1. Income tax in Australia is imposed on individual and business income and revenue at progressive rates. The Australian Taxation Office regulates taxation and provides information to taxpayers.

2. Joe's employment income including salary, overtime pay, and bonuses are taxable. Mining Matters can deduct business expenses and Joe's allowance for tools is not taxable. Rental income minus expenses like repairs is taxable for Joe.

3. Capital gains made from the sale of assets acquired after 1985 are generally subject to capital gains tax, but the painting Donna purchased in 1984 is exempt since it was bought before the capital gains tax regime began.

CMA Inter Direct Tax Summary Notes (1).pptx

The document provides an overview of the syllabus for the Direct Taxation paper. It outlines the topics that will be covered in each section:

- Section A covers Income Tax Act basics and accounts for 10% of the syllabus.

- Section B covers heads of income, computation of total income and tax liability, and makes up 70% of the syllabus.

- Section C covers administrative procedures and ICDS and is 20% of the syllabus.

The contents section then lists the specific study notes that will be included under each section and head of income. These study notes will cover definitions, concepts, and provisions related to computation of income tax in India.

Chapter6FinancialStatementAnalysis.ppt

This document discusses financial statement analysis and key financial statements including the balance sheet, income statement, and statement of cash flows. It provides examples of Horizon Limited's financial statements for the years ending March 31, 20X0 and 20X1, including key line items and ratios. Ratios are calculated for liquidity, leverage, turnover, profitability, and valuation and compared to industry averages. A time series of selected ratios is also presented.

More Related Content

What's hot

Accounting for Income Tax

This document summarizes key points from a lecture on accounting for income tax in accordance with PSAK 46. It discusses temporary and permanent differences between pre-tax income and taxable income, and how these lead to deferred tax assets or liabilities. Examples are provided to illustrate deferred tax calculations for temporary differences that arise over multiple years. The document also covers topics like current and deferred tax expense/revenue, loss carryforwards, and implications of changes in tax rates.

IAS 12

IAS 12 provides guidance on accounting for income taxes. It aims to ensure that entities account for deferred tax liabilities and assets for temporary differences between the carrying amount of assets and liabilities and their tax bases. Key aspects covered include defining temporary differences, recognizing deferred tax assets and liabilities, offsetting current tax assets and liabilities, and presenting current and deferred taxes. Entities must also disclose information related to income taxes in their financial statements.

Personal income tax in canada

The document discusses key aspects of personal income tax in Canada, including:

1) Canadians must file self-assessed tax returns each year reporting all income and expenses to calculate taxes owing. Returns can be filed by mail or electronically.

2) The Canada Revenue Agency administers income taxes and the purposes include raising government revenue and promoting policies around home ownership, retirement savings, education and the environment.

3) Taxable income is calculated by subtracting deductions and credits from total income, which includes employment, business, property, capital gains and investment income.

4) Taxpayers can claim various deductions and non-refundable tax credits to reduce taxes owing and receive benefits like the Canada Child Tax Benef

Ayar law -IRS offer in Compromise

An offer is an agreement between a taxpayer and the government that settles a tax liability for payment of less than the amount owed.

Deferred taxes

The document discusses key concepts related to accounting for income taxes, including temporary vs permanent differences, deferred tax assets and liabilities, valuation allowances, loss carrybacks and carryforwards, and intraperiod tax allocation. Temporary differences between book and tax income can result in future taxable or deductible amounts, creating deferred tax liabilities or assets. The enacted tax rate is used to calculate deferred tax amounts, which are presented on the balance sheet. A valuation allowance may reduce the deferred tax asset if future taxable income is uncertain. Loss carrybacks and carryforwards allow losses to offset past or future taxable income. Total tax expense must be allocated to income statement line items.

06 chapter 7 business taxes

This document discusses various types of business taxes in the Philippines. It covers transactions that are subject to business tax, including commercial activities involving the sale of goods and services, as well as services rendered by nonresident foreign persons. It also discusses non-business transactions like the sale of stocks and overseas communications that are subject to other percentage taxes. The document then provides examples of casual or occasional sales by those not engaged in business. It concludes with summaries of value-added tax (VAT), other percentage tax (OPT), and excise tax responsibilities and requirements for business registration and invoicing.

Bir form 1700

This document appears to be an annual income tax return form for individuals in the Philippines earning compensation income. It requests information such as the tax filer's name, address, income sources, deductions, exemptions, tax credits, payments made and amounts owed. It contains sections to provide background information on the tax filer and spouse, compute total tax payable, provide details of income and withholdings, calculate tax credits and payments, and supply supplemental information. The multi-page form must be filled out in capital letters and includes tables, boxes to check and places to sign declaring the truth and accuracy of the filing.

TDS NEW SYSTEM

The notification provides amendments to certain rules under the Income Tax Act of 1961 relating to time and mode of payment of tax deducted at source (TDS) or collected at source (TCS), certificates for TDS and TCS, and quarterly statement filings. Key changes include:

1) TDS/TCS to be paid within a prescribed time period from the month of deduction/collection electronically through specified modes.

2) Revised forms for TDS certificates and due dates for issuance aligned with different cases.

3) Introduction of quarterly statement of TDS/TCS details to be filed electronically.

BIR FORM 1701

This document provides information about BIR Form 1701-A, the income tax return form that must be filed in the Philippines. It discusses who must file the form based on income thresholds for different filing statuses. It also outlines when and where the form must be filed each year, noting it is due by April 15 to the local Revenue District Officer. The document explains what factors like exemptions, deductions, and the nature of income affect the tax computation. It defines gross compensation income and gross income for tax purposes.

IAS 12 Deferred Tax

This document provides an overview of accounting for income taxes under IAS 12. It discusses the key concepts of current tax and deferred tax. Current tax is the amount of income taxes payable for the current period based on taxable profit. Deferred tax arises from temporary differences between the carrying amount of assets and liabilities in the statement of financial position and their tax bases. The document explains recognition and measurement of current and deferred tax, and provides examples of common temporary differences that give rise to deferred tax assets and liabilities, such as provisions, property, plant and equipment, and fair valuation adjustments.

2316

This document is a Certificate of Compensation from the Philippine Department of Finance for an employee. It contains information about the employee such as name, address, tax ID number, employer details, compensation income from the employer which is categorized as taxable and non-taxable, exemptions, taxes withheld, and signatures of the employer and employee to certify the accuracy of the compensation details.

18 tax deducted at source

Tax deducted at source (TDS) involves deducting income tax from certain types of payments and depositing this amount with the government. The document discusses TDS concepts like scope, applicable incomes, TDS rates, TAN registration, deductors, deductees, and configuring TDS in Tally ERP 9 software. It provides steps to enable TDS in a company, set up TDS statutory masters for nature of payments and deductee types, and create necessary expense and party ledgers for accounting TDS transactions.

income tax act and law

The document outlines various penalties under the Income Tax Act of India for failure to comply with tax laws and procedures. These include penalties for failure to file tax returns, pay taxes owed, maintain proper accounting records, deduct or collect taxes that are required to be deducted or collected at the source, and penalties for intentionally evading taxes through concealment or providing false information. The penalties include fines, imprisonment, or both and range from minimum to maximum amounts depending on the type and severity of the offense.

Tax

TDS and TCS are methods for collecting tax in India. TDS refers to tax deducted at source, where a person making payments deducts tax from the payment. TCS refers to tax collected at source, where a seller collecting payment collects tax on top of the sale price. Key differences are that TDS deducts tax from payments while TCS collects additional tax on sales. Both aim to simplify tax collection by collecting taxes as and when transactions occur. The document provides detailed sections under the Income Tax Act that specify rules for TDS and TCS rates and compliance procedures.

Tax issues for swedish companies

The document discusses various tax issues that Swedish companies may face when doing business in the United States, including establishing a permanent establishment, setting up a subsidiary or branch office, corporate income tax rates, and determining resident alien vs. nonresident alien status for tax purposes. Key considerations include whether business income is attributable to a permanent establishment located in the US, how branches and subsidiaries are taxed differently, federal and state corporate income tax rates, and tests for determining resident alien status.

M&J/ZIMRA Taxation Workshop Presentation

Slides from the Presentations that were hosted by M&J Consultants and the Zimbabwe Revenue Authority focused on Tax Updates for the 4th Quarter of 2020.

Taxation System in Canada

This document discusses taxation in Canada. It outlines that Canadian residents are taxed on worldwide income and must file a T1 tax return. Non-residents are taxed only on Canadian-source income. Topics covered include types of income tax collected, deductions, filing deadlines, federal and provincial tax structures, and provincial/territorial tax rates. Both federal and provincial governments collect income tax in Canada through the Canada Revenue Agency, with Quebec being the exception.

Tax Reform Update: What It Means to Business Owners

Senior leaders from Perkins & Co's tax team explain the consequences of tax reform for corporations, pass-through entities and their owners.

Tds rates for fy 2014 15 (ay 2015-16)

This document provides information on tax deducted at source (TDS) rates for the financial year 2014-2015 in India, including:

- TDS rates for various sections like 194A, 194C, 194D etc for individuals/HUF and others.

- Notes on not adding surcharge/education cess, deducting 20% TDS if PAN not provided, and software acquisition.

- Due dates for TDS payment, return filing, and certificate issuance monthly from April 2014 to March 2015.

- Events that attract penalties like failing to deduct/deposit TDS, providing incorrect details in TDS return, and failing to furnish TDS return.

law case study

1. Income tax in Australia is imposed on individual and business income and revenue at progressive rates. The Australian Taxation Office regulates taxation and provides information to taxpayers.

2. Joe's employment income including salary, overtime pay, and bonuses are taxable. Mining Matters can deduct business expenses and Joe's allowance for tools is not taxable. Rental income minus expenses like repairs is taxable for Joe.

3. Capital gains made from the sale of assets acquired after 1985 are generally subject to capital gains tax, but the painting Donna purchased in 1984 is exempt since it was bought before the capital gains tax regime began.

What's hot (20)

Tax Reform Update: What It Means to Business Owners

Tax Reform Update: What It Means to Business Owners

Similar to Income tax form for company it-11 gha2016

CMA Inter Direct Tax Summary Notes (1).pptx

The document provides an overview of the syllabus for the Direct Taxation paper. It outlines the topics that will be covered in each section:

- Section A covers Income Tax Act basics and accounts for 10% of the syllabus.

- Section B covers heads of income, computation of total income and tax liability, and makes up 70% of the syllabus.

- Section C covers administrative procedures and ICDS and is 20% of the syllabus.

The contents section then lists the specific study notes that will be included under each section and head of income. These study notes will cover definitions, concepts, and provisions related to computation of income tax in India.

Chapter6FinancialStatementAnalysis.ppt

This document discusses financial statement analysis and key financial statements including the balance sheet, income statement, and statement of cash flows. It provides examples of Horizon Limited's financial statements for the years ending March 31, 20X0 and 20X1, including key line items and ratios. Ratios are calculated for liquidity, leverage, turnover, profitability, and valuation and compared to industry averages. A time series of selected ratios is also presented.

Principles of Microeconomics Problem Set 10 Due on 12215 .docx

Principles of Microeconomics Problem Set 10

Due on 12/2/15

1. How does taxation harm the economy? If taxes hurt the economy, why do they exist?

2. Which would you expect to be larger, the price elasticity of demand for luxury goods, or the

price elasticity of supply for luxury goods? Based on that, where do you expect the majority of

the burden of a luxury tax to fall? Based on that, do you think that the luxury tax is

accomplishing its goals?

3. Draw a supply and demand diagram for a market with a unit tax. Be sure to label the

deadweight loss, the consumer surplus, the producer surplus, and the government's revenue.

4. Name a good with an excise tax. Does it feature a negative externality? If so, what is it? If not,

explain lawmakers' motivations for taxing that good extra.

SAMPLE

XYZ Contracting Corporation

Financial Statements

December 31, 20XX

CPA Accounting Firm Name

Address & Phone Number

CPA Accounting Firm Name

Address & Phone Number

Table of Contents

Page

Accountant’s Review Report 1

Financial Statements

Balance Sheet 2

Income Statement 3

Schedule of General and Administrative Expenses 4

Retained Earnings Statement (Statement of Net Worth) 5

Statement of Cash Flow (Cash Flow Analysis) 6

Notes to Financial Statements 7-8

Accounts Receivable Aging Schedules 9

To the Stockholders of XYZ Contracting Corporation:

We have reviewed the accompanying balance sheet, income statement, retained earnings, cash flows and

schedules of general and administrative expenses for the years then ended, in accordance with Statements on

Standards for Accounting and Review Services, issued by the American Institute of Certified Public

Accountants. All information included in these financial statements is the representation of the management

of XYZ Contracting Corporation.

A review consists primarily of inquiries of Company personnel and analytical procedures applied to the

financial data. It is substantially less in scope than an audit in accordance with generally accepted auditing

standards, the objective of which is the expression of an opinion regarding the financial statements taken as a

whole. Accordingly, we do not express such an opinion.

Based on our reviews, we are not aware of any material modifications that should be made to the

accompanying financial statements in order for them to be in conformity with generally accepted accounting

principles.

Signed,

CPA Accounting Firm

Date

1

CPA Accounting Firm Name

Address & Phone Number

XYZ Contracting Corporation

Balance Sheet

December 31, 20XX and 200X

ASSETS

Current Assets: 20XX 200X

Cash and Cash Equivalents $1,191,729 $1,158,079

Accounts Receivable:

Trade, net of allowance for doubtful accounts 1,649,073 2,387,469

Retainage 445,682 .

FAC 2122Assignment Due Date April 24, 2019Instructions An.docx

FAC 2122

Assignment

Due Date: April 24, 2019

Instructions : Answer all questions

Question 1

Arcade Corporation's balance sheet and income statement appear below:

Income Statement

Sales

$723

Cost of goods sold

453

Gross margin

270

Selling and administrative expenses

163

Income before income taxes

107

Income tax expense

32

Net income

$75

Balance Sheet

Ending Balance

Beginning Balance

Cash

$42

$36

Debtors

77

80

Inventories

54

58

Plant and equipment

581

480

less: accumulated depreciation

(318)

(294)

Total Assets

$436

$360

creditors

$23

$28

Bonds payable

293

270

Common stock

61

60

Retained earnings

59

2

Total liabilities and equity

$436

$360

The company did not dispose of any property, plant, and equipment, retire any bonds payable, or repurchase any of its own common stock during the year. The company declared and paid a cash dividend of $18.

Required: Prepare a statement of cash flow . (10 marks)

Question 2

Comparative Balance Sheet

Shiner Corporation

Assets

Dec 31, 1996

Dec 31, 1995

Cash

$37,000

$49,000

Accounts Receivable

$26,000

$36,000

Prepaid Expenses

$6,000

$0

Land

$70,000

$0

Building

$200,000

$0

Accumulated Depreciation

$11,000

$189,000

$0

Equipment

$68,000

$0

Accumulated Depreciation

$10,000

$58,000

$0

Total Assets

$386,000

$85,000

Liabilities and Stockholder Equity

Accounts Payable

$40,000

$5,000

Bonds Payable

$150,000

$0

Common Stock

$60,000

$0

Retained Earnings

$136,000

$20,000

Total Liabilities and Stockholder Equity

$386,000

$85,000

Income Statement

Shiner Corporation

Revenue

$492,000

Operating Expenses

$269,000

Depreciation

$21,000

$290,000

Income before Income Taxes

$202,000

Income Tax Expense

$68,000

Net Income

$134,000

Additional information:

1. During the year Shiner Corporation paid dividends of $18,000.

2. Shiner also issued $150,000 in bonds.

Copy and complete the statement below: (15 marks)

Statement of Cash Flows

Cash Flow from Operating Activities

Net Income

Adjustments to reconcile net income to net cash

Depreciation

Accts Receivable decrease

Prepaid Expense increase

Accts Payable Increase

Net cash provided from Operating Activities

Investing Activities

Land Purchase

Building Purchase

Equipment Purchase

Financing Activities

Dividend payment to shareholders

Issuance of Bonds Payable

Net Decrease in Cash

Cash Jan 1, 1996

Cash Dec 31, 1996

Question 3

Caribbean Distributors

Balance Sheet for

Assets20102009

Cash 191 000 159 000

Debtors/Accounts Receivables 12 000 15 000

Stock/Inventory 170 000 160 000

Prepaid expenses 6 000 8 000

Land 140 000 80 000

Equipment 160 000 0

Accumulated depreciation – equipment (16 000) 0

Total 663 000 422 000

Liabilities and Shareholders Equity

Trade creditors/Accounts Payable 52 000 60 000

Accrued expenses payable/owing 15 000 20 000

Income tax .

Certain Cash Contributions for Typhoon Haiyan Relief Efforts .docx

Certain Cash Contributions for Typhoon Haiyan Relief Efforts

in the Philippines Can Be Deducted on Your 2013 Tax Return

A new law allows you to choose to deduct certain charitable contributions

of money on your 2013 tax return instead of your 2014 return. The

contributions must have been made after March 25, 2014, and before April

15, 2014, for the relief of victims in the Republic of the Philippines affected

by the November 8, 2013, typhoon. Contributions of money include

contributions made by cash, check, money order, credit card, charge card,

debit card, or via cell phone.

The new law was enacted after the 2013 forms, instructions, and

publications had already been printed. When preparing your 2013 tax

return, you may complete the forms as if these contributions were made on

December 31, 2013, instead of in 2014.

The contribution must be made to a qualified organization and meet all

other requirements for charitable contribution deductions. However, if you

made the contribution by phone or text message, a telephone bill showing

the name of the donee organization, the date of the contribution, and the

amount of the contribution will satisfy the recordkeeping requirement.

Therefore, for example, if you made a $10 charitable contribution by text

message that was charged to your telephone or wireless account, a bill

from your telecommunications company containing this information

satisfies the recordkeeping requirement.

Form 1120S

Department of the Treasury

Internal Revenue Service

U.S. Income Tax Return for an S Corporation

▶ Do not file this form unless the corporation has filed or is

attaching Form 2553 to elect to be an S corporation.

▶ Information about Form 1120S and its separate instructions is at www.irs.gov/form1120s.

OMB No. 1545-0130

2013

For calendar year 2013 or tax year beginning , 2013, ending , 20

TYPE

OR

PRINT

Name

Number, street, and room or suite no. If a P.O. box, see instructions.

City or town, state or province, country, and ZIP or foreign postal code

A S election effective date

B Business activity code

number (see instructions)

C Check if Sch. M-3 attached

D Employer identification number

E Date incorporated

F Total assets (see instructions)

$

G Is the corporation electing to be an S corporation beginning with this tax year? Yes No If “Yes,” attach Form 2553 if not already filed

H Check if: (1) Final return (2) Name change (3) Address change (4) Amended return (5) S election termination or revocation

I Enter the number of shareholders who were shareholders during any part of the tax year . . . . . . . . . ▶

Caution. Include only trade or business income and expenses on lines 1a through 21. See the instructions for more information.

In

c

o

m

e

1 a Gross receipts or sales . . . . . . . . . . . . . . . 1a

b Returns and allowances . . . . . . . . . . . . . . 1b

c Balance. Subtract line 1b from line 1a . . . . . . . . . . . . . . . . ...

Balance SheetConsolidiated Balance SheetsAssets26-Sep-1527-Sep-14C.docx

Balance SheetConsolidiated Balance SheetsAssets26-Sep-1527-Sep-14Current Assets:Cash and Cash Equivalents$21,120$13,844Short-Term Marketable Securities20,48111,233Accounts Receivable, Less Allowances of $82 and $86, respectively16,84917,460Inventories2,3492,111Deferred Tax Assets5,5464,318Vendor non-trade receivables13,4949,759Other Current Assets9,5399,806 Total Current Assets$89,378$68,531Long-Term Marketable Securities164,065130,162Property, Plant and equipment, net22,47120,624Goodwill5,1164,616Acquired intangible assets, net3,8934,142Other assets5,5563,764 Total Assets$290,479$231,839Liabilities and Shareholders' EquityCurrent Liabilities:Accounts Payable$35,490$30,196Accrued Expenses25,18118,453Deferred Revenue8,9408,491Commercial Paper8,4996,308Current Portion of Long-Term Debt2,5000Total Current Liabilites$80,610$63,448Deferred Revenue, non-Current3,6243,031Long-Term Debt53,46328,987Other Non-Current Liabilites33,42724,826Total Liabilities$171,124$120,292Commitments and ContingenciesShareholders' EquityCommon Stock and additional paid-in-capital, $0.00001 par value: 12,600,000 shares authorized; 5,578,753 and 5,866,161 shares issued and outstanding, respectively27,41623,313Retained Earnings92,28487,152Accumulated other Comprehensive Income-3451,082Total Shareholders' Equity119,355111,547Total Liabilities and Shareholders' Equity$290,479$231,839

Income StatementIncome StatementYears Ended26-Sep-1527-Sep-1428-Sep-13Net Sales$233,715$182,795$170,910Cost of Sales140,089112,258106,606Gross Margin$93,626$70,537$64,304Operating Expenses:Research and Development8,0676,0414,475Selling, General and Administrative14,32911,99310,830Total Operating Expenses22,39618,03415,305Opearting Income71,23052,50348,999Other Income/(Expense), Net1,2859801,156Income before Provision for income taxes72,51553,48350,155Provision for income taxes19,12113,97313,118Net Income$53,394$39,510$37,037Earnings per Share:Basic$9.28$6.49$5.72Diluted$9.22$6.45$5.68Shares used in computing earnings per share:Basic5,753,4216,085,5726,477,320Diluted5,793,0696,122,6636,521,634Cash Dividends declared per share$1.98$1.82$1.64

Statement of Cash FlowsStatement of Cash FlowsYears Ended26-Sep-1527-Sep-1428-Sep-13Cash and Cash Equivalents, beginning of the year$13,844$14,259$10,746Operating Activities: Net Income53,39439,51037,037 Adjustments to reconcile net income to cash generated by operating activites:Depreciation and Amortization11,2577,9466,757Share-based compensation expense3,5862,8632,253Deferred Income tax expense1,3822,3471,141 Changed in operating assets and liabilities:Accounts Receivable, net$ 611$ (4,232)$ (2,172)Inventories$ (238)$ (76)$ (973)Vendor non-trade receivables$ (3,735)$ (2,220)$ 223Other current and non-current assets$ (179)$ 167$ 1,080Accounts Payable5,4005,9382,340Deferred Revenue1,0421,4601,459Other current and non-current liabilities8,7466,0104,521Cash Generated by operating a ...

ARUN Q2 2014 10Q.pdf

The document is Aruba Networks' Form 10-Q quarterly report filed with the SEC for the quarter ended January 31, 2014. It includes:

- Consolidated balance sheets, statements of operations and comprehensive loss, and cash flows for the periods ended January 31, 2014 and 2013.

- Revenue was $176 million for the 3 months ended January 31, 2014, with a net loss of $11 million. For the 6 months ended, revenue was $337 million and the net loss was $19 million.

- Cash and investments totaled $278 million as of January 31, 2014.

gtyccccccccccccccccccccccccccccccccccccccccccccccccccccccc

okokolkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkk

cashflowstatement-180516040943_230519_001118.pdf

The document discusses the cash flow statement, including its importance, purposes, components, and methods of preparation. Specifically, it defines operating, investing and financing activities, and what constitutes cash and cash equivalents. It also provides examples of the direct and indirect methods to prepare the cash flow statement, including working notes and calculations to derive cash flows from the given trial balance for a sample company.

Cash flow statement

The document discusses the cash flow statement, including its importance, purposes, components, and methods of preparation. Specifically, it defines operating, investing and financing activities. It also provides examples of indirect and direct methods to prepare the cash flow statement, including working notes and calculations. Finally, it includes a sample problem demonstrating the preparation of a cash flow statement using both the direct and indirect methods.

Financial Accounting

The document discusses preparing final accounts which include a trading and profit and loss account to show the results of buying and selling goods and ascertaining net profit or loss, as well as a balance sheet to set out assets and liabilities to determine the financial position. It provides details on items that appear in trading and profit and loss accounts and balance sheets, as well as adjustments made in final accounts like closing stock, outstanding expenses, prepaid expenses, and accrued incomes.

Financial accounting MCQ

The document contains 100 multiple choice questions related to accounting concepts, processes, financial statements, and the accounting equation. It tests understanding of key accounting terms like assets, liabilities, equity/capital, income, expenses. Several questions relate to the accounting cycle and identify the first step as identifying economic events or transactions. Other questions cover double-entry bookkeeping, preparation of financial statements, users of accounting information, and classification of accounts.

cashflowstatement03.pdf

The cash flow statement summarizes the cash inflows and outflows for A Ltd. for the year ended March 31, 2012. It shows a net cash from operating activities of Rs. 86,000, net cash used in investing activities of Rs. 60,000 from purchase of fixed assets, and net cash used in financing activities of Rs. 26,000 from repayment of bank loan and dividend payment. Overall, there was no change in the closing cash and bank balance of Rs. 30,000 from the opening balance.

Cash Flow Statement

The cash flow statement summarizes the cash inflows and outflows for A Ltd. for the year ended March 31, 2012. It shows that cash from operating activities was Rs. 40,000, which was primarily from net profit adjusted for depreciation. Cash used in investing activities was Rs. Nil. Cash from financing activities was Rs. Nil as bank loan repayment was offset by dividend payment. Overall, cash and cash equivalents increased by Rs. 8,000 to Rs. 30,000.

Chapter 5 - Cash flows - handout.pptx

The document discusses cash flow statements, including:

1) It compares cash flows from operating, investing, and financing activities and contrasts cash flow statements prepared under IFRS and US GAAP.

2) It distinguishes between the direct and indirect methods of presenting cash from operating activities.

3) It analyzes and interprets both reported and common-size cash flow statements, calculates performance and coverage cash flow ratios, and interprets free cash flow.

Changes in tax audit report

The document summarizes the major changes made to the tax audit report structure and various clauses/sections for the assessment year 2014-2015. Some of the key changes include:

1. The new tax audit report structure has Form 3CD divided into Part A (clauses 1-6) and Part B (clauses 7-32).

2. Several new clauses have been added to capture additional information like applicable indirect taxes, period of audit, presumptive income, etc.

3. Clauses relating to disallowances under various sections have been expanded to require more detailed information in specified formats.

4. Clauses on TDS/TCS now require furnishing additional details like TAN, amounts

Ross7e ch02

This chapter discusses key accounting statements used to analyze the financial performance and cash flows of a company. It includes:

1) The balance sheet, which provides a snapshot of assets, liabilities, and equity on a given date.

2) The income statement, which measures revenues and expenses over a period of time to determine net income.

3) The statement of cash flows, which reconciles cash flows from operating, investing, and financing activities to understand a company's actual cash position.

Q118 earnings presentation final 2

- Net revenue for the first quarter of fiscal year 2018 was $576 million, a 3% increase from the previous year's first quarter. Earnings per share excluding special items was $0.60, a 24% increase.

- Trailing twelve months free cash flow was $819 million, representing 35% of trailing twelve month revenue.

- Guidance for the second quarter of fiscal year 2018 estimates revenue of $600-640 million and earnings per share excluding special items of $0.61-0.67.

Q118 earnings presentation final

- The company reported net revenue of $576 million for the first quarter of fiscal year 2018, gross margin of 66.9% excluding special items, and earnings per share of $0.60 excluding special items.

- For the second quarter of fiscal year 2018, the company expects revenue between $600-640 million, gross margin between 66-68% excluding special items, and earnings per share between $0.61-0.67 excluding special items.

- Over the last twelve months, the company generated $819 million in free cash flow, representing 35% of revenue, and returned $177 million to shareholders in the form of dividends and stock repurchases.

Final Accounts of Companies.docx

This document contains the balance sheet and notes to accounts of a company as of March 31, 202x. The balance sheet shows total assets of ₹2,60,700 consisting of non-current assets of ₹94,510 and current assets of ₹1,66,190. The liabilities side shows total equity and liabilities of ₹2,60,700 consisting of shareholders' funds, non-current liabilities, and current liabilities. The notes to accounts provide additional details on items in the balance sheet such as fixed asset details, calculation of depreciation, provisions, reserves and surplus, trade receivables, and payables.

Similar to Income tax form for company it-11 gha2016 (20)

Principles of Microeconomics Problem Set 10 Due on 12215 .docx

Principles of Microeconomics Problem Set 10 Due on 12215 .docx

FAC 2122Assignment Due Date April 24, 2019Instructions An.docx

FAC 2122Assignment Due Date April 24, 2019Instructions An.docx

Certain Cash Contributions for Typhoon Haiyan Relief Efforts .docx

Certain Cash Contributions for Typhoon Haiyan Relief Efforts .docx

Balance SheetConsolidiated Balance SheetsAssets26-Sep-1527-Sep-14C.docx

Balance SheetConsolidiated Balance SheetsAssets26-Sep-1527-Sep-14C.docx

gtyccccccccccccccccccccccccccccccccccccccccccccccccccccccc

gtyccccccccccccccccccccccccccccccccccccccccccccccccccccccc

Recently uploaded

Safeguarding Against Financial Crime: AML Compliance Regulations Demystified

Safeguarding Against Financial Crime: AML Compliance Regulations DemystifiedPROF. PAUL ALLIEU KAMARA

To ensure the integrity of financial systems and combat illicit financial activities, understanding AML (Anti-Money Laundering) compliance regulations is crucial for financial institutions and businesses. AML compliance regulations are designed to prevent money laundering and the financing of terrorist activities by imposing specific requirements on financial institutions, including customer due diligence, monitoring, and reporting of suspicious activities (GitHub Docs).Sangyun Lee, 'Why Korea's Merger Control Occasionally Fails: A Public Choice ...

Presentation slides for a session held on June 4, 2024, at Kyoto University. This presentation is based on the presenter’s recent paper, coauthored with Hwang Lee, Professor, Korea University, with the same title, published in the Journal of Business Administration & Law, Volume 34, No. 2 (April 2024). The paper, written in Korean, is available at <https://shorturl.at/GCWcI>.

Search Warrants for NH Law Enforcement Officers

Training aid for law enforcement officers related to search warrants, the requirements needed, drafting, and execution of the search warrant.

The Future of Criminal Defense Lawyer in India.pdf

https://veteranlegal.in/defense-lawyer-in-india/ | Criminal defense Lawyer in India has always been a vital aspect of the country's legal system. As defenders of justice, criminal Defense Lawyer play a critical role in ensuring that individuals accused of crimes receive a fair trial and that their constitutional rights are protected. As India evolves socially, economically, and technologically, the role and future of criminal Defense Lawyer are also undergoing significant changes. This comprehensive blog explores the current landscape, challenges, technological advancements, and prospects for criminal Defense Lawyer in India.

Genocide in International Criminal Law.pptx

Excited to share insights from my recent presentation on genocide! 💡 In light of ongoing debates, it's crucial to delve into the nuances of this grave crime.

The Work Permit for Self-Employed Persons in Italy

Learn more on how to obtain the work permit for self-employed persons in Italy at https://immigration-italy.com/selfemployment-work-permit-in-italy/.

在线办理(SU毕业证书)美国雪城大学毕业证成绩单一模一样

学校原件一模一样【微信:741003700 】《(SU毕业证书)美国雪城大学毕业证成绩单》【微信:741003700 】学位证,留信认证(真实可查,永久存档)原件一模一样纸张工艺/offer、雅思、外壳等材料/诚信可靠,可直接看成品样本,帮您解决无法毕业带来的各种难题!外壳,原版制作,诚信可靠,可直接看成品样本。行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备。十五年致力于帮助留学生解决难题,包您满意。

本公司拥有海外各大学样板无数,能完美还原。

1:1完美还原海外各大学毕业材料上的工艺:水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠。文字图案浮雕、激光镭射、紫外荧光、温感、复印防伪等防伪工艺。材料咨询办理、认证咨询办理请加学历顾问Q/微741003700

【主营项目】

一.毕业证【q微741003700】成绩单、使馆认证、教育部认证、雅思托福成绩单、学生卡等!

二.真实使馆公证(即留学回国人员证明,不成功不收费)

三.真实教育部学历学位认证(教育部存档!教育部留服网站永久可查)

四.办理各国各大学文凭(一对一专业服务,可全程监控跟踪进度)

如果您处于以下几种情况:

◇在校期间,因各种原因未能顺利毕业……拿不到官方毕业证【q/微741003700】

◇面对父母的压力,希望尽快拿到;

◇不清楚认证流程以及材料该如何准备;

◇回国时间很长,忘记办理;

◇回国马上就要找工作,办给用人单位看;

◇企事业单位必须要求办理的

◇需要报考公务员、购买免税车、落转户口

◇申请留学生创业基金

留信网认证的作用:

1:该专业认证可证明留学生真实身份

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

Presentation (1).pptx Human rights of LGBTQ people in India, constitutional a...

Human rights of LGBTQ people in India, constitutional and judicial approach

原版制作(PSU毕业证书)宾州州立大学公园分校毕业证学历证书一模一样

学校原件一模一样【微信:741003700 】《(PSU毕业证书)宾州州立大学公园分校毕业证学历证书》【微信:741003700 】学位证,留信认证(真实可查,永久存档)原件一模一样纸张工艺/offer、雅思、外壳等材料/诚信可靠,可直接看成品样本,帮您解决无法毕业带来的各种难题!外壳,原版制作,诚信可靠,可直接看成品样本。行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备。十五年致力于帮助留学生解决难题,包您满意。

本公司拥有海外各大学样板无数,能完美还原。

1:1完美还原海外各大学毕业材料上的工艺:水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠。文字图案浮雕、激光镭射、紫外荧光、温感、复印防伪等防伪工艺。材料咨询办理、认证咨询办理请加学历顾问Q/微741003700

【主营项目】

一.毕业证【q微741003700】成绩单、使馆认证、教育部认证、雅思托福成绩单、学生卡等!

二.真实使馆公证(即留学回国人员证明,不成功不收费)

三.真实教育部学历学位认证(教育部存档!教育部留服网站永久可查)

四.办理各国各大学文凭(一对一专业服务,可全程监控跟踪进度)

如果您处于以下几种情况:

◇在校期间,因各种原因未能顺利毕业……拿不到官方毕业证【q/微741003700】

◇面对父母的压力,希望尽快拿到;

◇不清楚认证流程以及材料该如何准备;

◇回国时间很长,忘记办理;

◇回国马上就要找工作,办给用人单位看;

◇企事业单位必须要求办理的

◇需要报考公务员、购买免税车、落转户口

◇申请留学生创业基金

留信网认证的作用:

1:该专业认证可证明留学生真实身份

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

It's the Law: Recent Court and Administrative Decisions of Interest

2024 Idaho Water Users Association, Sun Valley, Idaho - June 11, 2024. Presented by Payton Hampton and Garrett Kitamura

Business Laws Sunita saha

Business law for the students of undergraduate level. The presentation contains the summary of all the chapters under the syllabus of State University, Contract Act, Sale of Goods Act, Negotiable Instrument Act, Partnership Act, Limited Liability Act, Consumer Protection Act.

San Remo Manual on International Law Applicable to Armed Conflict at Sea

Presentation by Justin Ordoyo

University of the Philippines College of Law

V.-SENTHIL-BALAJI-SLP-C-8939-8940-2023-SC-Judgment-07-August-2023.pdf

सुप्रीम कोर्ट ने यह भी माना था कि मजिस्ट्रेट का यह कर्तव्य है कि वह सुनिश्चित करे कि अधिकारी पीएमएलए के तहत निर्धारित प्रक्रिया के साथ-साथ संवैधानिक सुरक्षा उपायों का भी उचित रूप से पालन करें।

Integrating Advocacy and Legal Tactics to Tackle Online Consumer Complaints

Our company bridges the gap between registered users and experienced advocates, offering a user-friendly online platform for seamless interaction. This platform empowers users to voice their grievances, particularly regarding online consumer issues. We streamline support by utilizing our team of expert advocates to provide consultancy services and initiate appropriate legal actions.

Our Online Consumer Legal Forum offers comprehensive guidance to individuals and businesses facing consumer complaints. With a dedicated team, round-the-clock support, and efficient complaint management, we are the preferred solution for addressing consumer grievances.

Our intuitive online interface allows individuals to register complaints, seek legal advice, and pursue justice conveniently. Users can submit complaints via mobile devices and send legal notices to companies directly through our portal.

一比一原版(Lincoln毕业证)新西兰林肯大学毕业证如何办理

Lincoln硕士毕业证成绩单【微信95270640】办理新西兰林肯大学毕业证原版一模一样、Lincoln毕业证制作【Q微信95270640】《新西兰林肯大学毕业证购买流程》《Lincoln成绩单制作》新西兰林肯大学毕业证书Lincoln毕业证文凭新西兰林肯大学

本科毕业证书,学历学位认证如何办理【留学国外学位学历认证、毕业证、成绩单、大学Offer、雅思托福代考、语言证书、学生卡、高仿教育部认证等一切高仿或者真实可查认证服务】代办国外(海外)英国、加拿大、美国、新西兰、澳大利亚、新西兰等国外各大学毕业证、文凭学历证书、成绩单、学历学位认证真实可查。

[留学文凭学历认证(留信认证使馆认证)新西兰林肯大学毕业证成绩单毕业证证书大学Offer请假条成绩单语言证书国际回国人员证明高仿教育部认证申请学校等一切高仿或者真实可查认证服务。

多年留学服务公司,拥有海外样板无数能完美1:1还原海外各国大学degreeDiplomaTranscripts等毕业材料。海外大学毕业材料都有哪些工艺呢?工艺难度主要由:烫金.钢印.底纹.水印.防伪光标.热敏防伪等等组成。而且我们每天都在更新海外文凭的样板以求所有同学都能享受到完美的品质服务。

国外毕业证学位证成绩单办理方法:

1客户提供办理新西兰林肯大学新西兰林肯大学毕业证学位证信息:姓名生日专业学位毕业时间等(如信息不确定可以咨询顾问:我们有专业老师帮你查询);

2开始安排制作毕业证成绩单电子图;

3毕业证成绩单电子版做好以后发送给您确认;

4毕业证成绩单电子版您确认信息无误之后安排制作成品;

5成品做好拍照或者视频给您确认;

6快递给客户(国内顺丰国外DHLUPS等快读邮寄)

— — — — 我们是挂科和未毕业同学们的福音我们是实体公司精益求精的工艺! — — — -

一真实留信认证的作用(私企外企荣誉的见证):

1:该专业认证可证明留学生真实留学身份同时对留学生所学专业等级给予评定。

2:国家专业人才认证中心颁发入库证书这个入网证书并且可以归档到地方。

3:凡是获得留信网入网的信息将会逐步更新到个人身份内将在公安部网内查询个人身份证信息后同步读取人才网入库信息。

4:个人职称评审加20分个人信誉贷款加10分。

5:在国家人才网主办的全国网络招聘大会中纳入资料供国家500强等高端企业选择人才。问山娃想买什么想吃什么山娃知道父亲赚钱很辛苦除了书籍和文具山娃啥也不要能牵着父亲的手满城闲逛他已心满意足了父亲连挑了三套童装叫山娃试穿山娃有点不想父亲说城里不比乡下要穿得漂漂亮亮爸怎么不穿得漂亮望着父亲山娃反问道父亲听了并不回答只是吃吃地笑山娃很精神越逛越起劲父亲却越逛越疲倦望着父亲呵欠连天的样子山娃也说困了累了回家吧小屋闷罐一般头顶上的三叶扇彻夜呜呜作响搅得满屋热气腾腾也搅得山娃心烦意乱父亲一的

快速办理(SCU毕业证书)澳洲南十字星大学毕业证文凭证书一模一样

学校原件一模一样【微信:741003700 】《(SCU毕业证书)澳洲南十字星大学毕业证文凭证书》【微信:741003700 】学位证,留信认证(真实可查,永久存档)原件一模一样纸张工艺/offer、雅思、外壳等材料/诚信可靠,可直接看成品样本,帮您解决无法毕业带来的各种难题!外壳,原版制作,诚信可靠,可直接看成品样本。行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备。十五年致力于帮助留学生解决难题,包您满意。

本公司拥有海外各大学样板无数,能完美还原。

1:1完美还原海外各大学毕业材料上的工艺:水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠。文字图案浮雕、激光镭射、紫外荧光、温感、复印防伪等防伪工艺。材料咨询办理、认证咨询办理请加学历顾问Q/微741003700

【主营项目】

一.毕业证【q微741003700】成绩单、使馆认证、教育部认证、雅思托福成绩单、学生卡等!

二.真实使馆公证(即留学回国人员证明,不成功不收费)

三.真实教育部学历学位认证(教育部存档!教育部留服网站永久可查)

四.办理各国各大学文凭(一对一专业服务,可全程监控跟踪进度)

如果您处于以下几种情况:

◇在校期间,因各种原因未能顺利毕业……拿不到官方毕业证【q/微741003700】

◇面对父母的压力,希望尽快拿到;

◇不清楚认证流程以及材料该如何准备;

◇回国时间很长,忘记办理;

◇回国马上就要找工作,办给用人单位看;

◇企事业单位必须要求办理的

◇需要报考公务员、购买免税车、落转户口

◇申请留学生创业基金

留信网认证的作用:

1:该专业认证可证明留学生真实身份

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

Recently uploaded (20)

Safeguarding Against Financial Crime: AML Compliance Regulations Demystified

Safeguarding Against Financial Crime: AML Compliance Regulations Demystified

Sangyun Lee, 'Why Korea's Merger Control Occasionally Fails: A Public Choice ...

Sangyun Lee, 'Why Korea's Merger Control Occasionally Fails: A Public Choice ...

The Future of Criminal Defense Lawyer in India.pdf

The Future of Criminal Defense Lawyer in India.pdf

The Work Permit for Self-Employed Persons in Italy

The Work Permit for Self-Employed Persons in Italy

Presentation (1).pptx Human rights of LGBTQ people in India, constitutional a...

Presentation (1).pptx Human rights of LGBTQ people in India, constitutional a...

It's the Law: Recent Court and Administrative Decisions of Interest

It's the Law: Recent Court and Administrative Decisions of Interest

San Remo Manual on International Law Applicable to Armed Conflict at Sea

San Remo Manual on International Law Applicable to Armed Conflict at Sea

V.-SENTHIL-BALAJI-SLP-C-8939-8940-2023-SC-Judgment-07-August-2023.pdf

V.-SENTHIL-BALAJI-SLP-C-8939-8940-2023-SC-Judgment-07-August-2023.pdf

Integrating Advocacy and Legal Tactics to Tackle Online Consumer Complaints

Integrating Advocacy and Legal Tactics to Tackle Online Consumer Complaints

Income tax form for company it-11 gha2016

- 1. RETURN OF INCOME For a company as defined under clause (20) of section 2 PART I Basic Information 01 Assessment Year 02 Return under section (tick one) 82BB 82 (proviso) Other 03 Name of the Assessee 04 Address 05 Phone(s) 06 E-mail 07 Type (tick one) 07A Public Limited 07B Private Limited 07C Local Authority 07D Other If other, mention the type 08 TIN 09 Old TIN 10 Circle 11 Zone 12 Incorporation Number 13 Incorporation Date 14 Income Year 15 Resident Status (tick one) Resident Non-resident 16 Main business 17 Business Identification Number(s) 18 (tick the boxes if YES) 19 Main export item (if applicable) 18A Any export in the income year? 18B Liable to furnish statement of international transaction under section 107EE? 20 Name of auditor(s) 18C Has the Statement under section 107EE been attached? 21 Audit report date 2 0 - - National Board of Revenue www.nbr.gov.bd IT-11GHA2016

- 2. PART II Particulars of Income and Tax A. Particulars of Total Income Amount $ 22 Interest on securities S.22 23 Income from house property (annex Schedule 24B) S.24 24 Agricultural income S.26 25 Income from business or profession S.28 26 Capital gains S.31 27 Income from other sources S.33 28 Total income (22+23+24+25+26+27) B. Tax Computation and Payment Amount ৳ 29 Tax computed on total income 30 Net tax after tax rebate (if any) 31 Minimum tax 32 Interest or any other amount under the Ordinance (if any) 33 Total amount payable 34 Tax deducted or collected at source (attach proof) 35 Advance tax paid (attach proof) 36 Adjustment of tax refund [mention assessment year(s) of refund] 37 Amount paid with return (attach proof) 38 Total amount paid and adjusted (34+35+36+37) 39 Deficit or excess (refundable) (33-38) TIN :

- 3. PART III Particulars of Tax Benefits A. Income enjoying tax exemption (provide additional paper if necessary) 40 Income exempted from tax Source Section SRO Amount $ 1 2 3 B. Income enjoying reduced tax rate (s) (provide additional paper if necessary) 41 Income subject to reduced rate of tax Source Section SRO Amount $ 1 2 3 C. Amount of tax benefits enjoyed Amount $ 42 Tax payable if there were no exemption or reduced rate 43 Tax payable with exemption or reduced rate 44 Amount of tax benefits (42- 43) 45 Tax rebate 46 Tax benefits and rebate (44 + 45) TIN :

- 4. PART IV Financial Statements A. Income Statement Current Income Year $ Previous Income Year $ 47 Sales/ Turnover/ Receipts 48 VAT (if any) 49 Net Sales/ Turnover/ Receipts (47-48) 50 Cost of Sales 51 Gross Profit (49-50) 52 Other operating income 53 General & Administrative expenses 53A Expenses paid in cash 54 Selling & Marketing expenses 54A Expenses paid in cash 55 Other operating expenses 55A Expenses paid in cash 56 Profit from operation {(51+52)-(53+54+55)} 57 Financial expenses 57A Expenses paid to non-resident 58 Income from associates/subsidiaries 59 Any other business income 60 Profit before tax TIN :

- 5. B. Balance Sheet Current Income Year $ Previous Income Year $ 61 Non-current assets (61A+61B+61C+61D+61E) 61A Property, plant and equipment, software, etc. 61B Intangible assets 61C Financial assets (other than 61D) 61D Investments and loans to affiliated entities 61E Other non-current assets 62 Current assets (62A+62B+62C+62D+62E) 62A Inventories 62B Trade and other receivables 62C Advance, deposits and prepayments 62D Cash, bank and cash equivalents 62E Other current assets 63 Total Assets (61+62) 64 Equity (64A+64B+64C) 64A Paid-up capital 64B Reserves & Surplus 64C Retained earnings 65 Non-current liabilities (65A+65B+65C+65D) 65A Bonds / Debentures 65B Long term borrowings 65C Loans from affiliated entities 65D Other non-current liabilities 66 Current liabilities (66A+66B+66C+66D) 66A Short term borrowings 66B Creditors/ Payables 66C Provisions 66D Others 67 Total Equity and Liabilities (64+65+66) TIN :

- 6. PART V Other Particulars A. Particulars of bank accounts (provide additional paper if more names) 68 Name of bank(s) Account number(s) Branch name (if applicable) 1 2 3 4 5 B. Particulars of directors (provide additional paper if more names) 69 Name of director(s) TIN % of share in paid-up capital 1 2 3 4 5 C. Particulars of affiliated entities (provide additional paper if more names) 70 Name (s) of affiliated entity TIN Type (company, firm etc.) 1 2 3 4 5 TIN :

- 7. PART VI Instruction, Enclosures and Verification 71 Instructions (1) The Return shall be: (a) signed and verified by the person as specified in section 75, and (b) accompanied by- (i) statements of accounts audited by a Chartered Accountant; (ii) depreciation chart as per THIRD SCHEDULE of the Ordinance; (iii)computation of income in accordance with the provisions of the Ordinance; (iv)Schedule 24B if the assessee has income from house property; (2) In this return two entities shall be affiliated entities if they belong to a common group of companies or have more than twenty five percent common shareholders or directors or run by a common management; (3) All amounts shall be in rounded up taka (৳). 72 Schedules, statements, documents, etc. attached (list) 73 Verification I solemnly declare that- (a) to the best of my knowledge and belief the information given in this return and statements and documents annexed or attached herewith are correct and complete; (b) I am signing this return in my capacity as ............................................................................. and I am competent to sign this return and verify it. Name Signature Designation Date of Signature (DD-MM-YYYY) Place of Signature For official use only Return Submission Information Date of Submission (DD-MM-YYYY) Tax Office Entry Number TIN: 2 0 2 0

- 8. ACKNOWLEDGEMENT RECEIPT OF RETURN OF INCOME Assessment Year Return submitted under section (tick one) 82BB 82 (proviso) Other Name of the Assessee Twelve-digit TIN Old TIN Circle Taxes Zone Total income shown (serial 28) $ Amount payable (serial 33) $ Amount paid and adjusted (serial 38) $ Date of Submission (DD-MM-YYYY) Tax Office Entry Number Signature and seal of the official receiving the return Date of Signature Contact Number of Tax Office National Board of Revenue www.nbr.gov.bd Company 2 0 2 0 -