Embed presentation

Download to read offline

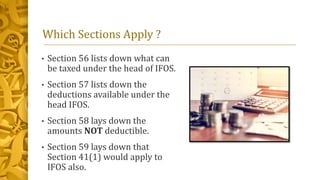

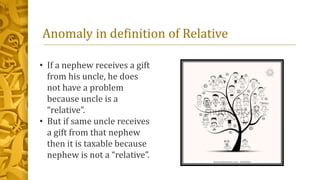

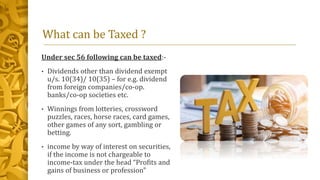

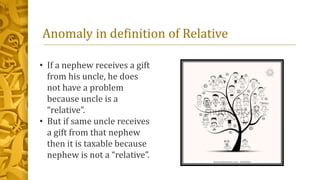

The document outlines the taxation framework for income from other sources (IFOS) under Section 56, detailing what qualifies as taxable income, such as dividends and lottery winnings. It also explains related deductions as per Sections 57 and 58, and clarifies definitions of terms like 'relative' and 'property' within this context. The document emphasizes that personal expenses are not deductible, and details the implications for tax on income that does not fit into other income categories.