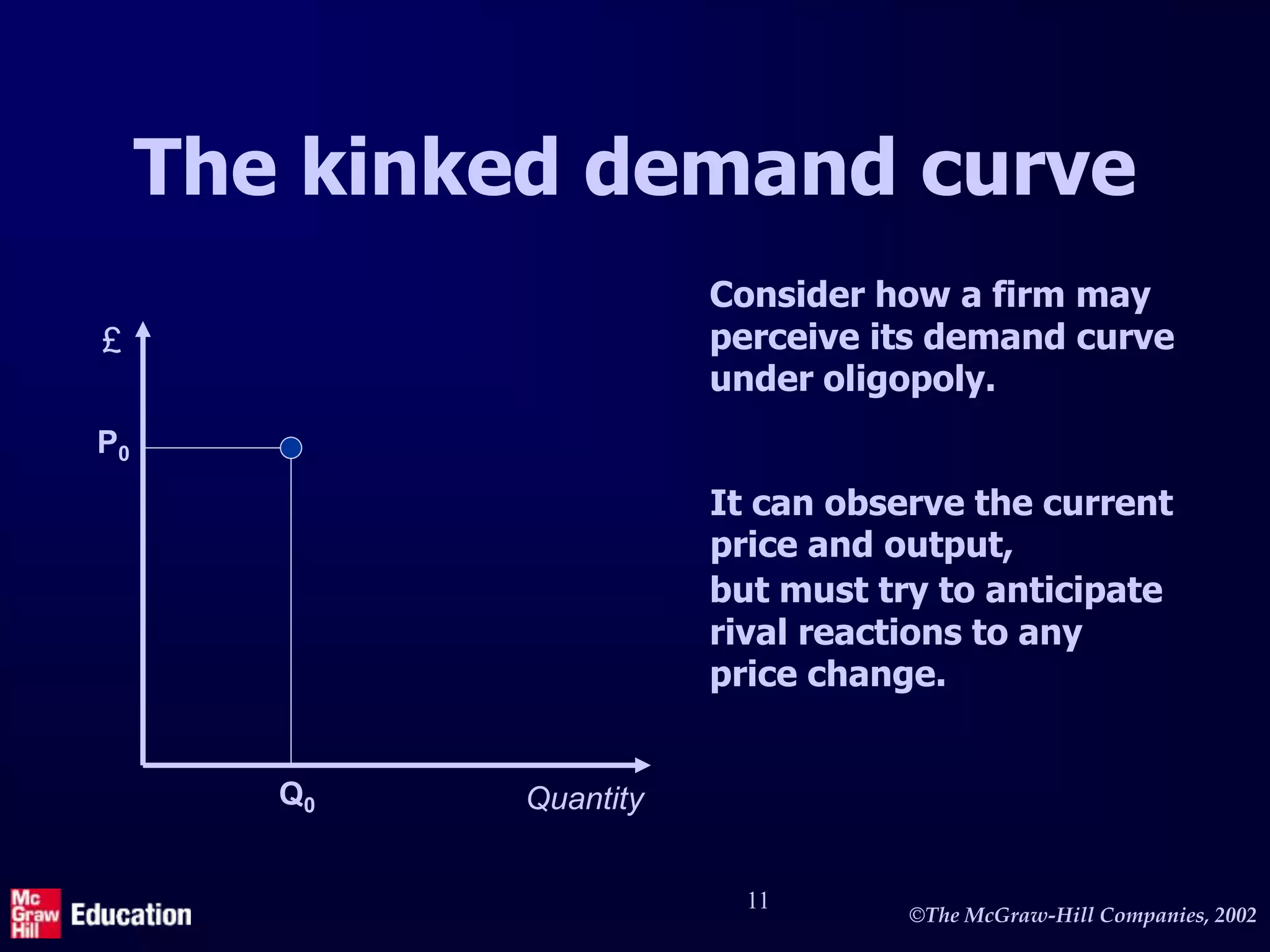

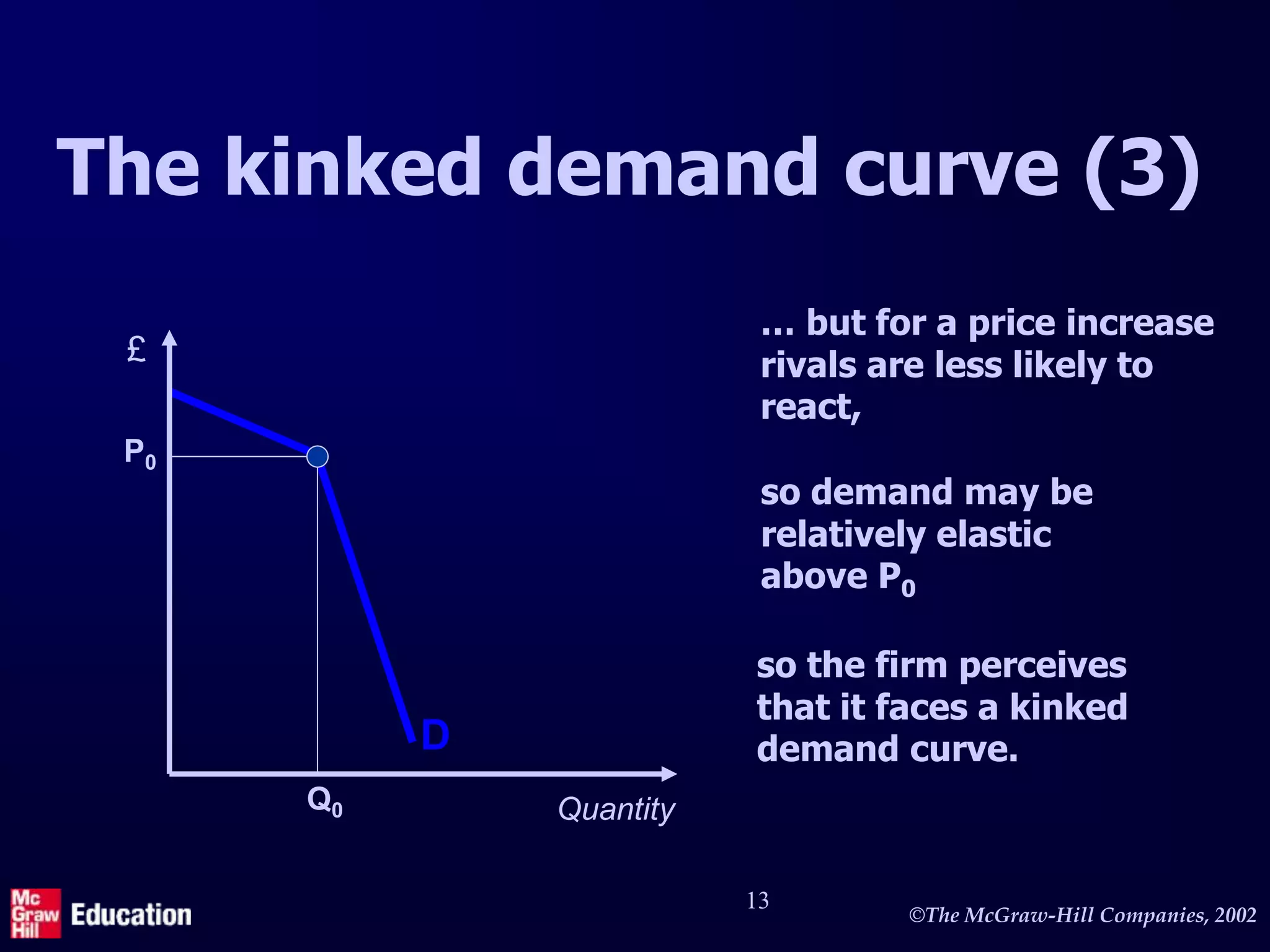

Most markets exist between the extremes of perfect competition and monopoly. There are several forms of imperfect competition, including monopolistic competition where many firms produce differentiated products, and oligopoly where a few firms recognize their actions influence rivals. Firms in monopolistic competition earn only normal profits in the long run due to no barriers to entry. Oligopolistic industries are characterized by strategic interactions among the few firms and collusion is difficult to maintain. The kinked demand curve model suggests oligopolistic firms will keep prices stable to avoid triggering responses from rivals.