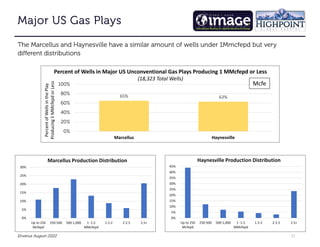

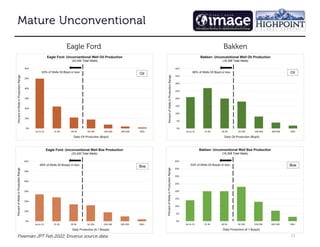

- Many aging US shale wells are producing at very low rates, with over 30% under the stripper well classification of 15 barrels of oil per day. As more time passes, the number of wells with significantly declining production is growing.

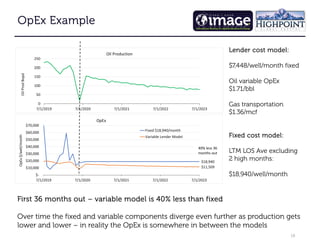

- Low production rates present economic challenges including the ability to cover fixed operating expenses, complete workovers, and support debt obligations. With many wells approaching the end of their economic life, asset retirement obligations for plugging and abandoning wells will continue increasing over time.

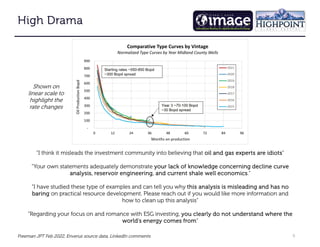

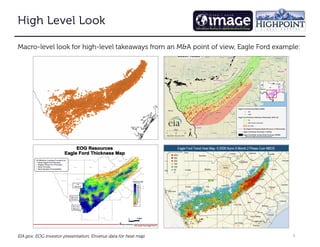

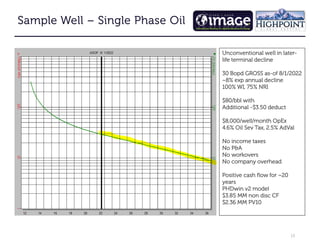

- Proper evaluation of aging well performance and long-term economics is important for assessing asset value in acquisition deals and portfolio management. Technical analysis can help address some of the "muddy waters" around investment decisions in mature