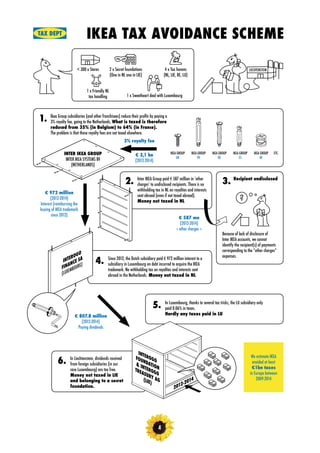

IKEA has a complex corporate structure that splits the company into two groups, the IKEA Group and the Inter IKEA Group, which are owned by secretive foundations in the Netherlands and Liechtenstein respectively. This report investigates how IKEA may be using this structure to avoid taxes by shifting profits between subsidiaries in low-tax countries, such as through royalty payments from IKEA stores to the Dutch company and on to Liechtenstein. The report estimates that these tax avoidance strategies have cost European countries over €1 billion in lost tax revenues between 2009-2014. It also examines how IKEA uses other mechanisms like intracompany loans to shift profits to low-tax Luxembourg.