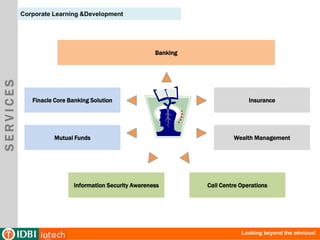

IDBI Intech Limited is an IT solutions and consulting firm focused on the BFSI sector. They have over 1000 technology experts with 15+ years of experience on average. They offer comprehensive IT consulting services, information security consulting, corporate learning and development programs, and business process outsourcing. Their offerings include both technology consulting services and proprietary products tailored for the financial sector. They have worked with several large banks and insurance companies in India, helping them optimize processes, launch new digital initiatives, and improve business metrics like lead conversion rates.