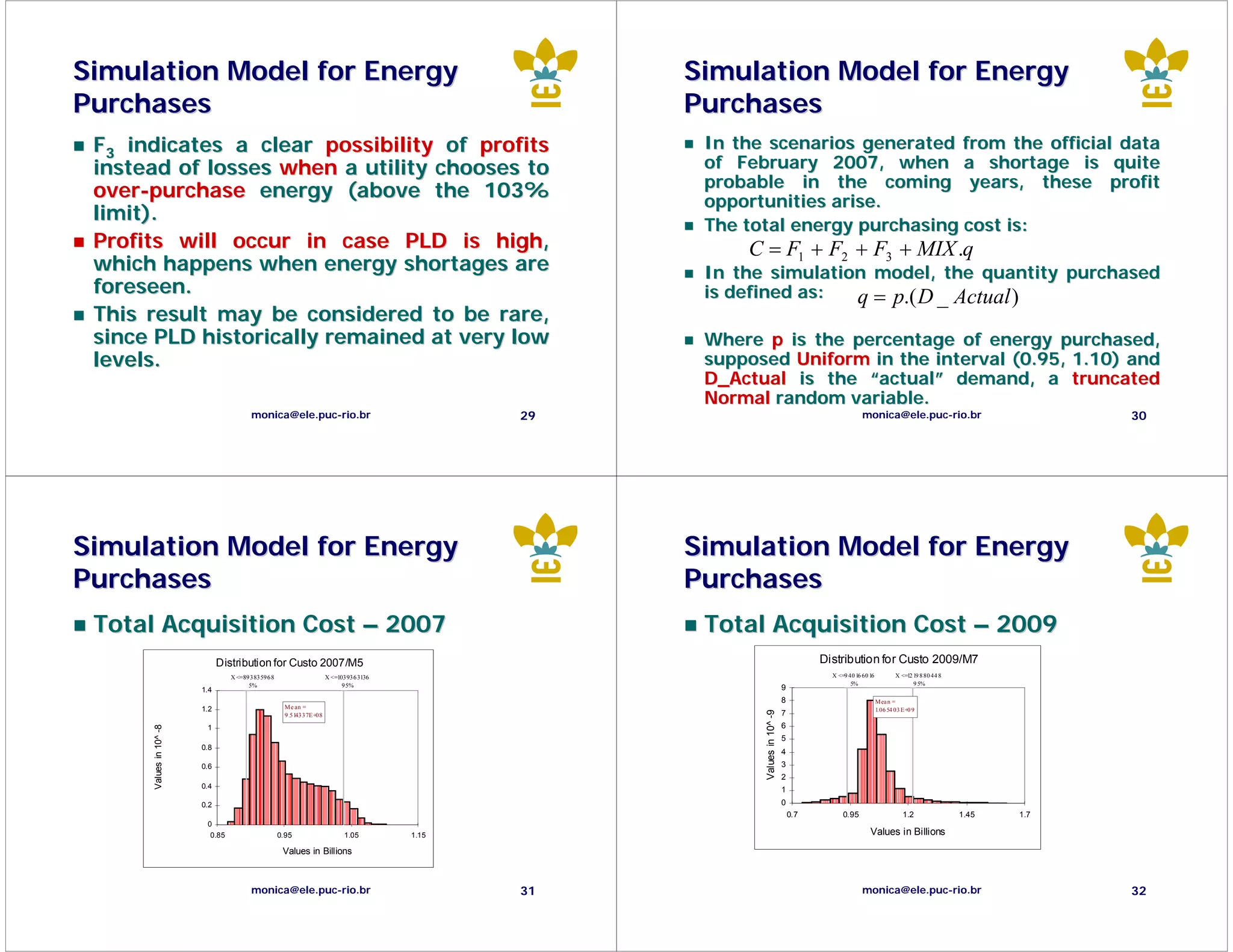

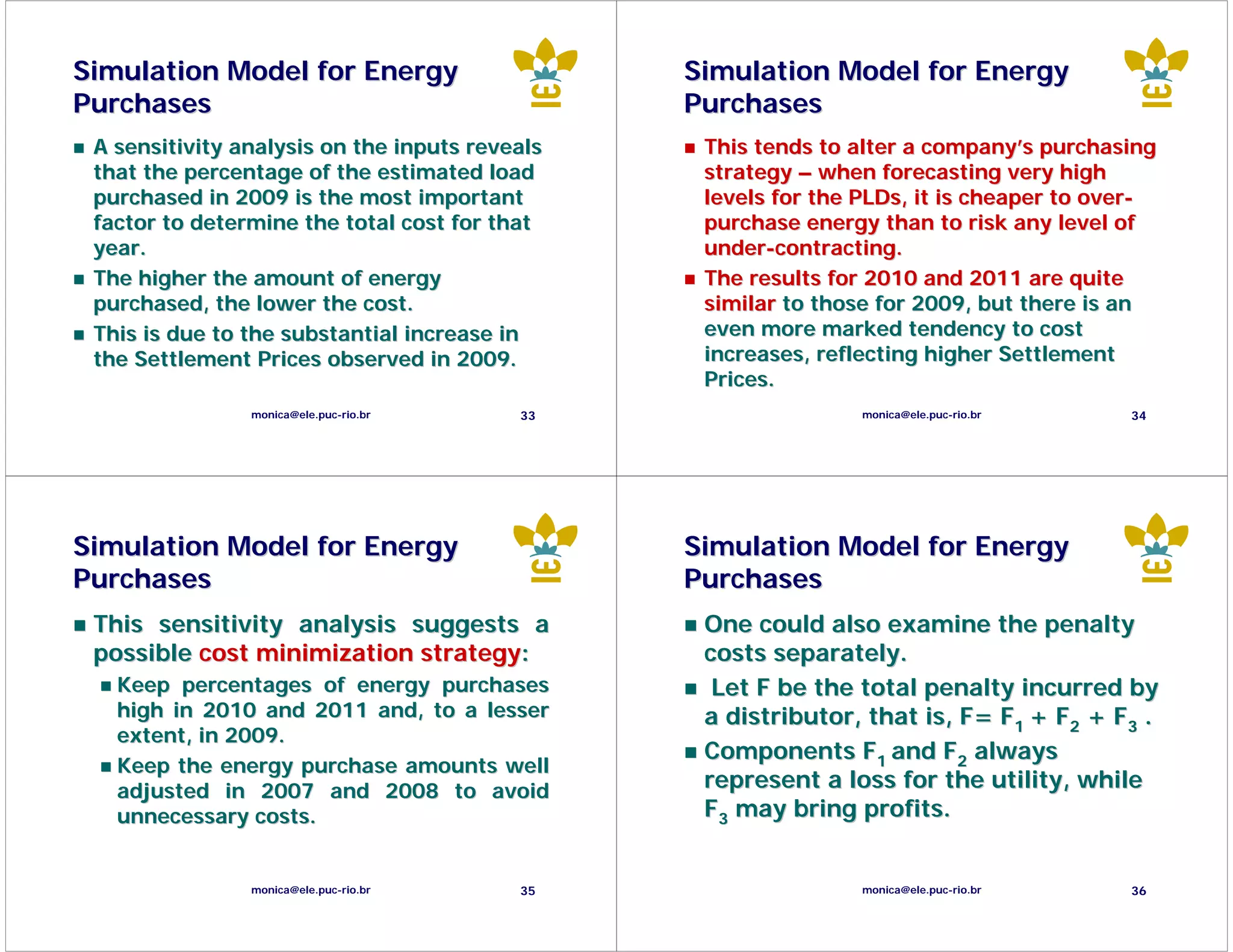

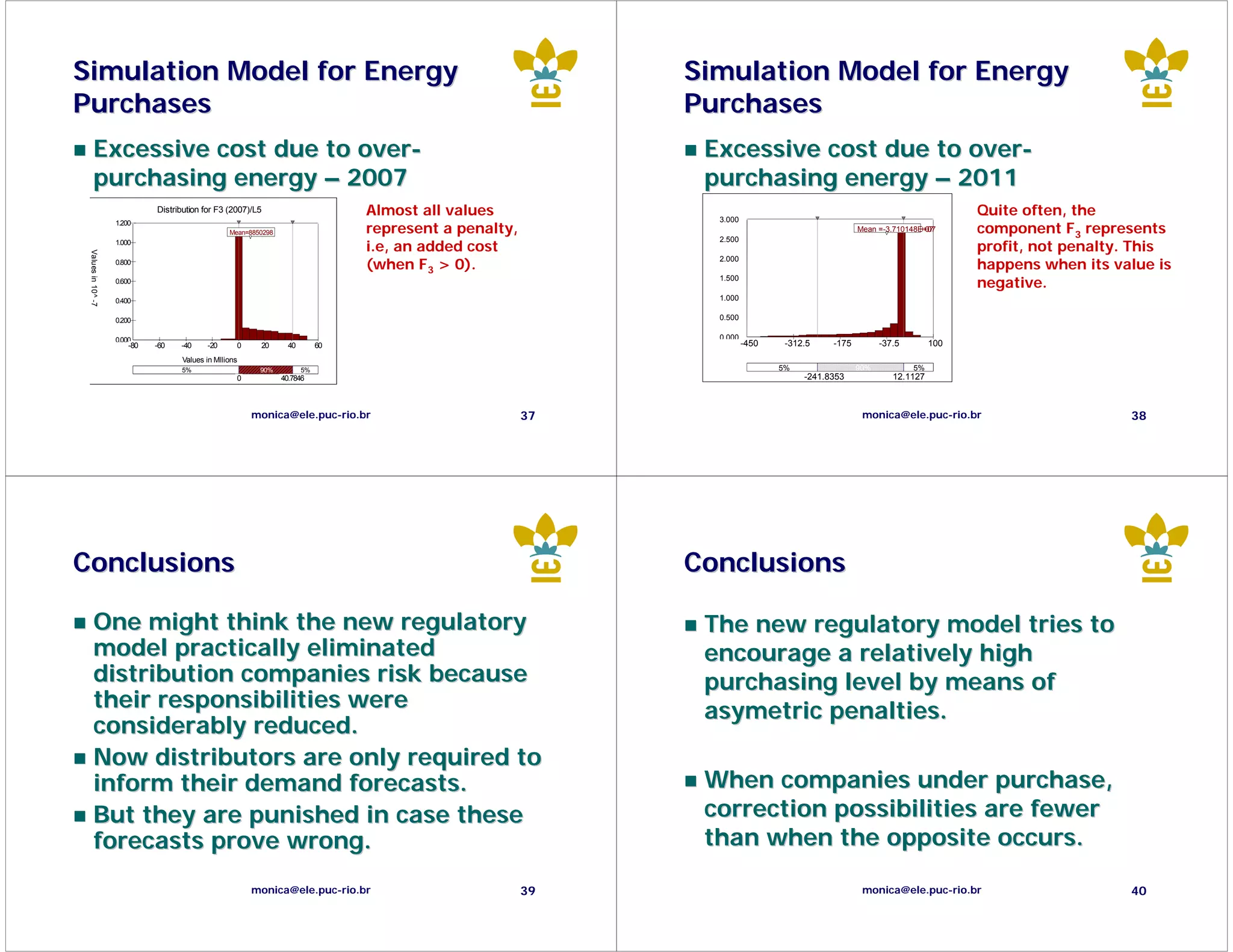

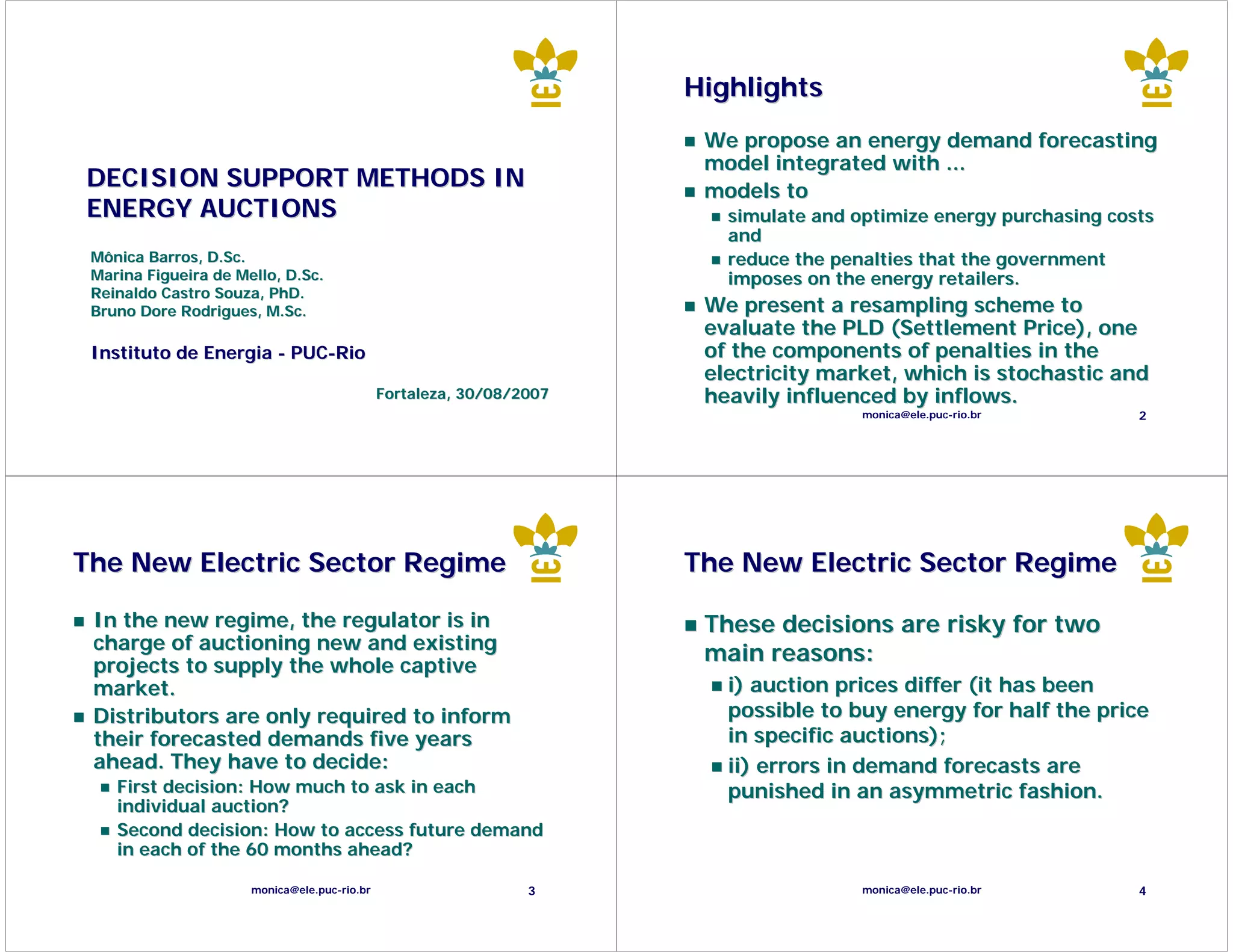

The document discusses decision support methods for energy auctions and risk in the new Brazilian electricity sector regime. It proposes a simulation model to optimize energy purchasing costs for distributors. The model integrates an energy demand forecasting model with simulations of the settlement price (PLD) using hydro dispatch optimization software. It also simulates different percentages of estimated load purchased each year to minimize total costs over multiple years amid demand and PLD uncertainties.

![The New Electric Sector Regime The New Electric Sector Regime

Distributors who demand a relatively high

The weighted average of the prices share of their needs in low price auctions

paid by the regulator for the total will have their profits increased.

energy bought from various

generators will be passed-through to Losses will come to those distributors who

prices. concentrate their demand in the high price

auctions.

Distributors will pay for their energy

in proportion to their declared Distributors are not truly free to allocate

demand in each auction. their demand amongst auctions because

the terms of the contracts being auctioned

monica@ele.puc-rio.br 5

may be incompatible with theirs needs. 6

monica@ele.puc-rio.br

PLD – Settlement Price Simulation

Demand Model

Model

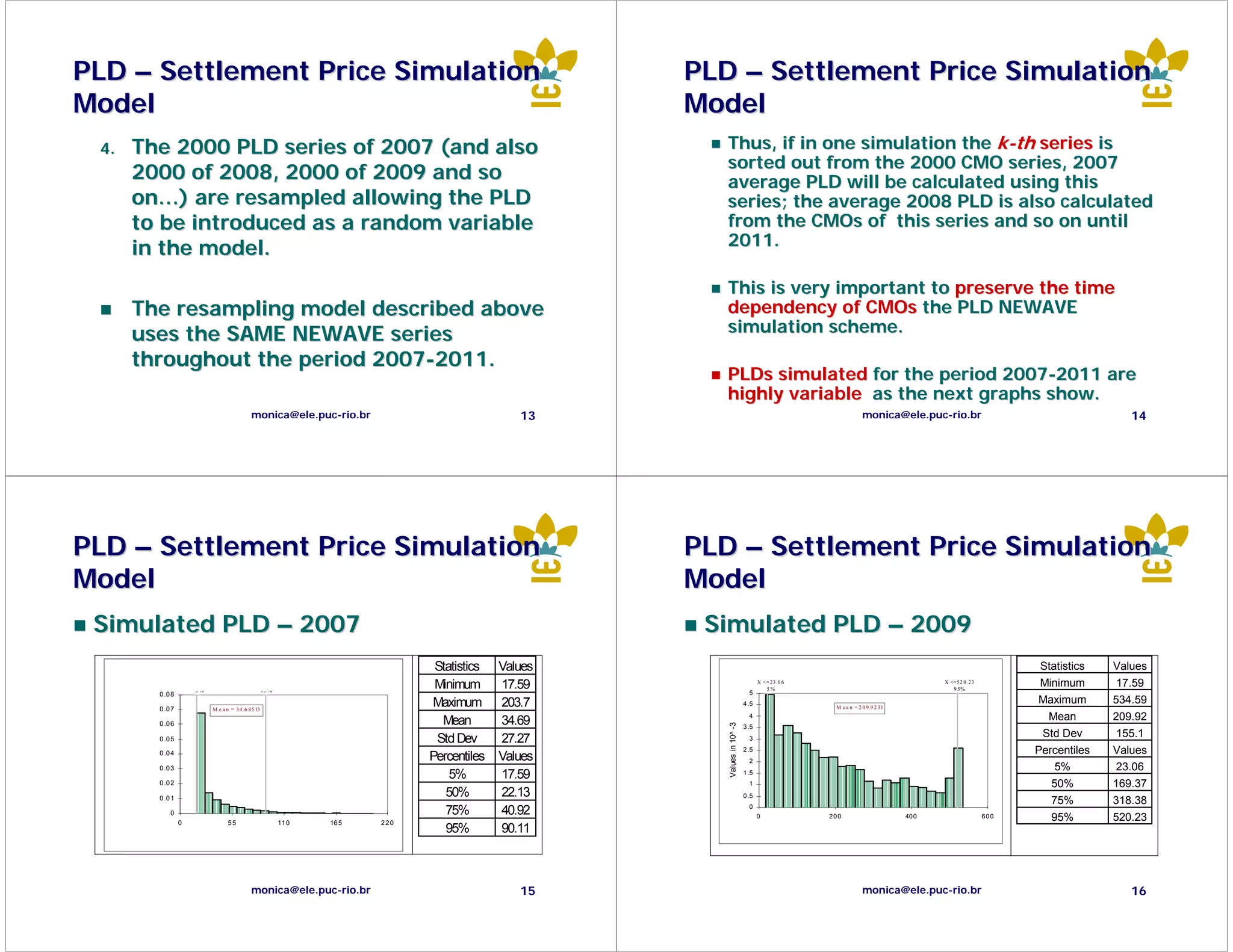

The structure of the demand model is:

Variable Coefficient Standard Error T Statistic Significance

Hydroelectric energy is generally cheaper

Log(C_TOTAL[-1]) 0,772 0,077 10,085 100,0%

but hydro units are not always fully

dispatched since low water levels mean a

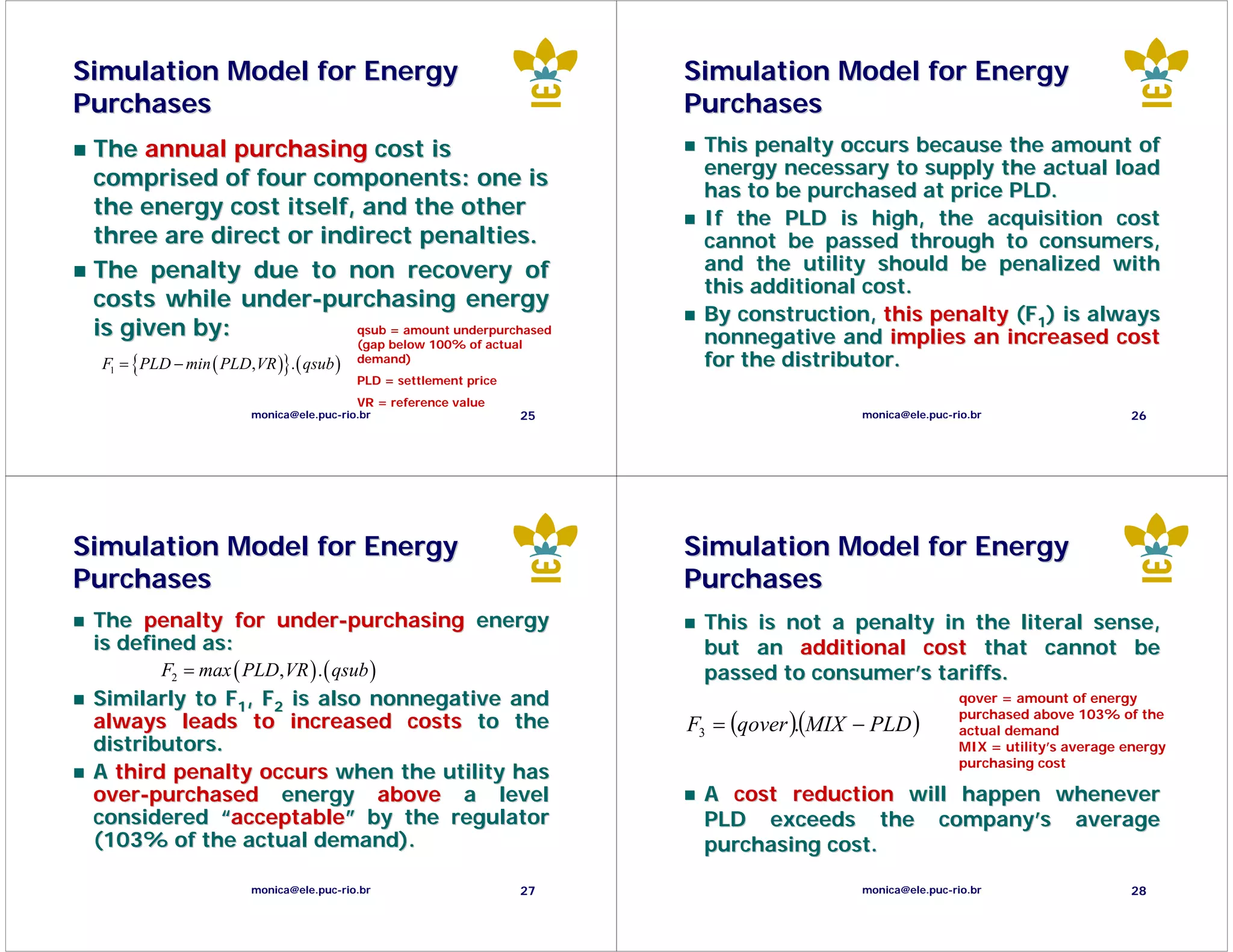

Log(PIB[-1]) 0,367 0,122 3,013 98,9%

Log(PR_ENERGIA) -0,189 0,053 -3,564 99,6%

supply risk.

Log(PR_GAS) 0,053 0,017 3,111 99,1%

RACION -0,132 0,022 -6,105 100,0%

Where:

C_total[-1] = consumption in the previous month

C_total[- The ISO ponders the present benefit of

PIB[-1] = GDP in the previous month

PIB[- cheap water use and the future benefits of

PR_ENERGIA = electricity price high level reservoirs, both measured by

PR_GAS = GLP price their opportunity cost in terms of fuel

RACION = dummy variable – rationing period savings in thermoelectric plants.

monica@ele.puc-rio.br 7 monica@ele.puc-rio.br 8](https://image.slidesharecdn.com/icord2007-12729310458563-phpapp01/75/Icord-2007-2-2048.jpg)