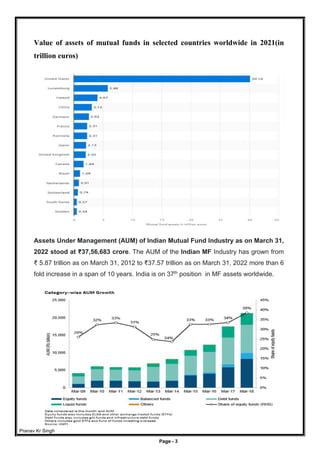

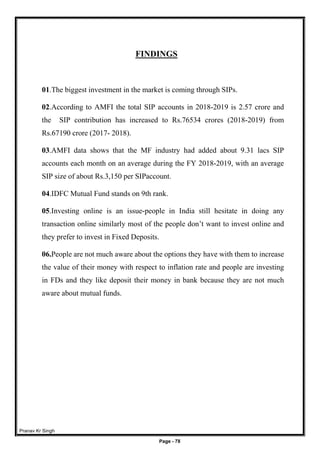

The document outlines the history of mutual funds in India, starting with the establishment of the Unit Trust of India in 1963 as the first mutual fund, followed by a period of UTI monopoly until 1987 when other public sector entities were allowed to start mutual funds. It then discusses the key phases in the growth and development of the Indian mutual fund industry, from the initial UTI dominance to the current phase of high growth with over 30 fund houses and thousands of schemes.