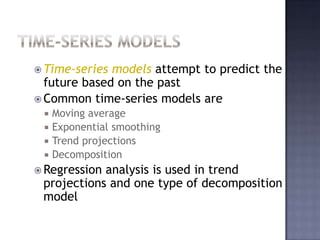

This document discusses different forecasting techniques including qualitative models, time-series methods, and causal methods. It provides examples of time-series models like moving average, exponential smoothing, trend projections, and decomposition. Regression analysis is discussed as a technique used in trend projections and decomposition models. The document also discusses using causal models with independent variables that influence the quantity being forecasted. Finally, it discusses evaluating forecast accuracy using measures like mean absolute deviation.

![THREE-MONTH WEIGHTED

MONTH ACTUAL SHED SALES MOVING AVERAGE

January 10

February 12

March 13

April 16 [(3 X 13) + (2 X 12) + (10)]/6 = 12.17

May 19 [(3 X 16) + (2 X 13) + (12)]/6 = 14.33

June 23 [(3 X 19) + (2 X 16) + (13)]/6 = 17.00

July 26 [(3 X 23) + (2 X 19) + (16)]/6 = 20.50

August 30 [(3 X 26) + (2 X 23) + (19)]/6 = 23.83

September 28 [(3 X 30) + (2 X 26) + (23)]/6 = 27.50

October 18 [(3 X 28) + (2 X 30) + (26)]/6 = 28.33

November 16 [(3 X 18) + (2 X 28) + (30)]/6 = 23.33

December 14 [(3 X 16) + (2 X 18) + (28)]/6 = 18.67

January — [(3 X 14) + (2 X 16) + (18)]/6 = 15.33](https://image.slidesharecdn.com/lecture6-100815131416-phpapp01/85/IBM401-Lecture-6-25-320.jpg)