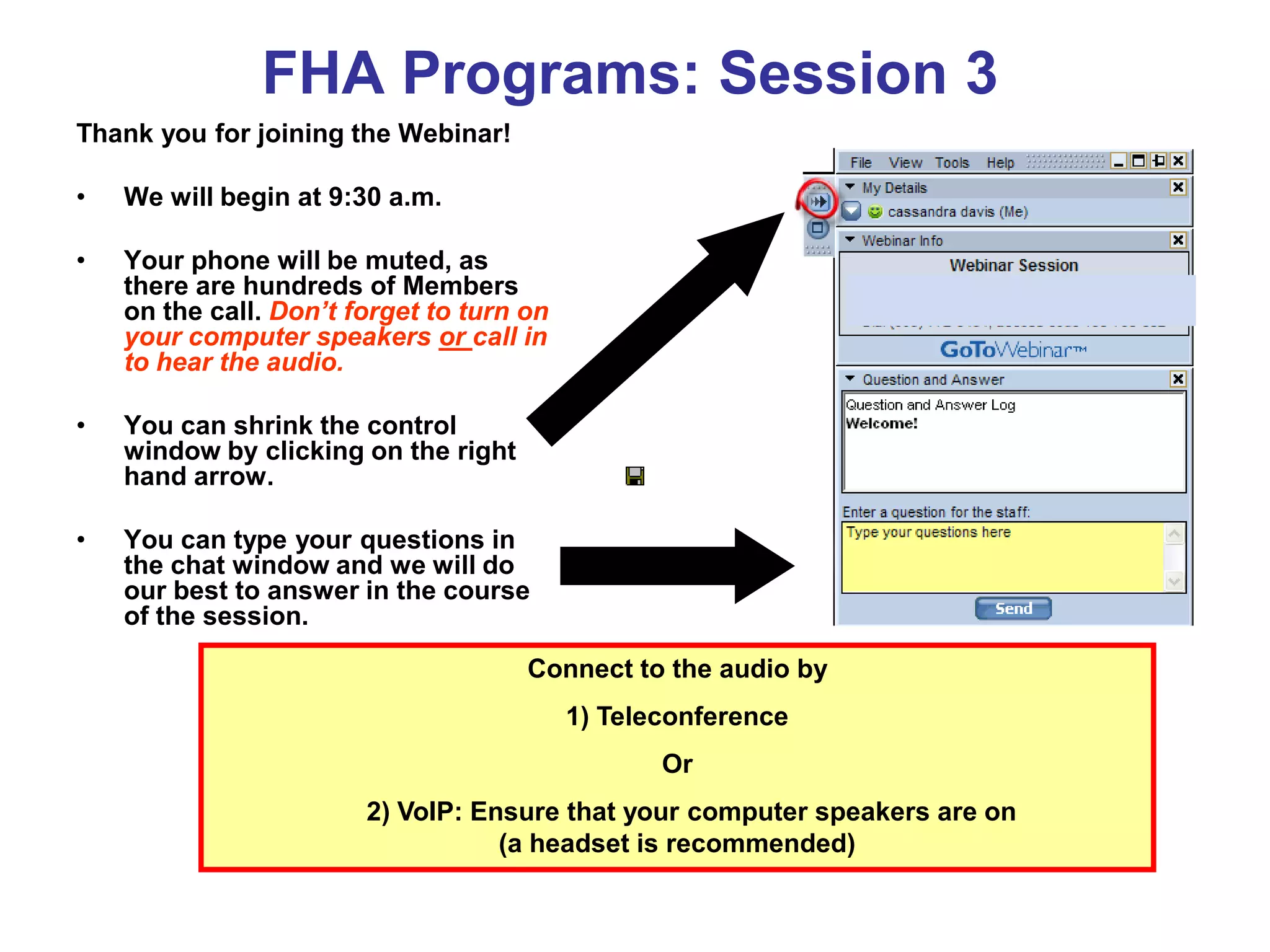

This document provides an agenda and instructions for an online webinar about FHA programs. The webinar will begin at 9:30 am and participants' phones will be muted. Questions can be typed into the chat window. The webinar will cover FHA programs including 203(k) rehabilitation loans, streamlined 203(k) loans, Energy Efficient Mortgages, other repairs programs, and solar and weatherization programs.