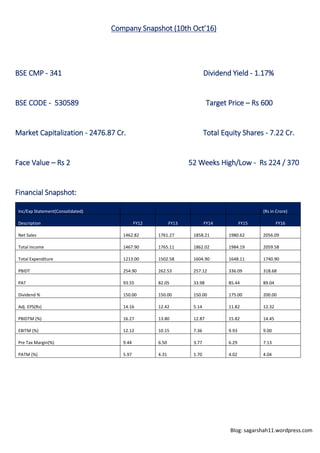

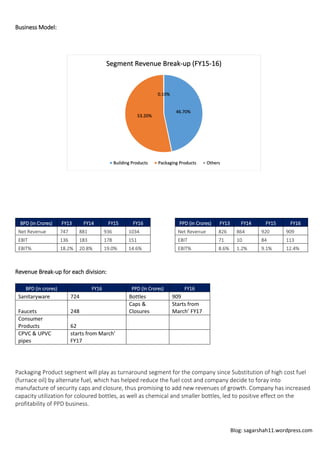

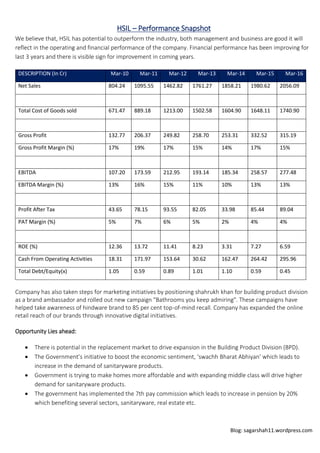

This document summarizes a blog post analyzing HSIL Ltd, an Indian building products and packaging company. It provides an overview of HSIL's business segments, financial performance, industry drivers, management, and valuation. Key points include that HSIL has leadership in sanitaryware and glass containers, with future potential in new products. The analysis evaluates HSIL's financials, industry growth opportunities, and provides revenue and profit estimates to justify a target share price of Rs. 600.