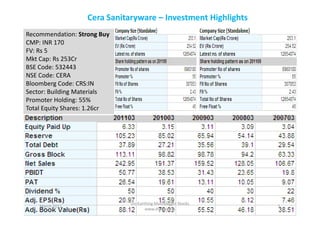

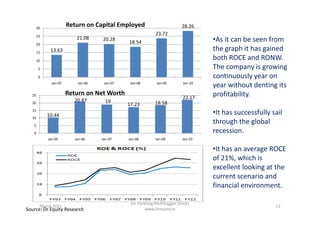

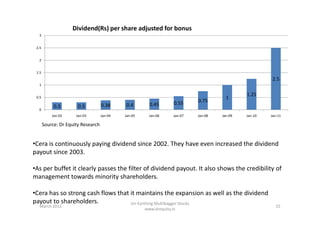

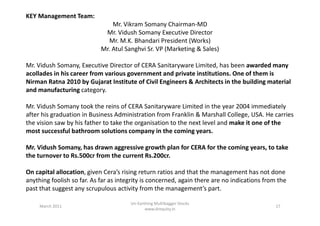

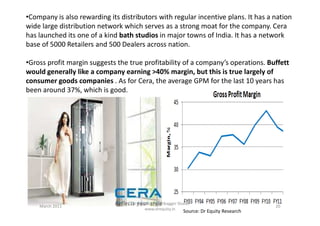

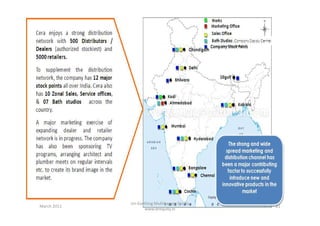

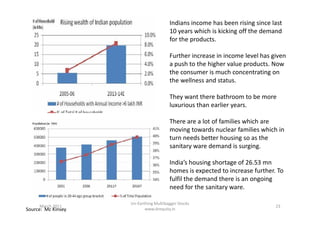

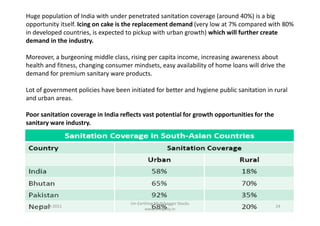

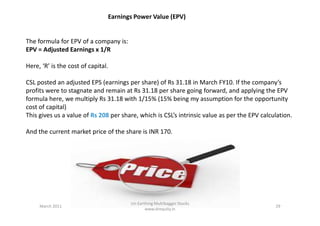

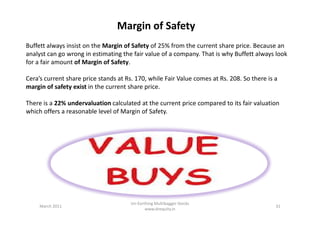

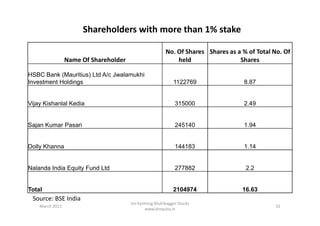

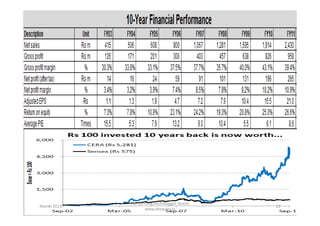

This document provides an overview and analysis of Cera Sanitaryware Ltd, an Indian company that pioneered the sanitary ware segment in India. It discusses Cera's business operations, products, financial performance, and growth opportunities in the industry. The management team, led by Vikram Somany and Vidush Somany, has grown the business successfully over the years and increased shareholder value through strong returns and dividend payouts. The industry is expected to continue growing rapidly due to increasing housing demand, rising incomes, and greater awareness of hygiene in India.