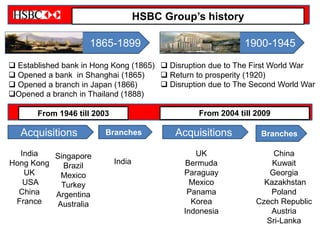

HSBC is one of the largest banking and financial services organizations in the world, headquartered in London with over 8,000 offices globally. It was established in 1865 in Hong Kong and Shanghai to finance trade between China and Europe. HSBC positions itself as the "world's local bank" by operating in local markets around the world while providing a global banking platform. It aims to understand each local market uniquely through its large international presence and local knowledge.