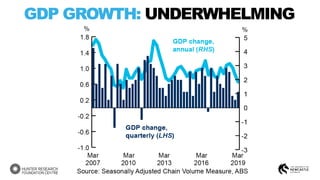

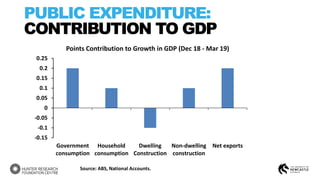

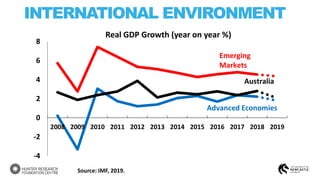

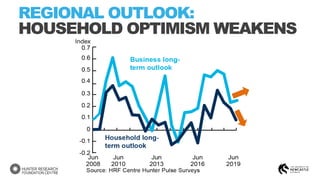

The document summarizes economic indicators for the Hunter region of Australia. It finds that:

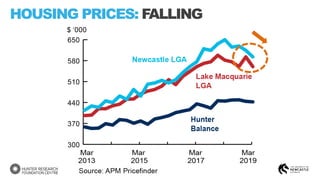

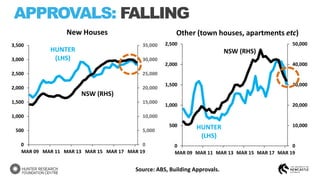

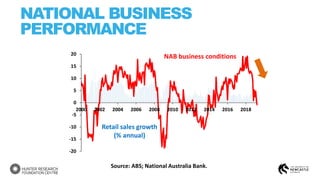

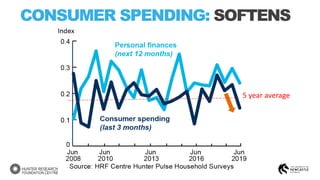

1) National economic growth is slowing, and the local Hunter region is experiencing some softening, with falling house prices, declines in new housing approvals especially for apartments, and weaker business performance and consumer confidence.

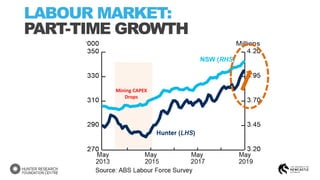

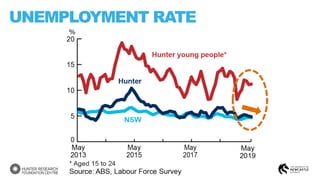

2) The labor market is experiencing growth in part-time jobs while maintaining a low unemployment rate similar to New South Wales.

3) The overall regional outlook shows weakening optimism among households and businesses.