- The document contains forward-looking statements regarding Antero Resources Corporation's expectations, beliefs, anticipations or intentions regarding future activities and developments.

- It cautions that forward-looking statements are subject to risks and uncertainties that may cause actual results to differ from expectations.

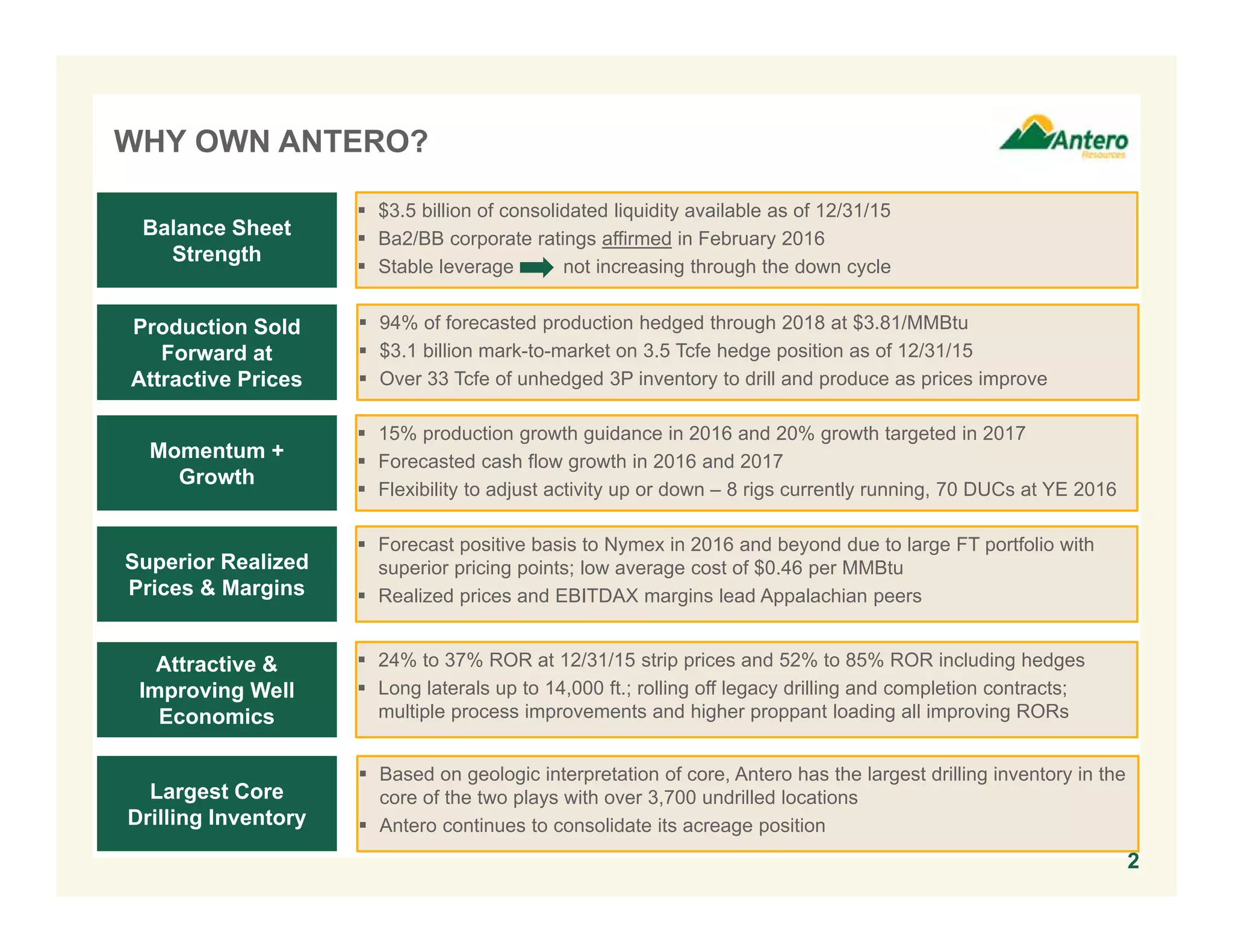

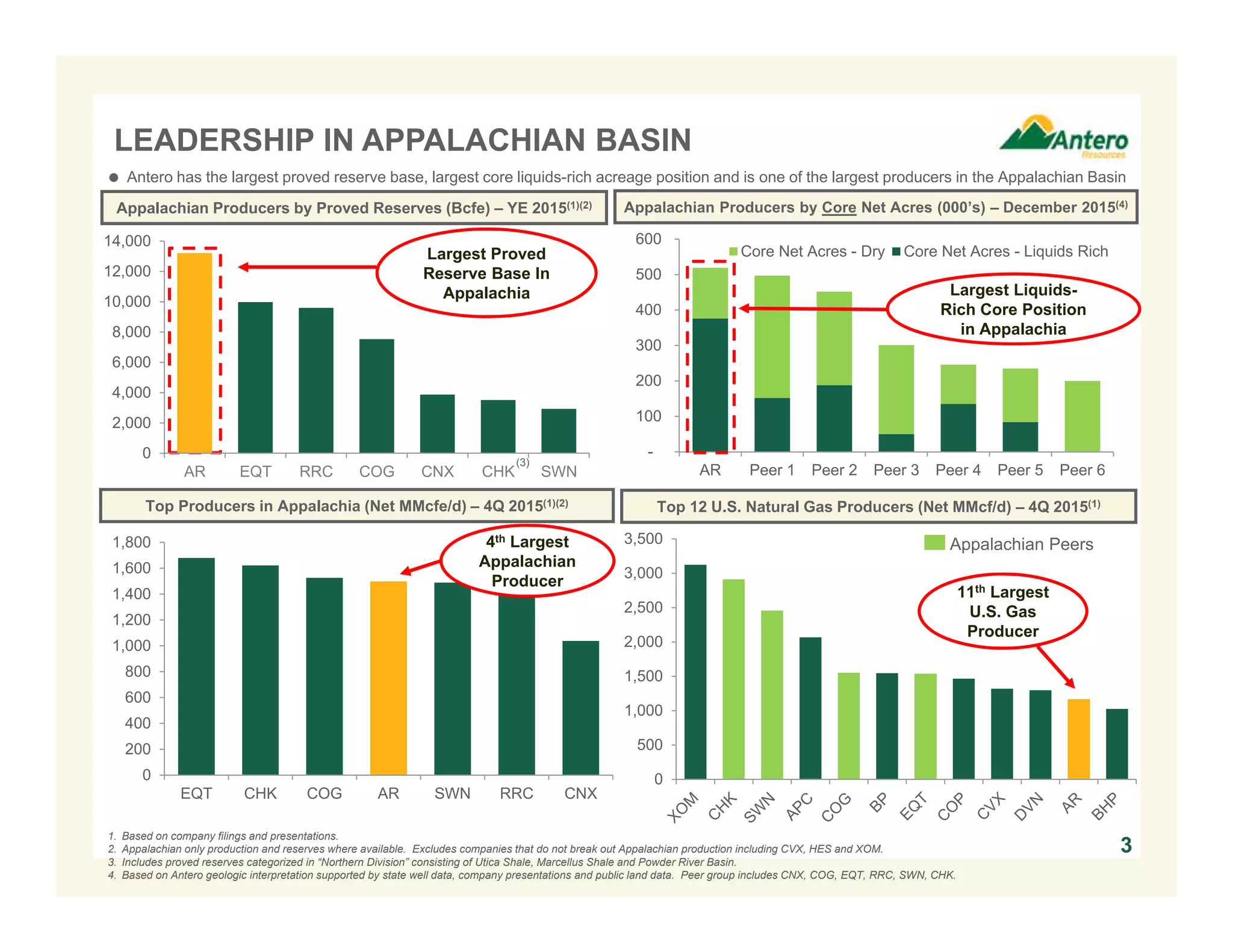

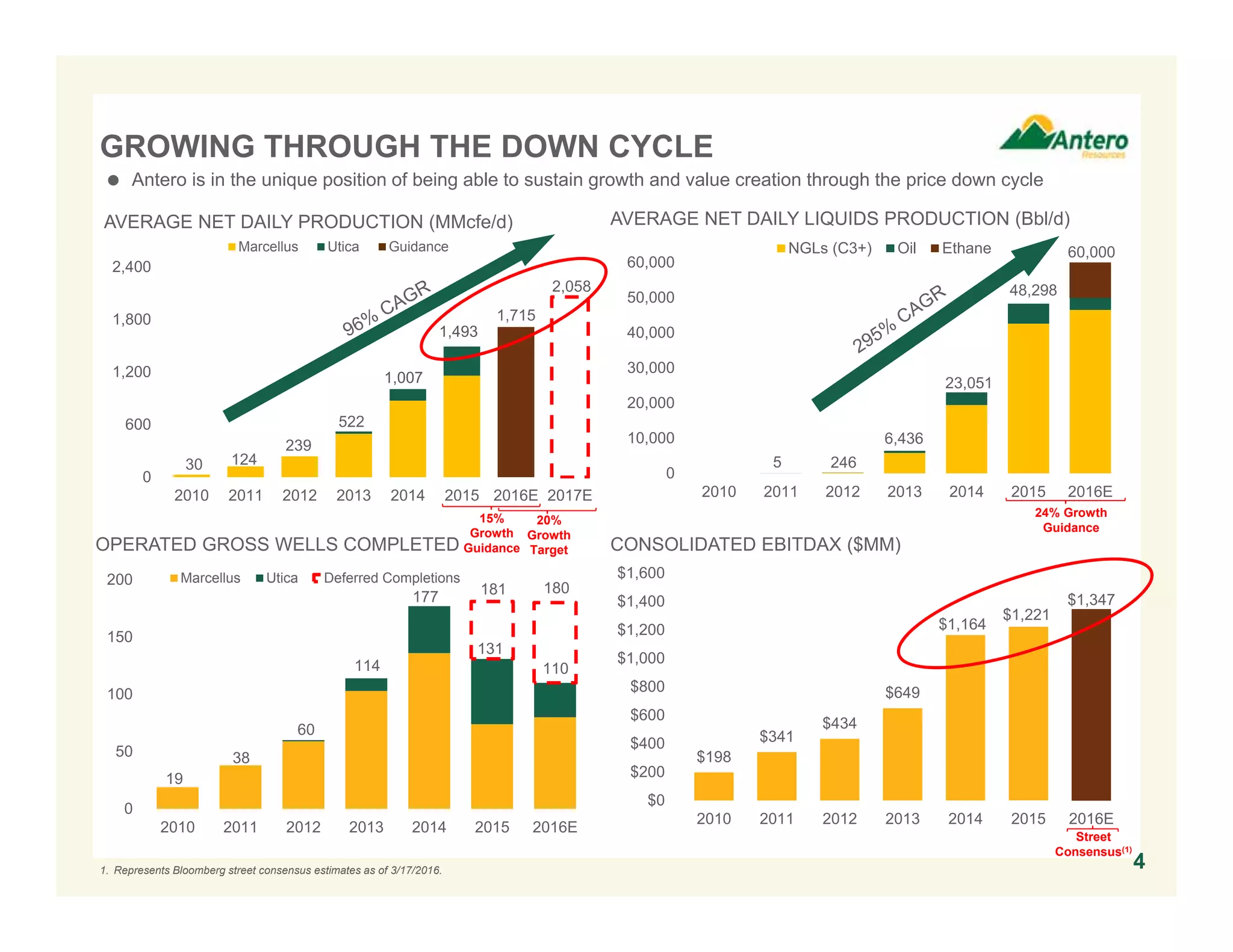

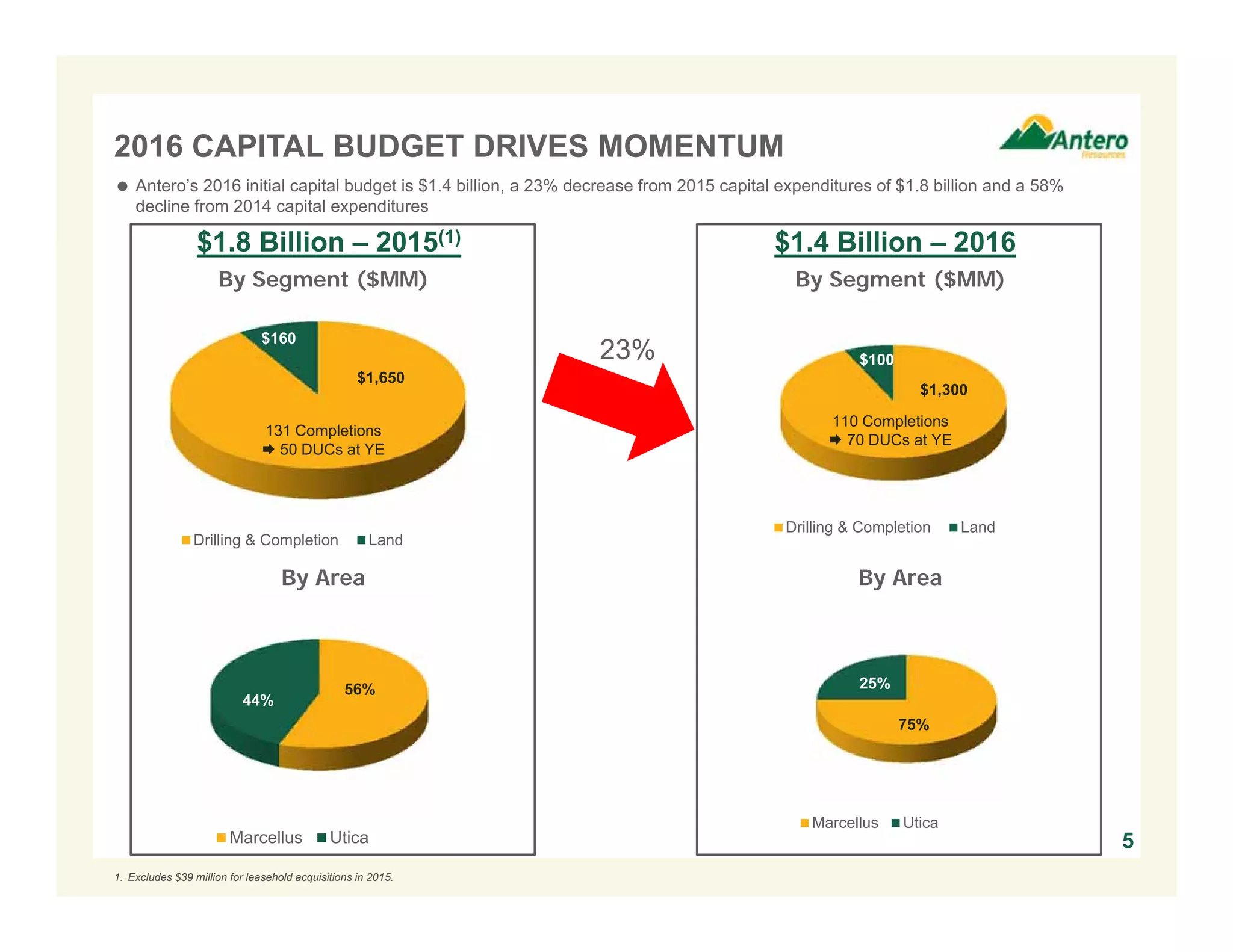

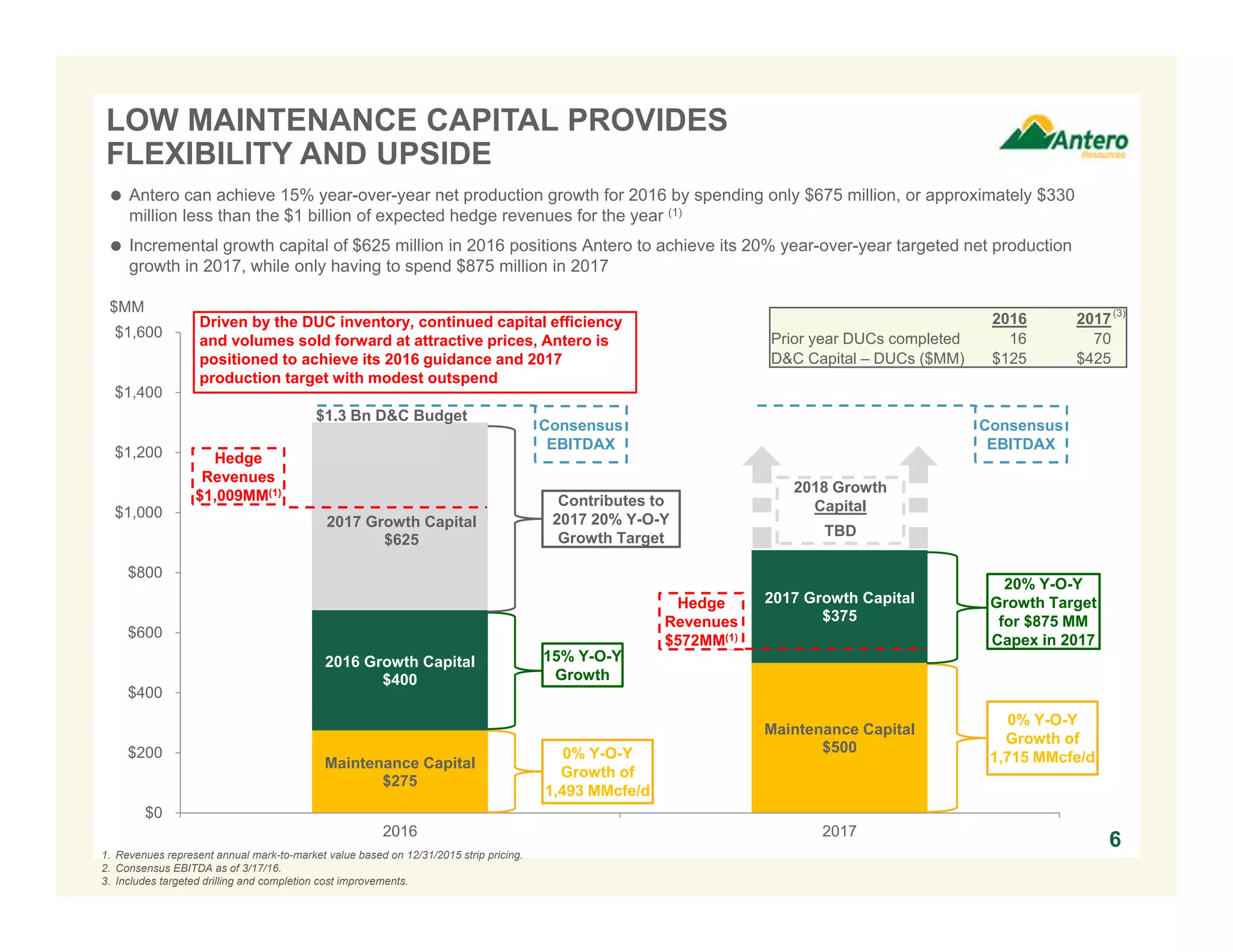

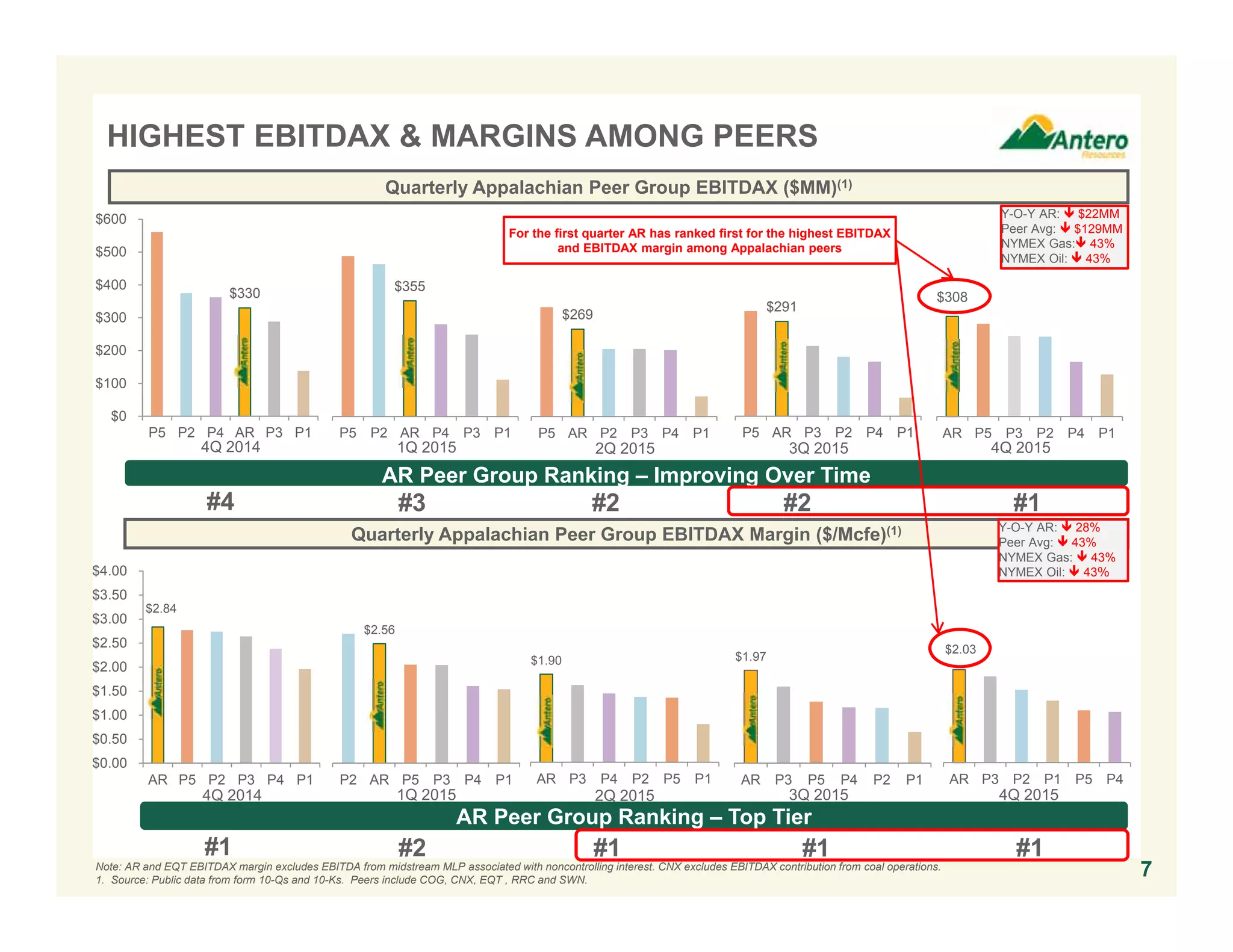

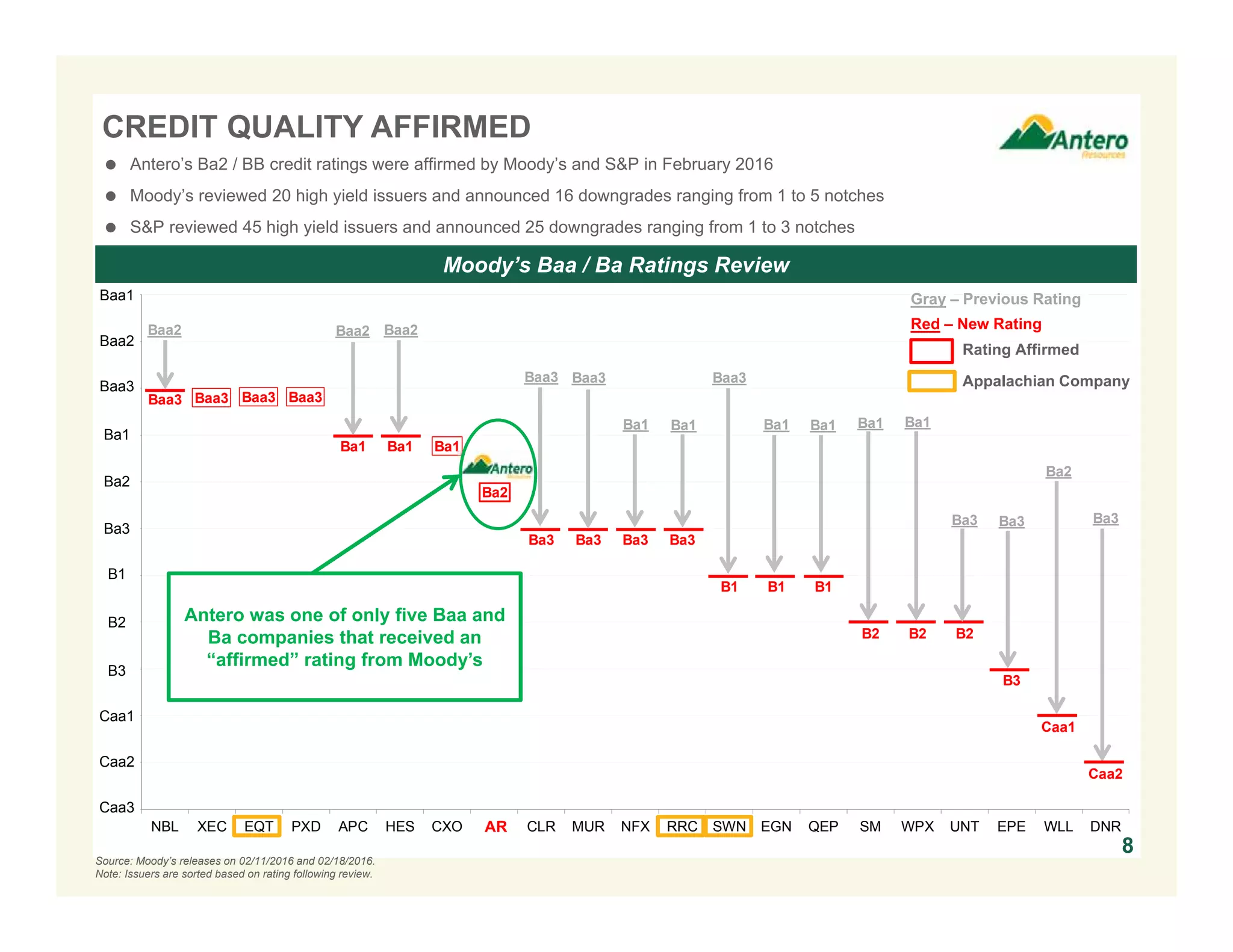

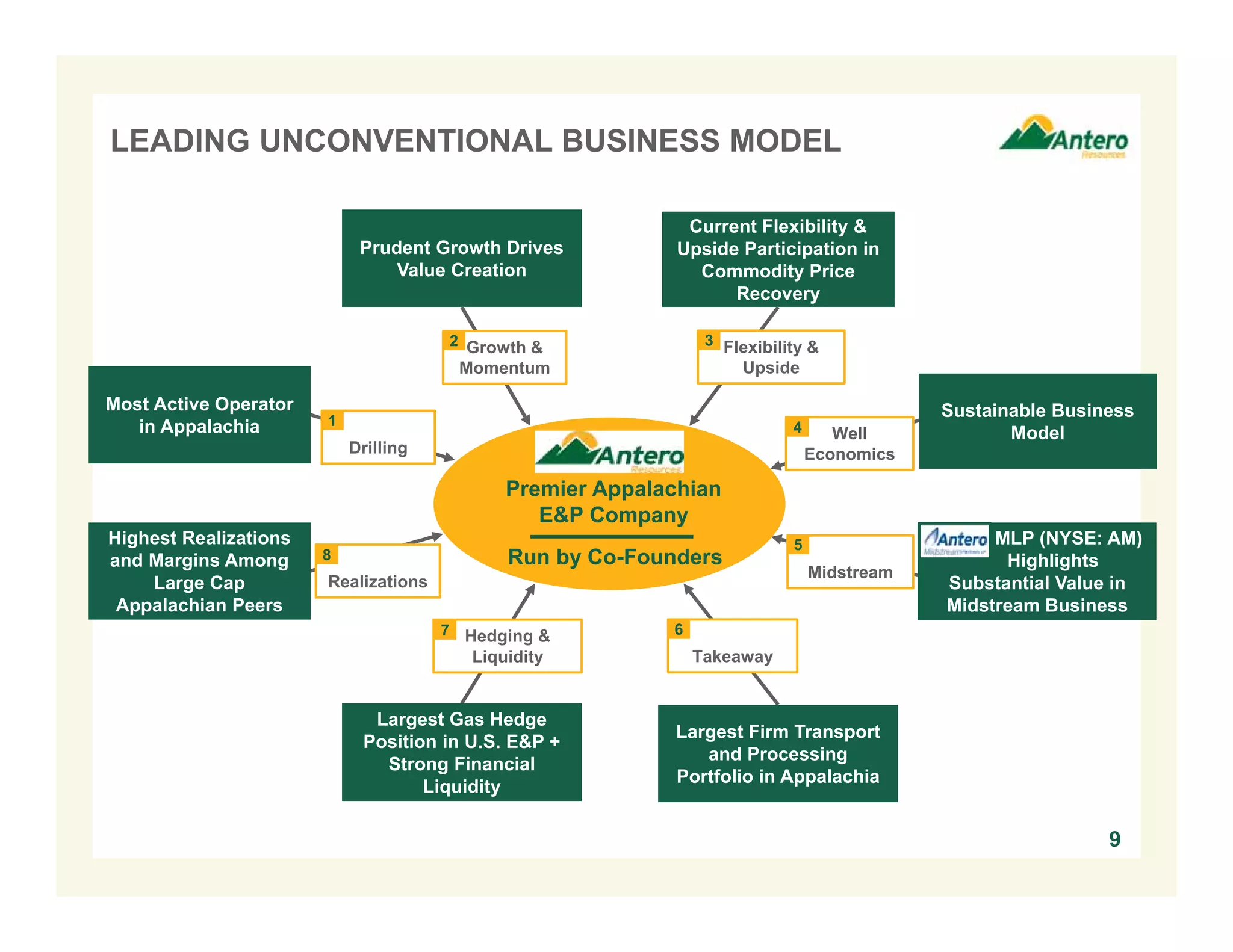

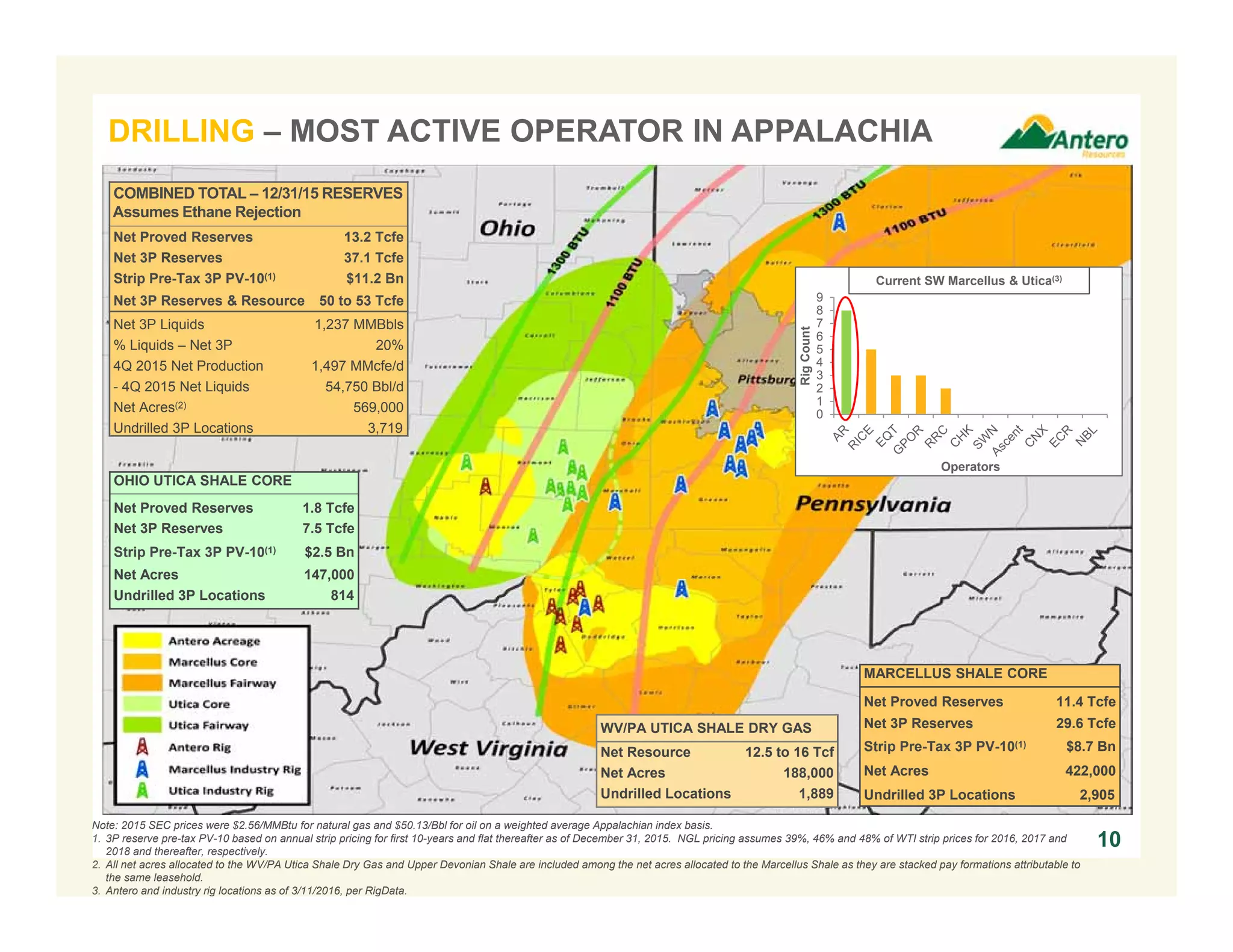

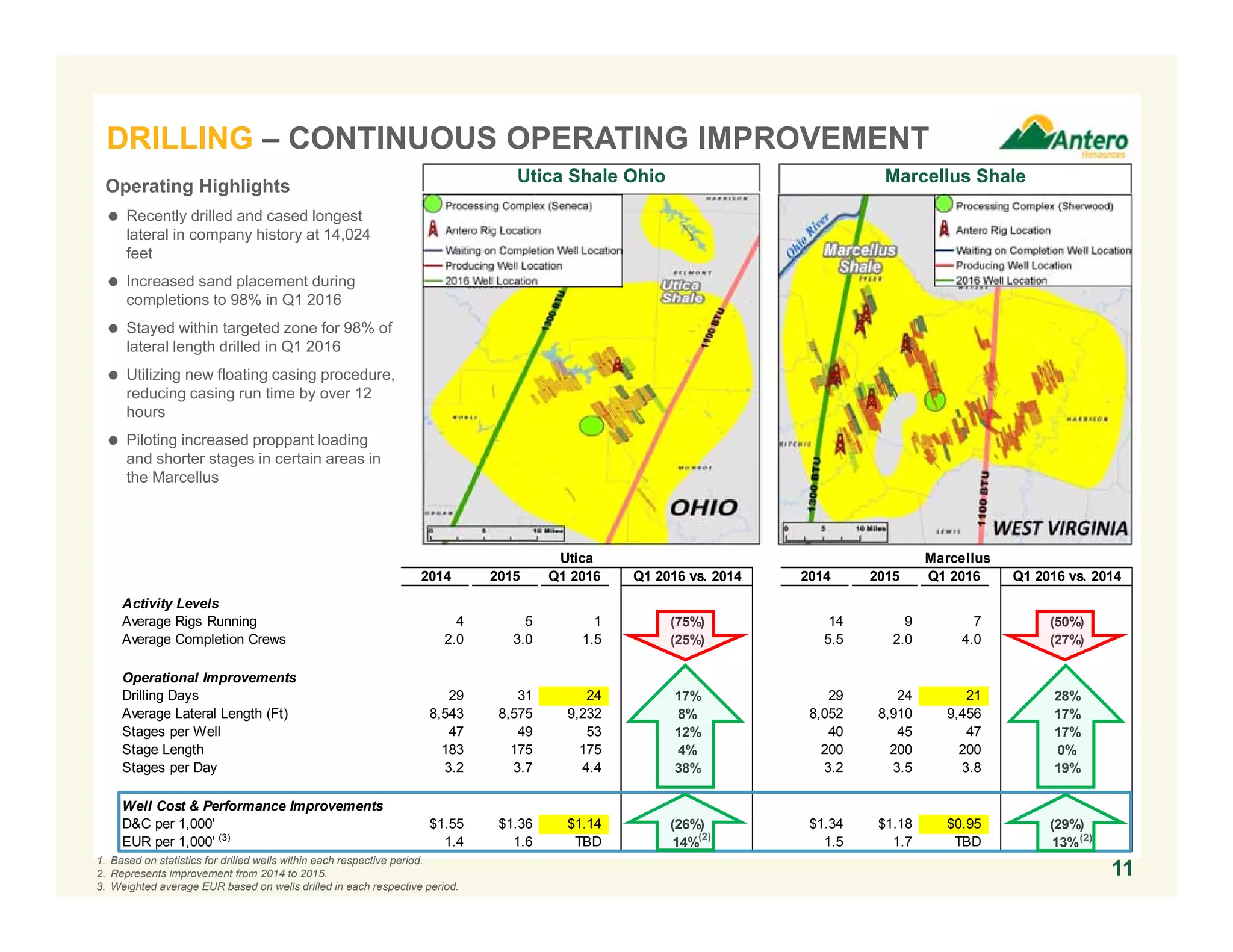

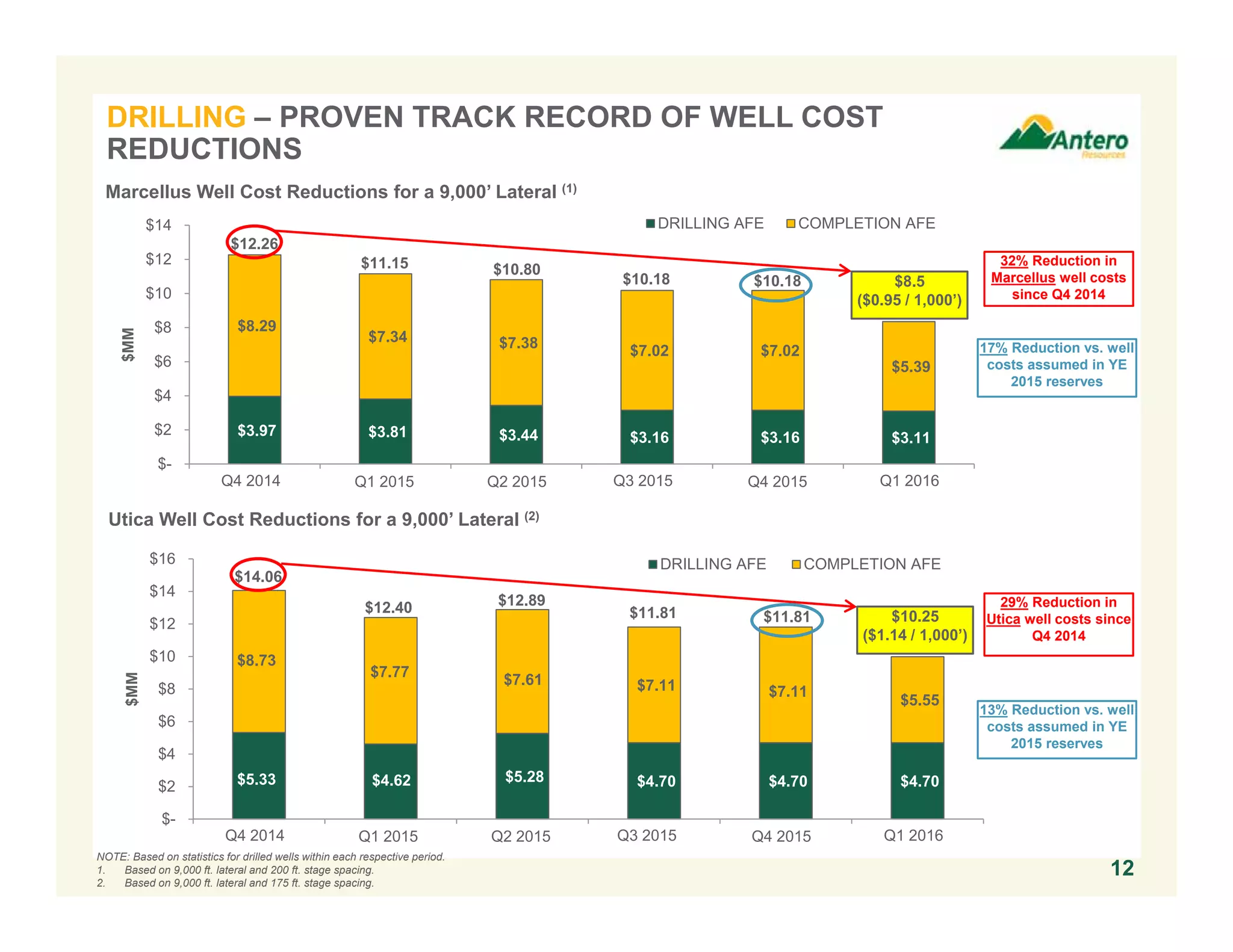

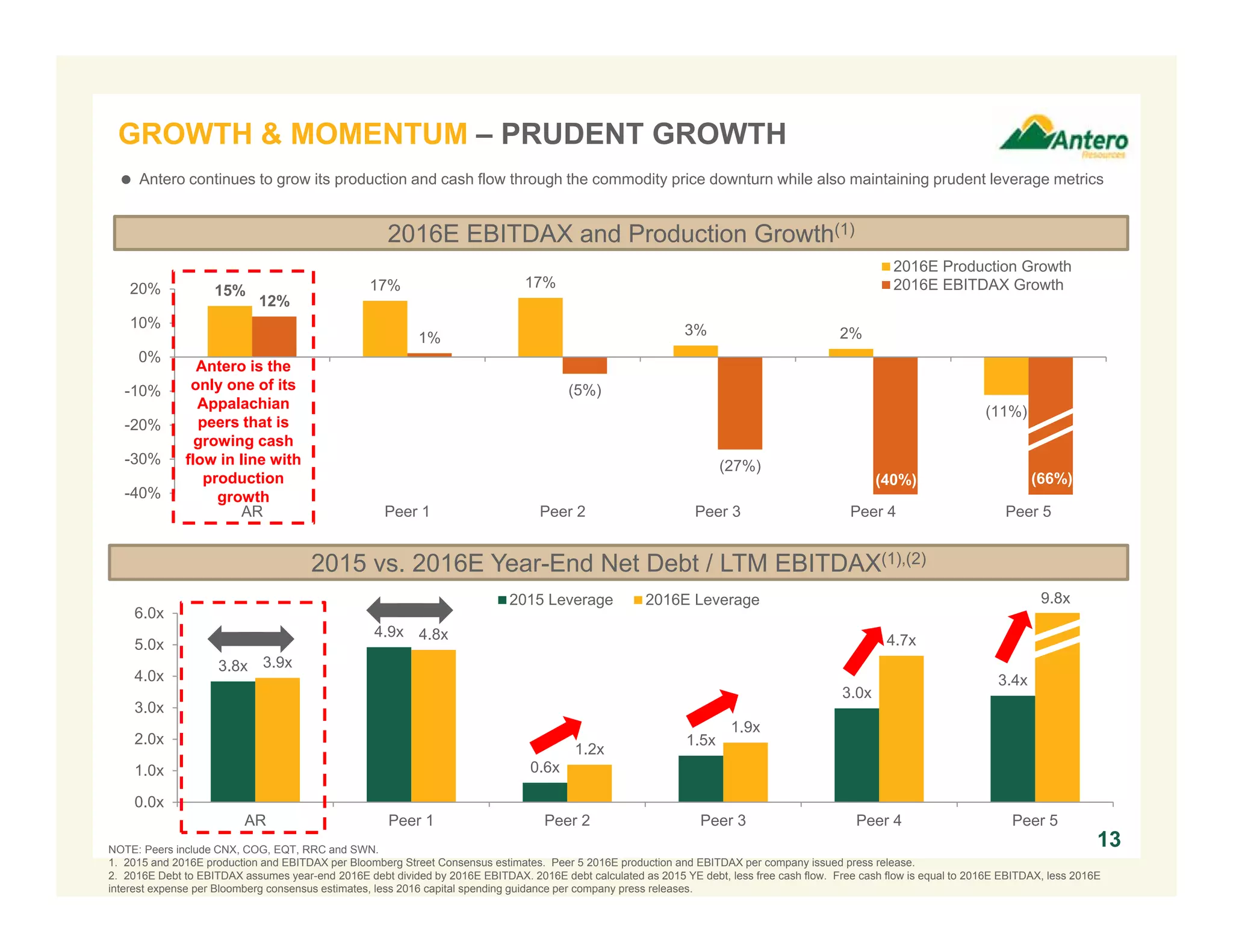

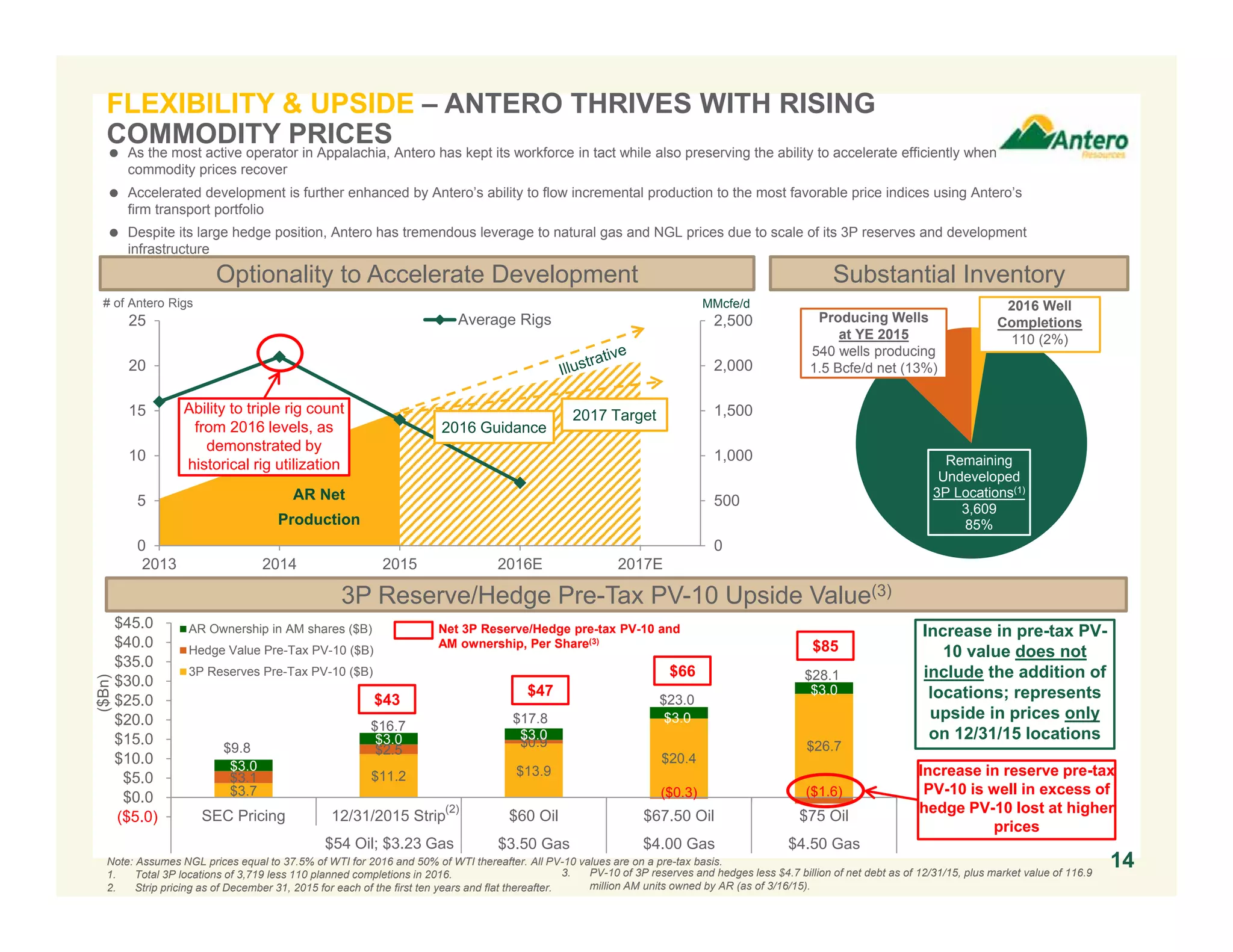

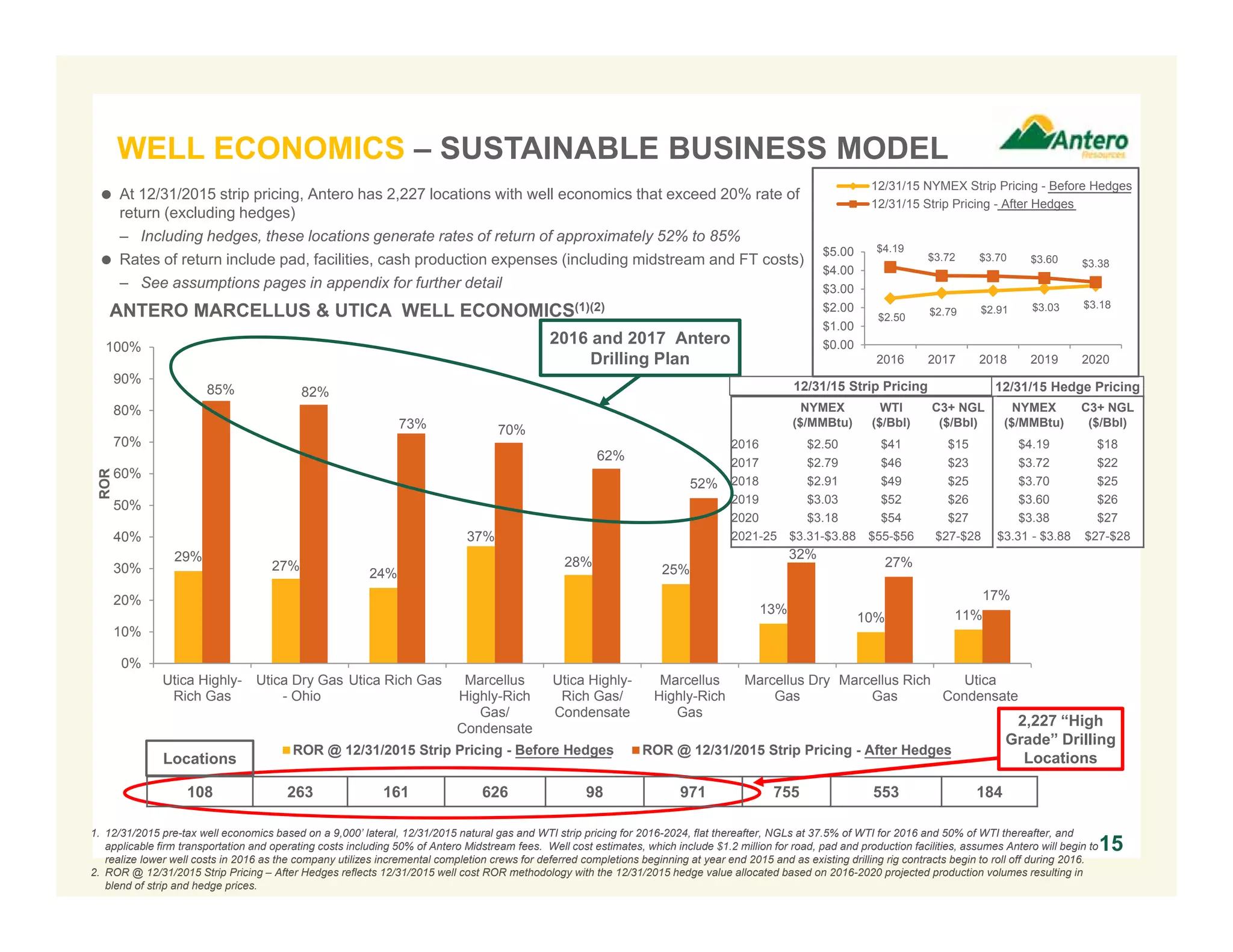

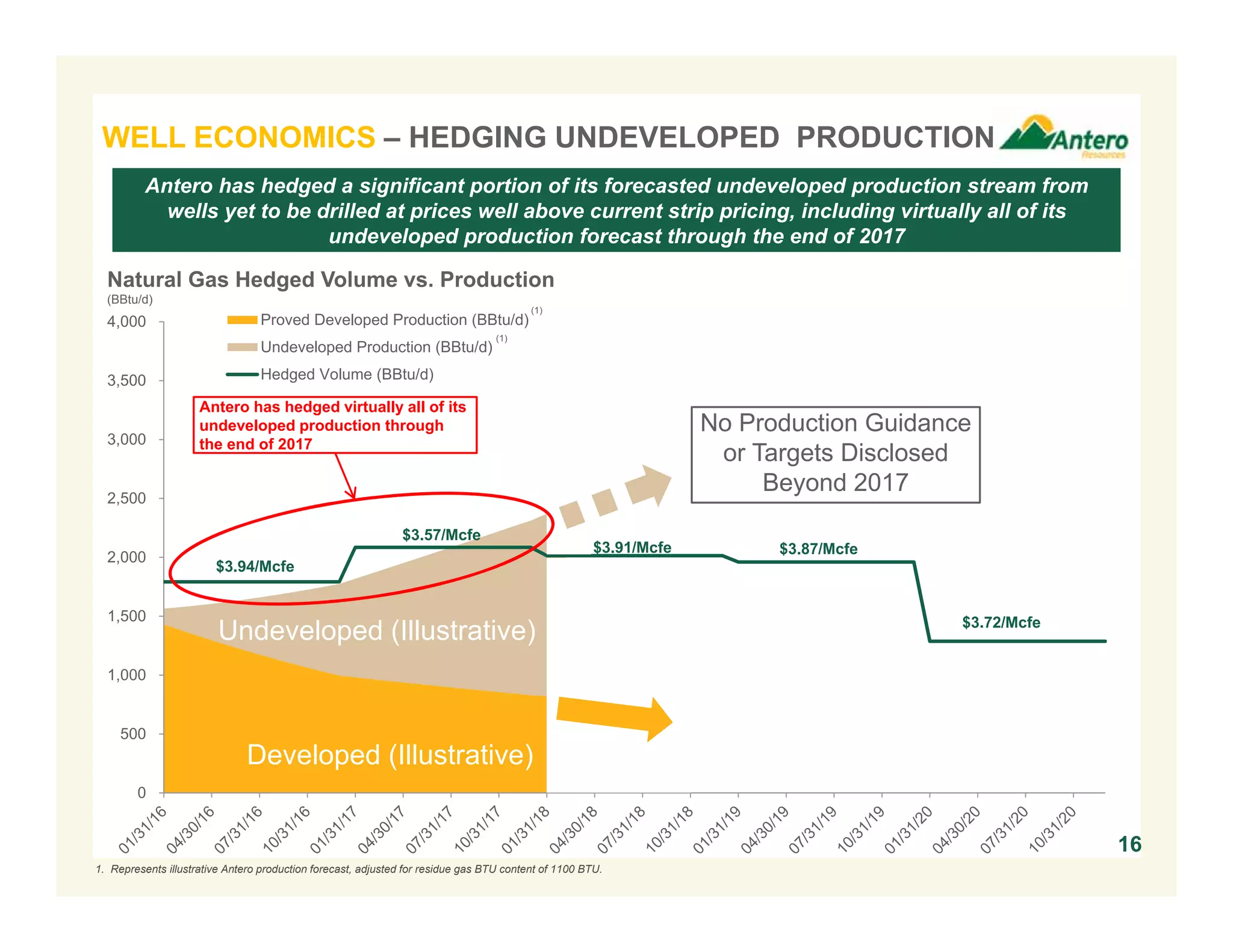

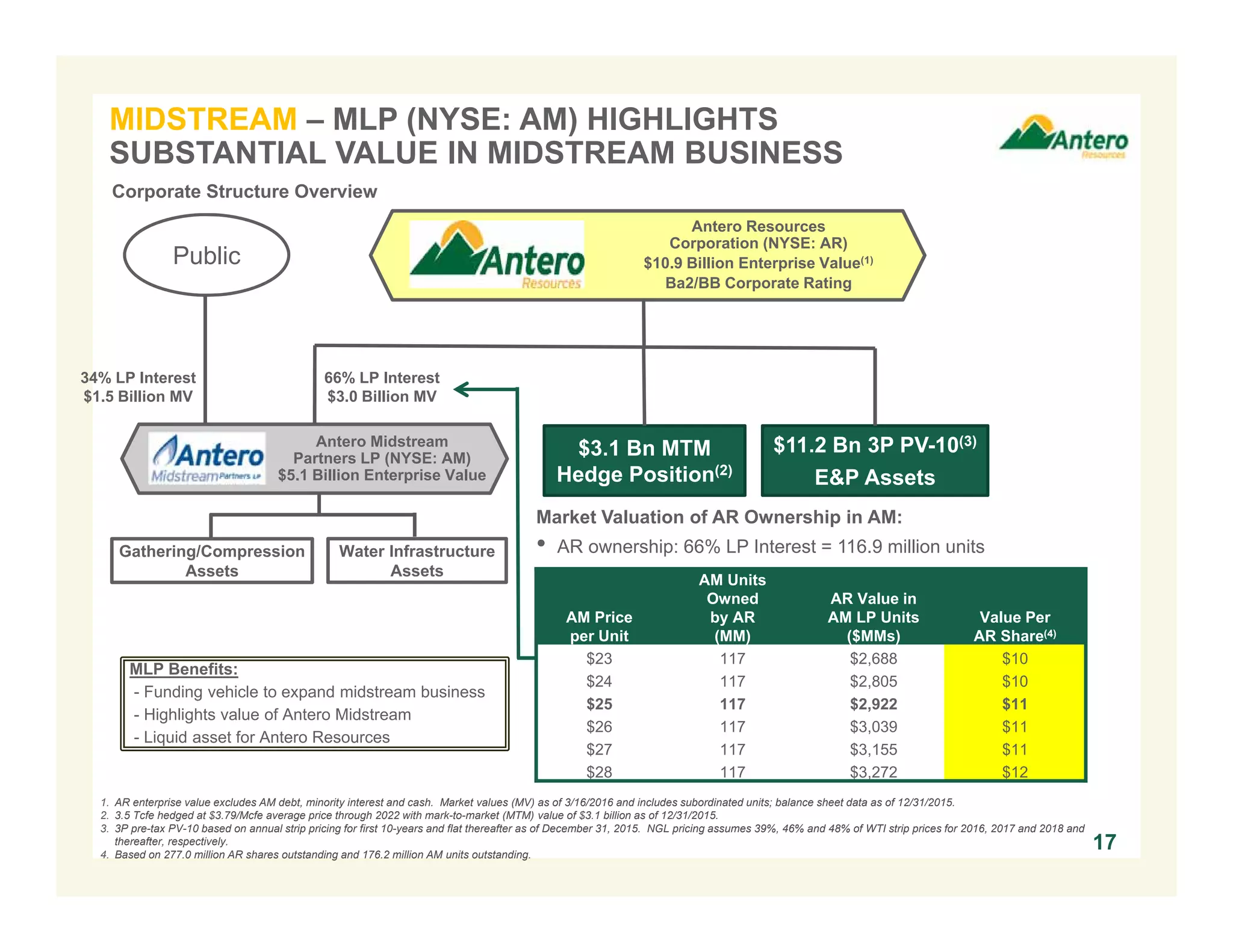

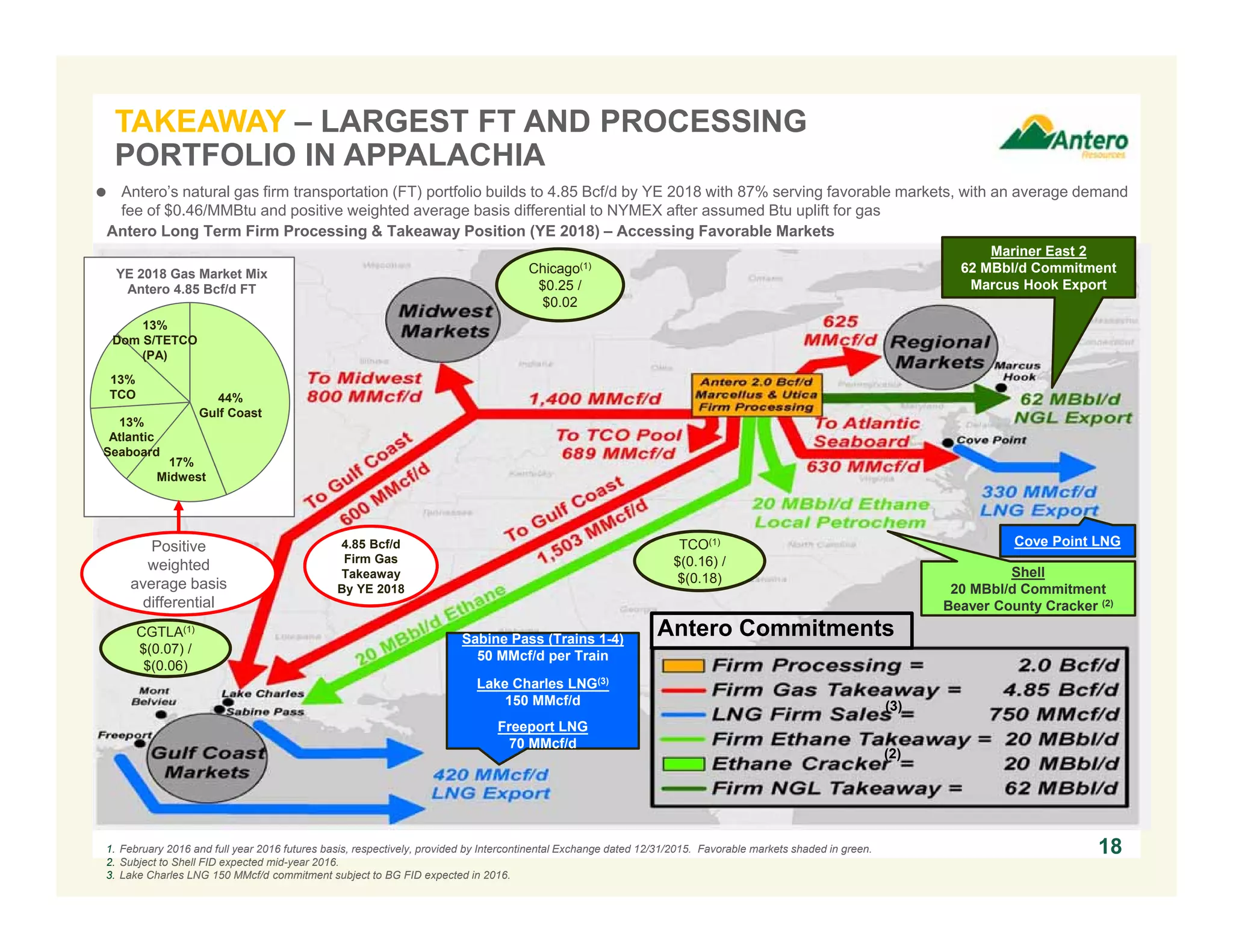

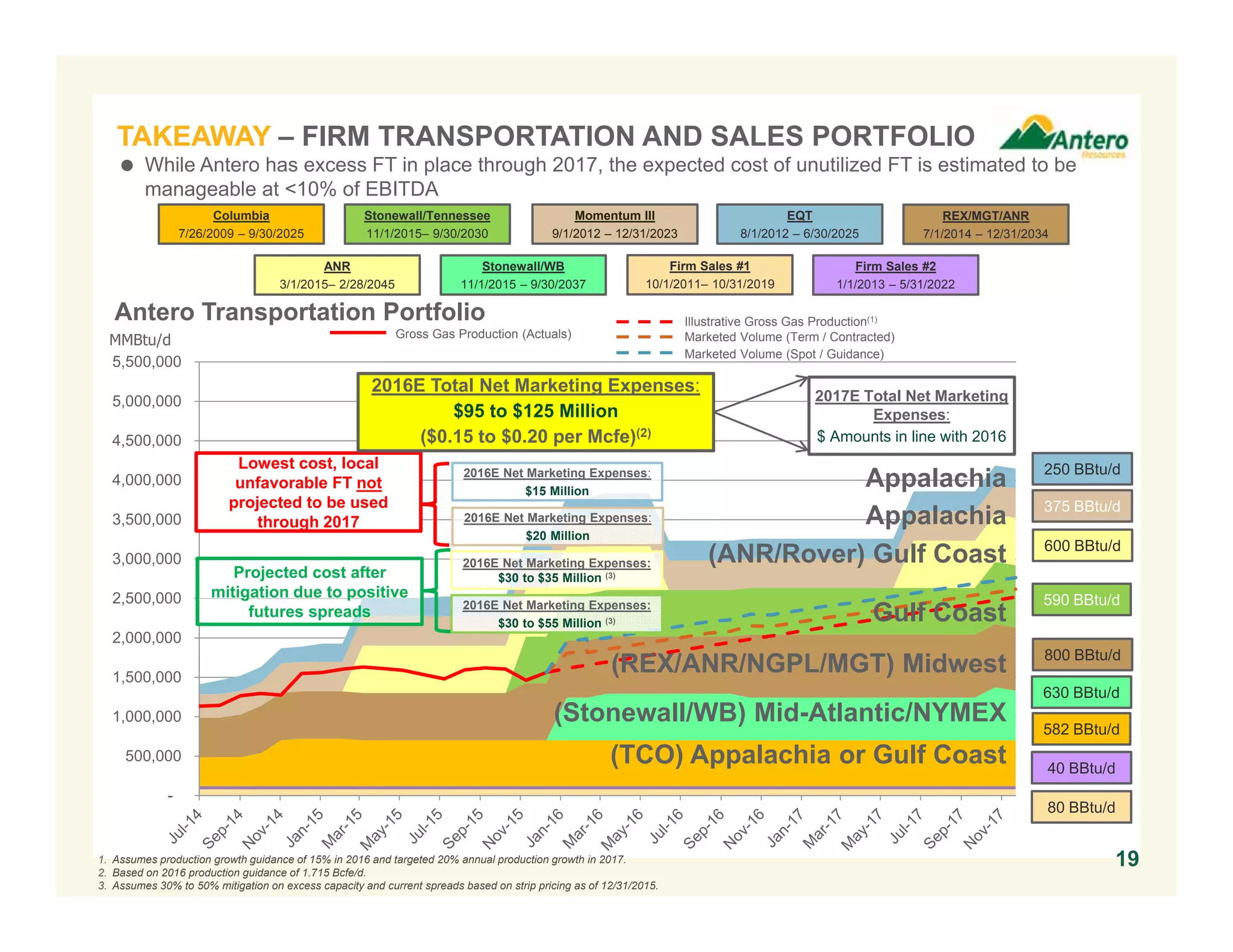

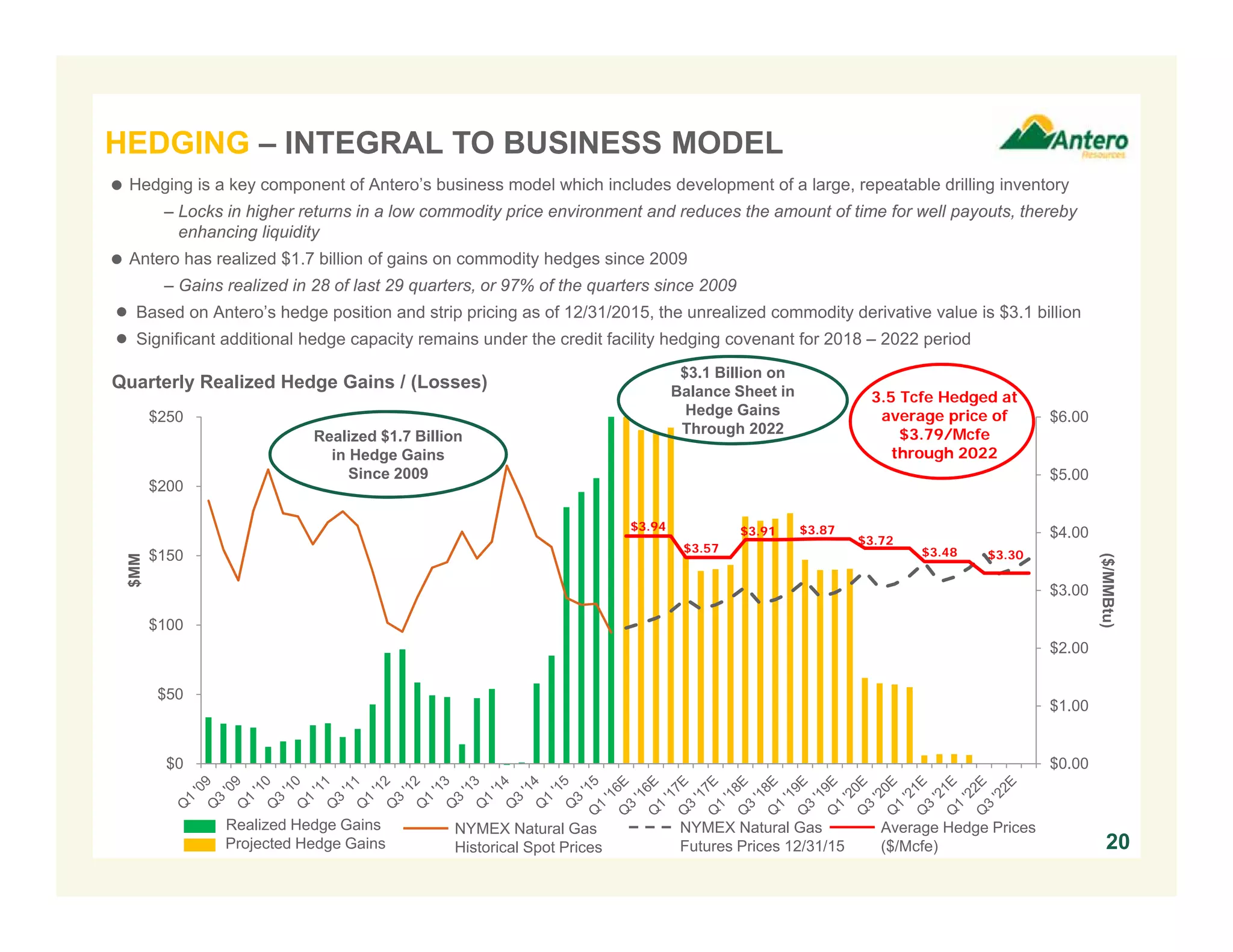

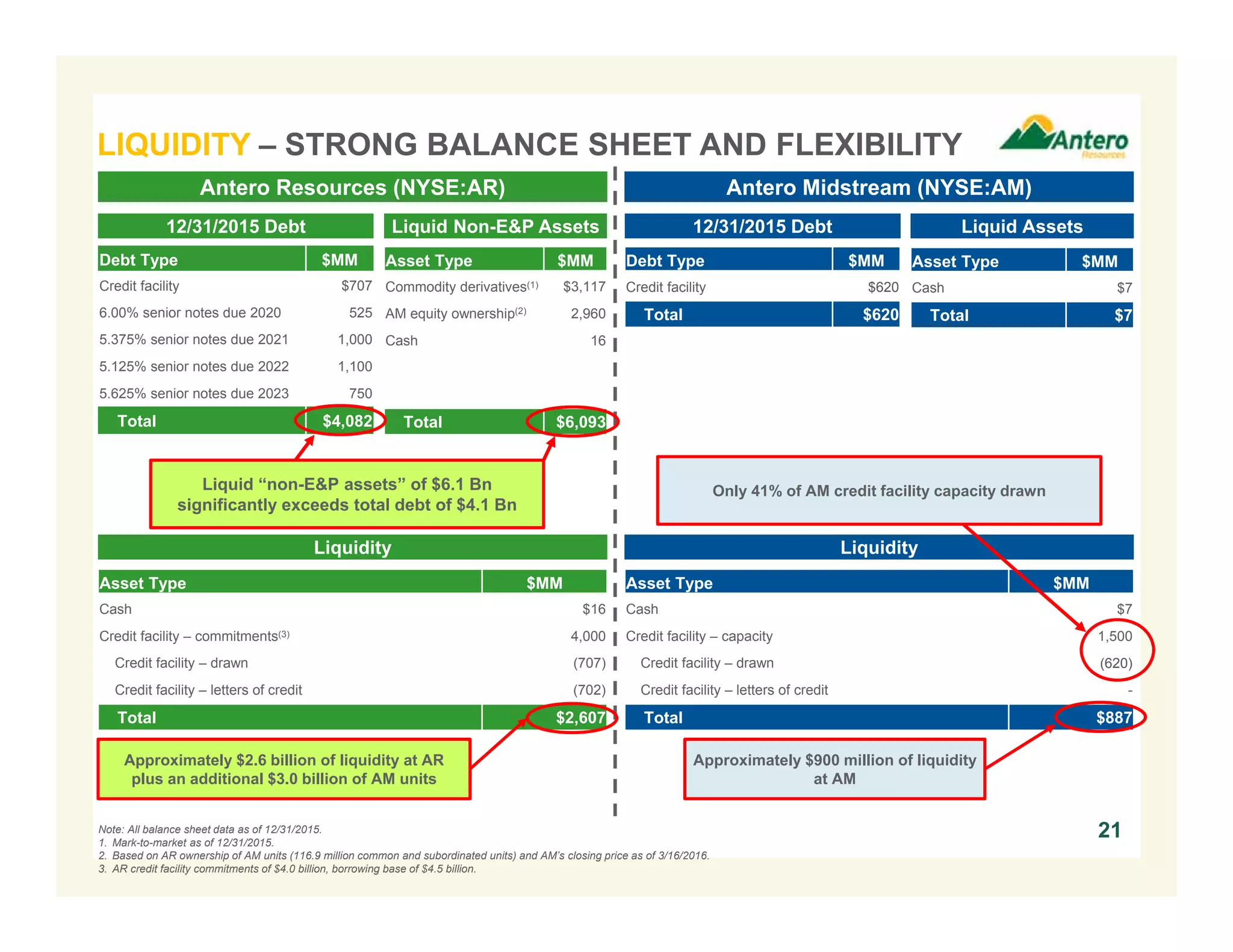

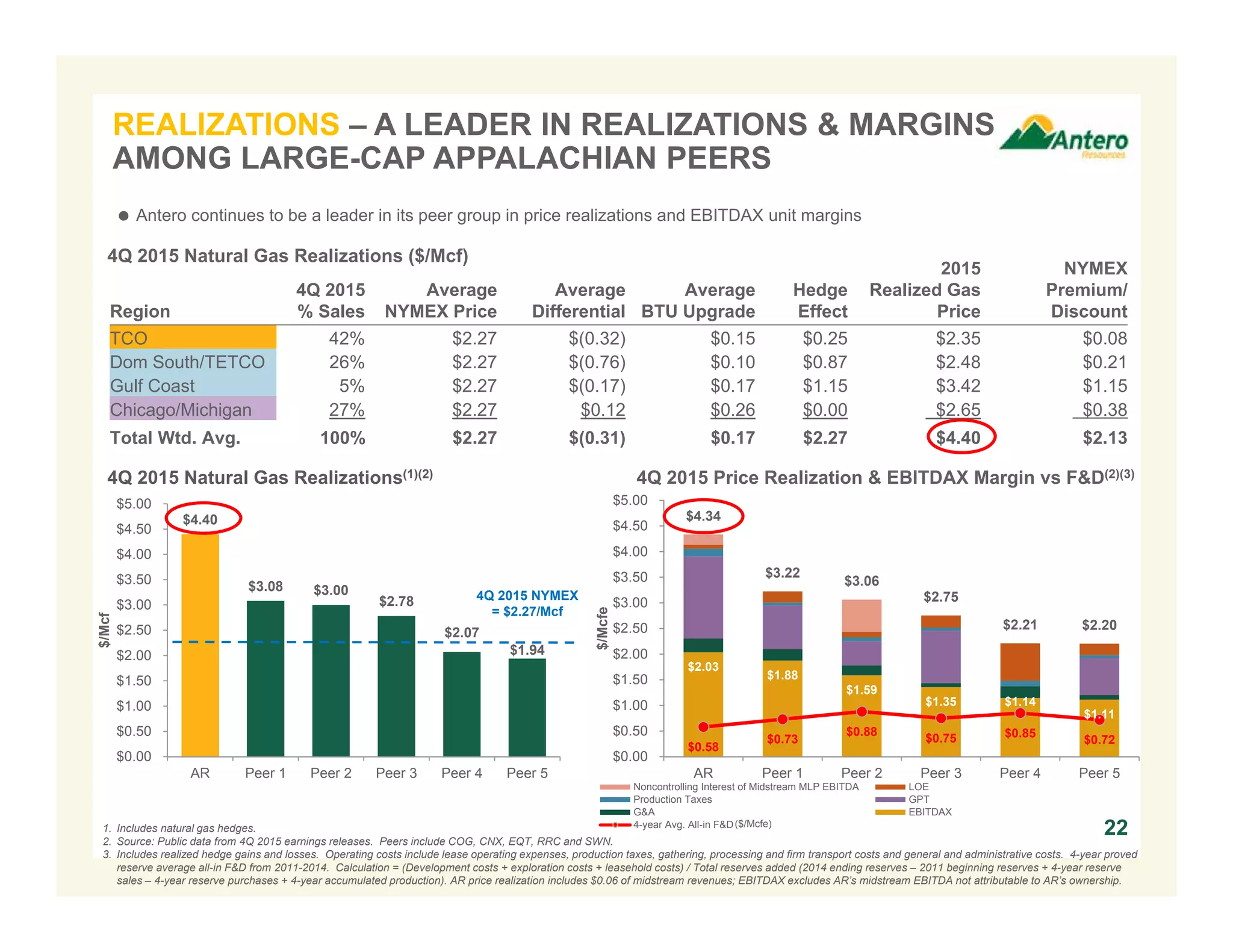

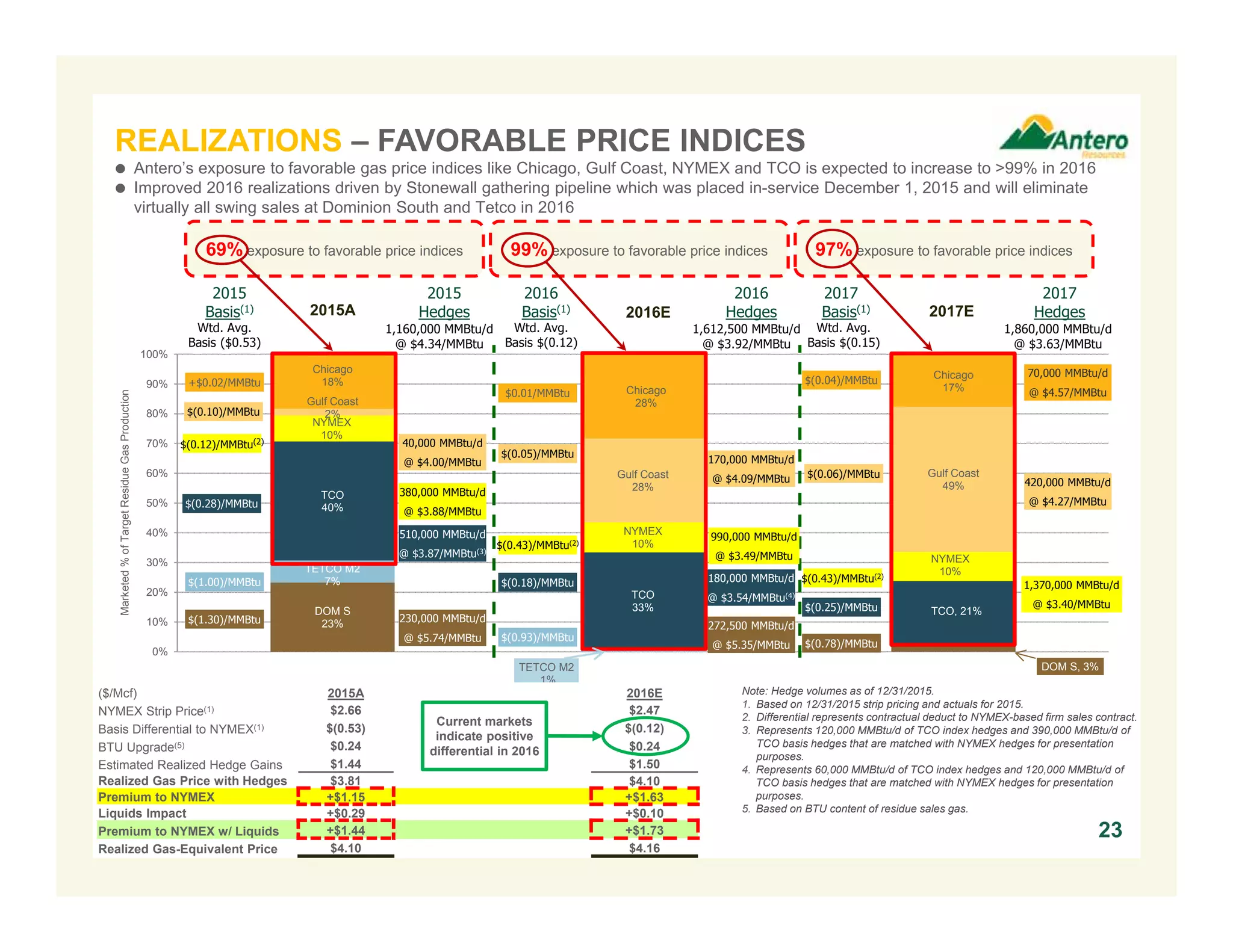

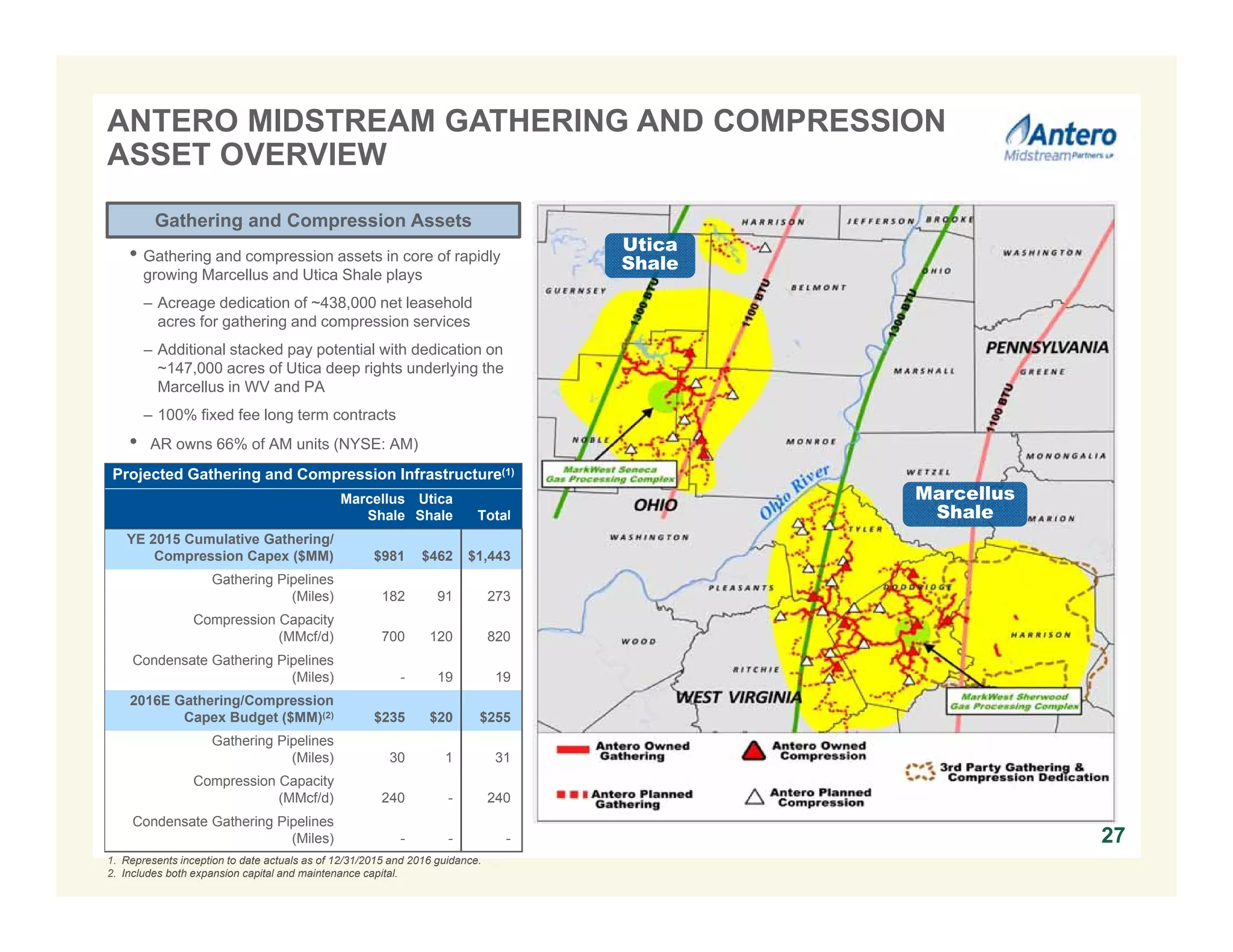

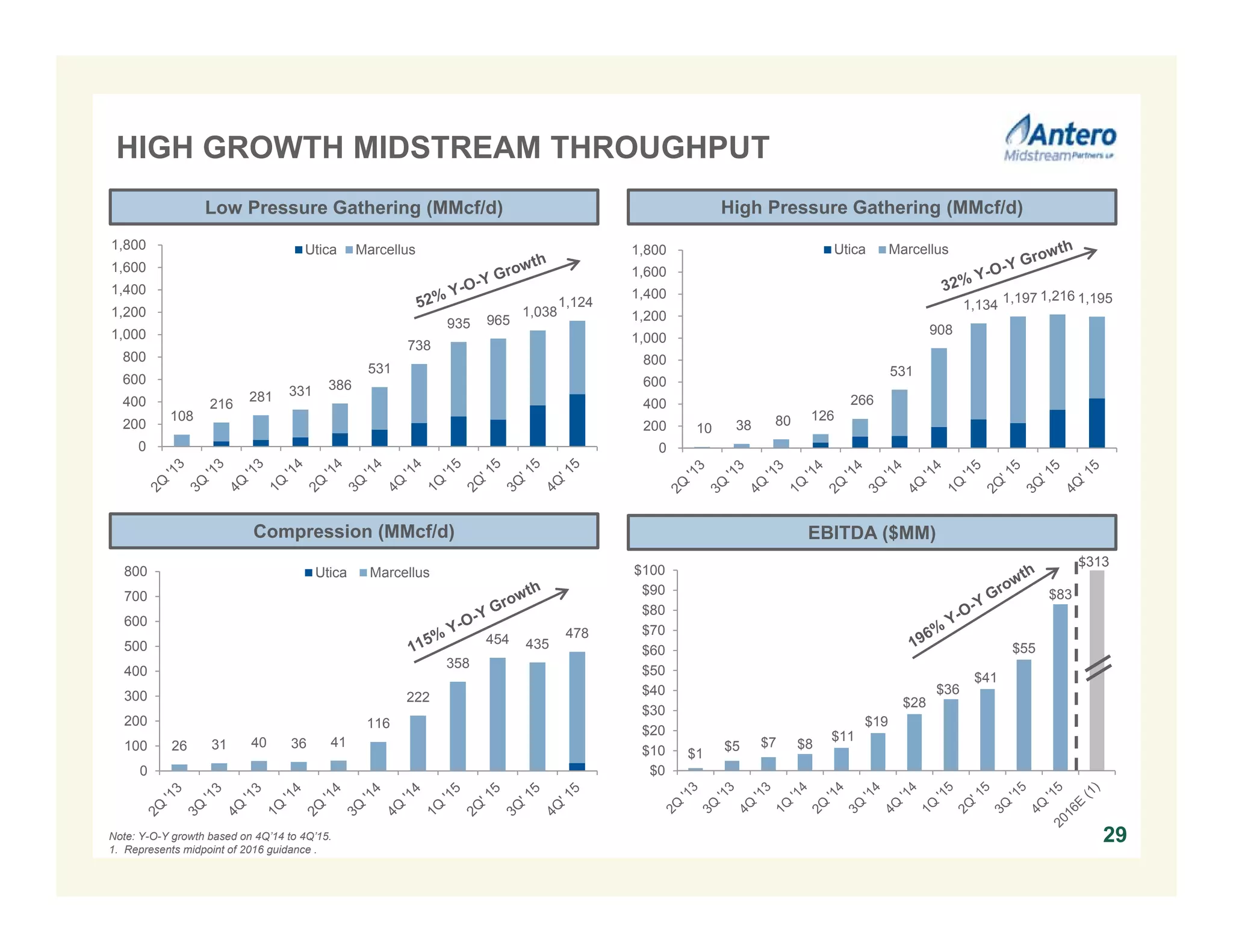

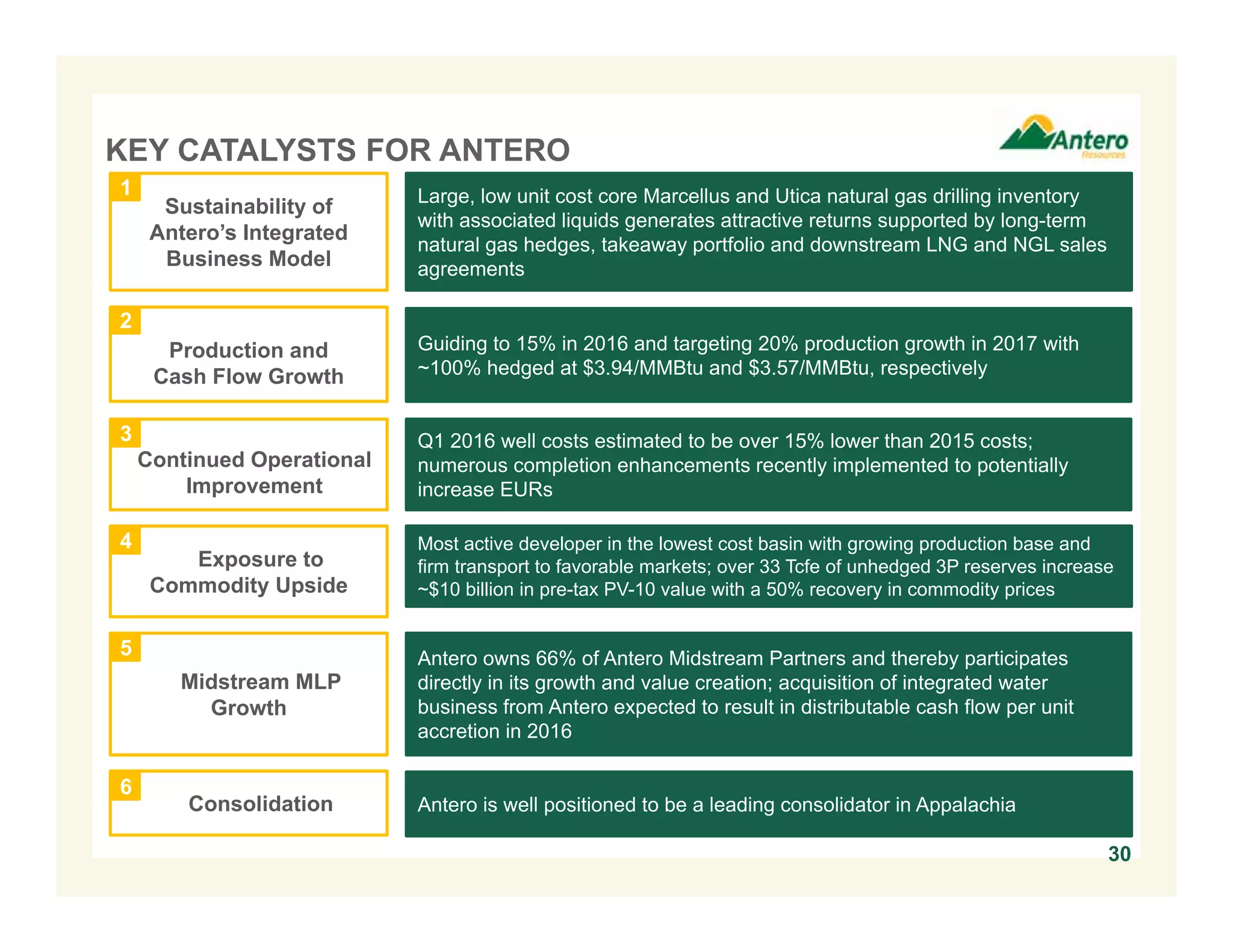

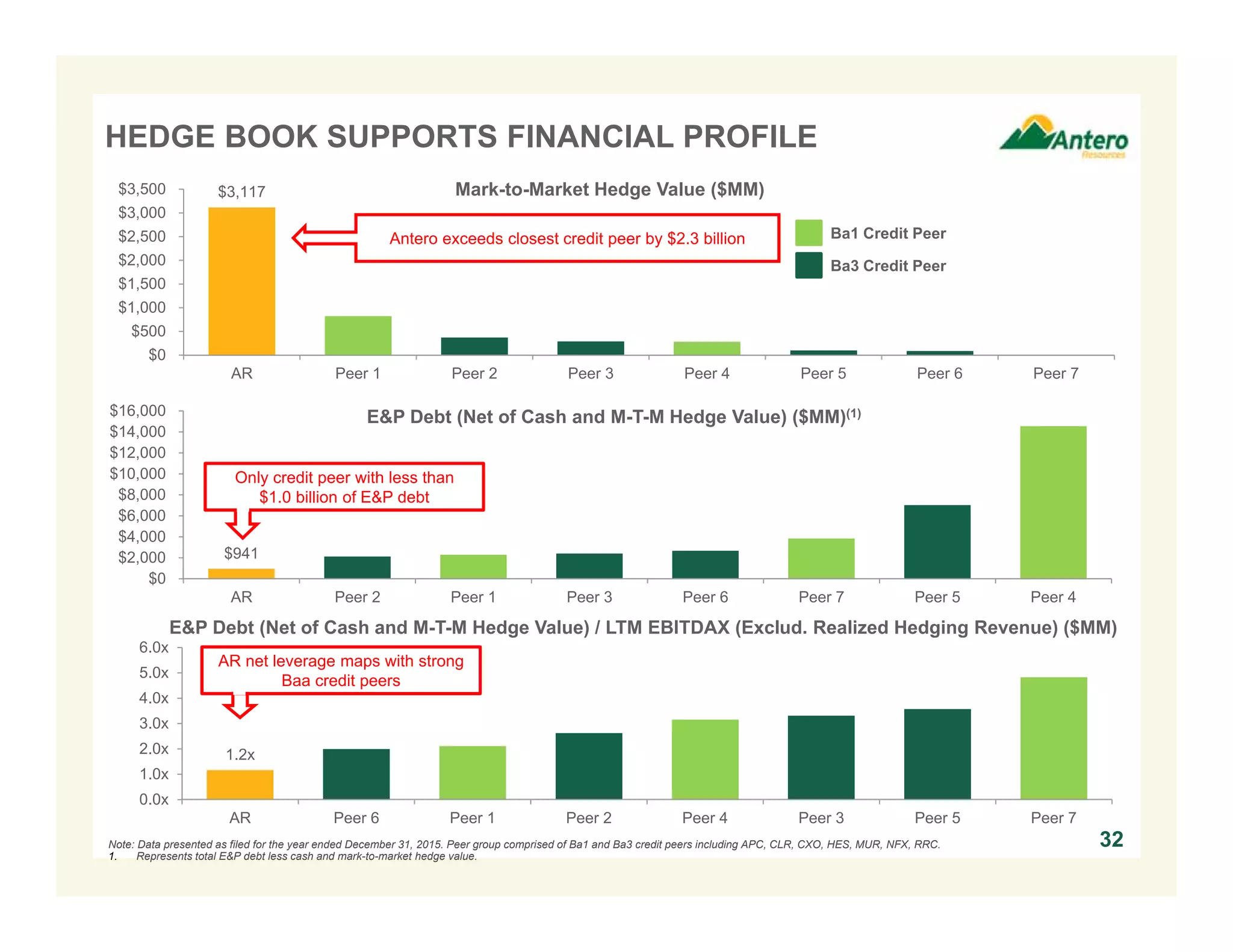

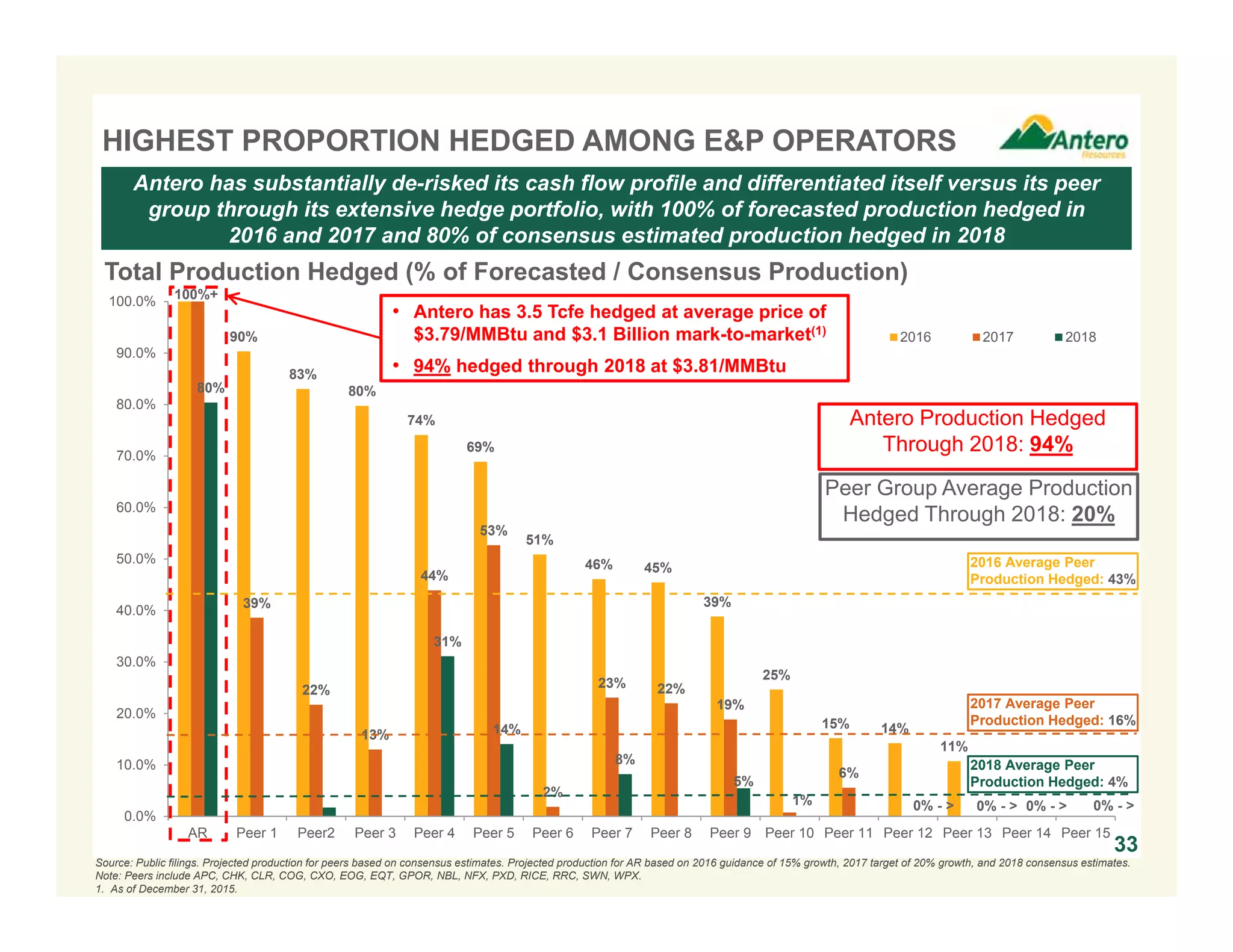

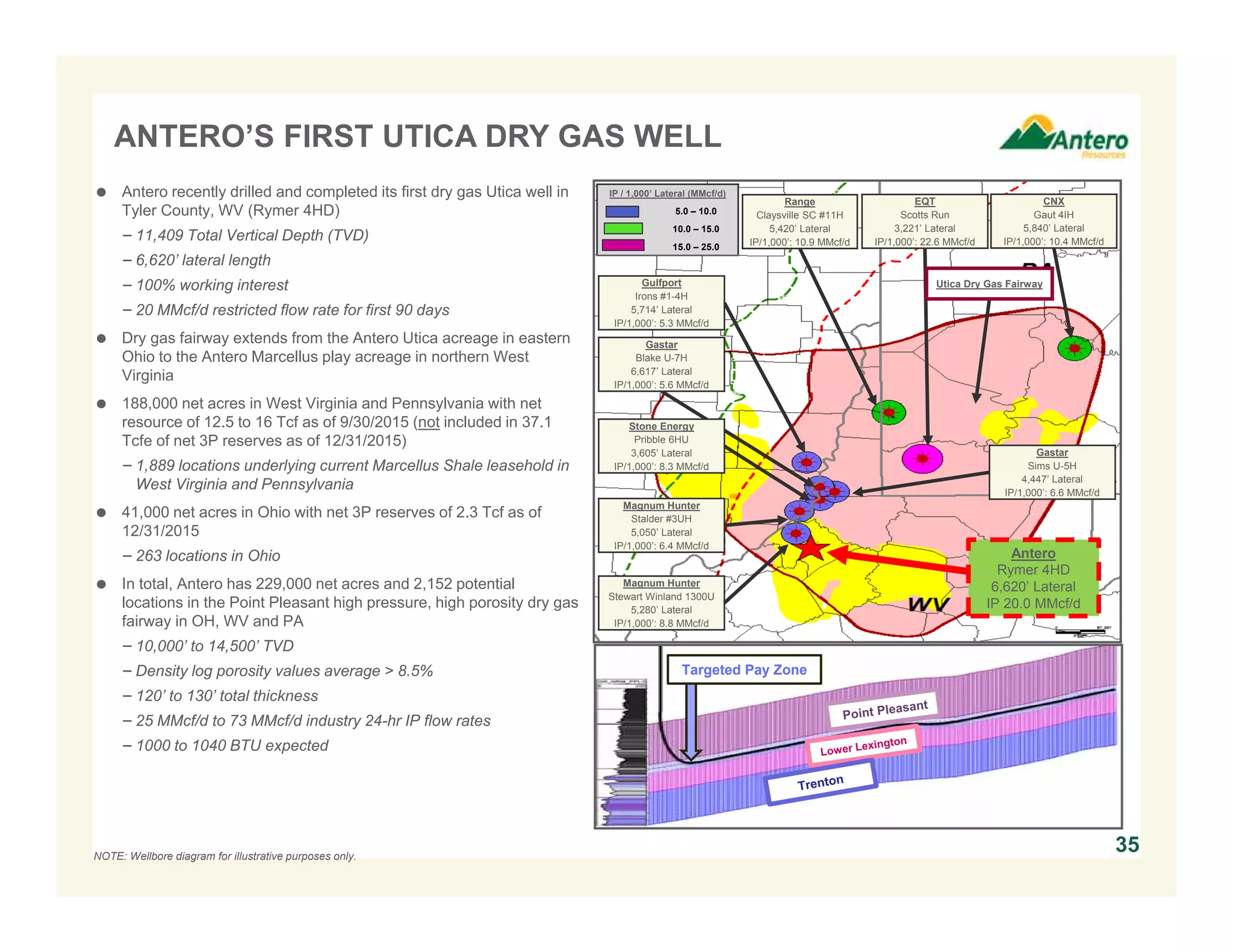

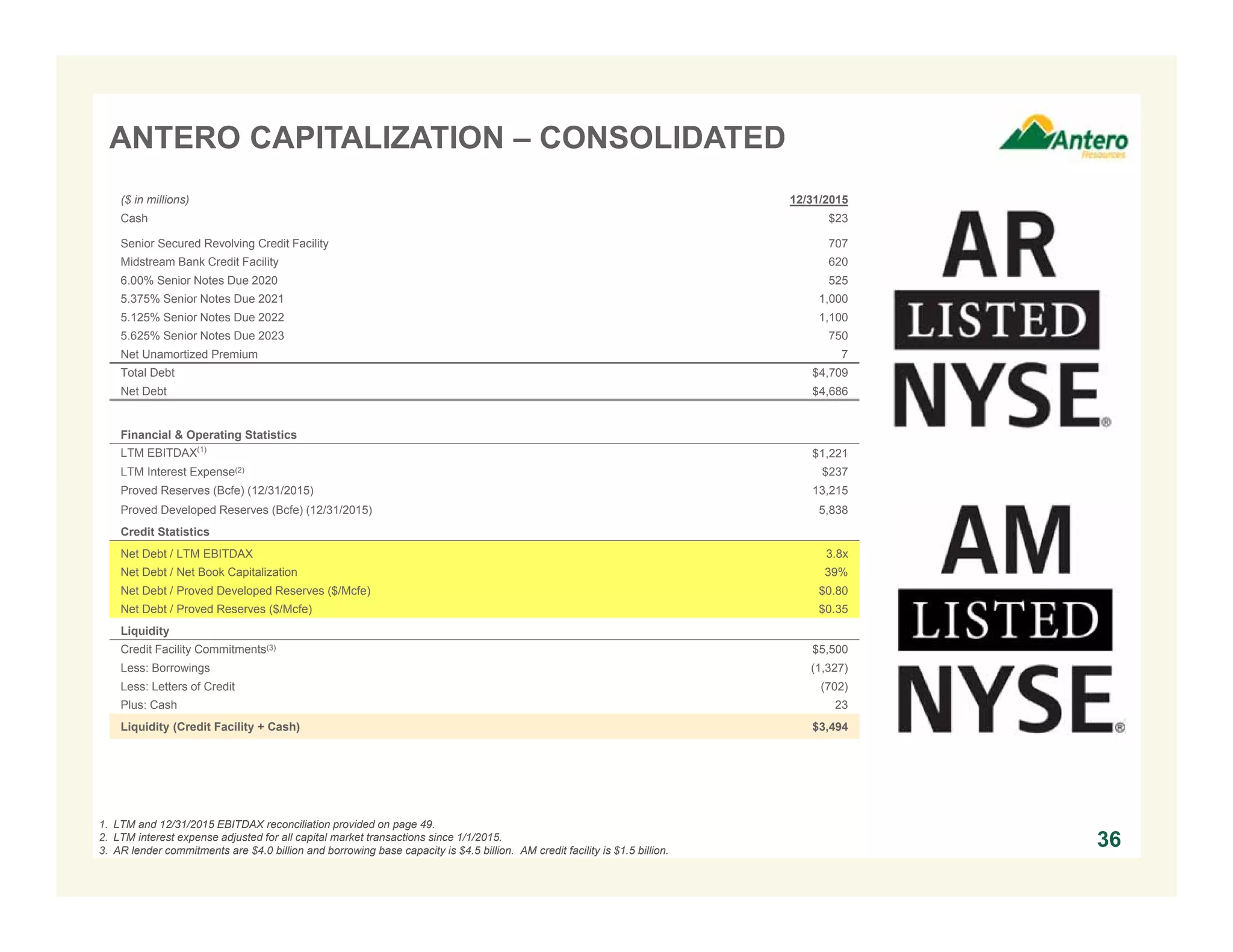

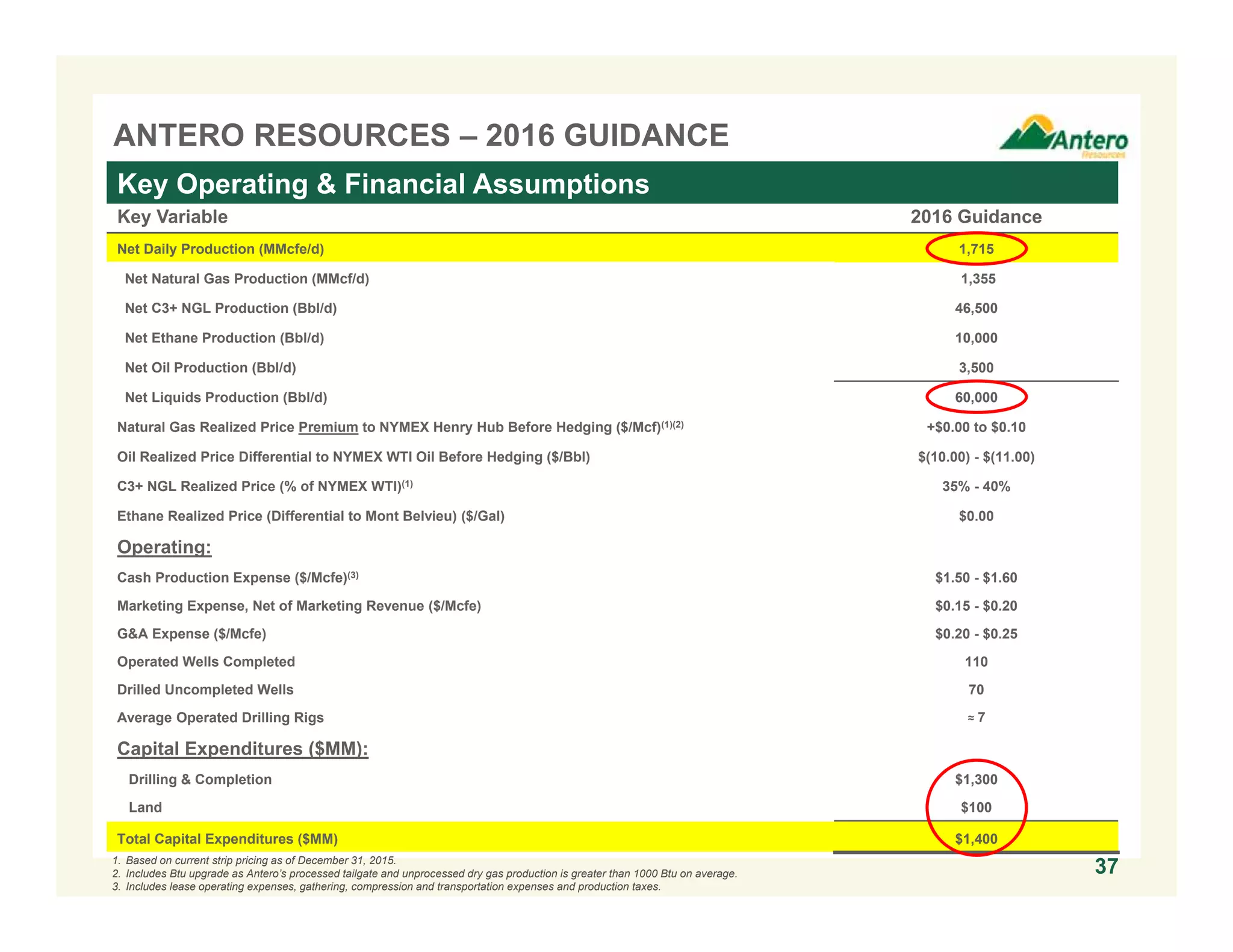

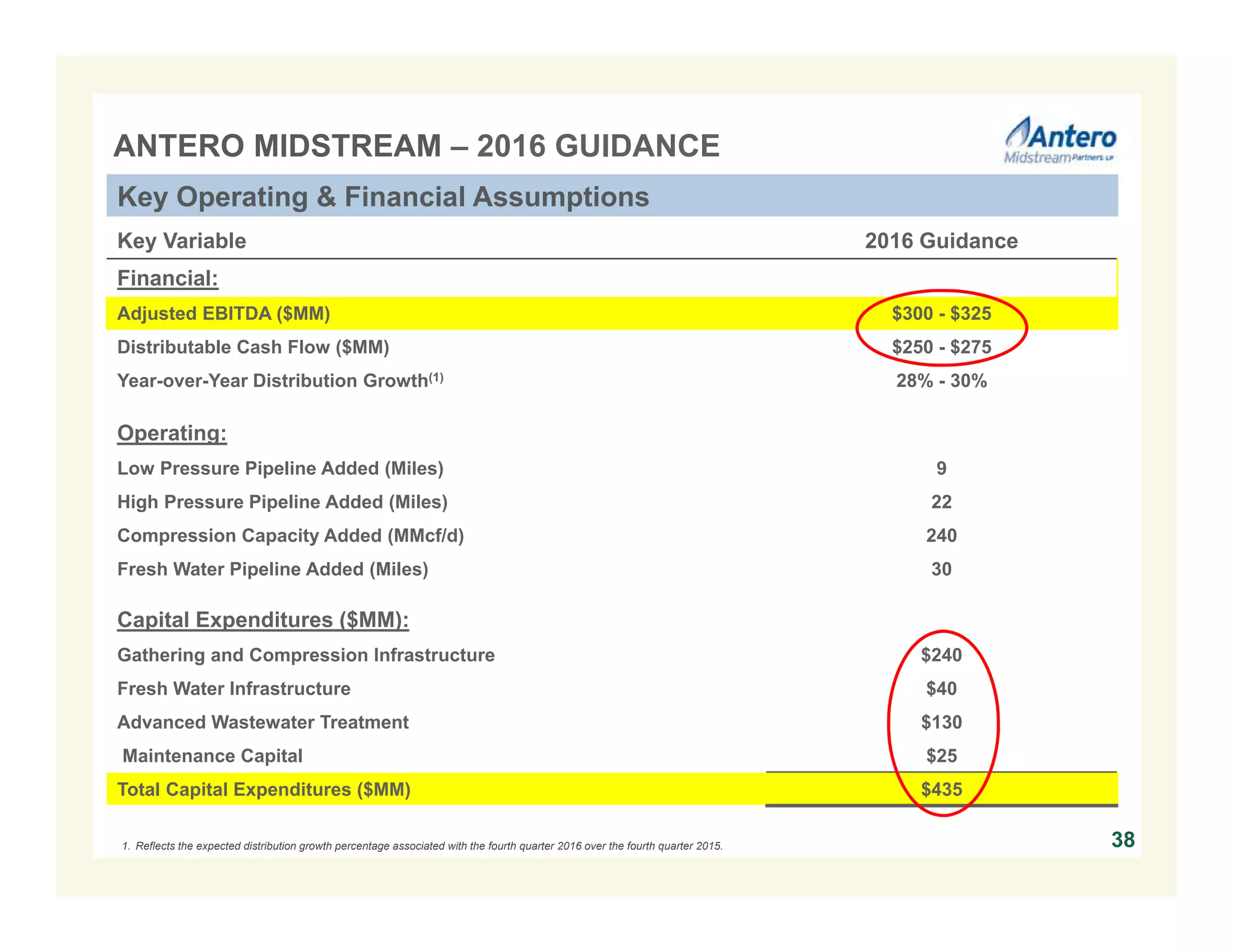

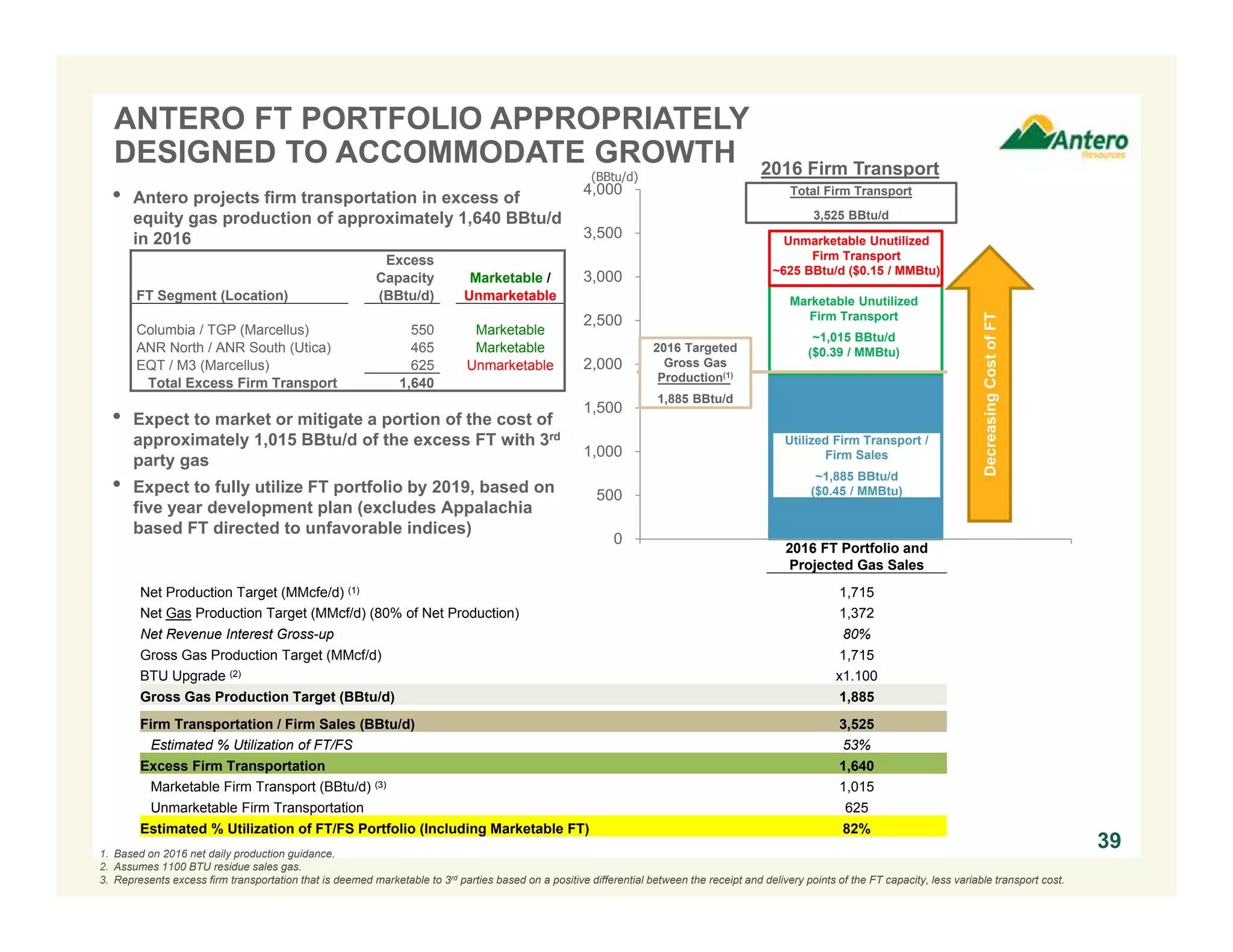

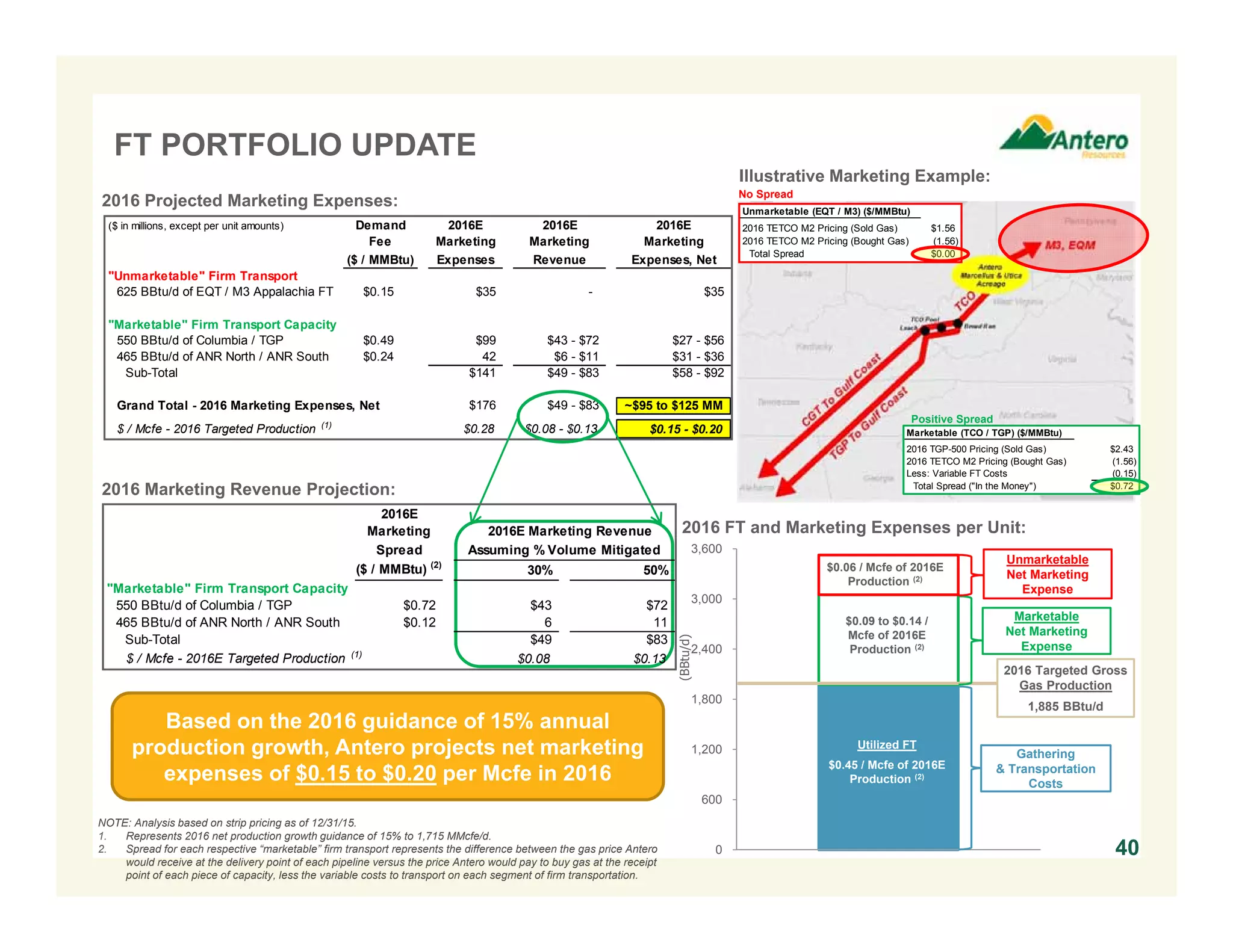

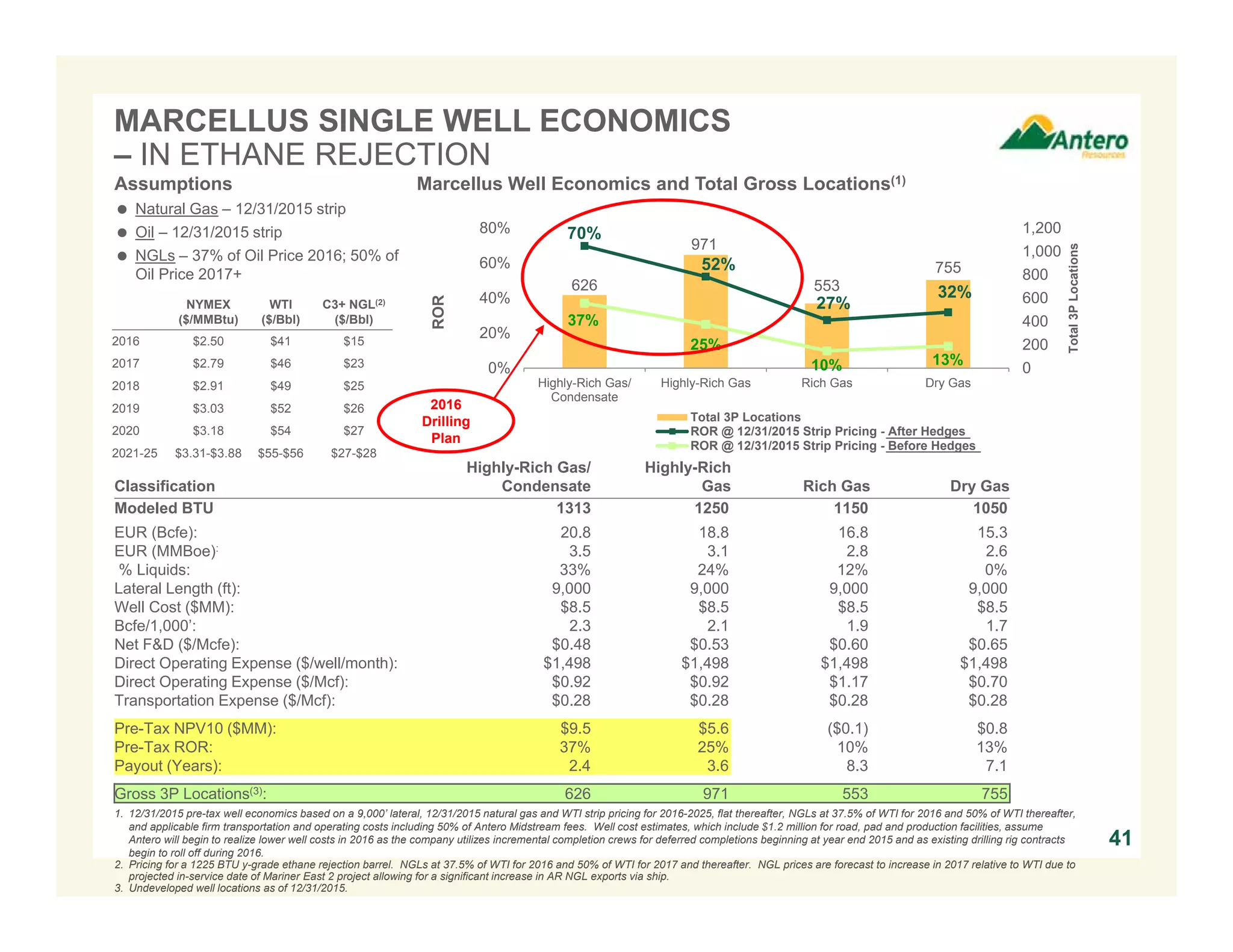

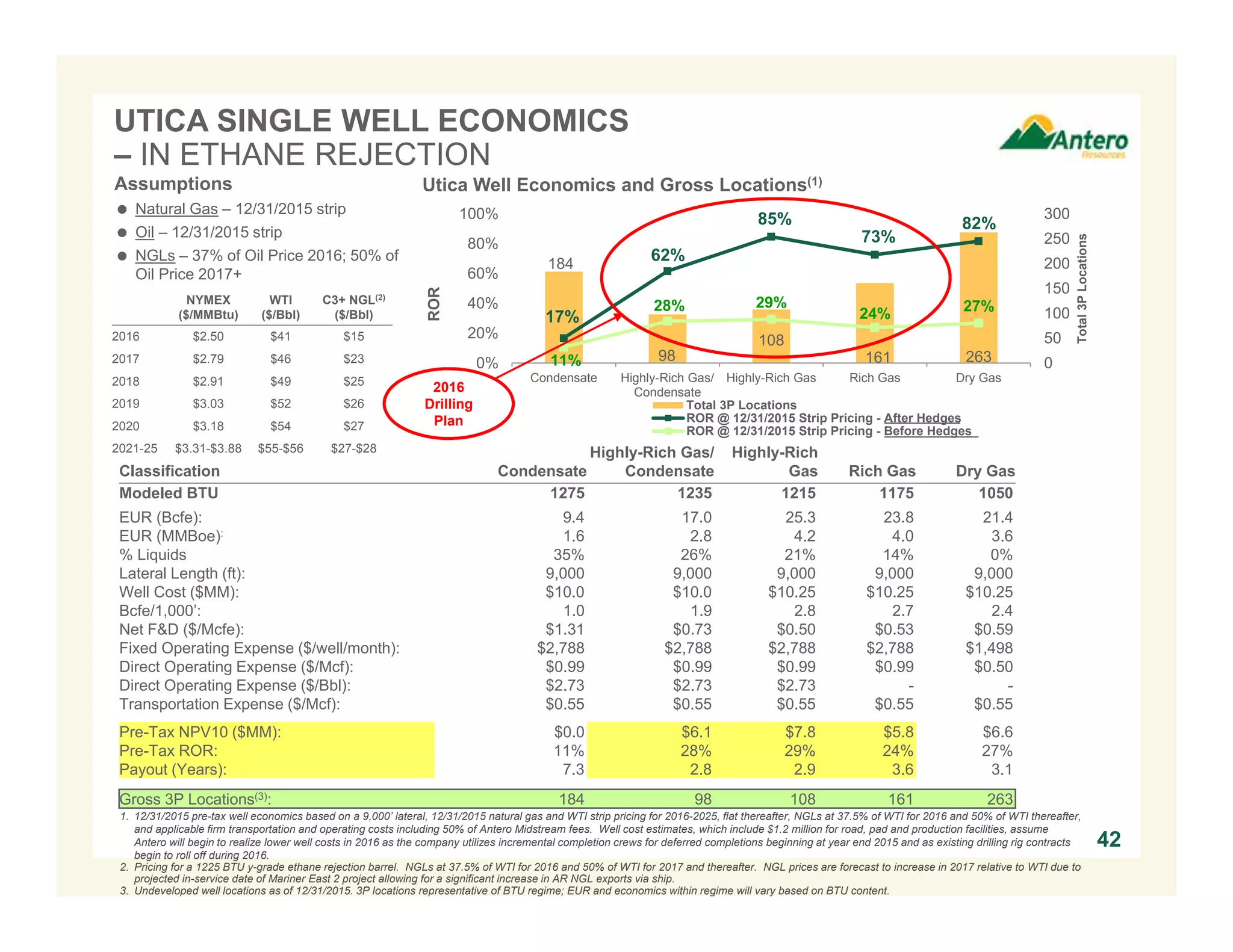

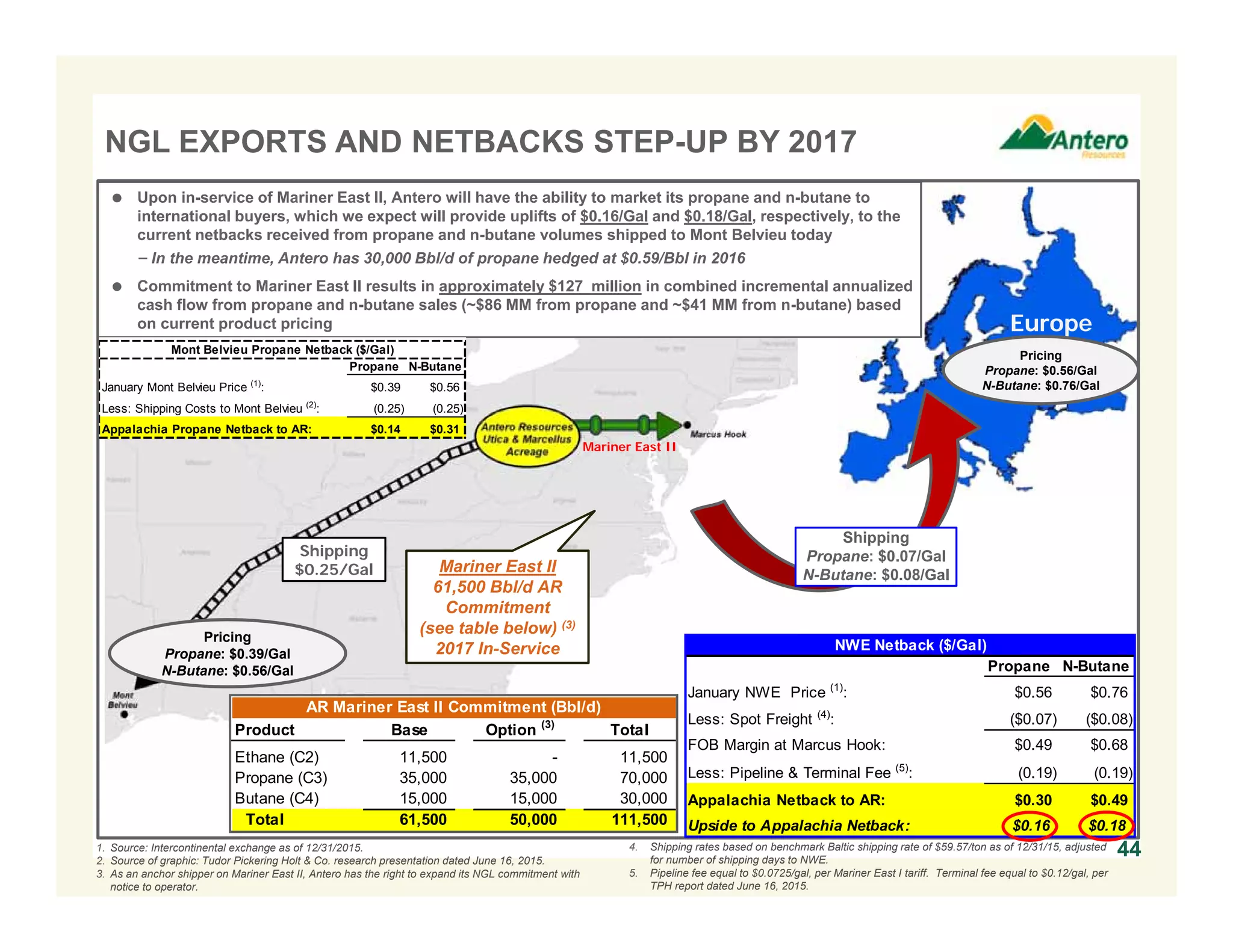

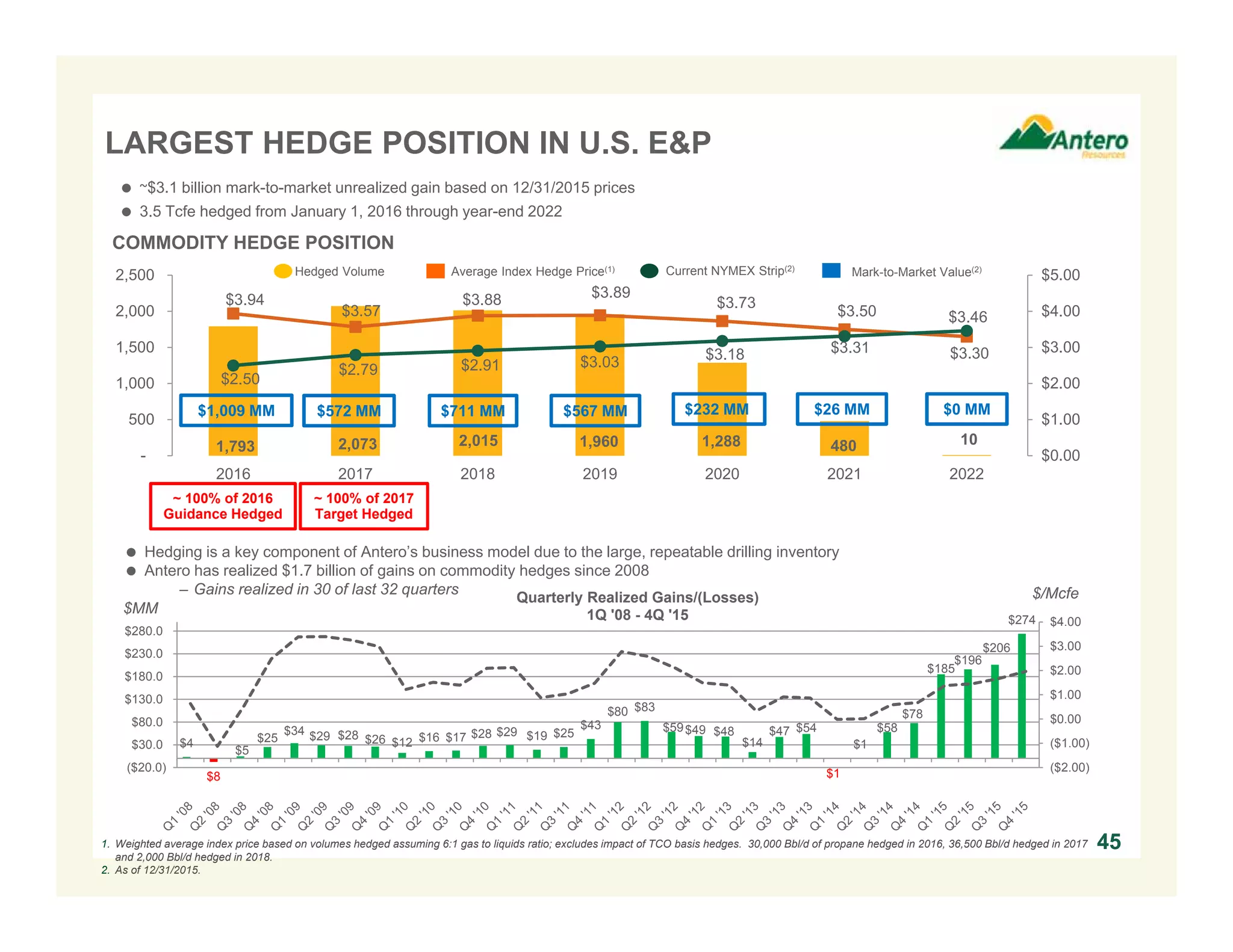

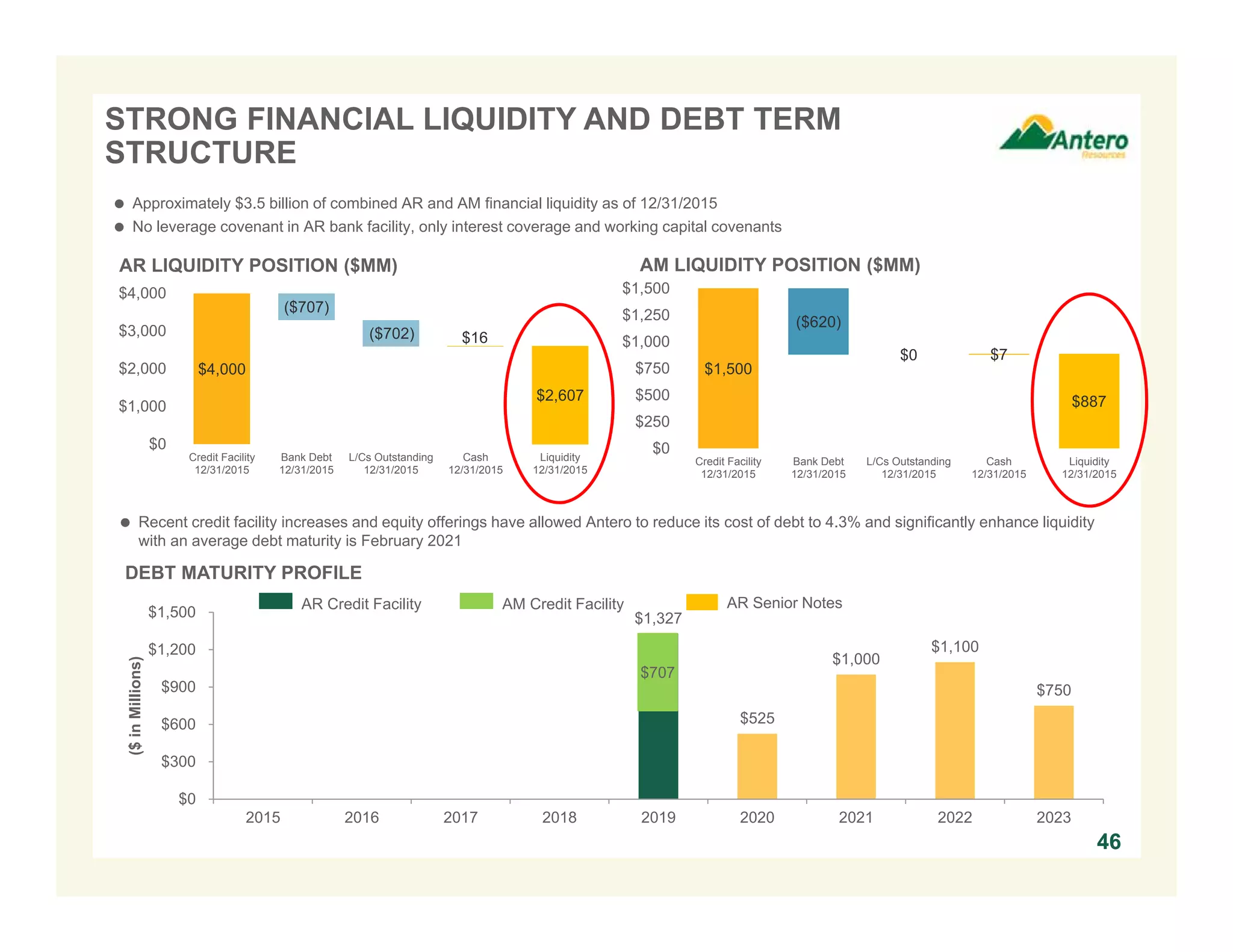

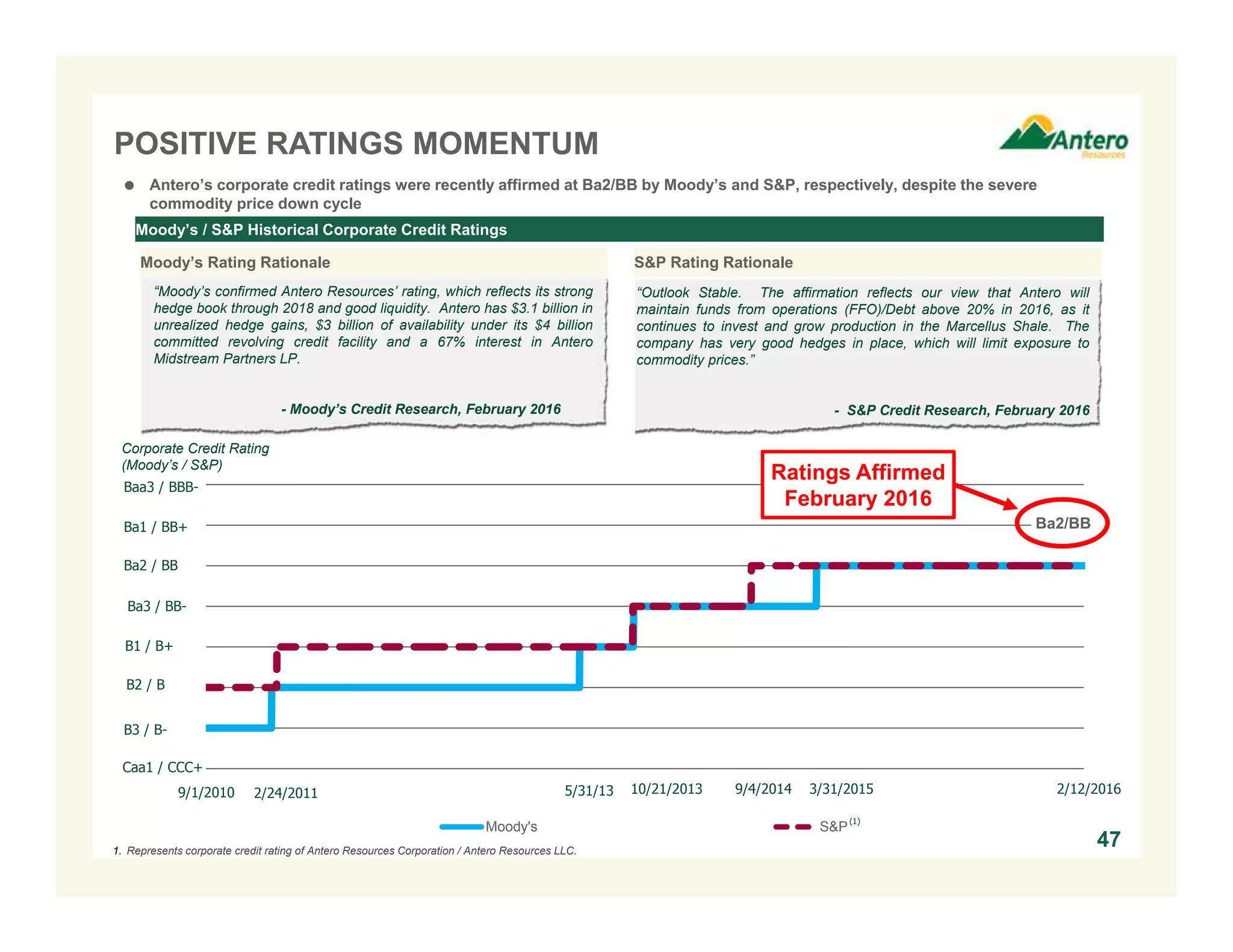

- It provides an overview of Antero's business strategy, competitive positioning, and financial strength. Key points include that Antero has significant liquidity, production sold forward at attractive prices, improving well economics, and the largest core drilling inventory position in the Marcellus and Utica plays.