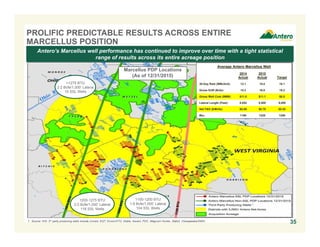

The document summarizes an asset acquisition by Antero Resources Corporation of 55,000 net acres of core Marcellus and Utica shale assets for $450 million. The acquisition significantly increases Antero's acreage position and drilling inventory in the core of the Marcellus and Utica plays. Specifically, the acquisition adds over 4.1 trillion cubic feet of estimated reserves and over 1,000 new drilling locations. The acquired acreage will also be dedicated to Antero Midstream Partners for gathering and processing, providing additional growth opportunities. The acquisition enhances Antero's position in the top producing regions and improves the economic returns of its drilling program.