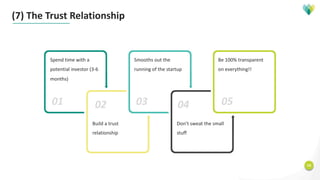

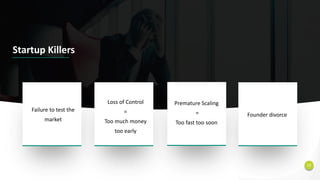

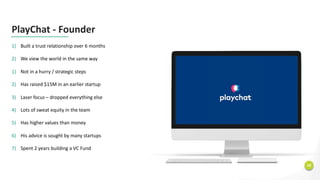

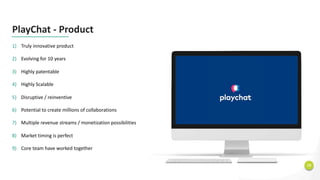

The document outlines strategies for securing seed funding for startups, emphasizing the importance of innovation, collaboration among multiple founders, and building trust with investors. It highlights that only a small percentage of startups succeed and stresses the need for a supportive ecosystem to foster more 'unicorns'. Key points include the significance of sweat equity, the traits of effective teams, and the critical role of investor relationships.