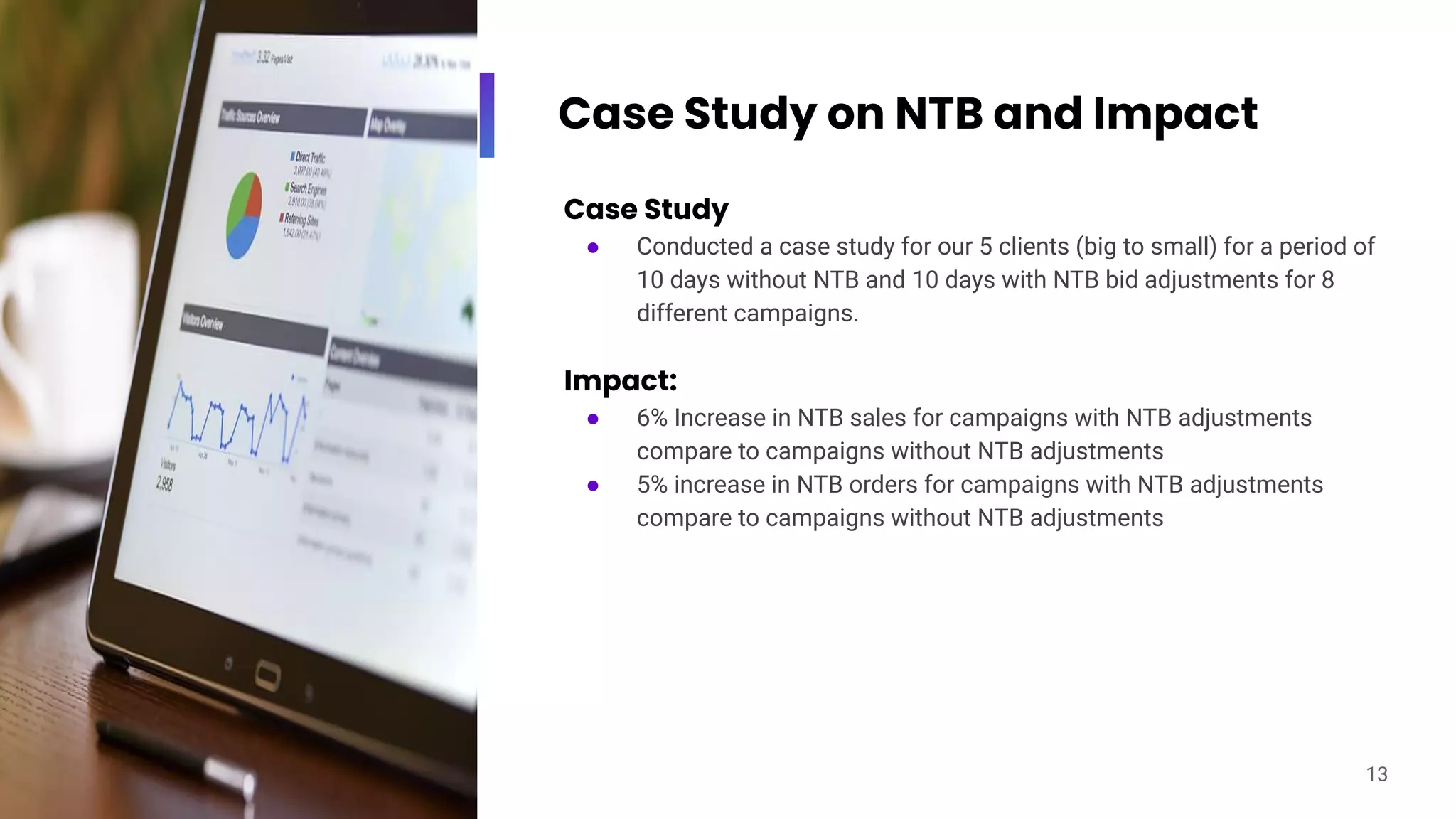

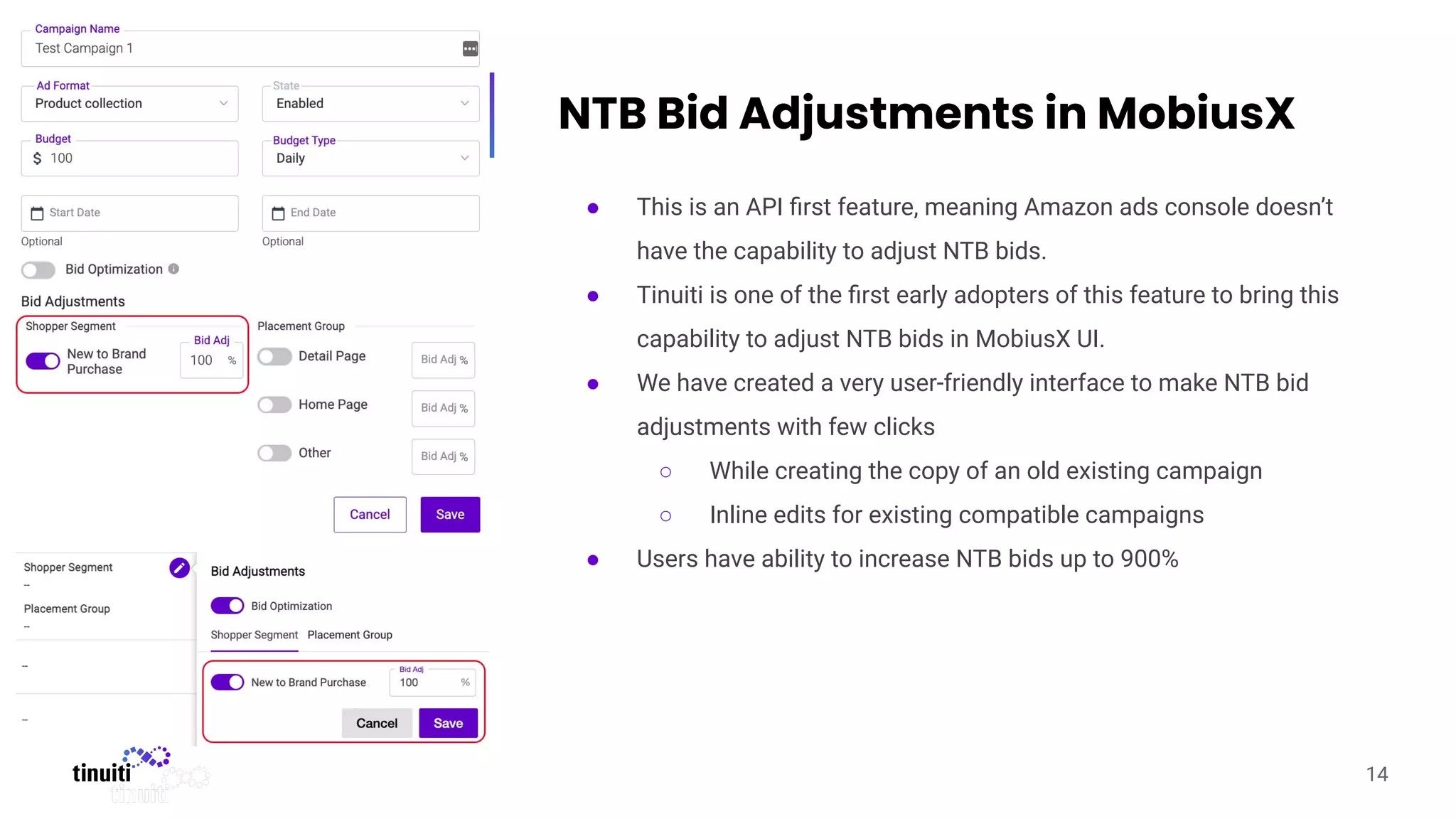

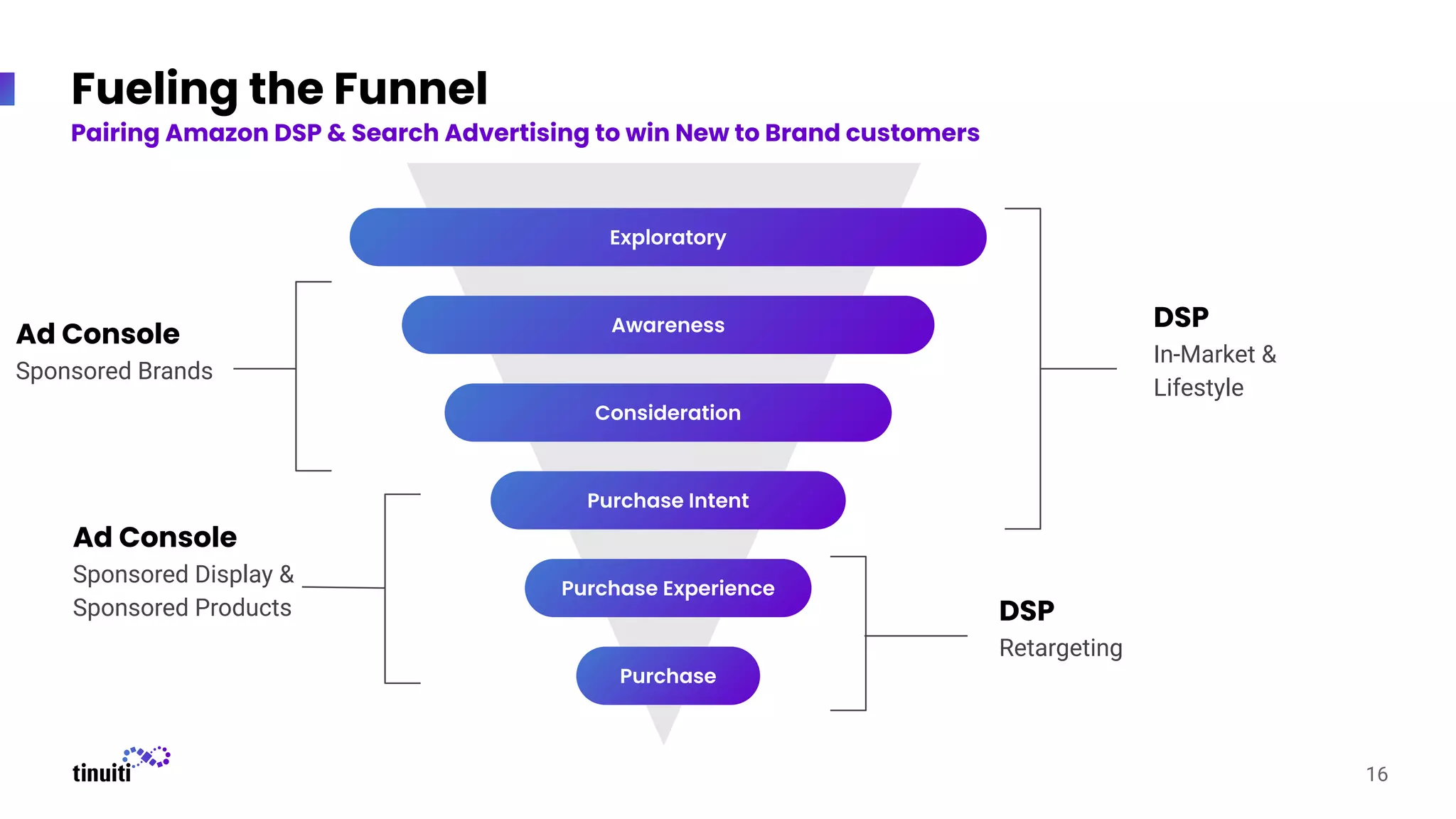

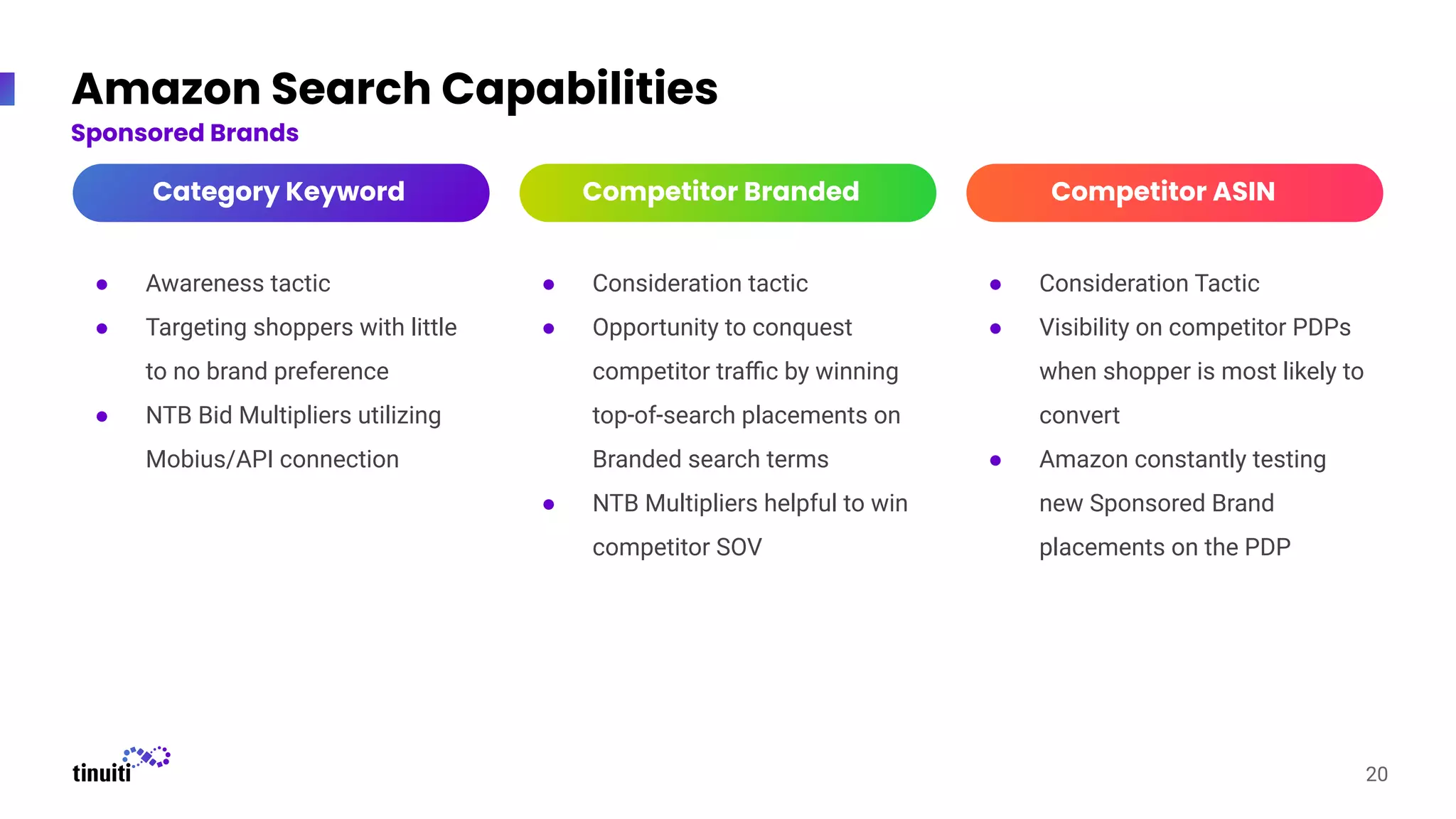

The document outlines strategies for engaging new-to-brand customers on Amazon in 2023, highlighting the importance of targeting these customers due to their brand agnosticism and the competitive nature of the marketplace. It also discusses a case study showing a 6% increase in sales with new-to-brand bid adjustments and various advertising types that can aid in acquiring these customers. Key takeaways stress the need to focus ad spending on Amazon's ad types that leverage new-to-brand metrics and to regularly update creatives to enhance sales volume.