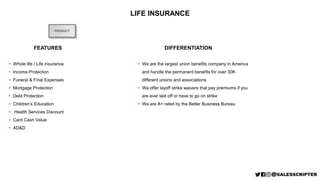

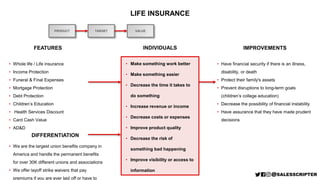

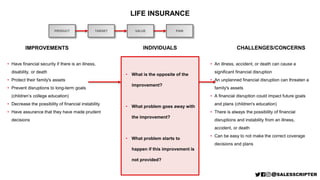

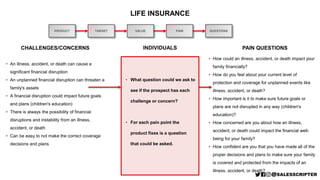

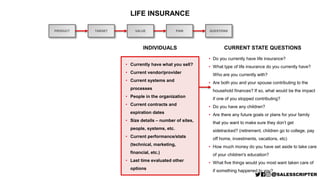

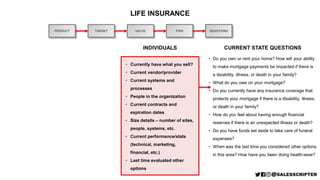

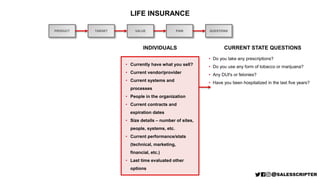

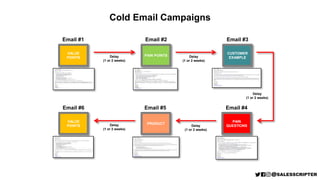

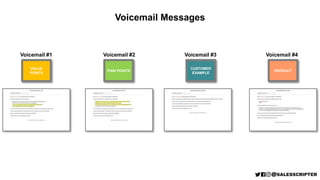

The document outlines how to create a life insurance sales script. It includes sections on the product (life insurance), features, differentiation, target market (individuals), improvements, challenges/concerns, value proposition, pain points, questions to ask prospects, evaluating a prospect's current state, and examples of scripts for cold calls, first appointments, email campaigns, and voicemail messages. The goal is to help salespeople understand the product, identify customer needs and concerns, and structure a consistent sales process.