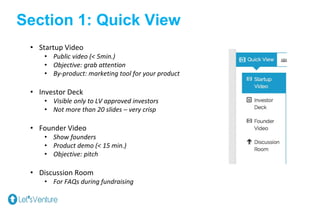

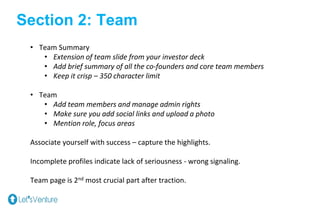

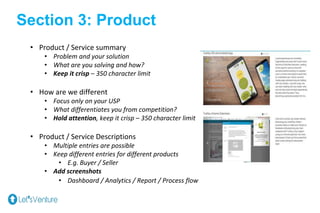

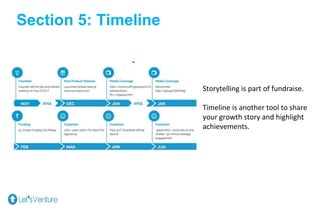

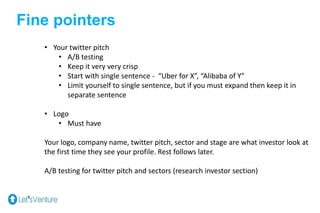

This document outlines how to create a compelling startup profile for attracting investors on LetsVenture, emphasizing the importance of completeness and clarity in sections such as team, product, traction, and financials. Key components include a crisp company overview, evidence of traction, and thorough financial details to demonstrate growth potential. It also stresses social proof and storytelling, urging startups to effectively communicate their unique selling propositions and engage investors with concise summaries and visuals.